Ibaitik Itsasora

******

Gaza BEFORE Israel showed up

Israel is a criminal state

Bideoa: https://x.com/i/status/1887980771178070396

******

******

Zionists in 2025… “Palestine never existed”

Zionists in 1899… “We will colonise Palestine”

In 1948 Albert Einstein foresaw the Israeli terrorism in Palestine that would eventually bring a catastrophe on the Jewish colonists.

******

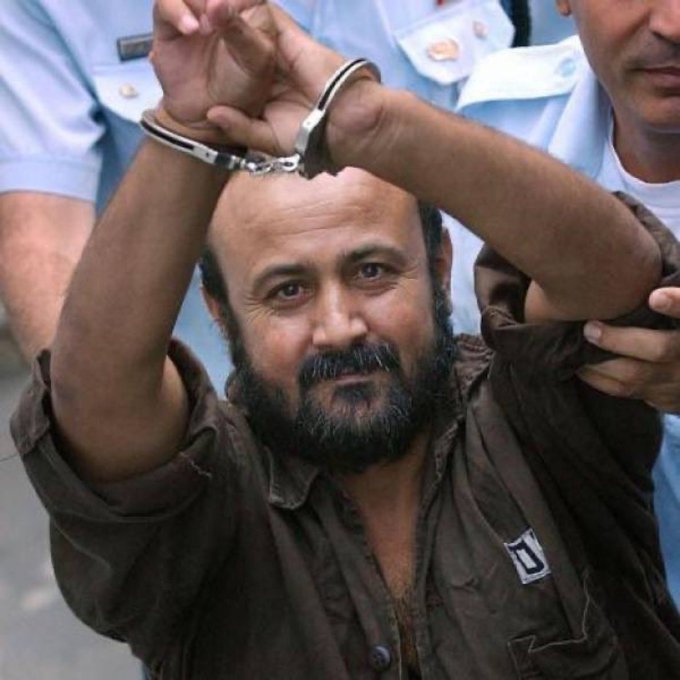

George Galloway@georgegalloway

I’m pretty sure the Nazi Ben Gvir signed his own eternal death sentence yesterday when he invaded the cell of Palestine’s Nelson Mandela. In fact I think I have never seen a more repugnant display of supremacism and fascist arrogance. Marwan Barghouti has clearly been starved and tortured by his jailers and may be close to death. When the Labour Minister and grandee Roy Mason attended the eventual death bed of Bobby Sands to dance upon it while declaring Labour’s total refusal to accept the legitimate demands of the Irish hunger strikers I thought I could never again feel such revulsion against any political figure. But at least he didn’t film his own moral degeneracy. Ben Gvir promised Marwan that he would “crush him” and maybe he will. But he will bury seeds. The Palestinian hero will come back to haunt him. In this life and in the next.

oooooo

Our One State Palestine appeal to

and

#OneStatePalestine Watch our One State Palestine broadcast in an hour’s time at 7pm #here on Twitter X!

George Galloway@georgegalloway

Marwan, his wife and his children are friends of mine. This is Marwan Barghouti. Palestine’s Nelson Mandela. He is their true leader. The only leader capable of uniting the whole people and the world behind the just demands of the Palestinian cause, the moral centre of the world.

OneStatePalestine@1StatePalestine

Barbaric

Aipamena

حسام شبات@HossamShabat

abu. 16

Israel deliberately targets journalists in Gaza to silence the truth. At the same time, it blocks international press from entering—sealing Gaza off from the world’s eyes so that genocide can proceed in darkness.

Bideoa: https://x.com/i/status/1956679470993080399

oooooo

WARNING: You are about to be CONNED by the UN

A Uniting for Peace Resolution will soon be tabled at the UNGA on using force to stop the Gaza genocide.

In this video, I explain how France & Saudi Arabia will hijack momentum for a military intervention and instead call for a “stabilisation force” to effectively perpetuate the conditions of occupation and apartheid.

Palestine activists around the world must be CAREFUL. Rather than supporting a UN process, we should demand military intervention NOW, not just to stop the genocide but to tear down all checkpoints, walls, military infratructure and FORCE Israelis to evacuate from Palesting as ordered by the ICJ & to liberate Palestine from river to sea.

The UN is a place where good ideas go to die. We should never trust it to assist Palestine.

