Bill Mitchell-en Mayday1! Mayday! The skies were meant to fall in … what happened?2

Filologoentzako oharra, Brexit hitza dela eta3.

Sarrera:

Nazioarteko mailan, ekonomiak gaizki funtzionatzearen errua Brexit-i leporatu nahi izan diote hainbat lanetan. Ikusia daukagu: Hazkunde ekonomikoa txartuz doa, Brexit-en aldeko botoak ez dauka zerikusirik horrekin.

Orain gauza bertsua gertatzen ari da Britainia Handian bertan, azti eta zoritxar-igarle guztiak batu dira atsekabezko deialdiak plazaratzeko eta larrialdizko oihuak egiteko, zerua eroriko delakoan… Alta, zerua ez da erori, ezta eroriko ere.

Aipaturiko punturik garrantzitsuenak:

(i) Britainia Handiko estatistika (ONS)4

(ii) Zerua erori behar zen5

(iii) Hala ere, errealitatea bestelakoa da6

(iv) Zerua ez da erori: Europako herrialdeek ikasi behar dute eta Eurexit praktikan jarri7

(v) Aurreiritziak nonahi Brexit-ez geroztik8

(vi) Baita Brexit baino lehen ere9

(vii) Alderantzizko datu onak egon arren, berdin segitzen dute zoritzar-igarleek10

(viii) Dena den, etorkizunean ekonomia ez da aldatuko egun batetik bestera11, eta aldaketa hartuko duten politikaren araberakoa izango da12

(ix) Nola eta noiz hasi zen desastrea Britainia Handian?13

(x) Afera ziklikoak hor daude14

(xi) Noski, denborak esango du eta orain arte desastrearen aurka hitz egiten du15

(xii) Izan ere, salmenten datuak ez dira txarrak16

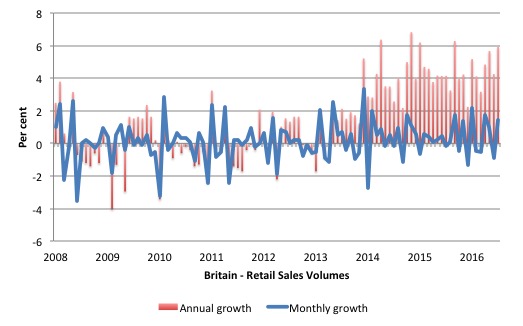

The following graph shows the annualised growth (red bars) and monthly growth (blue line)

in retail volumes since January 2008

(xiii) Beraz?17

(xiv) Albisteak…18

(xv) … eta datuak, berriz19

(xvi) Espainiara joandako Britainia Handiko turismoa20

(xvii) Are gehiago: Britainia Handira egindako Suitzako esportazioak handitu dira21

(Adi Urkullu jauna, Euskal Herriko politikari eta ekonomialari guztiak, kazetari ia guztiak eta progre guztiak, gogoratu ondoko hau: herrialde baten aberastasuna hauxe da: bertan ekoiztutako guztia gehi inportazioak ken esportazioak!)

Gogoratuko al duzue hori hurrengoan?)

(xviii) Turismoa gorantz doa: aurreikusitako hondamendia ez da azaldu22

(xix) Industria: ez dago inongo kolapsorik23

Mitchell-ek dioenez,

“As regular readers will know, I am pro-Brexit and scorned the doom predictions at the time.”

Ondorioak:

(1) Zerua eta austeritatea24

(2) Gobernuak tresnak ditu atzerapeneranzko edozein joera alboratzeko25

(3) Hala ere, “… the current data doesn’t suggest a recession is on its way”

(4) Eurexit da etorkizunerakoko ikasgairik garrantzitsuena26

1 Mayday: an international radiotelephone distress call: atsekabe deialdia.

3 Brexit izen ‘propioa’ da, ez arrunta. Beraz, Brexit idatzi behar da eta ez Brexit-a. Ekonomian, gainera, aparteko garrantzia historikoa dauka gertaera horrek. Beraz, idatz dezagun bera letra larriz eta ez letra xeheaz. Argi?

4 Ingelesez: “The British Office for National Statistics, which although recently revamped continues to have the most user-unfriendly home page and dissemination service of all the national statistical agencies, published the latest – Retail Sales in Great Britain: July 2016 – data last week (August 18, 2016). It looked good to me. In the past week or so there has been a stream of data coming out of Britain or about Britain, which also looks good to me.”

