Sarrera gisa, irakur azken bolada honetako ondoko lanak:

(a) DTM hedatuz doa…: Subiranotasun monetarioa eta lan bermea (eta iruzkina)

(b) DTM-z: Zazpi gezur politika ekonomikoan eta Nola funtzionatzen duen diruak (Iruzkina, batez ere)

(c) Draghi-z, politika monetarioaz eta politika fiskalaz:

Ludwig von Mises eta xelebre monetarioak

Zer gertatzen da gero? Jadanik ikusia… (Iruzkina, batez ere)

Gogoratu, halaber, oraingo krisiarekin bukatzeko, Warren Mosler-en legea:

“There is no financial crisis so deep that a sufficiently large fiscal adjustment cannot deal with it”

Euskal Herrian ekonomia mailan ezjakintasuna eten gabe hedatuz eta ‘sakonduz’ doan bitartean, AEB-n DTM zabalduz doa, hurrengo lanean ikus daitekeen moduan.

Radical Economic Theory

Albistea: Ignored for Years, a Radical Economic Theory Is Gaining Converts1

Aipaturiko punturik garrantzitsuenak:

(i) AEB-ko hauteskunde garaian, non ekonomian ortodoxia nagusia den, ondoko tabuak ukitu gabe segitzen du: defizitak arriskutsuak dira

(ii) Ekonomialari disidenteen eskola bat tabu horren aurka altxatu da

(iii) Garaia aproposa da2, eta ez soilik AEB-n, zeren susperraldi ekonomikoa ez baita inon ikusten

(iv) Ekonomialari batzuk gehitu zaizkio gobernuak daukan erantzukizunezko eskaerari, defizit handiagoak proposatuz3

(v) Politika monetarioaren gabeziak onartuz, fokapena politika fiskalera igaro da4

DTM eta monetaren monopolioa

(vi) Bere moneta daukaten herrialdeek ez dute finantza krisiaren inongo arriskurik jasan5

(vii) Mugak badaude, noski: baliabide errealak6

(viii) Zergak eta inflazioa7

AEB-ko defizita: BPG-ren %tan8

(ix) Defizit belatzak9, defizit usoak10… eta defizit hontzak11

Randy Wray eta DTM

(x) DTM-ren hedapena 1988an12

(xi) DTM gaur egun, Italian eta espainiar Estatuan13

(xii) DTM AEB-n14

Aurrekontu orekatuen afera

(xiii) Aurrekontu orekatuen entusiasmoa AEB-n15

(xiv) Wray-ren jarrera, langabezia dela eta16

Depresio Handia, ekonomia keynestarra, New Deal eta aldaketak

(xv) Wray-k Depresioa Handiaz eta New Deal delakoaz17

Aro bitxia, arraroa

(xvi) Bill Hoagland-ek lau dekadatan zehar AEB-ko politika fiskala moldatuz lagundu du18

Hoagland-ek desberdintzen ditu etxe baten aurrekontua eta gobernuarena19

Berak aldaketa sakon bat aurreikusten du ekonomia ortodoxoan20.

Berak dioenez,

“We’re going through a very strange period where all economic theories are being tested”

Twitterrak: Ikus https://twitter.com/stf18/status/709174667349602304

Very good article on #MMT in Bloomberg @business by @mljamrisko featuring Randy Wray http://www.bloomberg.com/news/articles/2016-03-13/ignored-for-years-a-radical-economic-theory-is-gaining-converts …

2016 mar. 13

Don St. Clair, CFP® @DonStClairJr

@stf18 argh… “so long as there’s balance in the longer term.” #stillgettingthelastword

@DonStClairJr Coverage of MMT is getting better, though–simple criticisms of past don’t fly anymore.

@stf18 so the only thing missing still, is a ‘Kelton curve’, and it will all fall in place. Has to fit on a napkin. Exit Laffer.