Bideoa: https://x.com/i/status/1956393898768548182

oooooo

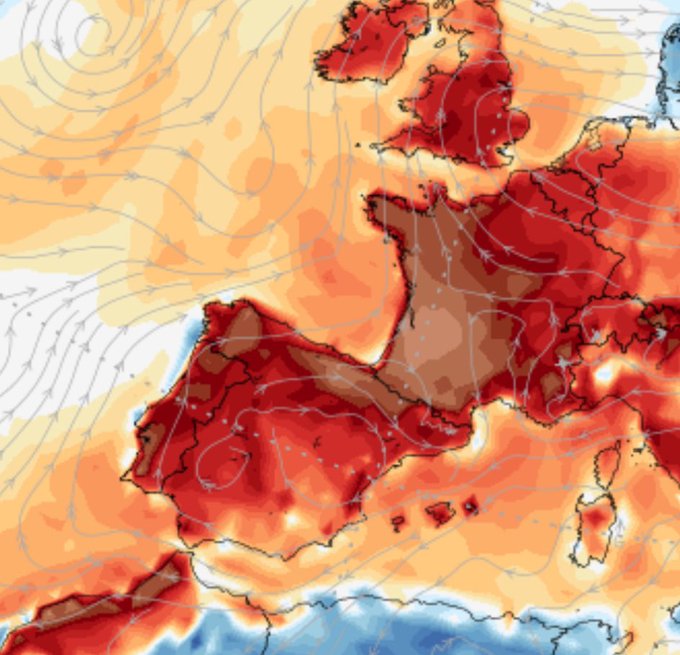

Now Imagine this for weeks and not one press conference not one editor not one TV Show about the cascades that will make this all worse day by day! And not a single word about potential and temporal stratospheric upwind cooling ideas. Nothing just paid and stupid silence.

abu. 9

Europe could face weeks of 40°C heat in current worst-case scenario A perfect storm of conditions priming the atmosphere for extreme heat could result in devastating droughts and deadly temperatures lasting for weeks across Europe

oooooo

1948–54: Thousands of Mizrahi babies (Yemeni, Iraqi, Moroccan Jews) vanished in Israel. Parents were told they “died”—but no graves, no proof. DNA later revealed many were taken & adopted by Ashkenazi families. A racist social engineering crime.

#YemeniteChildren #Israel #Mizrahi #Zionism #StolenChildren #OneStatePalestine

Absolute monsters

Aipamena

Max Blumenthal@MaxBlumenthal

abu. 19

Israel’s Final Solution is underway Trump and Congress have signed off on it, and the EU is standing by x.com/mosababutoha/s…

oooooo

HALT THE GENOCIDE: Legal Case for Gaza Military Intervention NOW | UN Chapter 7 & R2P

Of course, there will be no one state if there are no Palestinians left alive or on the territory to form it, and I strongly support the call that you have just made @ousmannoor for international intervention.

If America vetoes UN chapter 7, then the willing should form a coalition and should enter the Gaza strip to bring the killing to a halt.

That’s not just moral. That’s not just the right thing to do. It is the only legal course of action. It is illegal to see a genocide going on and not to do anything, everything that you can, to bring it to an end.

#Chapter7Now #RightToProtect #InvokeR2P #EnforceUNCharter #EndTheSlaughter #Gaza #Palestine #USVetoKills #BypassTheVeto #CoalitionOfTheWilling #MilitaryInterventionNow #ProtectGaza #ActForGaza #MoralImperative #NeverAgainIsNow #LawNotPolitics #GazaCrisis #IsraeliCrimes #InternationalLaw #ICJ

Bideoa: https://x.com/i/status/1956803386809966968

oooooo

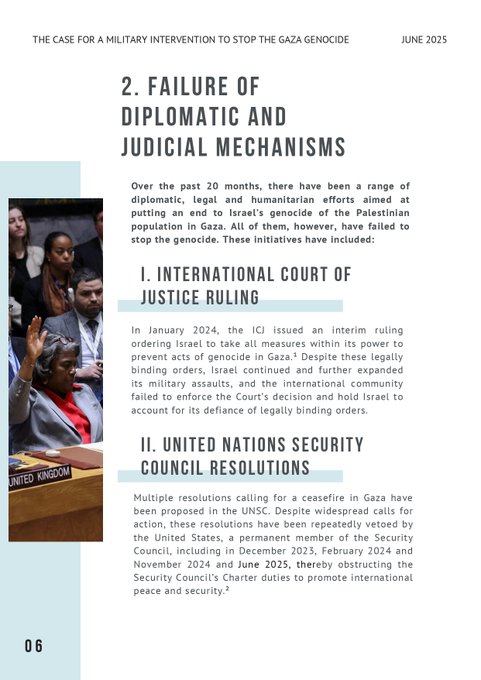

THE CASE FOR A MILITARY INTERVENTION TO STOP THE GAZA GENOCIDE

The genocide in Gaza will not stop without direct military intervention. The law is clear, the moral duty is undeniable, and the mechanisms exist—what is missing is political courage.

States that claim to uphold international law and value civilian life must form a coalition of the willing and undertake a military intervention to:

1.Impose a no-fly zone to stop Israeli airstrikes.

2.Break the siege to allow food, water, medicine and aid into Gaza.

3.Blockade Israeli Ports to ensure arms are prohibited from entering.

4.Disarm Israel’s genocide war machine through targeted strikes if necessary.

5.Enforce a permanent ceasefire.

6.Ensure Israel complies with international law including rulings of the ICJ and Resolutions of the UNGA for Israel, including all Israeli settlers, to evacuate from Palestinian territory.