5 Ingelesez: “What the hell is going on? The skies over Britain were meant to have fallen in by now. Unemployment was meant to be going through the roof or was the roof meant to collapse first. All manner of despair was meant to be visiting the shores of Britain after the June 23 vote to get out of the dysfunctional European Union.”

6 Ingelesez: “The reality is that things are looking okay there. Skies are intact and quite blue I believe which has boosted the confidence of British consumers. Tourism is booming. Unemployment is falling or at least those claiming unemployment benefits. One investment bank put out a briefing last month with a Mayday! Mayday! warning that unemployment was about to rise dramatically. Who has been sacked for that piece of public misinformation. George Osborne, remember him, said in mid-June that British public finances were about to collapse and an immediate, emergency fiscal response would be needed.”

7 Ingelesez: “Days have passed – things are looking ok. Eurozone nations should take note! Ignore the neo-liberal scare mongering. Follow Britain’s lead in abandoning the ridiculous notion that there is something special about ‘Europe’. Eurozone nations should get out of the currency union as soon as possible.”

8 Ingelesez: “In the weeks after the Brexit vote, the sore losers were in abundance – predicting the worst and even worse, accusing those who voted the sensible way (to exit) of being dumb, racist, or regretful, or all three things.

What was going to happen? Scan back in the media and you will spikes of unemployment, financial collapse of the banks, diving sharemarkets, first division soccer teams losing players and the idiocy kept outdoing itself on a daily basis.”

9 Ingelesez: “Remember back in mid-June, when the then (failed) Chancellor warned British citizens that if they voted to leave the European Union on June 23 it would be disastrous for the government finances.

The BBC report (June 15, 2016) – EU referendum: Osborne warns of Brexit budget cuts – documented the bullyboy tactics that Osborne employed to try to distort voter choice.

Osborne and his creepy partner-in-misinformation (Labour’s Chancellor Alistair Darling) told an audience that the Government would:

… have to slash public spending and increase taxes in an emergency Budget to tackle a £30bn “black hole” if the UK votes to leave the European Union.

Does sick joke come to mind!”

10 Ingelesez: “In fact, the British ONS released data showing that the UK government actually was in surplus in July 2016.

Even with the evidence emerging to the contrary, they are still at it. William Keegan’s article in the UK Guardian (August 21, 2016) – Leavers should be ashamed of the harm yet to come from Brexit – is an example.

Keegan is playing it safe. He talks up things which are impossible to verify – among them being his claim that there is now ” an outbreak of buyer’s remorse”.

He defers any of his doom predictions to a period in the future where causality will be unclear. So the next recession, whenever it will come, will be Brexit-induced – irrespective of what the policy of the government of the day is at that time.

The likes of Keegan will wax on about having told his fellow citizens what venal dopes they were for “the chaos they have helped to create, not least for their grandchildren” by voting to exit the dysfunctional European Union.

He is already lecturing them – “They should be ashamed of themselves”.”

11 Ingelesez: “What was interesting was his characterisation of the British economy and the upcoming fiscal statement from the new Chancellor:

Make no mistake, this is going, to all intents and purposes, to be a budget for an economy that is already suffering severe structural damage …

Structural damage doesn’t emerge the day after a vote is taken – one way or another. If the British economy is “suffering severe structural damage” then it has nothing to do with the Brexit vote outcome.

It has more to do with years of stupid policy decisions which promoted the financial sector and starved the productive side of the economy of incentives.”

12 Gogoratu: “…The next recession, whenever it will come, will be Brexit-induced – irrespective of what the policy of the government of the day is at that time.”

13 Ingelesez: “It started with the surrender by the Callagan Labour government to the Monetarist madness in the mid-1970s. The trend was accelerated under Thatcher (who wrecked manufacturing and promoted the banksters) and entrenched by Tony Blair and Gordon Brown’s ‘light touch’ financial market regulation – which basically saw all the unproductive, incompetents run riot.

It is obvious that the British economy has relied too much on household debt and on housing markets to drive growth.

These ‘structural imbalances’ have been a long time in the making and certainly nothing at all to do with the June 23 vote.”

