ower Initiative for Modern Money Studies@GowerInitiative

Stephanie Kelton – To Bond, or Not to Bond, that is the Question #Bonds #FinancialMarkets

youtube.com

Stephanie Kelton – To Bond, or Not to Bond, that is the Question.

ooo

Stephanie Kelton – To Bond, or Not to Bond, that is the Question.

(https://www.youtube.com/watch?v=ql0OFY7W3Qs)

“To Bond, or Not to Bond, that is the Question” – a paper by Stephanie Kelton, Professor of Economics and Public Policy, Stony Brook University and Scott T. Fullwiler, University of Missouri — Kansas City. Presented by Stephanie Kelton at the UK MMT Conference, University of Leeds on 17th July 2024.

Transkripzioa:

0:07

issuing bonds for a currency issuing government is a policy choice not an economic imperative it’s a policy Choice

0:14

here’s Randy and Yea issuing bonds is voluntary operation that gives the public the opportunity to substitute

0:22

non-interest earning government liabilities thank cash for interest

0:28

bearing government liabilities T bills notes bonds which are credit balances in

0:33

Securities Accounts at the same Central Bank if people believe the government needs to borrow to spend then you get

0:40

into all of these debates who’s going to buy them is the bid to cover ratio going

0:45

to be adequate and all the rest of the kind of stuff but if you understand that bonds are voluntary operations then it

0:52

becomes irrelevant these sort of debates whether there are takers for government bonds and whether they’re owned by

0:58

domestic or foreign citizens so we show most of the debates that take place are

1:05

just rooted in fundamental myths and misunderstandings about what’s really

1:11

happening basically the operational side now there may be reasons to be

1:17

concerned Warren touched on this the other day might it become an issue when

1:23

you have a large enough stock of public debt and you have a central bank that is

1:29

following a tailor rule or something like a tailor rule raising interest rates to try to fight inflation and you

1:36

could potentially get into a sort of toxic situation where the rate hikes themselves begin to feed inflationary

1:44

pressures 20 years ago I published a paper it was it appeared as a chapter in

1:50

this book where I sort of uh Randy mentioned the other day something about laugher and the napkin I didn’t put mine

1:56

on a napkin either but I drew in it kind of looks like laugh laer curve right where the point is that

2:03

if you’re in a low Dead uh environment and a lot of the well there are certain

2:09

conditions I’m not going to go into all of them let me just leave it at if you don’t have a large stock of public debt

2:15

and a few other things hold uh raising interest rates may have the usual

2:21

conventional effect that is they would be contractionary but if the public debt gets large enough raising interest rates

2:27

from say i1 to I2 could actually the stimulative at the macro level so we

2:33

got to recognize that and if that’s the case and it could create a sort of

2:39

unsustainable situation in terms of the inflation impacts is there an answer to

2:44

that the answer is sure you just keep the interest rate down because the interest rate has become the problem at

2:51

that point so Scott fulweiler wrote about this and I should say Scott would have been here today but he couldn’t

2:57

make it and so this presentation we did together okay so it’s it’s the both of us we both work on it uh this paper was

3:04

published by Scott in 2005 long before the FED started paying interest on

3:10

reserve balances but Scott asked the question what would happen if the FED

3:15

did what other central banks already do which is to pay interest on reserve

3:21

balances so he wrote this paper and it’s very good and it’s short especially for Scott uh

3:27

Fuller so Scott goes through this and he says you know we could issue bonds keep

3:33

issuing bonds and have a zero interest rate policy or just manage the interest rate so it stays below the growth rate

3:41

what would happen if we did that well we wouldn’t have the problem with the

3:46

intertemporal government budget constraint that all the mainstream economists use to tell us that fiscal

3:53

policy is on an unsustainable trajectory so they use this macro model and they

3:59

plug in uh the variables and they say based on the current outlook for

4:05

interest rates and growth rates in the debt and so forth we’re on an unsustainable trajectory we need to make

4:11

changes and Scott said well if you think it’s unsustainable just lower the interest rate below the growth rate and the debt will converge and the problem

4:18

goes away that’s basically this problem so Scott’s saying the in the interest

4:23

rate is a policy variable okay the mainstream treats the interest rate as what

4:29

Market phenomenal right the market is doing it which is why the bond vigilante is matter but Scott’s saying no set the

4:36

interest rate so if it’s a policy variable there’s a very easy solution to this problem all right option three so

4:43

the first two options were issue bonds issue bonds and let the Central Bank fiddle with the interest rate issue

4:49

bonds and anchor the interest rate at zero now we’re moving into don’t issue

4:55

bonds don’t issue bonds and let the Central Bank play with the interest rate

5:00

that’s another option okay we could do that and once again Scott has that base covered he’s very good at this so in

5:07

this p in this piece paying interest on reserve balances more significant than you think Scott says uh with with

5:16

interest on reserve balances eventually the entire national debt could be held

5:22

exclusively as Reserve balances just leave it there simplifies monetary policy

5:28

operations and the more significant point is that it makes it clear to everyone that interest

5:35

on reserve balances demonstrates that the fed’s operations are offsetting in nature not financing so that’s the

5:42

purpose of that paper all right option four no bonds and Zer zero interest rate

5:50

or nearly zero kind of uh overnight interest rate Bill Mitchell says uh this

5:56

is the preferred option from an mmt perspective no bonds and permanent zero

6:01

interest rate policy now like I said that’s a

6:07

policy P it’s a prescriptive policy right that’s his position he would like

6:12

to see no bonds issued to the non-government sector and interest rates permanently anchored at zero he calls it

6:20

uh um omf overt monetary financing okay that’s his preferred thing but he says

6:26

it’s you know the preferred option from an mmt perspect perspective government should not issue any public debt to the

6:32

non-government sector as the benefits of doing so are small relative to the large opportunity costs all right so those are

6:40

four options he goes on talk about helicopter money mm always understood QE

6:46

as an asset swap with little or no transmission apart of apart from a placebo effect okay doesn’t really do

6:53

anything overt monetary financing he says Central Bank provides the monetary

6:59

capacity to support larger fiscal deficits with no further debt being issued to the non-government sector so

7:06

what bill has in mind is the central bank just buys the bonds directly from treasury credits A treasury’s account

7:12

treasury spends and you’re of and running okay the original mmt proponents

7:19

he says would characterize overt monetary financing as a highly desirable policy development because it makes a

7:25

whole bunch of this stuff cleaner and clearer right next

7:30

part what should we do to bond or not to bond that is the question right so what

7:36

changes if we consider options three and four both of which involve not issuing

7:41

treasuries at least to the non-government sector all right what changes well the big thing is public

7:47

perception right if you’re only issuing bonds to that are purchased by the central bank then the public understands

7:55

that they’re not being burdened by this debt stock that you don’t have to worry about who’s going to buy them and

8:01

foreigners and all the rest of the stuff we often hear about no increase in public debt for he says this is Bill the

8:07

Rabid Financial commentators to beat into a frenzy and push out predictions of insolvency it would get us all

8:14

focused on inflation risk instead of solvency and the morality play borrowing

8:19

driving us all into debt is immoral and all the rest of it who will buy them paying it back neuter the IMF the rating

8:26

agencies they have nothing to complain about and all of that of stuff so he says there are major political

8:33

advantages to moving to overt monetary financing all right I think we’re damned

8:40

if we do and damned if we don’t there’s no clear winner here there’s no way to

8:46

entirely avoid criticism weaponization no matter what you do all right so I’m going to show you some of this if we