7.Provide protective security to Palestinians in the exercise of their righ to self-determination.

States do not need approval of the UNSC, nor is it necessary to wait for a Resolution of the UNGA.

The legal authority for a military intervention already exists within the Genocide Convention and is supported by R2P and customary international law.

States must therefore act immediately to conduct a military intervention to stop Israel’s genocide of the Palestinians people.

Read our full briefing at: https://protect-palestine.com/case-for-military-intervention-to-stop-gaza-genocide

George Galloway has become the first leader of a UK political party to back military intervention to stop the genocide.

Why are other Socialists failing to step up?

Where are @jeremycorbyn and @zarahsultana? Are you waiting for Palestinians to be fully exterminated so you can complain about it at the next election?

It is a straightforward fact that Israel is committed to the extermination of Palestinians. After 22 months of witnessing the genocide Israel has declared full military occupation of Gaza.

The failure of political leaders worldwide to organise a military intervention to break the siege, implement no fly zone, deliver aid and stop the genocide is a disgrace, especially to those who claim to stand up for the Palestinian right to exist.

Either politicians mobilise for a military intervention, or we watch Israel complete its final solution of total extermination or expulsion. Thank you @georgegalloway and @WorkersPartyGB for your courage and leadership. Now let’s mobilise for this to happen, and help create the conditions for a One State Palestine.

Bideoa: https://x.com/i/status/1957039299611816195

oooooo

George Galloway@georgegalloway

Dear @10DowningStreet

I know you hate me as I hate you. But for the country’s sake please hear me. Drop this ludicrous pretence that Palestine Action is a terrorist organisation. This devalues the deadly serious word terrorism which has slaughtered so many of our compatriots. I’m sat here with foreign visitors who are literally bemused at what you’ve done. They actually SAW a man arrested for a Plasticine Action T-shirt. The justice system will not be able to handle this. No jury would convict on this. The police are being mis-used and this is all a waste of police-time. Please, for the sake of our reputation drop this.

oooooo

David, I just finished watching Corbyn’s Middle Eastern Eye interview beginning to end. 1m46s on IHRA I disagreed with, sure thing same as you and most of the left will too.

But the other 48+ minutes were inspiring. Should I throw him under the bus over one subject and that many minutes out of the whole interview?

Do we value the rest of the vision, ideas, and concepts that filled the rest of the interview or just bin them too on the less than the 2 minutes highlighted?

Aipamena

David Miller@Tracking_Power

13 h

Oh, My Goodness! Jeremy Corbyn comes out fighting against Zarah Sultana‘s (@zarahsultana) statement that she is an anti-Zionist and that the Labour Party under Corbyn had been wrong to adopt the IHRA definition of “antisemitism”, a definition cooked up by the Mossad and the Zionist regime.

What an appalling response.

He says that “it wasn’t really necessary for her to bring all that up. But that’s what she decided to do”.

Really unbelievable.

He goes on to say that he was “personally” more in favour of the Jerusalem Declaration, a liberal Zionist alternative to the IHRA. What a catastrophic thing to say. I have been told repeatedly that Jeremy is not a Zionist. And here he is effectively confirming as much.

He says that a “huge majority” of the NEC adopted the IHRA “including people very close to me” being in favour of it being adopted. These people, let us remember are the same people that Jeremy has re-appointed again and again as advisors: including Karie Murphy and James Schneider. They are traitors. They should be nowhere near a party which seeks to be anti-racist or to oppose the genocide in Palestine. And yet, as I revealed earlier today, they have a glacial grip on the executive committee of the new party.

We see here an foretaste of what Jeremy will do when there are future pressures from the Zionist movement. He will collapse, just like before. And he will not say – even now – that he is an anti-Zionist. I am genuinely shocked by how poor this response is.

Bideoa: https://x.com/i/status/1958616923396350446

oooooo

Last night, Lebanese Army Intelligence carried out a security operation inside the Phoenicia Hotel in Beirut, during which they arrested Palestinian Shadi Mahmoud Mustafa al-Far, a former official in the Fatah Movement from Burj al-Barajneh camp, who had been expelled from the movement several months ago and is wanted under several judicial warrants. According to available information, Far was expelled from Fatah at the beginning of July after rebelling against the decisions of the Palestinian Authority (PA), rejecting the directives of PA President Mahmoud Abbas, and opposing the new appointments made by the PA in its embassy and Fatah offices in Lebanon. Following this rebellion, his office in the camp was raided and he was expelled from it in mid-July after refusing to hand it over, until his arrest last night inside the hotel. Reports indicate that the arrest was carried out in a highly calculated manner, as part of a series of measures by Army Intelligence to ‘reinforce security’ and pursue individuals wanted by the judiciary and those involved in sensitive security cases.

