Hasiera gisa, ikus ondokoak:

(i) Europako Banku Zentralaz

(https://twitter.com/tobararbulu/status/1326261263245119489)

@tobararbulu # mmt@tobararbulu

b) https://twitter.com/BMoon_bee/status/1324496817195749378

Irtenbidea:

Warren Mosler: https://unibertsitatea.net/blogak/heterodoxia/2020/03/19/warren-mosler-ek-krisiari-buruz/

La UE acuerda un ambicioso marco presupuestario hasta 2027 para reactivar su economía tras el covid – https://naiz.eus/eu/actualidad/noticia/20201110/la-ue-acuerda-un-marco-presupuestario-hasta-2027-para-reactivar-su-economia-tras-el-covid#.X6r3IxBtw7I.twitter

oooooo

moonbee@BMoon_bee

@MehreenKhn erabiltzaileari erantzuten

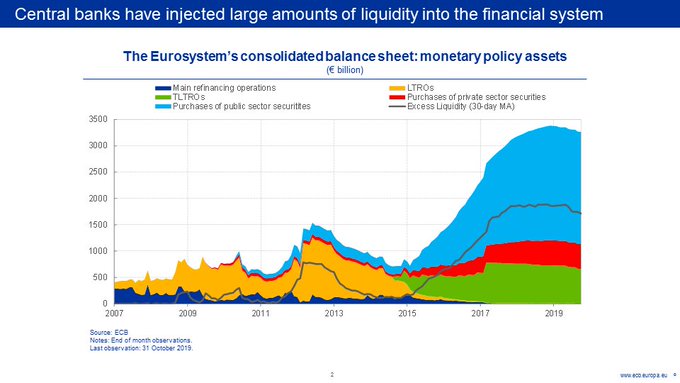

If ECB had decided to create money to provide the liquidity that was missing from the banks (Yellow on the graph).

Why then did the states put themselves at risk for a crisis for which neither of them nor their citizens were responsible?

(ii) QE delakoaz

(https://twitter.com/sarahollando552/status/1326139850685370381)

Sara Holland #MMT@sarahollando552

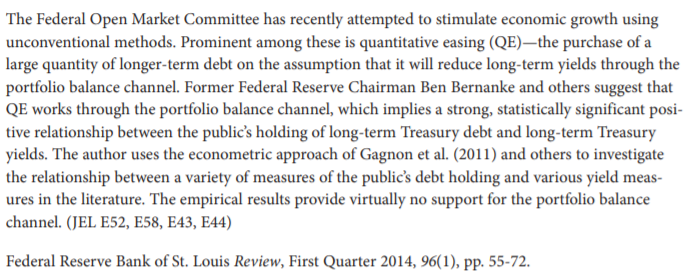

QE is not an effective way of stimulating economies.

Quantitative Easing – The Gower Initiative for Modern Money Studies

Segida:

(iii) Warren Mosler

(https://twitter.com/wbmosler/status/1326248614436462597)

Warren B. Mosler #MMT@wbmosler

At the macro level unless there are new corporate issues all that can happen is the existing financial assets can change hands while the total risk stays the same.

oooooo

Warren B. Mosler #MMT@wbmosler

The ECB could instead take a step back and simply purchase newly issued tax credits from all member nations on a per capita formula, no strings attached. Start with maybe 10% of euro zone GDP for openers. It’s fair to all, reduces national indebtedness, minimizes new issues, etc.

oooooo

Warren B. Mosler #MMT@wbmosler

The presumed portfolio effect is a shift to higher risk in search of yield. But that can’t happen unless both corps issue more high yield debt and portfolios expand. But that doesn’t happen and in any case that isn’t called the portfolio effect.

oooooo

Warren B. Mosler #MMT@wbmosler

eta 2beste erabiltzaileei erantzuten

Yes, to reduce long term rates, which only works if that induces more spending on goods and services (GDP) vs financial assets.

oooooo

Warren B. Mosler #MMT@wbmosler

Portfolio effect = portfolios shifting to riskier assets due to QE (for the further purpose of subsequent credit expansion/new issuance). I’m saying that while rates can shift, at the macro level the shift to more riskier assets can’t happen until after the ‘risky’ credit growth.

oooooo

Warren B. Mosler #MMT@wbmosler

eta 3beste erabiltzaileei erantzuten

So seems the portfolio balance channel comes down to ‘if you lower long Tsy rates long corporate rates come down as well‘ and nothing more. It’s just part of the general presumption that rate cuts are expansionary/inflationary which I see as backwards:

MMT White Paper – The Center of the Universe

Click Here for the White Paper on Modern Money Theory Italian Version Español

oooooo

Warren B. Mosler #MMT@wbmosler

eta 2beste erabiltzaileei erantzuten

I’ve never found twitter limits a constraint… 😉 But understood, thanks!

(https://twitter.com/wbmosler/status/1326497811479859201)

Gehigarriak:

QE: Mosler eta Draghi, berriz…

Quantitative Easing (QE) inozoentzat

EBZ (M. Draghi) NMF (C. Legarde), Bundesbank (J. Weidmann) eta QE…

PQE (politika fiskala) eta QE (politika monetarioa)

Draghi-ren politika monetarioaren (QE) itxaropenak, gabeziak eta ondorioak

QE, Europar Batasuna, inflazioa eta deflazioa…, Schäuble, progreak eta abar

Draghi-ren politika monetarioaren (QE) itxaropenak, gabeziak eta ondorioak

Quantitative Easing (QE): Espainian ikasi dute (batzuek!), Euskal Herrian ez!