8:53

continue to issue government bonds to the non-government sector the way we do today then we hear the usual stuff

9:00

economists the Press policy makers they weaponize the dead they talk about burdening future Generations who’s going

9:06

to buy it they weaponize the sustainability models they talk about exploding Debt Service it doesn’t

9:13

converge you got people like Olivia Blanchard Larry Summers Jason Ferman all using this framework to make the

9:19

argument that the US needs to reduce the deficit because it’s on an unsustainable

9:24

trajectory based on these models weaponized Bond vigil anes you’ll lose control of rates and and all that sort

9:31

of stuff but if we propose Zer which eliminates a lot of those problems then

9:37

they weaponize something different they say well if you if you keep the interest rate at zero then you’re depriving the

9:42

Central Bank of its ability to find our star and so you’ll hear stuff about fiscal dominance or one uh argument or

9:49

another it’s going to be inflationary and all that if we say don’t issue bonds

9:54

to the non-government sector then they’ll just say your printing money is going to be inflationary

10:00

so what’s an mmti to do the hell are you supposed to do they’re going to pick on you no matter which one you choose so we

10:08

created this little table and we just sort of imagine you know under which of

10:13

the four options do you avoid the most

10:18

criticism okay where where is it the cleanest and as you can see there’s not really a clear winner here okay if we do

10:26

what we do today which is column one they weaponize at that they weaponize the uh intertemporal government budget

10:32

constraint you hear about Vigilantes but you know at least you’d leave them with

10:38

the interest rates so they wouldn’t complain about interfering with the central bank and because you leave them

10:44

with the bonds and the interest rate they’re not going to complain about printing money you move to the next option and you got a different set of

10:50

things I don’t have time to go through each one of them okay but make the slides available but the point of this

10:56

is to say there’s not a clear winner in terms of the options okay

11:03

so so I’m going to put my cards on the table because as I said when I first got

11:09

involved in this project it was the descriptive stuff that interested me I liked it I liked learning about and

11:15

digging into and arriving at a place where I thought I had pretty good Mastery of the monetary operations it

11:22

felt good to understand so I like the descriptive stuff and that first paper I referred to earlier was descrip

11:29

and then I went to work on the hill and I realized what a mess we’re in because I was surrounded by people working as

11:36

the chief Economist for the Democrats on the Senate budget committee that no one

11:41

in the Senate and their staffers had the obvious idea how to understand the role

11:48

of deficits or debt in the economy that they were all falling prey to these myths and misunderstandings so I would

11:55

go around playing this game and I would ask them hey if you had a magic w wand and I told you you could wave the magic

12:01

wand and it would eliminate the national debt would you wave the magic wand

12:06

everybody said yes not even hesitation of course I would wave the wand I want the debt gone said okay well what if I

12:13

give you a different wand and I say if you wave the wand you will eradicate the world of treasuries no bills notes bonds

12:21

they’re just all gone would you wave the wand and they would look at me like I had three horns you know coming out of

12:27

my head say why would I do that why would I want to do that so they didn’t even understand that the thing we call

12:34

the national debt is nothing more than the stockpile right the stock of us

12:40

Treasures held in portfol excuse me portfolios and all the rest of it right they didn’t understand they want one to

12:46

go away but they want to keep the other well I’m sorry you can’t have it both ways so that started to shake my

12:53

confidence in things and then I wrote the deficit myth and I talked about some of this I told these kind of stories was

12:59

in the book and I said look I’m sort of agnostic on whether we issue bonds or

13:05

don’t issue bonds the problem seems to be the way we refer to them it’s the word debt that has everybody hung up

13:12

right and so maybe we just need to give it a different name Warren used to recommend calling it instead of the

13:18

national debt having a giant Debt Clock Loom over people in New York City

13:23

ticking away Warren would say you know just call it the interest rate maintenance account maybe everybody

13:28

would just just calmed down a little bit we’ve said call it the dollar savings clock we’ve tried right marketing

13:35

rebranding it’s just that it didn’t catch on and everyone is still very clearly worried about and weaponizing

13:43

the national debt and then you see what happened in the UK with Liz trust and everybody believes that the bond market

13:50

smacked her down and said you will not get the fiscal package that you are

13:56

proposing we aren’t willing to finance it and now labor is terrified and everybody looks at what happened to Liz

14:02

truss and they view that as a lesson for future governments and so at some point

14:07

you go you know maybe we’re not going to win this fight maybe we’re not going to get the policy response we need to deal

14:14

with climate and housing and all the rest of it uh because we can’t get

14:19

Beyond where we are in our understanding of deficits and especially the debt so I

14:25

did an interview with the ft and they asked me if you had five wishes or a magic wand and you could do five things

14:31

what would you do Warren and I talked a little bit about it uh before I committed to all five of those and I

14:38

made one of them I said no more bonds just don’t do it they’re more trouble than they’re worth we’re not going to

14:43

educate people fast enough to get Beyond this to get the right policy so let’s just stop right so that’s kind of where

14:51

I have arrived and I like my little play on words here which is if we were to do

14:57

that if the UK were to do that it could enjoy guilt-free spending isn’t that

15:06

nice you know the German word for Deb is guilt right and we do feel guilty about

15:14

increase in the deficit because it adds to the debt and we have this idea that this is a burden somebody’s ultimately going to have to pay it back so let’s

15:20

just get let’s just get over it let’s stop issuing it the labor party’s fiscal rules are clearly I think intention

15:28

Within missions you want to build a lot of housing but you want to rely on the private sector to do it just spend and

15:34

build the public housing leave the resulting pounds in the system let the bank of England decide what to pay on

15:40

those Reserve balances and tell the market to pound sand that is my position

15:46

uh as I stand here today so what can we do to De weaponize right uh to avoid

15:53

this is Scott’s line mass destruction de weaponized to avoid we got to have policy responses some of the very

16:00

critical challenges that we are facing and we’re having trouble getting there I think largely because we’re still too

16:07

hung up on what the national debt so-called means and the dangers the

16:12

dangers that it poses so we have written a lot over the years trying to educate

16:18

people trying to help people understand that there are options and that the way

16:23

we understand things today has flaws and and there misunderstandings and so so

16:29

forth again this is Bill Mitchell what would happen if a sovereign currency issuing government ran a fiscal deficit

16:36

and didn’t issue debt at all or sold bonds only to the central bank instead of the non-government sector what would

16:43

happen if we did over monetary financing and he says uh with a fiscal deficit and

16:48

no bond sales you get excess reserves in the cash system and the overnight interest rate Falls to zero or to the

16:55

support rate we’ve explained this a million times I have Warren has Scot has ad nauseum the only difference between

17:01

this and issuing bonds to drain the reserves is that the central bank has to use a different technique to hit its

17:07

interest rate target that’s all that changes and Larry got it Larry recognized it there’s no difference

17:14

between issuing the bonds or not issuing the bonds the difference is on Whose Ledger are you going to write down the

17:20

liability on the central bank’s Ledger or the treasuries and who’s going to

17:26

get I was going to say credit for but I don’t want to say that who is going to pay the interest the central bank or the

17:31

treasury that’s what the difference comes down to all right so here’s Scott fulweiler again from his 2005 paper

17:39

deficits that are unaccompanied by Bond sales are viewed disapprovingly as

17:44

monetization even though there’s no meaningful difference between doing it the way we do it today issuing the bonds

17:51

deficits always create net Financial Assets in direct proportion no matter which way you do it what matters isn’t

