Ekonomia arloan eta aspalditik oso ezaguna dugunez, Europako Ezkerra galduta dago erabat.

Kasu, Brexit dela eta, ez dakite ezer, ez dute ahalmenik ere ez Brexit bera ulertzeko.

Eta Euskal Herrian? Harrigarria bada ere, ezjakintasuna are sakonagoa da gure artean.

Irakur edo/eta entzun EHko komunikabideetan agertzen dena! Benetan lotsagarria!

Eta politika mailan? Antzekoa edo eta okerragoko egoeran!

Gogoratu ondoko hau, ulertezina bide dena Europan: Brexit eta autodeterminazioa

Zer esan EHri buruz, non faltsukeria hutsa den, eta inongo zentzu politikorik, ezta internazionalik ere, ez daukan, eta progre guztiek etengabe erabiltzen duten sasiko ‘derecho a decidir‘ (sic) modan jarri den?

Espainolek, alta, argi daukate: Progre guztientzako mezua…

Ekonomiari dagokionez, sarrera gisa, ikus:

Hazkunde ekonomikoa txartuz doa, Brexit-en aldeko botoak ez dauka zerikusirik horrekin

Segida:

(i) Brexit eta libra esterlina

Brexit : la chute de la livre, chance ou damnation de l’économie britannique?1

“La monnaie britannique a encore reculé cette semaine. Cette chute réveille le risque de “stagflation”, mais elle annonce aussi un rééquilibrage inévitable de l’économie du Royaume-Uni.

La livre sterling a continué à reculer au cours de la semaine passée. Vendredi, il fallait encore un peu plus de 1,22 livre pour un dollar étasunien contre 1,2434 livre lundi 7 octobre et 1,108 livre pour un euro contre 1,11 livre. Depuis le 23 juin, la dépréciation de la monnaie de Sa Majesté Britannique approche les 18 % face au dollar des Etats-Unis et 15 % face à l’euro. La décision de la première ministre britannique Theresa May de prendre le risque d’un « Brexit dur », autrement dit d’une absence d’accord commercial avec l’UE, a accéléré ce mouvement.

Perte du statut de monnaie de réserve ?

(…)

Fuite des capitaux

(…)

La fin de la « gentillesse des étrangers »

(…)

Stagflation?

(…)

La BoE veille au grain

(…)

L’action du gouvernement britannique

(…)

« Maladie hollandaise »

Pour certains économistes, comme l’ancien vice-directeur pour l’Europe du FMI Ashoka Mody ou l’ancien « prix Nobel » Paul Krugman, la chute de la livre est même une forme de chance pour l’économie britannique, car elle met de facto fin à sa « maladie hollandaise ». Cette « maladie » décrit la forte dépendance d’une économie dans un secteur, traditionnellement une matière première. (…)

Ajustement inévitable

Le Brexit a provoqué l’ajustement inévitable. (…)

Logique politique

(…)

Rééquilibrage complexe

Reste que ce « rééquilibrage » n’est ni acquis, ni aisé. Il suppose une phase de transition toujours risquée si l’environnement international se dégrade et où la croissance sera logiquement moins forte, comme on l’a vu. Pour franchir une telle phase, il faudra que le gouvernement britannique se saisisse de l’occasion pour mener une politique industrielle et territoriale active et encourager l’investissement productif. Le défi est immense et loin d’être gagné, mais il existe bien une logique économique à la décision politique qu’est le Brexit et la chute de la livre en est l’instrument. Ceci invite donc à se défier de tout jugement simplificateur sur la dépréciation de la monnaie britannique.”

(ii) Brexit eta EB

What Future for the EU after Brexit?2

“Paul De Grauwe has contributed a policy analysis to the Forum section of the latest issue of Intereconomics, which is devoted to the broad question of “Post-Brexit European Union”. It can be downloaded, along with other contributions on this question, at https://www.ceps.eu/system/files/IEForum52016_1.pdf

In this contribution, Paul De Grauwe argues that the UK’s main strategy in joining the EU in 1973 was to prevent the union from becoming too strong and believed that this could best be done from inside. Now that the UK is departing, he finds that this strategy remains the same, i.e. to weaken the forces that aim to make Europe stronger, by insisting on a special deal with the EU whereby it maintains the benefits of the union while not sharing in the costs. De Grauwe warns that if the UK secures such a deal, it would signal to other members that by exiting they, too, could continue to enjoy the benefits of the union without contributing to the costs, with the result that the EU would be fatally weakened.”

