Bill Mitchell-en The British reality defying the ideologically-based gloom and doom1

Sarrera gisa2

Hasierarako, ikus Brexit-ez haratagoko balediko hondamendiaz hitz bi.

Artikuluan ukitutako punturik garrantzitsuenak:

(i) OECD3 eta IMF (aka Nazioarteko Moneta Fondoa)

(a) IMF4

(b) OECD5

(ii) Datuek beste historia bat erakusten dute: “The fact is that the data is telling a very different story”

(c) Inbertsioak direla eta, goranzko joera6

(d) Txikizkako salmentak, gora7

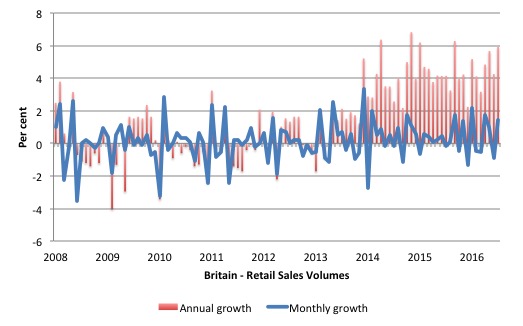

The following graph shows the annualised growth (red bars) and monthly growth (blue line) in retail volumes since January 2008 to October 2016

(e) Kontabilitate nazionala, hazkunde ekonomikoa gorantz 8

The following graph shows real GDP growth – annual (blue bars) and quarterly (red line) from the March-quarter 2005 to the September-quarter 2016. The annual real GDP growth has picked up pace in recent quarters.

(iii) IMF aka NMF, berriz

(f) Prentsa aurreko bateko galdera-erantzuna: aldaketak9

(g) IMF-ren jarrera10

Ondorioak

(1) E-posta haserretu gehiago azalduko dira11

(2) Egoera aldatu daiteke, noski, baina egindako aurreikuspenak ez dira izan egiazkoak, urrunetik ere ez12

(3) Britainia Handiko gobernua ez-gai den jendez beteta dago eta Alderdi Laboristak ez daki zein egunetan bizi den13

(4) Brexit delakoaren aldeko botoak ez du ekonomia bere bidetik atera14

(5) Gobernuak edozein gauza txar egin dezake15

Euskal Herriko egoerari buruzko oharra: Gabriel Arestiren Granada honetan antzeko gauzak esan daitezke Hego Euskal Herriko egoerari buruz.

Izan ere,

-

Egunero aurreikuspenek eta kazetarien hitz jarioek ez dute inoiz ezer asmatu

-

Ekonomialariek, politikariek eta kazetariek ez dute ulertu Brexit zertan datzan

-

Nafarroako gobernua ez-gai den jendez beteta dago, ekonomia dela eta

-

Baskongadetako gobernu lotsagarriak ez daki ezer ekonomiaz, eta oposizioak ez daki, makroekonomia dela eta, zein egunetan bizi den

Beraz, ezjakintasunean britainiarrak ez daude bakarrik, segizio handia daukate Euskal Herrian.

2 Ingelesez: “I last wrote about the aftermath of the June 2016 Brexit vote in this blog – Mayday! Mayday! The skies were meant to fall in … what happened?. (Ikus Brexit-ez haratagoko balediko hondamendiaz hitz bi.)

Admittedly, it was written just a month after the vote and so the analysis could legitimately be considered as being tentative and was designed to refute the claims by the remainers that the UK would instantly sink into recession. It didn’t and it hasn’t. Despite the tentative nature of the blog (using the first data releases after the vote), I received a bevy of ‘hate’ E-mails, presumably from those ‘darlings’ that were miffed they didn’t get their way in the vote. Bad luck, that is the way ‘democracy’ works. We are now at the end of June and we have more information and my conclusion in August is now more concrete. The doom and gloom that was meant to follow the vote outcome is not to be seen in the data. While we might dismiss the on-going strength of consumption expenditure as being short-termism (it might change quite rapidly), last week (November 25, 2016) we learned that private capital formation (investment) is growing strongly and a number of foreign companies have reaffirmed their commitment to on-going investment in the UK. That is forward-looking decision making – out years into the future. Doesn’t look like a Brexit calamity to me.”