17:58

whether you sell bonds but whether the deficit is too large given the non-government desire to net save once

18:05

you have interest bearing reserves it becomes obvious that Bond sales are

18:11

offsetting interest rate maintenance not financing operations with interest on reserve balances eventually Scott says

18:18

the entire national debt could be held exclusively as Reserve balances or as

18:24

learner said issue bonds only in keeping with the principles of functional

18:30

Finance so paying interest on reserves simplifies monetary policy frees the treasury and the fed from selling bonds

18:37

to support the interest rate target it just makes it cleaner and more transparent otherwise it changes very

18:42

little fundamentally again no difference between issuing government debt to the non-government sector and the Central

18:49

Bank paying interest on Reserves at the Target rate they’re identical but the politics can be different all right it

18:57

doesn’t make it less inflation AR if you issue bonds it doesn’t alter the quantity of net Financial Assets in the

19:03

non-government sector and it doesn’t add jet fuel to the spending it doesn’t make

19:09

the deficit more stimulative because there’s no difference between so-called

19:14

Bond financed and money financed deficits there’s no reason for the government to sell bonds at all that’s

19:21

from Full Wilder’s pwor no further increase in the debt means no

19:26

unnecessary and counterproductive debt sealing drama no fights about burning

19:32

grandchildren all that sort of stuff all right this is just a image that Scott

19:38

uses a lot because people don’t understand they see the way the

19:43

government arranges treasury auctions coupled with deficits I say oh well this is how we

19:50

pay for things and I call this one on the left covert monetary financing and

19:56

the one on the right overt monetary financing it’s the same thing the Central Bank back stops the dealers and

20:02

it all works the same way you end up in the same place whether you do it overtly or covertly that’s the point here so

20:11

would stopping Bond issuance undermine Central Bank Independence no if you’ve

20:17

got interest bearing Reserve balances the central bank still has control of the overnight interest rates that’s the

20:23

policy rate if you moved away from that uh and oh you’re not issuing bonds then

20:30

government agency Securities or swaps could emerge as benchmarks you could still have something the private sector

20:37

could use to price risk even without treasuries because you often hear well if you get rid of bonds that’s the

20:42

risk-free rate that’s used to price risk for other Securities and lending and so

20:48

forth you you’d have a huge problem if you got rid of bonds and Scott is saying no you wouldn’t there are other ways uh

20:54

to do that the transmission of monetary policy with interest bearing Reserve balances is identical to that uh with

21:02

non-interest bearing Reserve balances and bonds to drain the excess balances treasury Securities could eventually be

21:08

replaced the interest rate on the national debt would then be whatever interest rate the central bank is paying

21:15

on reserve balances there’s no inherent reason for treasury liabilities to exist

21:20

across the entire term structure except to support operations for long-term

21:27

interest rates if you want do it that way all right now how would you manage credit

21:34

conditions without the tailor rule if you said to the central bank keep the

21:39

interest rate at zero uh oh how do you conduct monetary policy how do you

21:45

manage credit conditions oh Warren has a paper where he put forward I don’t know

21:50

20 30 different proposals for how to change uh what the treasury the fed and

21:57

the banking system everything from regulatory change changes to operational changes and so forth there a whole list

22:04

of things that we’ve proposed over time about how to go about managing

22:09

influencing credit conditions lending and all the rest of it but that’s there Eric T Mo and Randy did an edited volume

22:16

Randy’s book on Minsky Eric’s uh book on Central Bank and asset pric and all the

22:22

rest of it it’s all there uh bill has dealt with the question of well if you’re not able to

22:28

ra interest rates and you have a permanent zero interest rate policy won’t you just get asset bubbles people

22:34

say that all the time bills written about that uh and address those concerns everyone from the Federal Reserve to

22:41

some mm legal Scholars Nathan tankus and others have written to answer this

22:47

question how can you manage credit conditions if you’re not relying on changes in the short-term interest rate

22:53

the answer is there are 101 things that you can do all right

22:59

if you look at uh what other countries have done this is a from a paper where

23:04

they looked at um how many times countries have tightened or loosened

23:11

policy using tools other than the overnight interest rate okay so loan to

23:17

value debt to income other sorts of criteria being used to either loosen credit conditions or tighten credit

23:23

conditions how many times have countries done that this looks at that this one tells you how effective it’s been and

23:30

the paper just makes the arrives at the conclusion that it’s quite effective you

23:35

can use other tools that daren’t the overnight interest rate to manage credit

23:40

conditions other countries do it and they do it very effectively mmt has an answer for every one of these

23:46

weaponization we show that printing money as Scott says isn’t a thing if they really understood the operations

23:52

they wouldn’t say it if you’re not issuing debt it means you don’t have to deal with the fiscal sustainability that

23:58

comes out of the um intertemporal government budget constraint if you’re at Zer or managing interest rates it

24:06

means you don’t have to worry about Bond vigilantes Mosler Minsky Mitchell Ray T

24:11

Mo Etc have done research on as I just said macr credential other ways to

24:17

influence credit Beyond using short-term interest rates functional Finance means fiscal policy has a strong counter

24:24

cyclical role to play and yet we still have to recognize and be prepared for the fact that no matter which option we

24:30

choose people are going to complain about one thing or

24:36

another all right coming close to the end adding some additional concerns so

24:44

we open a conversation and as I said you know the descriptive stuff we’re aligned

24:50

around but on a prescriptive side and on this question about whether we should continue to issue bonds whether we

24:57

should only issue them directly to the central bank whether we should not issue them at all or whether we should carry

25:02

on with current practice issuing bonds to match the deficit to the non-government sector we’ve been having

25:09

these discuss it’s important that we talk about this and that we understand one another’s concerns so ry’s raised uh

25:17

some concerns around Financial fragility oh I’m sorry I’m not there yet this is a different one I’m about to get there uh

25:25

all right mm have had their own additional reasons for favoring no bonds

25:31

and or sir all right this is a different slide if you are doing things the way we

25:37

do them today which is column one and you have a central bank following a tailor rule or otherwise using rate

25:44

hikes to fight inflation the rate hikes might become inflationary so that’s an issue if you do things the way we’re

25:51

doing it today Financial fragility Alam Minsky right the rate hikes leading uh

25:57

highly lever um borrowers into potentially unsustainable speculative reponds and

26:03

positions it’s corporate welfare is what bill and Warren call it like Ubi for the

26:08

rich or whatever so you have those issues if you stopped issuing bonds and or did serve then those problems

26:17

disappear you’re not going to cause Financial fragility if you’re anchoring the interest rate at zero you’re not

26:22

going to have uh rate hikes becoming inflationary because you don’t have uh the bond market any longer and so forth

26:29

right so those problems go away why ISS you de at all if there’s no compelling case to do so as Bill Mitchell says why

26:36

do we keep doing it so I’m going to jump here to some of Randy’s concerns that have been raised just in internal

26:43

conversations and I think he’s had a a paper just uh recently on some of this

26:49

at believe Le right so he’s asking look if we got rid of bonds completely would

26:56

it really not matter matter would it create some problems maybe in terms of

27:01

the Public’s portfolio preferences would it compromise the business model of banking where could there potentially be

27:09

problems there does a modern financial sector need risk-free collateral for liquidity it’s important to deal with

27:16

these questions right shouldn’t be proposing something without thinking about all of the potential risks and

27:22

things that you know you got to uh anticipate problems that you could create so

27:29

we’ve dealt with these I think uh to some extent Scot and I were thinking them through on the saving vehicle issue

