Albistea: Now We Know Why the ECB Panicked1

(a) Adierazpen faltsuak eta itxaropenak2

(b) Urte bete beranduagoko egoera: metodo aldaketa baina ekonomia errealean aldaketarik ez3

(c) 2015eko martxoaren 5eko adierazpena, antzekoa4

(d) Bi hilabete beranduagoko Wall Street Journal-ek: more of the same5

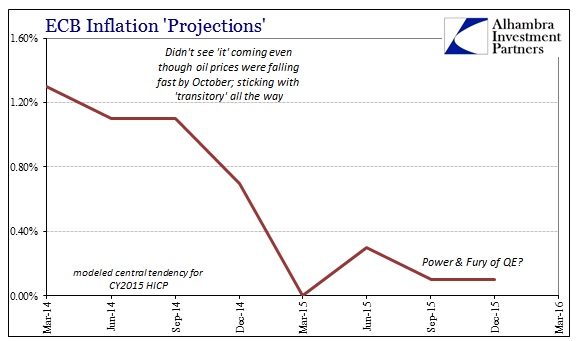

(f) EBZ-ren txosten eguneratuak: 2015ean QE-k ez zuen eduki inongo eraginik6

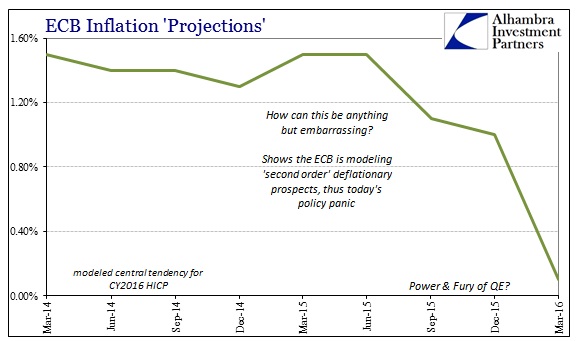

(g) Monetarismoan sinesten duen agentziaren ustez, QE-k ez luke edukiko inongo eraginik 2016an ere!7

(h) EBZ izutu zen: Japoniak ezagutu du esperimentua8

(i) Ondorioa: stimulus is just a word9

Bukatzeko, berrirakur ondoko hau: Deflazioaren aurka: interes tasa %0an

Ez, Draghi-k ez du ezer ikasi!

Gogoratu: in Draghi-k ez du ezer ikasi! (2)

Twitterra: https://twitter.com/ndrea_terzi/status/706451368995889154

The belief that you can create jobs without creating new debt underscores a serious conceptual fault (forthcoming)

Warren B. Mosler @wbmosler mar. 6

@ndrea_terzi Yes!!!

2 Ingelesez: “The catalog of false statements and expectations is long and getting longer. The ECB then assured “us” that this was different and that the LTRO’s, massive as they were, did not work because they weren’t QE.”

3 Ingelesez: “Still less than a year later, it is comical to see what a fuss was made back then when the ECB did nothing more than switch the method. To some economists, there might be a practical distinction between the LTRO’s and the technically named PSPP, but in the end those don’t matter because the true purpose is not now nor has it ever been about how any central bank will interfere, rather the intent is whether that interference further transmits into productive economic catalysts. Who really cares that Portugal’s borrowing costs are record lows if youth unemployment in Portugal is still 30% and general economic prospects are no different than they were four and five years ago? The byproducts of both the LTRO’s and QE has been inert, useless bank reserves whose only real effects have been to completely obliterate the function of “money” markets. The real economy remains undisturbed, unimpressed and still hugely underperforming.”

4 Ingelesez: “On March 5, 2015, for example, Mario Draghi was already claiming that QE had worked even though he had to yet purchase a single bond under its gaping auspices.”

5 Ingelesez: “Almost two months later, (…), the Wall Street Journal suggested only more of the same.“

6 Ingelesez: “The ECB today released its quarterly modeled updates for economic accounts including HICP calculated “inflation” and it was a total embarrassment. Not only did QE have no impact whatsoever in 2015,…”

7 Ingelesez: “… it is now being projected by the very same agency that believes in monetarism to its very core to not have any impact in 2016, either. We have to assume that these updated projections include the current, reshaped monetary policy interventions, so what does that say about the whole mess?”

8 Ingelesez: “Ingelesez: “The ECB panicked. Not only did QE fail to ignite inflation, the second order indications, modeled or real, suggest the real economy is in much, much worse shape than thought just a few months ago. The timing is not coincidental, as again there was a palpable global change starting around mid-year last year, cemented by the events of August and now January. It’s bad enough in policy terms (in reality, the ECB’s ineptness is the bright side in the real economy as should be apparent by what the Bank of Japan did to the Japanese people) to see any calendar year at about zero “inflation” as 2015, but to suggest and model that to repeat for a second? Disaster.”

9 Ingelesez: “There is and has been no recovery no matter how much “flooding” of whatever format, just the intermittent flirtation with positive numbers interspersed between slowdowns, rough patches and even re-recession. Stimulus is just a word.””