Bideoa: https://x.com/i/status/1958484346240733577

oooooo

Aipamena

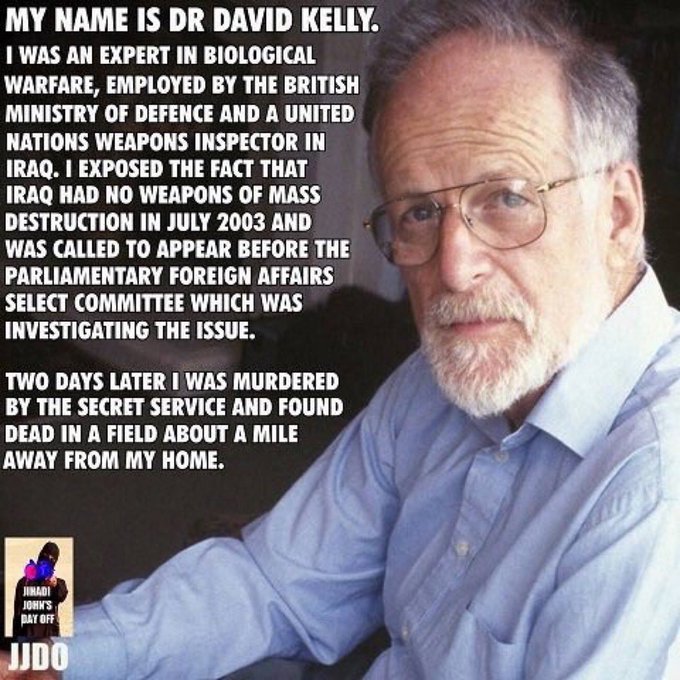

Britain People@Britain_People

2024 abe. 4

What really happened to Ministry of Defence Dr #DavidKelly

Watch @georgegalloway explosive documentary

https://seanmurray.tv/video/killing-kelly/

@tobararbulu # mmt@tobararbulu

Killing Kelly

Bideoa: https://seanmurray.tv/wp-content/themes/haru-circle/assets/images/single-video-bg.jpg

Film Story

An explosive new documentary about the strange death of Dr David Kelly, the British weapons expert found dead in the woods – as he predicted he would be – amidst the swirl of Tony Blair and George W Bush’s ill-fated invasion of Iraq. It was said to be suicide, though of a most peculiar kind. This film is a detailed look at the circumstances of Dr Kelly’s death and the subsequent cover-up that followed. ‘Killing Kelly’ asks the most uncomfortable of questions of the role of Tony Blair’s government along with Britain’s secret service into the untimely death of the world renowned chemical weapons expert.

This video does not exist.

oooooo

Netanyahu‘s IT chief flees US child s*x charges

Tom Alexandrovich, who participated in the assassination of Hezbollah’s Hasan Nasrallah, was charged in Nevada but, although a flight risk, was allowed to flee back to Israel

Follow #MOATS 475 X:

Bideoa: https://x.com/i/status/1958786216771617118

oooooo

Famine has now been confirmed in Gaza.

Over half a million people are facing the most devastating form of hunger, warns @theIPCinfo.

An immediate ceasefire and unhindered humanitarian access is imperative to save lives.

— via @WFP

Save the Children UK@savechildrenuk

Famine has been confirmed in Gaza, with over half a million facing starvation, destitution and death.

We have been warning about this impending tragedy for months. The UK can’t say they didn’t know this would happen.

All available evidence indicates that the Government of Israel is using starvation as a weapon of war.

This siege must end, and the full flow of aid restored.

The UK Government cannot stand by while children in Gaza are starved in plain sight.

No child should face this horror. The UK must uphold international law: hold Israel accountable and suspend all arms sales, including F-35 components.

Demand Keir Starmer takes urgent action to protect Palestinian children now – sign our petition: https://bit.ly/4kXTLJs

7 h

Famine has been confirmed in Gaza City, UN-backed body says – follow latest updates https://bbc.in/45FTAwU

oooooo

State of Palestine@Palestine_UN

Statement condemning Israel’s violence against journalists and media workers by

Aipamena

Media Freedom Coalition@MediaFreedomC

abu. 21

The undersigned members of the Media Freedom Coalition urge Israel to allow immediate independent foreign media access and afford protection for journalists operating in Gaza.

oooo

Media Freedom Coalition Statement on Foreign Media Access to Gaza

(https://mediafreedomcoalition.org/joint-statement/2025/mfc-statement-media-access-to-gaza/)

- MFC

- August 21, 2025

والبيان متاح أيضًا باللغة العربية

The MFC has expedited the opt-in process for this statement. Because of this, further member countries may sign the statement after publication. This page will be updated when new countries join.

In light of the unfolding humanitarian catastrophe in Gaza, we, the undersigned members of the Media Freedom Coalition, urge Israel to allow immediate independent foreign media access and afford protection for journalists operating in Gaza.

Journalists and media workers play an essential role in putting the spotlight on the devastating reality of war. Access to conflict zones is vital to carrying out this role effectively. We oppose all attempts to restrict press freedom and block entry to journalists during conflicts.