27:36

if you just keep with current practice then there’s no problem everybody has their risk-free asset and you’ve got

27:42

your treasuries uh Bank costs and profits not a problem because banks have

27:47

access to uh treasuries a risk-free return uh doesn’t compromise the

27:52

business model of banking you have no liquidity approaching but if you move to options three and four or and this is

27:58

ry’s question and maybe concern then do you start to get into uh a new set of

28:05

problems right do you open yourself up to a new set problem and we’re open to that possibility we’re saying yeah it’s

28:12

worth thinking about right all right so what about two

28:17

additional options ask yourself this question what if the Central Bank issued the Securities instead of the

28:23

treasury there’s an idea Central Bank can do that so central banks have a lot

28:28

of options if the government stops issuing bonds you can have Central Bank Securities you could rely more on

28:34

reverse repost time deposit accounts uh you could have fed accounts or central bank accounts and you could even make

28:40

them available to the business Community or to individuals it’s obvious if we do

28:45

that that central banks can never run out of money Central Bank could issue its own liabilities at any maturity it

28:52

desires if it did that it could announce the rates at each maturity there’s a

28:57

twoyear 5 year 10 year 20 whatever if you weren’t doing zero interest rate

29:03

then you could set rates across the entire term structure you have risk-free

29:09

uh interest rates across the term structure for private lenders to price from if you’re doing Z then you could

29:14

set rates slightly higher or not Scott says that’s his uh line you could have

29:20

on tap Securities which would mean risk-free collateral is plal you just

29:25

announce the price and let the quantity flow you’d avoid the stupid approach

29:31

currently employed which assumes that the desired increase in collateral is

29:37

whatever number happens to pop out of the budget box at the end of every year you get the number of treasuries that match the deficit the mainstream would

29:44

say this infringes on Central Bank Independence but the reality is it gives them more tools if you were to do

29:51

something like this so in conclusion some of you have seen the film finding the money and those of you

29:58

who’ve seen it probably will never forget a particular scene in the film where a White House Economist is

30:06

asked you know why is the government issue treasuries if you have if you have the ability to issue currency why do you

30:14

borrow and he flubs the question okay and I think the question is more

30:19

interesting in an era in which the central bank is paying interest on reserve balances it’s like if bonds are

30:27

about interest rate maintenance and that’s why we were issuing bonds to drain off reserves to allow the central

30:33

bank to achieve its interest rate target assuming the target is above zero now

30:39

that we’re paying interest on reserves now the Central Bank what’s the further purpose of issuing treasuries it’s it

30:46

becomes almost duplicative at that point right so I added another column which is

30:52

options five and six we could let the central bank issue Securities and then leave the central bank to set the

30:59

interest rates at different maturities uh including the overnight interest rate or we could anchor the overnight

31:04

interest rate at zero now does a more clear winner begin to

31:10

emerge doesn’t it maybe Warren says no so this is why

31:15

we’re doing this right because it opens up a conversation but when we think through the different issues and we just

31:22

answered yes or no on each of these this is how the chart filled itself out okay

31:27

so so uh I’m sure Warren will tell us why um this last option is no good but

31:32

the point is that no matter what we propose it’s going to be criticized okay

31:39

and our view Scott’s View and my view is that MNT is about making choices within the right framework and not avoiding

31:47

choosing something because we’re afraid of what the other side will say accusing us of printing money or compromising fed

31:54

Independence or whatever that’s not the right way for us to make a decision on this we ought to do so um in an mmt

32:02

consistent way

oooooo

We are now enrolling students for the February, June and September intakes of our global online MMT-informed Masters degree in the Economics of Sustainability. https://modernmoneylab.org.au/courses/

I had a chat with @StephanieKeltonabout the course last year.

ooo

Stephanie Kelton, in conversation with Steven Hail, March 2025

Transkripzioa:

0:00

hi I’m Steven hail I’m the academic

0:02

director of The Graduate certificate

0:04

graduate diploma and master’s degree in

0:07

the economics of sustainability of

0:09

modern money lab and torren University

0:11

Australia and I’m joined today by

0:14

Stephanie Kelton who is Professor of

0:17

economics and public policy at Stony

0:19

Brook University in Long Island author

0:22

of the 2020 New York Times bestseller

0:25

the deficit myth former Chief Economist

0:28

on the Senate budget committee in

0:30

Washington DC and many other things too

0:34

welcome Stephanie thank you your book

0:36

and your blog have been hugely

0:38

influential in the last few years

0:40

including with our

0:42

students how did we come to know each

0:45

other well I think we got to know one

0:47

another well uh when I was here in

0:51

January of 2020 at your invitation

0:53

really I mean I was the hardcour

0:56

visiting professor and I think I got to

0:58

spend almost 2 weeks in Adelaide and I

1:01

was finishing up the book and I think

1:03

that you and I spent a little bit of

1:04

time working through one of the chapters

1:07

that I was sort of struggling to edit

1:09

and get back to the Publishers so that

1:11

they could actually have the final

1:12

manuscript and I think that that’s where

1:14

we got to know one another the best yeah

1:16

and we ran a conference here at the time

1:18

with I think over 400 people at the

1:22

conference and indirectly that

1:24

conference LED on to us talking to

1:26

torren University and devising this

1:28

program which we been running out for 2

1:30

years with your support it’s great to

1:33

have you as a adjunct or honorary

1:35

professor at the University and it’s

1:37

been great to have you um involved in a

1:39

couple of events with our students in

1:41

the last couple of years I think our

1:44

program is the only one in the world

1:48

definitely as far as online programs is

1:49

concerned where Modern monetary theory

1:52

is either the basis of or at least

1:55

influences every subject in the program

1:59

and I think that’s important do you

2:01

agree what you’ve done stepen honestly

2:04

is beyond what I ever would have

2:07

imagined and I taught for many years at

2:10

a university where we had lots of mmt

2:12

economists but the whole of the program

2:15

wasn’t really infused with mmt and this

2:19

is I mean you’ve taken this to a whole

2:22

another level here and it’s really

2:25

inspiring to watch what you’ve done and

2:27

to see the enthusiasm you got students

2:30

from all over the world and I know that

2:32

many of them have to join sometimes they

2:34

they join in real time and it might be

2:37

two or three o’clock in the morning and

2:39

they want to be sure that they’re there

2:41

for the live portion of uh some

2:43

interaction with some of the incredible

2:45

faculty that you have so I’m just

2:48

thrilled to see you know what you’ve

2:50

built and continue to build with torren

2:52

University oh thank you very much

2:54

Stephanie I should add that they don’t

2:56

have to be up at 3:00 a.m. we run

2:59

everything twice

3:00

but we have several students who come to

3:03

both live webinars in the subject

3:05

they’re doing at the so they do they get

3:07

up in the middle get enough absolutely

3:10

right yes yes we have uh some people you

3:13

know quite well teaching for a Scott for

3:15

Wilder John Harvey Eric Dean um not to

3:18

mention me do you think these are good

3:20

people to study with well they’re great

3:22

people to study I know what you’re going

3:24

to say ask you anyway some of them are

3:26

my former colleagues Scott F Wilder was

3:28

a former colleague ER Dean was student

3:30

of ours John Harvey is so incredible

3:32

that I invite him to guest lecture in a

3:35

course that I teach so when I’m

3:37

handpicking people that I think are

3:40

outstanding in the classroom that bring

3:42

something that I think is important that

3:43

I want my students to hear these are the

3:46

kinds of people that I pick and

3:48

sometimes I only get a one-off lecture

3:49

and you get a whole course out of some

3:51

of them so it’s really remarkable yeah

3:53

we’ve been very fortunate in who we’ve

3:55

been able to have join in the program

3:57

it’s been great to have them uh we have

4:00

two themes I suppose going through the

4:01

master’s degree mmt is one of them the

4:04

other one is environmental

4:05

sustainability how do they fit together

4:08

well it’s really difficult to imagine

4:10

doing one without the other really to do

4:14

economics well I think is to recognize

4:18

uh some of the insights that mmt has

4:20

long emphasized which are you know real

4:24

resource constraints and inflation

4:26

limits and so forth but really truly

4:29

building in

4:30

the ecological constraints and helping

4:32

people appreciate why it’s important to

4:35

do that why you can’t just sort of

4:38

passively mention that one must pay

4:41

attention to things like planetary

4:42

boundaries and then move along but to

4:44

really do that kind of Deep dive and to

4:47

properly integrate that into a

4:49

macroeconomic framework is creating an

4:52

offering that I don’t think exists

4:54

anywhere else in the world why are you

4:56

in adelite at the moment well we’re here

4:59

to to bring this film this documentary

5:03

uh which is in a sense a the story of

5:05

mmt in many ways it’s called finding the

5:07

money and we’re screening it in major

5:11

cities all across the country for the

5:12

next 10 days or so and I think it got

5:15

started even before I arrived you know

5:17

this is a a film that tells the story of

5:21

the kind of rise to prominence of mmt

5:24

where did this framework come from how

5:25

did it kind of Catch Fire what does it

5:28

offer us by way of you know giving us

5:31

new ways to think about some big things

5:34

especially the way we think about the

5:36

capacity of the government to spend

5:38

money the mechanics of government

5:40

Finance where does money come from how

5:42

does it all work um why do we pay taxes

5:45

and should we worry about things like

5:47

deficits and the debt this film

5:49

addresses all of those questions and

5:52

answers them in ways that really run

5:55

counter to just about everything we’ve

5:57

been taught to believe and so I think

5:59

it’s been exciting for audiences to sit

6:02

through this and sort of have their

6:03

minds blown but I think what they come

6:06

away with is almost a sense of well of

6:09

course right it seems so intuitive once

6:12

it’s laid out for you so that’s why I’m

6:15

here and I’m hoping that you know this

6:16

will advance the debate that we have

6:20

over you know what we can actually

6:22

afford to do as a nation in ways that

6:26

you know ship the conversation open up

6:28

some space for us to think more

6:30

ambitiously about what we’re capable of

6:33

and to stop having the wrong debate stop

6:35

arguing about the wrong things and get

6:37

focused on what really matters so we’re

6:39

not saying that there are no limits on

6:41

government spending no we’re not saying

6:43

there are no limits we’re saying the

6:44

limits are there and they’re real and we

6:46

have to pay attention to them we have to

6:48

respect the real limits capacity

6:50

constraints in our economy there’s

6:52

inflation that you have to worry about

6:54

their ecological and planetary

6:55

boundaries but the things we’ve been

6:57

taught to worry about the number that

6:59

pops out of the budget box at the end of

7:01

each year the size of the national debt

7:04

um those are kind of distractions from

7:07

the things that really matter and that’s

7:09

what the film tries to get across

7:11

there’s there is at least one famous

7:13

economist in the film who says that you

7:16

say um deficit spending can be a problem

7:19

because of the inflation constraint

7:21

because of the a real resource

7:22

constraint we say that deficit spending

7:25

is a problem because of issues to do

7:27

with what we call fiscal sustainab

7:29

ability and the ratio of the national

7:32

debt to GDP rising over time and those

7:35

two things get us to roughly the same

7:37

place so that the issue doesn’t really

7:38

matter now we we don’t agree with those

7:41

people why the person you’re referring

7:44

to has worried about deficits and debt

7:46

for a long time and in fact pushed uh

7:49

was part of the Obama Administration he

7:52

was an economic uh adviser to the

7:54

president and at the time was pushing

7:57

deficit reduction not because he was

7:59

worried about inflation but because he

8:01

was worried about the deficit per se and

8:04

so it doesn’t get you to roughly the

8:06

same place in fact where it got us was

8:08

to a long period where the government

8:11

was pursuing the administration a

8:13

Democratic president and his

8:15

administration were pursuing austerity

8:18

for the sake of trying to achieve a

8:21

smaller deficit not because they were

8:23

worried about inflation so I would argue

8:26

that we got really poor economic policy

8:30

during those years and that it cost us

8:33

in many ways it cost Society we had a

8:36

much more sluggish recovery from the

8:39

global financial crisis the Great

8:40

Recession we could have done so much

8:43

more to repair the damage that had been

8:46

done but instead we you know pivoted to

8:50

austerity and we had what basically

8:52

amounted to a lost decade and we had

8:55

much the same thing in Australia right

8:56

so you could tell precisely the same

8:58

story yeah

9:00

H um it’s no secret that you’ve signed

9:03

on to write another

9:04

book can you tell us anything about

9:07

about it at all or perhaps when we can

9:09

expect it to come out well I’m not

9:11

expecting you to tell us the title or

9:13

exactly what is it uh another addition

9:16

of the deficit myth or will it be

9:17

something different well it has to be

9:19

something different but it is in some

9:21

ways a continuation of that story and I

9:25

do kind of like the myth mythbusting I I

9:29

think there are still a lot of things

9:31

that we get wrong and some of the

9:33

lessons that uh unfortunately I think

9:35

have been learned in the wake of the

9:37

policy response to co need to be

9:40

addressed and straightened out um before