3 OECD, euskaraz ELGE: Ekonomiako Lankidetza eta Garapenerako Erakundea.

4 Ingelesez: “OECD and IMF gloom

Remember when the IMF was predicting recession for Britain?

Prior to the Brexit vote, the IMF which was working hard to keep the elite neo-liberal establishment in place (Britain under the yoke of the European Commission) claimed that Britain would enter recession if it voted to leave the European Union.

On June 17, 2016, it published the annual – United Kingdom : 2016 Article IV Consultation-Press Release; and Staff Report.

It said that:

On balance, the net economic costs of an exit are likely negative and substantial … the level of output is … 51⁄2 percent below the baseline in a more adverse scenario.

Inflation was also forecast to accelerate although, curiously, Madame Lagarde had claimed in early May 2016 that a vote to leave the EU would lead to a “steep fall in house prices” (Source).

On July 19, 2016, its released its latest World Economic Outlook Update – IMF Cuts Global Growth Forecasts on Brexit, Warns of Risks to Outlook – and predicted the “economies of the United Kingdom … and Europe will be hit the hardest by fallout from the June 23 referendum”.

It predicted that:

The U.K. economy will expand 1.7 percent this year, the IMF said, 0.2 percentage point less than forecast in April. Next year, the nation’s growth will slow to 1.3 percent, down 0.9 point from the April estimate and the biggest reduction among advanced economies.”

5 Ingelesez: “On November 25, 2016, the OECD released its – Global Economic Outlook, November 2016 – and projected that the UK would grow by 2 per cent this year (2016) then slow to 1.2 per cent in 2017 and 1 per cent in 2018 as a result of the Brexit outcome.

The OECD is always wrong so we can safely ignore any warnings they provide.”

6 Ingelesez: “High Profile Investment Announcements

There have been a number of high profile investment announcements in the UK over the last several months:

1. Last week (November 25, 2015) Jaguar Land Rover announced that the company planned to increase its production output by 100 per cent to 1 millions cars by 2020.

Relatedly, the car manufacturer “said that designing and engineering its vehicles in the UK is a vital part of the company’s heritage” and that it “wanted to make Britain a global centre for battery research and development to power electric vehicles.” (Source).

2. The troubled Tata Steel UK operation has apparently sold off its Specialty Steels business in South Yorkshire to a London-based group (Liberty House).

The company also said it was working to “to develop a more sustainable business in Britain” (Source).

Liberty has been buying up other Tata Steel assets elsewhere in the UK.

3. The big three IT companies Apple, Facebook and Google have all announced major investments in the UK.

Facebook will invest in a new “a major London headquarters” at Fitzrovia, while Google “plans to build a new campus at King’s Cross”. Meanwhile Apple “s moving into Battersea Power Station, helping to generate new jobs and economic prosperity for Londoners” (Source).

As the Chancellor indicated these decisions represent “a clear signal that companies are continuing to invest in Britain’s future”.

It doesn’t look like Brexit gloom and doom to me.”

7 Ingelesez: “Latest retail sales

The British Office of National Statistics released the latest retail sales data on November 17, 2016.

The retail sales data measures first-hand how strong consumer spending is – it is immediate and doesn’t lie. The result for October was “the highest rate of growth since April 2002”.

ONS said on releasing the data that:

In October 2016, the quantity of goods bought (volume) in the retail industry was estimated to have increased by 7.4% compared with October 2015; all store types showed growth with the largest contribution coming from non-store retailing. This is the highest rate of growth since April 2002.

The underlying pattern in the retail industry continues to show strong growth with the 3 month on 3 month movement in the quantity bought increasing by 1.9%; this is the 34th consecutive period of 3 month on 3 month growth.

Ikus irudia:

The data suggests that there is some genuine confidence among consumers in the UK.

All those post-referendum stories of voter regret and gloom do not seem to be showing up in the data yet.

But it is clear that retail sales data can fluctuate and there so it is not impossible that there might be a plunge in confidence any day now!”

8 Ingelesez: “So lets look at the latest National Accounts for more clues.

Latest National Accounts

Last week (November 25, 2016), the British ONS released its – Second estimate of GDP: Quarter 3 (July to Sept) 2016 – which covers economic activity in the three months after the Brexit vote.