We also strongly condemn all violence directed against journalists and media workers, especially the extremely high number of fatalities, arrests and detentions. We call on the Israeli authorities and all other parties to make every effort to ensure that media workers in Gaza, Israel, the West Bank and East Jerusalem – local and foreign alike – can conduct their work freely and safely. Deliberate targeting of journalists is unacceptable. International humanitarian law offers protection to civilian journalists during armed conflict. We call for all attacks against media workers to be investigated and for those responsible to be prosecuted in compliance with national and international law.

We reiterate calls for an immediate ceasefire, the unconditional release of the remaining hostages, unhindered flow of humanitarian aid and for a path towards a two-state solution, long-term peace and security.

Signed:

Australia

Austria

Belgium

Chile

Denmark

Estonia

Finland

France

Germany

Iceland

Ireland

Italy

Japan

Latvia

Lithuania

Luxembourg

New Zealand

Norway

Portugal

Sierra Leone

Slovakia

Slovenia

Sweden

Switzerland

Ukraine

the Netherlands

the United Kingdom

Canada

oooooo

Zionist lobby tried to shut him up, but it just made him blow up bigger.

@BobbyVylanbig up man

Bideoa: https://x.com/i/status/1958496664978636861

oooooo

China Banking News@CBankingEditor

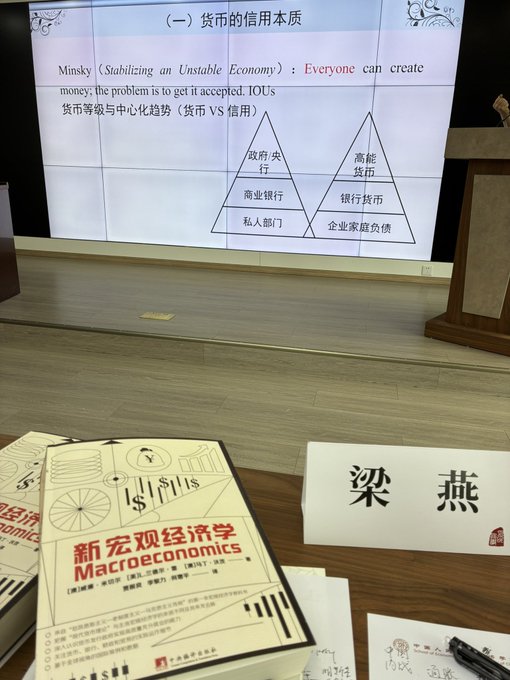

1/2 China’s top economists have turned to Ray Dalio and Modern Monetary Theory in search of intellectual support for their arguments over debt-fuelled fiscal spending.

@CbankingEditor erabiltzaileari erantzuten

2/2 Read the briefing for free and in full right here:

ooo

Chinese economists recruit Ray Dalio and MMT in their battle over deficit spending

(https://www.chinabankingnews.com/p/chinese-economists-recruit-ray-dalio)

Bank of China’s Xu Gao wants Beijing to step up debt levels.

Aug 14, 2025

Economic debate continues to simmer in China between deficit hawks and doves, as Beijing lifts its deficit ratio to record highs and embarks upon its biggest fiscal stimulus campaign since the Global Financial Crisis.

Partisans on either side of China’s fiscal policy debate have drawn inspiration from heterodox macroeconomic opinion derived from overseas sources.

Chinese deficit hawks find support for their arguments against fiscal spending in the popular works of storied hedge fund manager Ray Dalio, who contends that excess debt accumulation inevitably results in financial crises.

Doves, on the other hand, are making recourse to Modern Monetary Theory (MMT) to support their arguments in favour of deficit spending as a safe means of sustaining the Chinese economy.

This divide is best embodied by a vicious attack against Ray Dalio’s works that was recently launched by Xu Gao (徐高), chief economist at Bank of China International.

Xu cites MMT in arguing that China needs to dial up its debt levels, instead of pursue a “beautiful deleveraging” as prescribed by Dalio.

Dalio‘s works gain traction in China

The views of Ray Dalio have found a receptive audience amongst many economists in China, amidst concerns over fiscal policy that has been in an expansive state for much of the period since the Global Financial Crisis.

The Chinese translation of Dalio’s “Principles” topped Douban’s annual list of best-selling books in the business category following its release in 2018.

Since then, Chinese translations of Dalio’s works have been published to widespread popularity, including “Big Debt Crises” in 2019, and “Principles for Dealing with the Changing the World Order: Why Nations Succeed and Fail” just earlier this year.

Ray Dalio is the founder and co-chief investment officer of Bridgewater Associates – at one time listed as the world’s largest hedge fund.

His basic macroeconomic thesis is that cycles of excessive debt creation are the chief culprit for financial crises since the Second World War.

“Over the long run, debts can’t rise faster than the incomes that are needed to service the debts, and interest rates can’t be too high for borrower-debtors or too low for lender-creditors for very long,” Dalio writes.

“Big debt crises come about when the amounts of debt assets and debt liabilities become too large relative to the amount of money in existence and/or the amounts of goods and services in existence.”