Gehigarria:

Hona hemen ‘Kelton kurba’21

1 Ikus http://www.bloomberg.com/news/articles/2016-03-13/ignored-for-years-a-radical-economic-theory-is-gaining-converts.

2 Ingelesez: “It’s a propitious time to make the case, and not just in the U.S. Whether it’s negative interest rates, or helicopter money that delivers freshly minted cash direct to consumers, central banks are peering into their toolboxes to see what’s left. Despite all their innovations, economic recovery remains below par across the industrial world.”

3 Ingelesez: “Calls for governments to take over the relief effort are growing louder. Plenty of economists have joined in, and so have top money managers. Bridgewater’s Ray Dalio, head of the world’s biggest hedge fund, and Janus Capital’s Bill Gross say policy makers are cornered and will have to resort to bigger deficits.”

4 Ingelesez: ““There’s an acknowledgment, even in the investor community, that monetary policy is kind of running out of ammo,” said Thomas Costerg, economist at Standard Chartered Bank in New York. “The focus is now shifting to fiscal policy.””

5 Ingelesez: “… The 20-something-year-old doctrine, on the fringes of economic thought, is getting a hearing with an unconventional take on government spending in nations with their own currency.

Such countries, the MMTers argue, face no risk of fiscal crisis. They may owe debts in, say, dollars or yen — but they’re also the monopoly creators of dollars or yen, so can always meet their obligations. For the same reason, they don’t need to finance spending by collecting taxes, or even selling bonds.”

6 Ingelesez: “… MMT replies: No one’s saying there are no limits. Real resources can be a constraint — how much labor is available to build that road?”

7 Ingelesez: “Taxes are an essential tool, to ensure demand for the currency and cool the economy if it overheats. But the MMTers argue there’s plenty of room to spend without triggering inflation.”

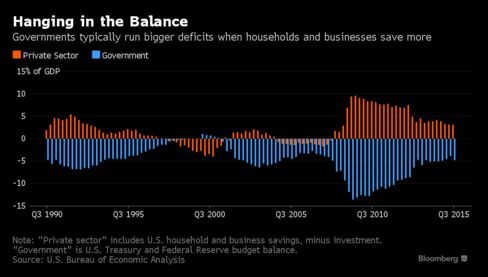

8 Ingelesez: “The U.S. did dramatically loosen the purse strings after the 2008 crisis, posting a deficit of more than 10 percent of gross domestic product the next year. That’s since been trimmed to 2.6 percent of GDP, or $439 billion, last year.” (Amerikar bilioi = Europako 1.000 milioi)

9 Ingelesez: “The Congressional Budget Office expects the gap to widen in the coming decade, as retiring baby-boomers saddle the government with higher social security and health-care costs. That’s the risk often cited by fiscal hawks.”

10 Ingelesez. “Mainstream doves accept the long-term caveat. But they point to record-low bond yields and say investors aren’t worried about deficits right now, so why not spend?”

11 Ingelesez: “MMT takes that argument even further.”

12 Ingelesez: “If MMT [DTM euskaraz] seems marginal now, Randy Wray, an economics professor at the University of Missouri-Kansas City and one of the doctrine’s founders, recalls a time when it barely registered at all.

Wray, who wrote “Understanding Modern Money” in 1998, says he used to meet with like-minded colleagues and count how many people understood the theory. “After 10 years, we had to go a little beyond two hands — we had to use a few toes,” he said.”

13 Ingelesez: “Now, thanks to the blogosphere, he says there are thousands around the world, especially in struggling euro-area countries like Italy and Spain.

(Italian askotan egon dira DTMkoak, blog honetan azpimarratu dugunez.