9:42

we get ourselves into real trouble so

9:45

the next book will take me probably a

9:47

year and a half to write I’ve just uh

9:50

signed a contract for publishing that

9:52

next book so I’ve got a lot of work to

9:54

do late 2025 maybe people can look for

9:57

that early 2026 Maybe

9:59

what we’re pushing for really is nothing

10:01

short of a paradigm shift in

10:03

macroeconomics and in framing Economic

10:06

Policy issues generally that’s not going

10:08

to be easy to bring about well no

10:11

there’s a lot of resistance a lot of

10:13

entrenched interests uh you know how the

10:16

academy Works economists are uh very

10:19

protective of their domain and the sort

10:22

of big boys like to have conversations

10:24

among themselves and often not invite

10:27

folks who have a very different way of

10:30

thinking about things to be part of the

10:32

conversation they prefer to interact

10:34

with people who differ at the margins

10:36

whereas we come essentially with a

10:38

completely different macroeconomic

10:41

framework a different Paradigm so it’s

10:43

more difficult in some ways to have

10:45

conversations with us because we see the

10:47

world so differently and so you have to

10:51

kind of elbow your way in to to have a a

10:55

place in some of these debates and I

10:57

think we’ve been pretty successful at

10:59

that so far but you you have to keep

11:01

going sometimes it’s two steps forward

11:02

one step back well you’ve been hugely

11:04

successful and the deficit myth was on

11:07

the New York Times best bestseller list

11:09

it must have been the bestselling

11:10

economics book in 2020 I’m very very

11:14

blessed to have seen that book do as

11:17

well as it did and you know it’s funny

11:19

because it’s been adopted not just uh by

11:22

economists there people who teach and

11:24

adopt the book and use it in their

11:25

classrooms and I love that but I get

11:27

emails from high school teach who use it

11:30

I get emails from history professors

11:32

sociology professors political science

11:34

professors social people who teach

11:36

social work and I show up with you know

11:38

in the zoom and I go meet with the

11:39

students if they’re uh using the book

11:42

but the the reward is not just that

11:45

which is hugely rewarding but just how

11:47

accessible the book has been to to lay

11:50

people with no background in economics

11:52

who you know you see a book with the

11:54

titled the deficit myth well who in the

11:56

world wants to read about budget

11:57

deficits but somehow people really want

12:00

to understand they want to understand

12:02

what it is that people are constantly

12:04

harping on about uh on television and

12:07

radio programs and so forth you know as

12:10

long as people are banging on about you

12:13

know debt deficits and all of that sort

12:16

of stuff people will be looking for a

12:18

book like that to help them make sense

12:20

of things well I know we were largely

12:22

ignored um or at least I was in

12:24

Australia until you came last time in

12:27

January 2020 and then the deficit myth

12:29

came out and then after that we got

12:33

invitations from commercial Banks and

12:35

investment Banks and Torrens were kind

12:38

enough to agree for for us to run this

12:41

program that book and your work

12:43

generally has been the biggest

12:46

inspiration for what we’ve been doing

12:49

and we’re very grateful and it’s great

12:51

that you’re an Adjunct professor or

12:53

honorary professor at torren and it’s

12:55

been terrific having you talk to our

12:57

students the last couple of years and

12:59

and I hope you’ll go on doing that in

13:00

the future I sure I sure will your

13:03

students are um among the most dedicated

13:06

that I’ve interacted with they’re here

13:08

and they know why they’re here they know

13:10

why they’re signing up for these courses

13:12

and so you have the luxury of getting to

13:14

teach to students who actually want to

13:16

be there every single day that they log

13:18

in and um I couldn’t wish you better

13:21

success and I know that the program is

13:23

just going to continue to attract more

13:25

and more students so hugely um proud of

13:29

what you’re you’re doing here thanks

13:31

very much Stephanie you’re welcome thank

13:38

you

oooooo

Il tema “saldi commerciali” è probabilmente il meno compreso e più frainteso sulla #MMT. Quanto conta come “sistema Paese” è: -cosa ottieni in cambio dell’export -come usi l’import (che poi sono la stessa cosa) cioè l’obiettivo deve essere ottimizzare le ragioni reali di scambio:

Bideoa: https://x.com/i/status/1881022194249261432

oooooo

I think you will enjoy this chat myself and Lynne Dougan had with Professor L. Randall Wray. We talk about where money comes from, standardising a unit of measurement, the destruction of taxes, understanding IOUs, balance sheet entries and more …

Bideoa: https://x.com/i/status/1873422019762733068

oooooo

Bitxikeria

@tobararbulu # mmt@tobararbulu

The Trillion Dollar Equation https://youtu.be/A5w-dEgIU1M?si=i-4DwyxP04YGHhlW

Honen bidez: @YouTube

ooo

The Trillion Dollar Equation

(https://www.youtube.com/watch?v=A5w-dEgIU1M)

How the Black-Scholes/Merton equation made trillions of dollars. Go to https://www.eightsleep.com/veritasium and use the code Veritasium for $200 off your Pod Cover.

Transkripzioa:

0:00

– This single equation spawned four multi-trillion dollar industries and transformed everyone’s approach to risk.

0:07

Do you think that most people are aware of the size, scale, utility of derivatives?

0:13

– No. No idea. – But at its core, this equation comes from physics, from discovering atoms,

0:20

understanding how heat is transferred, and how to beat the casino at blackjack.

0:25

So maybe it shouldn’t be surprising that some of the best to beat the stock market were not veteran traders,

0:30

but physicists, scientists, and mathematicians. In 1988, a mathematics professor named Jim Simons

0:37

set up the Medallion Investment Fund, and every year for the next 30 years, the Medallion fund delivered higher returns

0:44

than the market average, and not just by a little bit, it returned 66% per year.

0:51

At that rate of growth, $100 invested in 1988 would be worth

0:56

$8.4 billion today. This made Jim Simons easily the richest

1:02

mathematician of all time. But being good at math doesn’t guarantee success in financial markets.

1:09

Just ask Isaac Newton. In 1720 Newton was 77 years old,

1:15

and he was rich. He had made a lot of money working as a professor at Cambridge for decades,

1:20

and he had a side hustle as the Master of the Royal Mint. His net worth was £30,000

1:27

the equivalent of $6 million today. Now, to grow his fortune, Newton invested in stocks.

1:34

One of his big bets was on the South Sea Company. Their business was shipping enslaved Africans across the Atlantic.

1:42

Business was booming and the share price grew rapidly. By April of 1720, the value of Newton’s shares had doubled.

1:49

So he sold his stock. But the stock price kept going up and by June, Newton bought back in

1:57

and he kept buying shares even as the price peaked. When the price started to fall, Newton didn’t sell.

2:03

He bought more shares thinking he was buying the dip. But there was no rebound,

2:09

and ultimately he lost around a third of his wealth. When asked why he didn’t see it coming, Newton responded,

2:16

“I can calculate the motions of the heavenly bodies, but not the madness of people.”

2:22

So what did Simons get right that Newton got wrong? Well, for one thing, Simons was able

2:29

to stand on the shoulders of giants. The pioneer of using math to model financial markets

2:35

was Louis Bachelier, born in 1870. Both of his parents died when he was 18

2:41

and he had to take over his father’s wine business. He sold the business a few years later and moved to Paris to study physics,

2:48

but he needed a job to support himself and his family and he found one at the Bourse, The Paris Stock Exchange.

2:54

And inside was Newton’s “madness of people” in its rawest form. Hundreds of traders screaming prices, making hand signals,

3:02

and doing deals. The thing that captured Bachelier’s interest were contracts known as options.

3:10

The earliest known options were bought around 600 BC by the Greek philosopher Thales of Miletus.

3:17

He believed that the coming summer would yield a bumper crop of olives. To make money off this idea,

3:22

he could have purchased olive presses, which if you were right, would be in great demand, but he didn’t have enough money to buy the machines.

3:29

So instead he went to all the existing olive press owners and paid them a little bit of money to secure the option

3:35

to rent their presses in the summer for a specified price. When the harvest came, Thales was right,

3:42

there were so many olives that the price of renting a press skyrocketed. Thales paid the press owners their pre-agreed price,

3:49

and then he rented out the machines at a higher rate and pocketed the difference. Thales had executed the first known call option.

3:58

A call option gives you the right, but not the obligation to buy something at a later date for a set price

4:04

known as the strike price. You can also buy a put option, which gives you the right, but not the obligation

4:10

to sell something at a later date for the strike price. Put options are useful if you expect the price to go down.

4:16

Call options are useful if you expect the price to go up. For example, let’s say the current price

4:21

of Apple stock is a hundred dollars, but you expect it to go up. You could buy a call option for $10

4:28

that gives you the right, but not the obligation to buy Apple stock in one year for a hundred dollars.

4:34

That is the strike price. Just a little side note, American options can be exercised on any date up to the expiry,

4:41

whereas European options must be exercised on the expiry date. To keep things simple, we’ll stick to European options.

4:48

So if in a year the price of Apple stock has gone up to $130, you can use the option to buy shares

4:55

for a hundred dollars and then immediately sell them for $130. After you take into account the $10 you paid

5:01

for the option, you’ve made a $20 profit. Alternatively, if in a year the stock prices dropped to $70,

5:08

you just wouldn’t use the option and you’ve lost the $10 you paid for it. So the profit and loss diagram looks like this.