(iii) Libra esterlinaz

Don’t believe what you’ve read: the plummeting pound sterling is good news for Britain3

“A former International Monetary Fund official argues that the sharp decline in the value of the UK currency will help the British economy to rebalance and grow sustainably

It signals, some say, that investors have lost confidence in Britain because it will trade less with the European Union and hence will be poorer in the future.

Others insist that the drop in the pound’s value makes the British public poorer already because they can buy less foreign currency and, hence, fewer goods and services abroad. British holiday-makers, says former Bank of England deputy governor Rupert Pennant-Rea, are the first to feel the shock of the weaker pound.

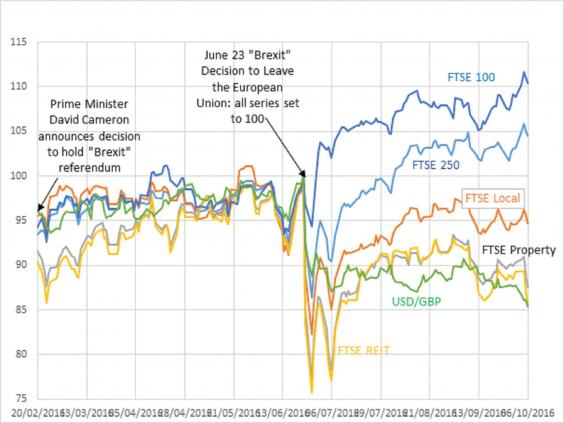

Those who take a more positive view of Brexit point to the smart recovery in stock markets.

(…)

What is going on? A careful look at market indicators suggests that far from being the disaster being portrayed, Brexit may have been a boon.

Composite Market View Gives Thumbs Up for Brexit

(…)

The composite picture from financial markets tells the following story.

Britain within the European Union became a magnet for speculative international financial capital.

From its unrivalled role as financial gateway to Europe, arose a property-buying frenzy in London and neighbouring districts. British banks channelled foreign speculative capital, and the finance-property bubble became a central feature of the British economy. Believing it was here to stay, even Russian oligarchs and Indian billionaires thought the craziness was a safe investment.

Silently but damagingly, the finance-property bubble also bid up the value of the pound, causing the pound to become overvalued for all other sectors of the British economy. Britain, quite literally, was living on borrowed time.

It is true that with an overvalued pound, the British public could command more foreign goods and services with their currency. But British producers lost competitiveness at home and abroad. Producers’ incentives to invest were weakened, leading to Britain’s poor productivity performance. And that led to a large current account deficit.

As a simple matter of arithmetic, the people of Britain were not richer before Brexit. To the contrary, they were living beyond their means.

(..)

And so the sense that the British public was richer because the pound was stronger was an illusion. To the extent the finance-property bubble was sowing the seeds of a financial crisis, Britain was living under a dangerous illusion.

Brexit has fortuitously corrected this long-standing distortion in the British economy. It is now easy to see why stock indices are going up. The depreciation of the pound has corrected an overvaluation of the pound, improving the prospects of domestic producers.

(…)

And after Brexit, Carney’s drumbeat about the need to protect the economy through lower interest rates and quantitative easing was evidently misguided. It mainly stirred up fear while providing little help to struggling producers. Easier monetary policy has, however, kept the property bubble from deflating even faster.

(…)

While several factors led to the Brexit vote, make no mistake, many were protesting that they had been left off the table where the economic pie is divided.

(…)

If the pound is about 20 per cent overvalued, then the fuss about the laughably trivial few percentage points increase in tariffs after leaving the European Union is really beside the point.

The pound has depreciated by about 15 per cent since Brexit, and has another 5, possibly 10, per cent go to before it stabilises at around $1.1 dollars per pound.

Rather than imposing a long-term cost, Brexit may, through a more reasonably priced pound, help expand British trade and productivity.

And if Prime Minister Theresa May’s pivot to more investment in education makes real headway, Brexit may have broken the past political lock on policymaking and redirected the economy to a more wholesome and sustainable path.”

joseba says:

“El brexit ha demostrado que hay vida fuera de la Unión Europea”