Dalio contends that “debt crises are inevitable,” given imperfections in the lending process, as well as the tendency of the debt cycle to generate asset bubbles and busts due to their psychological effects on investors.

He advocates the use of a “beautiful deleveraging” to reduce debt burdens without triggering economic crises.

This involves both the restructuring of debt to spread repayments over time, and having central banks print money and buy debt.

The goal of a “beautiful deleveraging” is to reduce debt burdens and produce nominal economic growth, so that debt burdens shrink relative to incomes.

Xia Chun (夏春), chief economist at Forthright Financial Holdings (方德金控), says that few have openly disputed Dalio’s assertions in the Chinese economics community since the publication of Mandarin-language editions of his works.

“In the Chinese language world, public criticism of Dalio’s research and viewpoints is extremely rare,” Xia writes (“夏春:不要轻易否定达利欧的国家债务认知“).

This has recently changed, however, with the publication of a 9000-word essay entitled “Where the errors are in Dalio’s understanding of national debt” (“达利欧的国家债务认知错在哪里?”) by Xu Gao, chief economist at Bank of China International.

Xu is scathing in his assessment of Dalio’s debt-cycle thesis, accusing the hedge fund legend of “inability to recognise his own ignorance of macroeconomics” and “misapplication of macroeconomic analytical methods.”

Xia Chun points out that Xu’s attack on Dalio is part of the ongoing debate between deficit hawks and doves in China over debt-fuelled fiscal spending.

In 2023, Xu Gao and Zhao Yanqing (赵燕菁) from Xiamen University took part in protracted online debate with Zhao Jian (赵建) a renowned macroeconomist and head of the Xijing Research Institute, over the issue of China’s debt levels.

The debates drew the participation of many other Chinese economists on either side of the fiscal policy divide.

Xu Gao‘s recent criticism of Dalio extends the themes of his debates against Zhao Jian in 2023. The Bank of China economist is now calling for Beijing to engage in further debt-fuelled fiscal spending to deal with its current economic challenges.

Why Xu Gao believes Dalio doesn’t understand macroeconomics

Xu argues that Ray Dalio has failed to grasp macroeconomic realities for two primary reasons.

The first is that Dalio uses a “microeconomic mentality” when it comes to the macroeconomic issues of national debt.

The second is that Dalio views the macroeconomy as a machine subject to inflexible laws.

Xu instead considers it to be a dynamic and mercurial beast, responding differently to the same policies depending on supply and demand conditions.

1. Microeconomic principles do not apply to monetary sovereign nations

Xu’s first argument is that Dalio has made the error of using intuitive microeconomic approaches – which are applicable to individuals and companies – to the economic challenges of sovereign nation-states.

“Dalio’s problem is not just that he makes a number of biased conclusions on the matter of government debt, it’s also that he misapplies methods of economic analysis,” Xu writes.

“He makes improper use of a microeconomic mentality to contemplate macroeconomic problems, thus obtaining incorrect results from incorrect methods.”

Xu highlights the fact that the debt of nations with monetary sovereignty is fundamentally different from the debt of individuals and businesses that depend on external cash flows.

“At the micro-economic level, the debt of individuals or businesses is easy enough to understand and fundamentally intuitive,” Xu writes.

“Their cash flows need to be able to cover the principal and interest payments for their debt at any time in order to be sustainable.

“If this isn’t the case, then these individuals or businesses will default on their debts.

“If we change the object of analysis to the debt of macroeconomic entities (national), then the microeconomic approach is no longer applicable.”

The critical distinction for Xu is that nation-states possess central banks or monetary authorities that are capable of creating money ex nihilio.

“The government possesses the right to issue its own sovereign currency, he writes.

“The government can always use printing of bills to repay debt in its own currency, and will never reach the point where it defaults on such debt.

“In theoretical terms, if it wants cash flow in its own currency then it can just print it.

“The cash flow of individuals and businesses is to a very large extent exogenous in supply, while the cash flows of a government are endogenous.”

Xu acknowledges that exceptions to this rule exist in recent history – the Asian Financial Crisis of 1997, and more recently the European sovereign debt crisis which ran from 2009 to 2018.

He argues, however, that these are exceptions that prove the rule, because in both examples sovereign nation-states found themselves unable to print the money needed to discharge their debts.

In the case of the European debt crisis, this was because countries such as Greece and Spain had ceded monetary sovereignty to the European Central Bank when they became EU members.

For nations hit by the Asian Financial Crisis, a copious volume of their debts were owed to foreign lenders, which meant their central banks were unable to print the currency needed to pay these liabilities.

2. “The macroeconomy is not a machine”

Xu’s says that Dalio’s second cardinal error lies in his conception of the macroeconomy as a mechanical entity which is ruled by invariable laws.

“Dalio erroneously imagines the macroeconomy to be a machine,” Xu writes.

“In 2008, Dalio wrote ‘How the Economic Machine Works.’ The first line of it is that ‘the economy is like a machine.’