Gogoratu Wray Madrilen egon zela bere liburuaren espainierazko bertsioa aurkezten eta lan bermeaz hitz egiten: Randall Wray espainieraz; Randall Wray Madrilen; Randall Wray: elkarrizketa (espainieraz). Mosler ere Madrilen egon da bere liburuaren espainierazko bertsioa aurkezten: Warren Mosler-en liburua espainieraz; Elkarrizketa: Warren Mosler (espainieraz). Mitchell hurrengo maiatzean Madrilen egongo da bere liburuaren (Eurozone Dystopia) espainierazko bertsioa aurkezteko. Gero Kataluniara joango da hango independentistekin hitz egitera. Gauza bera egingo du Mosler-ek, aurten ere: Abian: egun handia, egun ederra)

MMT was among the early doomsayers on the single currency, arguing the lack of monetary sovereignty would render governments helpless in a crisis.”

14 Ingelesez: “In the U.S., one presidential candidate is at least listening to MMT economists. Advisers to Bernie Sanders include some of the school’s leading advocates: Stephanie Kelton, a Sanders hire to the Senate Budget Committee, and James K. Galbraith, whose father helped shape President Lyndon Johnson’s “Great Society” programs.”

15 Ingelesez: “There’s also a peculiarly American enthusiasm for balanced budgets, according to Jim Savage, a political science professor at the University of Virginia. He’s traced it to the earliest days of the U.S., rooted in a “longstanding fear of centralized political power, going back to England.””

16 Ingelesez: “Wray says there are episodes in American history when a different understanding prevailed. During World War II, he says, U.S. authorities learned a lesson that’s since been forgotten — that “we’ve always got unemployed resources, including labor, and so we can put them to work.””

17 Ingelesez: “Wray says he’d expected attitudes to start shifting after the last downturn, just as the Great Depression gave rise to Keynesian economics and the New Deal, but “it really didn’t change anything, as far as the policy makers go.”

“I think it did change things as far as the population goes,” he said, citing the anti-establishment campaigns of Sanders and Republican Donald Trump. It might take another crash to change minds, Wray says.”

18 Ingelesez: “Bill Hoagland, a Republican who’s vice president of the Bipartisan Policy Center, has helped shape U.S. fiscal policy over four decades at the Congressional Budget Office and Senate Budget Committee.”

19 Ingelesez: “He [Hoagland] says a farm upbringing in Indiana helped him understand why “it’s engrained in a number of Americans outside the Beltway that you equate your expenditures with your revenue.” He also acknowledges that government deficits are different, and could be larger now to support demand, so long as there’s balance in the longer term.”

20 Ingelesez: “Most of all, Hoagland says he sees profound change under way. The “catastrophic event” of the 2008 crash may be reshaping American politics in a way that’s only happened a handful of times before. And economic orthodoxy has taken a hit too.”

joseba says:

Politika monetarioaz hitz bi:

In Britain and the 1970s oil shocks – the failure of Monetarism

“The stylised textbook model of the banking system isn’t remotely descriptive of the real world.

Modern Monetary Theory (MMT) provides a detailed understanding of how banks operate.

Private banks do not wait for depositors to provide reserves before they make loans. Rather, they aggressively seek to make loans to credit worthy customers in order to profit.

These loans are made independent of a bank’s specific reserve position at the time the loan is approved. A separate department in each bank manages the bank’s reserve position and will seek funds to ensure it has the required reserves in the relevant accounting period.

They can borrow from each other in the interbank market but if the system overall is short of reserves these transactions will not add the required reserves.

In these cases, the bank will sell bonds back to the central bank or borrow from it outright at some penalty rate.

At the individual bank level, certainly the ‘price’ it has to pay to get the necessary reserves will play some role in the credit department’s decision to loan funds.

But the reserve position per se will not matter.

For its part, the central bank will always supply the necessary reserves to ensure the financial system remains functional and cheques clear each day.

The upshot is that banks do not lend out reserves and a particular bank’s ability to expand its balance sheet by lending is not constrained by the quantity of reserves it holds or any fractional reserve requirements that might be imposed by the central bank.

Loans create deposits, which are then backed by reserves after the fact.

These conclusions are devastating for mainstream economics and undermine the Monetarist claim that the central bank controls the money supply.”