14 Ingelesez: “The upcoming fiscal statement might have to address some cyclical issues arising from the referendum vote given the amount of doom that was predicted – which may have affected the confidence of households and firms.

But we should reject notion that the Brexit vote has suddenly exposed the structural vulnerabilities of the British economy. They have been there for all to see if one could get free of the denial that accompanies the neo-liberal narrative.

If you then read the rest of Keegan’s article the descriptor ‘vacuous’ comes to mind. He really says nothing despite the alarming headline.”

15 Ingelesez: “Of course, time will tell whether being out of Europe is going to be the millstone that the doomsayers predicted. I think not.

And time is already ticking and the first data is starting to come in – it doesn’t look good for those who are demanding another vote.

You know – we lost the first one because people are stupid – so lets go again until we win – sort of mentality. The sort of nonsense that the contender for Labour Party leadership (Smith) is now trying to get away with. He should be sent to the boondocks by the Labour Party membership and encouraged to seek a different career.”

16 Ingelesez: “The retail sales data released last week by the ONS covered the period from July 3 to July 30, 2016 – so well after the Brexit vote had concluded and after the doomsayer economists used the week following the vote to predict all manner of crisis and mayhem.

The retail sales data measures first-hand how strong consumer spending is – it is immediate and doesn’t lie. The result for July 2016 didn’t produce the strongest monthly growth rate since the GFC but the result was not far off it.

ONS say that:

In July 2016, the quantity bought (volume) of retail sales is estimated to have increased by 5.9% compared with July 2015; all sectors showed growth with the main contribution coming from non-food stores.

Compared with June 2016, the quantity bought increased by 1.4%; all sectors showed growth with the main contribution again coming from non-food stores.”

17 Ingelesez: “So what have we got here?

Those stupid Brits spending up big with their last pounds because they are worried the shops are all going to close and the government is going to run out of money as a result of the Brexit vote?

Or some genuine confidence, aided by good seasonal conditions, a national team going gangbusters at the Rio Olympics (on raw medal tally that is), and a rejection of the nonsense my profession tried to foist onto them leading up to the Brexit vote.

Hmm. What else?”

18 Ingelesez: “Remember this headline from July 14, 2016 – CREDIT SUISSE: ‘Mayday! Mayday!’ — Britain’s impending recession will kill nearly 500,000 jobs.

The headline was accompanied by a picture of working class men in the Jarrow March (Crusade) which “was a protest march in England in October 1936 against the unemployment and poverty suffered in the northeast Tyneside town of Jarrow during the 1930s.”

The Jarrow March was a response to extreme hardship brought on by the Great Depression. It invokes pain and suffering.

The report tells us that:

In their note, reassuringly titled “Mayday! Mayday!” Credit Suisse’s Boussie et al. also note that they expect rising unemployment to trigger a slackening of the “robust” consumer sector, which in turn could cause even more serious problems for the economy.

Well the retail sales data isn’t quite what they were hoping for when they sent out their Mayday alarms.

And on August 17, 2016, the ONS also released the latest – Total Claimant count SA (UK) – thousands – which provides information about the number of people seeking unemployment benefits.

Changes in this statistic are not a perfect measure of the changes in unemployment but are closely related enough to make inferences.”

19 Ingelesez: “I was looking for a dramatic rise in claimants (unemployment).

What did I find?

A rather large decline of 8,600 or 1.1 per cent (seasonally adjusted) in July 2016. Oops!

Since January 2016, the claimant count has been rising each month. July marked a break in the trend even though the economists in the financial markets had reached a “consensus prediction” of a rise of 9.5 thousand.

A little matter of a massive prediction error – nothing to worry about. No one will be punished for spreading spurious information designed to alarm the public.

The other labour market data released on August 17, 2016 by the ONS covers the quarter to the end of June and while the unemployment rate was stable, it is not really reasonable to claim that as another piece of evidence that the vote didn’t matter much.

I haven’t looked at the sharemarkets today but last time I looked the aggregate indexes were heading towards the stratosphere – like record high levels.

And other financial market indicators appear to be unaffected – for example, the bid-to-cover for British government gilts is not plunging. The large pension funds are falling over each other to keep stocking up on government debt – yum, lovely public debt, more corporate welfare!

Markit released the latest – Household Finance Index – for the UK on August 17, 2016. This provides a guide to the state of household expectations about their financial situation.

