a) Pavlina Tcherneva: Dirua eta boterea

Oharrak:

Ingelesez: “A historical journey through the origins of money indicates that money is first and foremost a social relationship. More precisely, it is a power credit-debt relationship, whereby the indebted party issues a liability that is held by the creditor as an asset. Behind this social relationship lay varied social power relationships that codify human behavior in the specific historical context and cultural and religious norms that govern the process of social provisioning.“

Ingelesez: “It is a well-established fact that money predates minting by nearly 3,000 years. Clay tablets (the earliest discovered forms of money) and various other kinds of instruments which bear no “intrinsic” value had circulated for thousands of years before the emergence of coinage or trade. Indeed, clay tablets are themselves early checks or balance sheets, where the markings on the tablet specify how the debt can be extinguished (for example, a King’s Check would be inscribed “Say to NN to give X to the bearer”), the collateral for the debt (someone’s son or daughter), or the terms of debt slavery and bankruptcy.”

Ingelesez: “Assyriologists trace the origins of money to Mesopotamian temples and palaces, which developed an elaborate system of internal accounting of credits and debts (Hudson 2003). These large public institutions played a key role in establishing a general unit of account and store of value (initially for internal record keeping, but also for administering prices). Money, in a sense, evolved as a public good introduced by public institutions in the process of standardizing prices and weights.”

Ingelesez: “In Ancient Greece, as in Ancient Egypt, the emergence of money was closely tied to need of religious authorities to control the flow of surplus. In other words, money becomes a public mechanism of distribution of economic surplus and justice. (…) [In Ancient Greece] money emerged in the context of […] socioeconomic hierarchies and inequalities. Money was first embodied in the portions of sacrificial bull’s flesh distributed by religious authorities during the rituals of communal sacrificial meals.”

Ingelesez: “In sum, power, taxation, and religious tribute play a crucial role in all of these accounts of the origins of money. Taxation is the motor behind the transfer of real resources from subjects to authority. Money is the vehicle. The resource transfer was partly to provision the authority itself, and partly to allow the authority to redistribute the surplus to its subjects more “equitably” within the context of the cultural and religious social mores of the time. In a sense, money is a creature of the state, a public good, and a redistributive mechanism employed by that state for good or ill.”

Ingelesez: “The precise origins of money will never be known to us, but we know that it cannot be understood outside the powers of some authority or arbiter. In the modern context, however, money is not only a public good, but it is also a simple public monopoly. Modern nation states, like their ancient counterparts, also impose compulsory debts on the population and determine how they will be settled. But now they also have the exclusive power to issue the very thing that settles those debt obligations (even if they abdicate this power, as is the case of some countries today).”

Ingelesez: “Taxes In the modern context, taxes assume an additional role. They still serve as an instrument of transferring real resources from the private to the public sector, but the way this transfer occurs is by creating demand for government-issued fiat currency. Modern governments settle their debts and pay for their expenditures by issuing their own liabilities—reserves, notes, coins, government checks. The private sector, facing a series of compulsory obligations to the state, denominated in the state-administered and state-issued unit of account, must obtain the currency before it can settle its debts to the state. Obviously, the issuer (the government) cannot collect taxes in currency it has not already issued. The way the private sector obtains currency from the issuer is by offering labor, goods, and services for sale to the state, paid in state currency.”

Ingelesez: “In other words, in the modern context, taxes have two functions. First, they create demand for otherwise worthless paper currency (Mosler 1997–98; Wray 1998). Second, they serve as a means of provisioning the government in real, not in financial, terms. A monopoly currency issuer is never financially constrained by tax collections, as it always pays by issuing more of its own liabilities. It can spend as much currency/reserves as it wishes, so long as there are real goods and services for sale. And the state cannot possibly collect currency through taxes before it has provided it through spending. The state does not need “tax money” to spend; it needs real resources. A welfare state in particular needs an army, public school teachers, a police force, food inspectors, and any other resources necessary to fulfill its public purpose. In a way, the modern state, as in ancient Greece, continues to serve a redistributive function in the economy, where it collects real resources (labor) from the private sector, and then redistributes them back to the private sector “more equitably” in the form of infrastructure, public education, government research and development, and via any other social welfare functions it has been asked to fulfill by voters. The role of taxation in modern market economies remains the same as in ancient times: it is not a “funding mechanism,” but a “real resource transfer mechanism.””