“2025’s ‘Why Nation’s Fail’ also uses this concept in the first section of the first chapter.

“Consequently he is unable to see the differences in macroeconomic logic under different macroeconomic conditions.“

According to Xu, “the mechanistic research method that views the macroeconomy as a machine was long ago proven false, and is a methodology that was abandoned by economists over half a century ago.”

He cites in particular the fate of the Phillips Curve, which was advanced in 1958 and postulates an inverse correlation between inflation and rates of unemployment.

The Phillips Curve emerged as an “iron law” of macroeconomics by the 1970s, when it came to inform key policy decisions by leading economies.

It was just at this juncture that the phenomenon of stagflation overturned the assumptions of the Phillips Curve, by bringing about high inflation and high unemployment simultaneously.

“The disappearance of the Phillips Curve spurred the rational expectations revolution in macroeconomics in the 1970s, causing macroeconomists to thoroughly abandon their mechanistic view of the economy,” Xu writes.

“The lesson for people trying to understand the macroeconomy was this – to absolutely not think of the macroeconomy as a machine.

“The macroeconomy has various cause-and-effect linkages and contrary forms of behaviour, all of which can change due to changes in the macroeconomy.

“This machine is strange because it’s alive – it has expectations of the future, and is comprised of people whose behaviour will change once their expectations change.”

“Nations can rack up debt indefinitely without fear of crisis”

Because the macroeconomy is not a machine subject to fixed and immutable laws, Xu argues that the same set of policies can have different outcomes depending on different macroeconomic conditions.

It’s for this reason that Xu believes national economies can engage in debt-fuelled spending almost indefinitely under the right circumstances, without fear of inflation or financial crisis.

“Because Dalio views the macroeconomy as a machine, he erroneously believes that set behaviour will produce set consequences,” Xu writes.

“He believes that the central bank printing money to deal with a debt crisis will inevitably lead to depreciation of its currency.

“However, in real circumstances this isn’t inevitably the case. Printing money by the central bank can lead to depreciation of the currency or appreciation.

“What the outcome will be depends on the macroeconomic conditions”

According to Xu, the conditions that permit the issuance of money without risk of inflation or financial crisis are i) inadequate domestic demand and ii) oversupply of productive capacity.

Both of these conditions happen to characterise the Chinese economy at present.

“When domestic demand is inadequate, increasing the money supply will not bring about inflation – in fact, it will help to ease deflationary pressure, and will not trigger macroeconomic instability,” Xu writes.

Under such circumstances, Xu believes “the government can use money creation to repay domestic debt denominated in the national currency” without the need to worry about breakneck inflation.

Xu’s view is that the fundamental condition that restricts a nation’s debt levels is not its cash flows, but its productive capabilities.

“As long as a nation’s productive capability is larger than its domestic demand (and the nation’s domestic demand is inadequate) then its debt is sustainable… it can completely avoid a debt crisis” he writes.

For this very same reason, money printing can have severe inflationary consequences for nations where demand is excessive while production capacity remains inadequate.

“If a country has excess domestic demand and production capacity is insufficient – that is domestic production capacity is less than domestic demand, then issuing money will further increase domestic demand, and bring about strong demand-driven inflationary pressure.”

The rise of MMT in China

Xu says the macroeconomic conditions that make for safe debt growth are already aptly described by Modern Monetary Theory (MMT), which has recently risen to the fore in China’s economic discussion circles

“This is the situation described by MMT, which has become popular in the past several years,” Xu writes.

Xia Chun says MMT first made its debut in China at the start of 2020, when it was viewed as an intriguing school of heterodox economics.

Unlike Dalio’s views, which were broadly accepted, Xia says MMT was criticised by nearly all Chinese economists who held mainstream economic opinions.

“It was mistakenly simplified as ‘debt monetisation’,” Xia writes. “It was [viewed as] the government expanding fiscal spending without restraint, before using money printing to solve the problem.

According to Xia, his May 2020 article “Mainstream economics vs Modern Monetary Theory – whose defects are greater” (主流经济学vs现代货币理论:谁的缺陷更多?“), is perhaps the first article in China to support MMT thinking.

Xia Chun argues that Xu Gao’s viewpoints in his broadside against Dalio are fundamentally consistent with the core arguments of MMT.

Can China increase debt levels indefinitely

The conclusion of both Xu Gao and Xia Chun that derives support from MMT is that China can engage in debt-fuelled fiscal spending in its current macroeconomic states, without much fear of adverse consequences in the form of inflation or a debt crisis.

China is currently host to all the conditions that are supportive of worry-free fiscal expenditure, including:

- Inadequate domestic demand.

- Excess productive capacity.

- Low inflation.

Beijing’s top policymakers have explicitly pointed to each one of these conditions as major challenges faced by the Chinese economy at present.

Beijing has launched a “cash-for-clunkers” campaign to subsidise consumption by Chinese households, with the goal of boosting domestic demand.

The goal of Xi’s second-half crackdown on “involuted competition” and his campaign to create a unified national market is to reduce excess productive capacity in key industrial sectors.