5:16

If the stock price ends up below the strike price, you lose what you paid for the option. But if the stock price is higher than the strike price,

5:23

then you earn that difference minus the cost of the option.

5:28

There are at least three advantages of options. One is that it limits your downside.

5:34

If you had bought the stock instead of the option and it went down to $70, you would’ve lost $30.

5:39

And in theory, you could have lost a hundred if the stock went to zero. The second benefit is options provide leverage.

5:46

If you had bought the stock and it went up to $130, then your investment grew by 30%.

5:52

But if you had bought the option, you only had to put up $10. So your profit of $20 is actually

5:57

a 200% return on investment. On the downside, if you had owned the stock,

6:03

your investment would’ve only dropped by 30%, whereas with the option you lose all 100%.

6:09

So with options trading, there’s a chance to make much larger profits, but also much bigger losses.

6:16

The third benefit is you can use options as a hedge. – I think the original motivation for options

6:22

was to figure out a way to reduce risk. And then of course, once people decided they wanted to buy insurance,

6:28

that meant that there are other people out there that wanted to sell it or a profit, and that’s how markets get created.

6:36

– So options can be an incredibly useful investing tool, but what Bachelier saw on the trading floor was chaos,

6:43

especially when it came to the price of stock options. Even though they had been around for hundreds of years,

6:50

no one had found a good way to price them. Traders would just bargain to come to an agreement about what the price should be.

6:56

– Given the option to buy or sell something in the future, it seems like a very amorphous kind of a trade.

7:04

And so coming up with prices for these rather strange objects has been a challenge

7:10

that’s plagued a number of economists and business people for centuries.

7:15

– Now, Bachelier, already interested in probability, thought there had to be a mathematical solution

7:20

to this problem, and he proposed this as his PhD topic to his advisor Henri Poincaré.

7:26

Looking into the math of finance wasn’t really something people did back then, but to Bachelier’s surprise, Poincaré agreed.

7:34

To accurately price an option, first you need to know what happens to stock prices over time.

7:40

The price of a stock is basically set by a tug of war between buyers and sellers. When more people wanna buy a stock, the price goes up.

7:48

When more people wanna sell a stock, the price goes down. But the number of buyers and sellers

7:53

can be influenced by almost anything, like the weather, politics, new competitors, innovation and so on.

8:00

So Bachelier realized that it’s virtually impossible to predict all these factors accurately.

8:05

So the best you can do is assume that at any point in time the stock price is just as likely to go up as down

8:12

and therefore over the long term, stock prices follow a random walk, moving up and down as if their next move is determined

8:20

by the flip of a coin. – Randomness is a hallmark of an efficient market.

8:27

By efficient economists typically mean that you can’t make money by trading.

8:33

– The idea that you shouldn’t be able to buy an asset and sell it immediately for a profit is known

8:38

as the Efficient Market Hypothesis. – The more people try to make money by predicting the stock market

8:44

and then trading on those predictions, the less predictable those prices are. If you and I could predict

8:51

the stock market tomorrow, then we would do it. We would start trading today on stocks

8:56

that we thought were gonna go up tomorrow. Well, if we did that, then instead of going up tomorrow,

9:02

they would go up now as we bought more and more of the stock. So the very act of predicting actually affects the quality

9:10

of the future outcomes. And so in a totally efficient market, the prices tomorrow can’t possibly have any

9:18

predictive power. If they did, we would’ve taken advantage of it today.

9:24

– This is a galton board. It’s got rows of pegs arranged in a triangle and around 6,000 tiny ball bearings

9:31

that I can pour through the pegs. Now, each time a ball hits a peg, there’s a 50 50 chance it goes to the left or the right.

9:38

So each ball follows a random walk as it passes through these pegs, which makes it basically impossible

9:44

to predict the path of any individual ball. But if I flip this over, what you can see

9:50

is that all the balls together always create a predictable pattern. That is a collection of random walks

9:57

creates a normal distribution. It’s centered around the middle because the number of paths a ball could take

10:03

to get here is the greatest. And the further out you go, the fewer the paths a ball could take to get there. Like if you want to end up here, well the ball would have

10:10

to go left, left, left, left all the way down. So there’s only one way to get here,

10:15

but to get into the middle, there are thousands of paths that a ball could take. Now, Bachelier believed a stock price is

10:22

just like a ball going through a galton board. Each additional layer of pegs represents a time step.

10:29

So after a short time, the stock price could only move up or down a little, but after more time, a wider range of prices is possible.

10:37

According to Bachelier the expected future price of a stock is described by a normal distribution,

10:43

centered on the current price which spreads out over time. Bachelier realized he had rediscovered

10:50

the exact equation which describes how heat radiates from regions of high temperature

10:55

to regions of low temperature. This was first discovered by Joseph Fourier back in 1822.

11:02

So Bachelier called his discovery the radiation of probabilities.

11:07

Since he was writing about finance, the physics community didn’t take any notice, but the mathematics of the random walk would go on

11:14

to solve an almost century old mystery in physics.

11:20

In 1827, Scottish botanist Robert Brown was looking at pollen grains under the microscope,

11:25

and he noticed that the particles suspended in water on the microscope slide were moving around randomly.

11:31

Because he didn’t know whether it was something to do with the pollen being living material, He tested non-organic particles

11:37

such as dust from lava and meteorite rock. Again, he saw them moving around in the same way.

11:44

So Brown discovered that any particles, if they were small enough, exhibited this random movement,

11:50

which came to be known as Brownian motion. But what caused it remained a mystery.

11:58

80 years later in 1905, Einstein figured out the answer.

12:05

Over the previous couple hundred years, the idea that gases and liquids were made up of molecules became more and more popular.

12:11

But not everyone was convinced that molecules were real in a physical sense. Just that the theory explained a lot of observations.

12:18

The idea led Einstein to hypothesize that Brownian motion is caused by the trillions of molecules hitting the particle

12:25

from every direction, every instant. Occasionally, more will hit from one side than the other,

12:30

and the particle will momentarily jump. To derive the mathematics, Einstein supposed that as an observer we can’t see

12:38

or predict these collisions with any certainty. So at any time we have to assume that the particle is just as likely to move

12:44

in one direction as an another. So just like stock prices, microscopic particles move

12:50

like a ball falling down a galton board, the expected location of a particle is described by a normal distribution, which broadens with time.

12:59

It’s why even in completely still water, microscopic particles spread out.

13:04

This is diffusion. By solving the Brownian motion mystery.

13:09

Einstein had found definitive evidence that atoms and molecules exist. Of course, he had no idea

13:14

that Bachelier had uncovered the random walk five years earlier. By the time Bachelier finished his PhD,

13:21

he had finally figured out a mathematical way to price an option. Remember that with a call option,

13:27

if the future price of a stock is less than the strike price, then you lose the premium paid for the option.

13:33

But if the stock price is greater than the strike price, you pocket that difference and you make a net profit if the stock has gone up

13:39

by more than you paid for the option. So the probability that an option buyer makes a profit is the probability that the price

13:46

increases by more than the price paid for it, which is the green shaded area. And the probability that the seller makes money

13:53

is just the probability that the price stays low enough that the buyer doesn’t earn more than they paid for it. This is the red shaded area.

14:01

Multiplying the profit or loss by the probability of each outcome, Bachelier calculated the expected return of an option.

