@tobararbulu # mmt@tobararbulu

Don’t forget! Don’t forgive!

Utikan autonomismoa! Gora Independentzia!!

Ez ahaztu! Ez barkatu!

https://www.unibertsitatea.net/blogak/heterodoxia/2023/12/25/ez-ahaztu-ez-barkatu/

oooooo

@tobararbulu # mmt@tobararbulu

Ezker abertzale ofizialekoek badakite, guk ere bai!

Independentziari buruzko ipuintxoa

oooooo

Erremedioak:

In KATEA EZ DA ETEN. Andolini: euskaraz eta plazerez ——> Poesia? Ez, mila esker!:

“Independentzia da helburu, ez inolako autonomismoa. Hori gero eta garbiago geratu behar da. Epe laburreko eta epe ertaineko proposamenak loturik egon beharko lirateke independentziaren aldeko estrategia baten barruan. Independentzia baldin bada gure helburua, autodeterminazioaren bidez lortu behar da — eta independentzia hori, interdependentzia baten barruan kokatu behar denik ez dut uste inork ukatuko lukeenik.

Hortaz, autodeterminazioa da hic et nunc etengabe aldarrikatu behar dena.

Kanpo-autodeterminazioa Euskal Herri osorako, nahiz eta barnerako, taktika mailan eta epe ertainean, Baskongadetarako, Nafarroa garairako eta Iparralderako, konfederakunde moduko antolaketa bat edo antzekoren bat proposatzea.”

Gogoratu ondokoak:

Ekonomiaz jakin nahi zenuen eta galdetzeko ausartu ez zinen ia guztia (eguneraketa)

oooooo

I do wonder what the macroeconomic effect #GenocideJoe has had with his fully funding murder? Is there an economist out there who can weigh in on this? Seems most call this the greatest economy… everrrr… forget the dead children… that doesn’t go well in Democratic circles.

Aipamena

The Spectator Index@spectatorindex

15 h

BREAKING: The Washington Post reports that the Biden Administration ‘in recent days quietly authorized the transfer of billions of dollars in bombs and fighter jets to Israel’

oooooo

Stephanie Kelton@StephanieKelton

If you see the MMT documentary, Finding the Money, you’ll hear about my struggle to make sense of @wbmosler’s ideas, including his argument that the three-sources view of public spending was wrong. 1/

Like any Econ student, I had been taught that government must choose how to pay its bills: Tax, borrow, or print.

@wbmoslerargued that there was only one option. 2/

It didn’t seem right, but I worked through the mechanics of government finance (for the US) and eventually convinced myself that @wbmosler was correct. There is only one way to pay. 3/

I published my findings in a working paper in 1998 and then in a journal in 2000. 4/

https://levyinstitute.org/publications/can-taxes-and-bonds-finance-government-spending

Over the years, people like Scott Fullwiler and @tymoignee provided detailed elaborations of how it all works in the USA. 5/

The bottom line is that all (federal) government spending is necessarily money-financed. That is not an MMT policy proposal. It’s a description of the mechanics of how it all works. 6/

As others have shown, this is also true for the UK.

I’d forgotten what a superb paper this is. 7/

oooooo

“That is, when the government prints money to pay a bill, it is, in effect, borrowing.” – Greg Mankiw (2019)

Here is an alternative: When the government pays a bill, the Fed credits the account of a bank and debits the Treasury’s account.

link.springer.com

oooooo

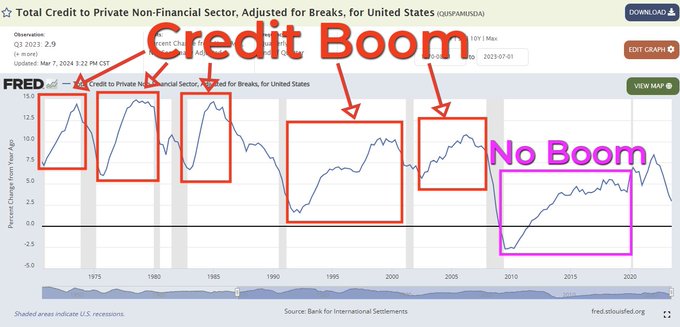

El único período en el que no ha habido un boom crediticio en Estados Unidos ha sido cuando los tipos de interés rozaban el 0%. Pero todavía hay gente que cree que los tipos bajos estimulan el endeudamiento y que los altos lo reducen…