Ikus ere: http://www.levyinstitute.org/pubs/wp_861.pdf.

b) Randall Wray: Randall Wray: (Dirua) Historiaren hasiera

“ …it was Babylonia maybe it was more like

6,000 years ago and it was created by

accountants who were keeping records on

clay shibati tablets and this was long

before there were coins long before

paper money …

(…)

money first existed as …

Records kept on Clay uh that didn’t

really change hands it was a form of

recordkeeping and purchases were mostly

in the form of credit that then would be

… eventually settled so we’d like to

think that we’re much more advanced than

the Babylonians we have credits …

credit and debt now but actually that’s

probably the way that money began and

it’s been very common for the past 6,000

years to buy things on credit if you’re

buying stuff on credit somebody’s got to

keep track so we got to keep records of

those debts and

credits so debts are denominated in a

money of account now we are used to

having measuring units and these are

probably as old as humans …

we have measurements for volume …

milliliters we have measurements for

weight pounds kilograms and we have

measurements for uh distance length ….

inches feet centimeters and so

on …

(…) now money was a conceptual

leap it’s pretty easy for a human to

come up with you know the notion of an

inch …

(…) but money is a

strange measuring unit because we can

measure things things that have no

obvious physical characteristic in

common

whatsoever that was the leap that

probably was made by Mesopotamians …

we can compare things that have nothing

obvious in common using this measuring

unit

money and so I show here the ale wife in

Babylonian times who makes the beer and

sells the beer when you drink a few

beers she records your D on slate chalk

on slate behind the … bar and then once

a year or sometimes it could go a couple

of years you would settle your debts

that are denominated in Mina which was

the money of account by delivering

barley which she needs because she’s

going to make more beer okay so this

what I meant by most transactions took

the form of credits and

debits so what is money money is an IOU

denominated in the money of account who

can create money my professor Hyman

Minsky used to always say anyone can

create money all you have to do is write

I owe you five bucks you have created

money the problem is to get it accepted

you have to have somebody willing to

accept your IOU denominated in the money

of account … I talked about Babylonia

they use the clay shabat tablets there’s

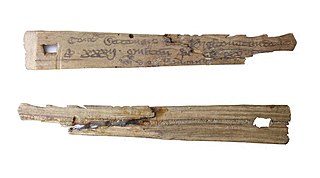

a picture here of those in Europe

records were kept uh mostly on tally

sticks … as far back as we know the

records of money and indebtedness was

recorded on sticks Hazelwood tally

sticks we still use the word tally for

tallying up your debts and what they

would do is Notch across the stick and

then split it in two so that you had a

stock and a stub so you have a record

that can be matched to make sure you

have not counterfeited by putting more

notches on the stick and then finally

the thicker notches were called scores

which we still use today as in a

baseball score which I’ll come back to

we also have the term raise a

tally when the king wants to spend which

c) Historia galdua

A history lost

https://gimms.org.uk/2019/03/08/history-english-tally/

Tally stick

https://en.wikipedia.org/wiki/Tally_stick

Do you know what a tally stick is? In David Graeber’s celebrated work ‘Debt: The first five thousand years’ the anthropologist explained that tally sticks were, quite simply, IOUs whereby a transaction was represented by a hazelwood twig notched to indicate the amount owed and then split in half. The creditor kept one half called a stock and the debtor the other which was called a stub.

Richard Tye, our guest writer this week, traces the history of the tally stick from the early 12th century until its fiery demise in the 18th. A fascinating and very readable account of how debt was recorded before written ledgers and today’s computer accounting systems. A recommended read.

joseba says:

Diruaren istorioa (Warren Mosler)

https://www.unibertsitatea.net/blogak/heterodoxia/2020/08/06/diruaren-istorioa-warren-mosler/