14:08

Now how much should it cost? If the price of an option is too high, no one will wanna buy it.

14:14

Conversely, if the price is too low, everyone will want to buy it. Bachelier argued that the fair price

14:20

is what makes the expected return for buyers and sellers equal. Both parties should stand to gain or lose the same amount.

14:28

That was Bachelier’s insight into how to accurately price an option.

14:33

When Bachelier finished his thesis, he had beaten Einstein to inventing the random walk and solved the problem that had eluded options traders

14:40

for hundreds of years. But no one noticed. The physicists were uninterested

14:45

and traders weren’t ready. The key thing missing was a way to make a ton of money.

14:52

Hey, so I’m not sure how stock traders sleep at night with billions of dollars riding on the madness of people,

14:57

but I have been sleeping just fine, thanks to the sponsor of this video, Eight Sleep. I’ve recently moved to Australia

15:03

and it has been really hot, but I’ve been keeping cool at night using the Eight Sleep Pod. It’s a smart mattress cover

15:09

that can control the temperature of the bed and track how well you sleep. You can set the temperature to whatever you like

15:15

from around 13 degrees Celsius, all the way up to 43 degrees Celsius, and my wife likes it a little warmer than I do,

15:22

so it’s useful that we can each have our own temperature on our own side of the bed. And if you don’t know what works best for you,

15:28

well the Pod will learn your ideal temperature and optimize it throughout the night using its autopilot.

15:34

And usually that means getting a couple of degrees cooler during the start of the night and then warming up in the morning to help you wake up.

15:40

You can also have it wake you with a slight vibration, which is really pleasant and it doesn’t disturb your partner

15:45

like an annoying phone sound. You know, I’ve been tracking my sleep before and after using the Pod, and I’ve found that I’ve been sleeping longer

15:52

and waking up less since using the Pod. So if you wanna try it out for yourself, click on the link in the description

15:58

and thanks again to Eight Sleep for sponsoring this part of the video. In the 1950s,

16:04

a young physics graduate, Ed Thorpe, was doing his PhD in Los Angeles, but a few hours drive away,

16:10

Las Vegas was quickly becoming the gambling capital of the world, and Thorpe saw a way to make a fortune.

16:16

He headed to Vegas and sat down at the blackjack table, back then, the dealer only used a single deck of cards,

16:21

so Thorpe could keep a mental note of all the cards that had been played as he saw them.

16:27

This allowed him to work out if he had an advantage. He would bet a bigger portion of his funds when the odds were in his favor

16:33

and less when they weren’t. He had invented card counting. This is a remarkable innovation,

16:40

considering blackjack had been around in various forms for hundreds of years, and for a while this made him a lot of money.

16:48

But the casinos got wise to his strategy and they added more decks of cards to the game to reduce the benefit of card counting.

16:55

So Thorpe took his winnings to what he called the biggest casino on Earth:

17:00

the stock market. He started a hedge fund that would go on to make a 20% return every year

17:07

for 20 years, the best performance ever seen at that time. And he did it by transferring the skills he honed

17:13

at the blackjack table to the stock market. Thorpe pioneered a type of hedging, a way to protect against losses with balancing

17:20

or compensating transactions. – Thorpe did it mathematically. He looked at the odds of winning and losing

17:27

and decided that under certain conditions you can actually tilt the odds in your favor by using certain patterns

17:34

to be able to make bets. – Suppose Bob sells Alice a call option on a stock,

17:40

and let’s say the stock has gone up, so now it’s in the money for Alice. Well now for every additional $1, the stock price goes up,

17:47

Bob will lose $1, but he can eliminate this risk by owning one unit of stock.

17:54

Then if the price goes up, he would lose $1 from the option but gain that dollar back from the stock.

18:00

And if the stock drops back outta the money for Alice, he sells the stock so he doesn’t risk losing any money from that either.

18:07

This is called dynamic hedging. It means Bob can make a profit with minimal risk from fluctuating stock prices.

18:14

A hedge portfolio pi at any one time will offset the option V with some amount of stock delta.

18:21

– It basically means I can sell you something without having to take the opposite side of the trade.

18:28

And the way to think about it is I have synthetically manufactured an option for you.

18:36

I’ve created it out of nothing by doing dynamic trading. Dynamic hedging.

18:42

– As we saw with Bob’s example delta, the amount of stock he has to hold, changes depending on current prices.

18:48

Mathematically, it represents how much the current option price changes with a change in the stock price.

18:54

But Thorpe wasn’t satisfied with Bachelier’s model for pricing options. I mean, for one thing, stock prices aren’t entirely random.

19:01

They can increase over time if the business is doing well or fall if it isn’t. Bachelier’s model ignored this.

19:08

So Thorpe came up with a more accurate model for pricing options, which took this drift into account.

19:14

– I actually figured out what this model was back in

19:19

the middle of 1967, and I decided that I would just use it for myself

19:26

and then later I kept it quiet for my own investors. The idea was to basically make a lot

19:32

of money out of it for everybody. – His strategy was if the option was going cheap, according to his model, buy it.

19:38

If it was overvalued, short sell it, that is bet against it. And that way, more often than not,

19:43

he would end up on the winning side of the trade. This lasted until 1973.

19:50

In that year, Fischer Black and Myron Scholes came up with an equation that changed the industry.

19:56

Robert Merton independently published his own version, which was based on the mathematics of stochastic calculus,

20:01

so he is also credited. – I thought I’d have the field to myself, but unfortunately, Fischer Black

20:08

and Myron Scholes published the idea and they did a better job of the model than I did

20:14

because they had very tight mathematics behind their derivation – Like Bachelier,

20:19

they thought that option prices should offer a fair bet to both buyers and sellers, but their approach was totally new.

20:26

They said if it was possible to construct a risk-free portfolio of options and stocks just like Thorpe was doing

20:32

with his delta hedging, then in an efficient market, a fair market, this portfolio should return nothing more

20:38

than the risk-free rate, what the same money would earn if invested in the safest asset, US treasury bonds.

20:45

The assumption was that if you’re not taking on any additional risk, then it shouldn’t be possible to receive any extra returns.

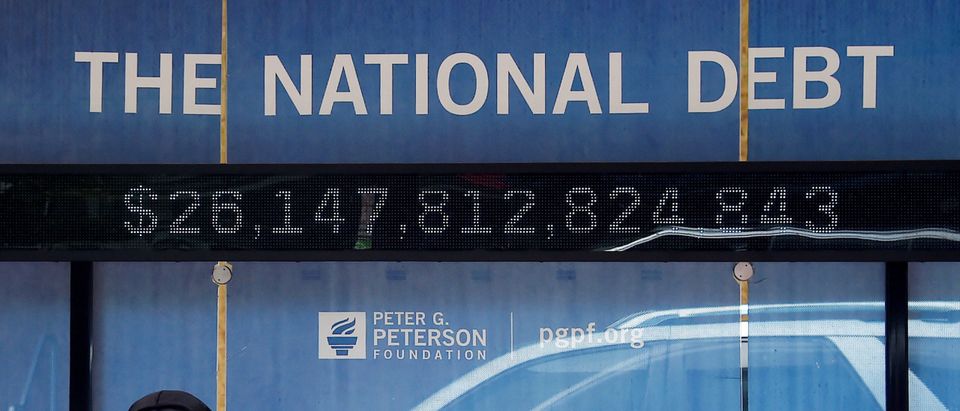

20:53