oooooo

starve a kid to save a quid £..@iainzeno

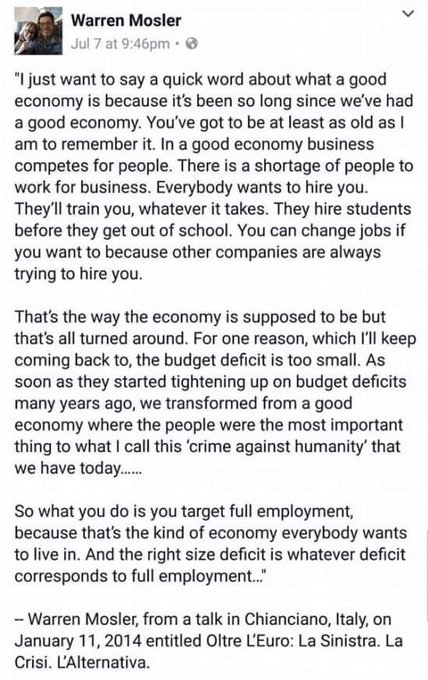

What is a Good Economy? If we are going to require a new way of economic thinking, answering this question should be the point from which we start.

oooooo

MMT Conference July 14-17

Leeds University Business School

We are delighted to be hosting all the leading Modern Monetary Theory academics speaking on the massive advantages to be gained by policy makers in using the MMT lens and helping us make sense of what’s going on.

oooooo

erabiltzaileari erantzuten

Looking forward to the reunion- me, Bill, Randy, Mat, Stephanie, Pavlina, Scott reminiscing about when it was ‘just us’ 🙂

(Open to the general public, tickets available online.)

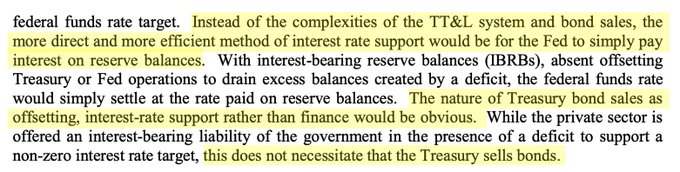

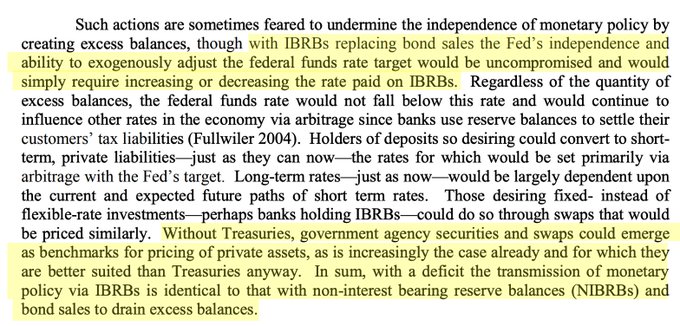

20 yrs ago, Scott Fullwiler wrote this paper, comparing the (then extant) practice of hitting interest rate targets via day-to-day open-market operations and managing TT&L accounts with the yet-to-be-adopted practice of paying interest on reserves. 1/

oooooo

Scott concluded that instead of replacing non-interest bearing reserves with interest-bearing Treasuries, it would be far “more direct and more efficient” to turn the non-interest bearing reserves into interest-bearing reserve balances (IBRBs). Treasury could then stop issuing securities altogether. 2/

But don’t financial markets need Treasuries for a whole variety of reasons? Could we really just stop issuing them? Scott explains why the answer is yes. 3/

Once the Fed starts paying interest on reserve balances, “all Treasury securities could eventually be replaced,” and it becomes transparently obvious that total interest on the “national debt” is a policy choice made by the central bank. 4/

The Fed started paying interest on reserve balances in October 2008, four years after Scott wrote his paper. It might seem like a small change, but as Scott said, “It’s more significant than you think.” Yet we haven’t taken the final step–i.e. phasing out Treasuries. Why? 5/

Leaving more reserves in the system would invite new debates, but it would end conventional debates over fiscal sustainability, periodic shutdowns and grandstanding over the debt ceiling, traumatizing images of a ticking debt clock, etc. 6/

Scott and I are working on something to advance this debate. Stay tuned! 7/end

oooooo

VIDEO PREMIERE NOW The man who coined MMT joins Bad Faith to explain the coordinated conservative effort to corrupt our economic system, and the establishment left’s complicity in that project. https://youtube.com/watch?v=Z_9NMXH7eDs

Bideoa: https://twitter.com/i/status/1783579229332074560

oooooo

A Progressive Vision for a Post-Neoliberal World w/ @briebriejoy and @billy_blog! Check it out now!

A Progressive Vision for a Post-Neoliberal World (w/ Bill Mitchell)

The man who coined the term MMT joins Bad Faith pod to explain how liberals failed to resist the rise of neoliberalism, how conservatives were able to wrest …

Bideoa: https://youtu.be/Z_9NMXH7eDs

oooooo

6 Days until nationwide Release! May 3rd FINDING THE MONEY: All tickets on sale now Featuring

@mattybram, @StephanieKelton, @wbmosler, @ptcherneva, @FadhelKaboub, @ProfYuille, @iamdelmancoates, Randall Wray and more!