Chinese officials have also voiced concern about ongoing deflationary pressure that has arisen as a result of the supply-demand mismatch.

PPI fell 3.6% year-on-year in July, while CPI only edged into positive territory in January and June during the first half of 2025.

For this reason, Xu vehemently argues for China to ramp up debt-fuelled spending, contrary to Dalio’s macroeconomic prescription of a “beautiful deleveraging”.

“Dalio says that under ideal conditions, China’s policymakers will vigorously, bravely and rapidly achieve a beautiful deleveraging,” Xu writes.

“He obviously believes that China’s debt size is already too high, and that it needs to use deleveraging to reduce debt risk.

“But when he makes this judgement, he has not at all noticed China’s current environment of inadequate demand and excess savings, which makes debt accumulation rational and necessary.”

Xu instead believes that efforts to deleverage the Chinese economy are the true cause of its woes, and that the best solution for its problems can be found in greater debt accumulation.

“In actuality, it’s precisely because in recent years China has excessively and strictly deleveraged and restricted rational growth in leverage, that domestic savings have been prevented from transforming into investment via debt,” he writes.

“This has added greater pressure to China’s inadequate demand, and put heavy downward pressure on economic growth and prices.”

“In recent years, the reason that China’s domestic debt has seen problems isn’t because the debt is so great that it will lead to a debt crisis, but because of strict deleveraging measures that have artificially created liquidity problems for debt extension.

“Given the severe shock created for the macroeconomy by deleveraging, what China needs isn’t more deleveraging, but a correction in its deleveraging mentality.”

China’s current policy settings

For the time being at least, China’s economic helmsmen appear aligned with the views of the deficit doves who have found succour from MMT.

In order to fund 2025’s out-sized stimulus plans, Beijing’s policymakers lifted the official deficit ratio to 4%, for a single percentage point rise compared to 2024.

4% is the highest level on record, and a major breach with the long-standing convention this century that China keep its deficit ratio at the Maastricht Treaty benchmark of 3%.

Lian Ping (连平), an academic at East China Normal University, points out that this official deficit ratio falls far short of the overall government deficit, as it does not include major forms of debt raising.

Chief amongst them are special treasuries issued by Beijing, and special purpose local government bonds issued by regional authorities.

These are excluded from China’s “narrow deficit” on the grounds that they are for investment in projects that generate cash flows or have assets as collateral.

Lian expects the “broad deficit” – which includes special treasuries and special-purpose local government bonds, to approach 10% in 2025.

“The super-large scale of government spending and debt arrangements has exceeded market expectations,” Lian wrote.

“It shows the massive determination to accelerate the recovery of demand this year and achieve 5% economic growth.”

Lian expects Beijng to keep fiscal and monetary policy loose until at least 2035.

He argues that China’s current fiscal and monetary loosening differs greatly from its shock GFC rescue plan, because this time it involves “medium and long-term considerations.”

Chief amongst these is fulfilling China’s long-term economic goal of achieving per capita income at middle-developed nation levels by 2035.

This means keeping per annum GDP growth at around 5% for the next decade.

“In the next several years, maintaining GDP growth at around 5% will require the adoption of intense loosening of macroeconomic policy,” Lian Ping writes.

oooooo

Gogoratzekoa:

New Macroeconomics – Chinese translation of the MMT macro textbook. Product of years of hard work and a landmark development for MMT in China!

oooooo

Perfect!

Ikasiko ote dute MTM inoiz euskaldunek?

Dudatan nago!

Dena den, hona hemen hasiera bat:

Warren Mosler: Zerga-betebeharrak (Tax Liabilities)

oooooo

“Taxation creates an unemployed surplus population that finds no place on the land or in towns, that seeks handouts from state offices, and prompts the creation of additional state bureaucracies.” – Karl Marx

Geure herriari, Euskal Herriari dagokionez, hona hemen gure apustu bakarra:

We Basques do need a real Basque independent State in the Western Pyrenees, just a democratic lay or secular state, with all the formal characteristics of any independent State: Central Bank, Treasury, proper currency1, out of the European Distopia and faraway from NATO, being a BRICS partner…

Euskal Herriaren independentzia eta Mikel Torka

eta

Esadazu arren, zer da gu euskaldunok egiten ari garena eta zer egingo dugun

gehi

MTM: Zipriztinak (2), 2025: Warren Mosler

(Pinturak: Mikel Torka)

Gehigarriak:

MTM klase borrokarik gabe, kontabilitate hutsa da

oooooo

1 This way, our new Basque government will have infinite money to deal with. (Gogoratzekoa: Moneta jaulkitzaileko kasu guztietan, Gobernuak infinitu diru dauka.)

joseba says:

Yan Liang: Txina, merkataritza eta sistemaren erreforma

https://www.unibertsitatea.net/blogak/heterodoxia/2023/08/10/yan-liang-txina-merkataritza-eta-sistemaren-erreforma/