The summary results for August 2016 are:

– Outlook for household finances recovers in August …

Current inflation perceptions remained broadly steady in August …

The news kept coming in yesterday (August 23, 2016).”

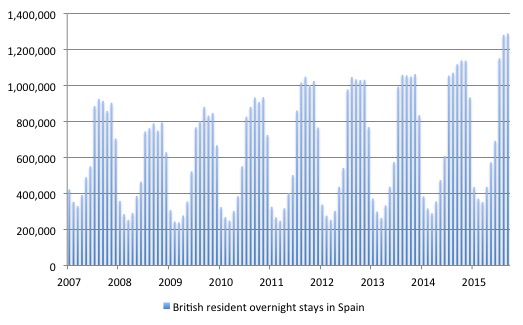

20 Ingelesez: “The Instituto Nacional de Estadística is the national statistical office for Spain and publish excellent data on Tourism into Spain.

Guess what? The hotel short terms trends data released yesterday shows that British citizens are flooding to that sunny destination even though travel costs have risen due to the decline in the pound. Overnight stays rose strongly in July 2016.

The following graph shows the data for overnight stays by British residents in Spain since November 2017. You can see the seasonality.

But even with the pound at much lower levels than before the vote, those sun-loving Brits have not been discouraged from heading down to beautiful Espana for vacations.

The GFC slowed the summer vacations down a lot. But Brexit doesn’t seem to have had much affect. July overnight stays pretty much increase by 11 per cent on June each year and so they did in July 2016.”

21 Ingelesez: “And if that wasn’t enough, the Verband der Sshweizerischen Uhrenindustry aka the Federation of the Swiss Watch Industry, published data on August 20, 2016 that shows that Swiss watch exports to Britain rose to 110.2 million CHF in July 2016, up from 90.6 million CHF in June 2016.

This 21.6 per cent increase was the fastest growth of all the Swiss manufacturers’ major export markets.

What is going on there? Well Britain is now a tourist mecca itself courtesy of the lower pound since Brexit and within that shift the so-called “luxury goods market” is booming.

This shopping boom is part of the retail sales data reported above.”

22 Ingelesez: “The UK Guardian article (August 22, 2016) – Tourist spending in UK surges after pound’s Brexit slump – summarises trade data (Global Blue) which shows that:

Japan, Indonesia and the US were the nations that accounted for the biggest increase. Despite Japan’s own economic problems, spending by Japanese visitors was up 96% in the UK compared with July 2015, while travellers from Indonesia spent 88% more than last year on tax-free shopping.Chinese tourists’ spending was up just 6% for July, but the country still accounted for the largest portion of spending overall, with a 32% share.

Whether you judge that to be a desirable trend or not doesn’t evade the reality that the doom predicted is not emerging.”

23 Ingelesez: “And, finally, the Confederation of British Industry – released the latest monthly – Industrial Trends Survey – which showed for July that:

– 19% of businesses reported total orders to be above normal (compared with 18% in July), and 24% said orders were below normal, giving a balance of -5%– 21% of businesses reported export orders to be above normal and 27% below, resulting in a balance of -6%, the highest since August 2014 (-3%).– 34% of businesses reported a rise in output volumes, and 23% a fall, giving a rounded balance of +11%, down from +16% last month, but better than expected (+6%)– Output growth is expected to remain steady over the next three months, with 30% companies expected a rise and 19% expecting a fall, leaving a balance of +11%

The CBI said that “export order books reached a two-year high, suggesting that the depreciation of sterling since the end of last year may be feeding through to stronger overseas demand … [and] … remained comfortably above the long–run average”.

No collapse there.”

24 Ingelesez: “While the sky may well still fall in – especially if the British government attempts any austerity stunts – I think it is unlikely.”

25 Ingelesez: “The Government has all the capacity it needs – as a currency-issuer – to divert any tendencies towards recession.”

26 Ingelesez: “The failure of the doom merchants’ predictions should also be a guide to what might happen if a Eurozone Member State walked out. All the prophecies of doom would follow (and precede) but the nation would soon find out that with renewed currency sovereignty things would settle down fairly quickly and growth would be rapid.”

joseba says:

Ikus

Grezia hasiera zen

eta

Eurolandia, CIA eta Brexit

in Zipriztin ekonomikoak (9)