The data revealed that:

1. Real GDP growth in the third-quarter 2016 was 0.5 per cent. The ONS said “This suggests limited effect so far from the referendum.”.

2. The annual growth rate was 2.3 per cent well above the IMF and OECD predictions for 2016. It would take a major collapse in spending for real GDP growth to come close to the IMF prediction.

The claim that the Brexit vote would generate a recession seems highly unlikely and was just ideological banter.

Ikus irudia:

(…)

3. Household expenditure grew by 0.7 per cent in the third-quarter 2016 and 2.6 per cent for the year to September. That rate of growth has been fairly constant since the beginning of 2015 (varying from quarter to quarter but fairly robust).

So no signs that households are changing behaviour, even in the face of higher imported prices via the depreciation in the pound.

4. Most significantly, Gross fixed capital expenditure grew by 1.1 per cent in the third-quarter 2016 and 1.2 per cent for the year to September.

This expenditure reflects forward-looking expectations of future growth in sales. Unless, the firms making these investment outlays are totally misguided, their commitment to building productive infrastructure within the UK suggests they have not been spooked by the Brexit decision.”

9 Ingelesez: “At a press conference on October 4, 2016 to mark the release of the latest World Economic Outlook (see Transcript of the Press Conference on the Release of the October 2016 World Economic Outlook), a journalist asked the IMF Director of Research, Maurice Obstfeld:

I do not really remember too many forecasts of the IMF saying they thought it was going to be a soft landing for the UK after a no vote. In fact, there were quite little warnings about how terrible life would be. There would be falling house prices, falling share prices. The economy would go into recession with knock on impacts on to the rest of Europe. Maybe I missed the caveat, but most of the IMF message seemed to be very negative about the short term for the UK.

So, my question is this: If you got it wrong about the short term, why should we trust you about the longer term impacts?

The IMF economist replied:

… We did focus on possible risks and those possible risks were there. I do not think we could have dismissed the outcome; I do not think policymakers dismiss the outcome. Partially because of the strong response and also the strong policy response by the Bank of England, we are looking at pretty much what I would call a soft landing …

… we are happy about the outcome. It is our job to warn against the risks.

He had earlier claimed that “There is some evidence of deferred investments in the UK economy that will have an impact in that year” (2017).”

10 Ingelesez: “So, as always with the likes of the IMF, it is a moving feast. If they are advocating austerity, they always predict the most benign outcome (usually that the economy in question will grow regardless) and if they are talking about some progressive development (such as a discretionary rise in the fiscal deficit or in this case the vote to leave the dysfunctional European Union), they predict the worst.

Then when these ideological biases show up as systematic predictive failures they mince their words and modify their predictions.

Sometimes they admit they got it categorically wrong – as in the October 2012 admission about Greece.

No executive in the IMF ever seems to lose their jobs given this incompetence. They just blithely sail on with their super high salaries, swanning around the world creating havoc.

I hope Donald Trump withdraws US funds for the IMF, which would see it collapse.”

11 Ingelesez: “I expect more indignant E-mails from UK citizens – mostly of an alleged progressive persuasion who are still amazed the hoy polloi in Britain had the audacity to resist their wise counsel and vote to leave.”

12 Ingelesez: “Of course, the situation could turn for the worse. But so far all the predictions that were made by the remainers and their squawk squad including the IMF and the OECD have not turned out to be remotely true.”

13 Ingelesez: “I am also not suggesting that Britain is a modern day nirvana. Far from it. It is ruled by an incompetent conservative swill and the Opposition Labour Party doesn’t know what day it is (in macroeconomic terms).”

14 Ingelesez: “But still, the June vote has not derailed the economy (so far) and with investment spending strong, it is not likely that a recession is in the wind.”

15 Ingelesez: “Yes, the government could get stupid and impose harsh austerity and drive the economy into the ground. But the Autumn Statement last week didn’t suggest to me that it was going down the George Osborne (2010 version) route.”

joseba says:

Ez, ez dakite!

https://www.unibertsitatea.net/blogak/heterodoxia/2015/04/19/ez-ez-dakite/