a) Aurodeterminazioaz eta independentziaz

@tobararbulu # mmt@tobararbulu

“le référendum d’autodétermination est une étape nécessaire pour accéder à l’indépendance.”

Chemins vers l’indépendance (1)

oooooo

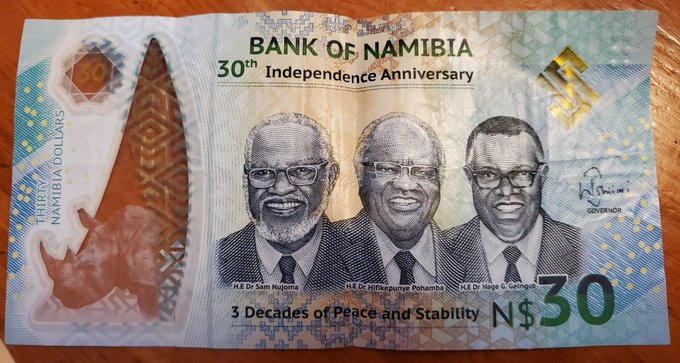

$30 Namibian dollars commemorating 30 years of independence (1990). One of the 1st things countries do as they gain independence, is launch a new currency with exclusive monopoly control over its issue. This should be a starting point for thinking about public finance.

oooooo

b) Diruaz eta Monetaz hiz batzuk

Money Did Not Come From Barter – It Came From Blood Feuds https://youtu.be/X-D5FERQzU4 Honen bidez:

youtube.com

Money Did Not Come From Barter – It Came From Blood Feuds

Professor L. Randall Wray, discussing the origin of money, which forms the foundational conception of money in Modern Moneta

oooooo

Questions?

oooooo

Real Progressives@RealProgressUS

oooooo

@tobararbulu # mmt@tobararbulu

Professor Randall Wray – Modern Monetary Theory in the Time of Inflation https://youtu.be/GrT0mB0-B_4 Honen bidez:

Bideoa: https://youtu.be/GrT0mB0-B_4

oooooo

oooooo

@tobararbulu # mmt@tobararbulu

oooooo

@tobararbulu # mmt@tobararbulu

Eliminating the cost of the Asset Purchase Indemnity https://new-wayland.com/blog/eliminating-the-cost-of-the-asset-purchase-indemnity/

new-wayland.com

oooooo

What Actually Happens at the Treasury and the Fed When Congress Spends -… https://youtu.be/Zzw8AO4vTqc Honen bidez:

Bideoa: https://youtu.be/Zzw8AO4vTqc

youtube.com

What Actually Happens at the Treasury and the Fed When Congress…

Dr. L. Randall Wray explains in simplified terms what acually happens at the Treasury and the Federal Reserve whenever Congress spend

oooooo

erabiltzaileari erantzuten

All consistent from the now proactively expanding fiscal deficit, including the gov’s interest expense from the rate hikes, military, social security, etc. Never been a recession with a proactive deficit this high.

oooooo

oooooo

82% of published humanities articles are never cited. Of those that get cited, only 20% get read. Half of all papers get read only by their authors, reviewers, and editors. So why are we still subjected to nearly 2 million academic articles each year?

joseba says:

Randall Wray, Money Did Not Come From Barter

Transkripzioa:

0:00

let me start off with the way that

0:03

everybody is introduced to money whether

0:06

you studied economics or not I’m sure

0:08

you got this story I can remember when

0:11

my daughter was in first grade and she

0:13

came to me and told me this story and I

0:15

said well actually that’s not quite

0:17

right that yes it is daddy that’s what

0:20

the teacher said so you get it from a

0:22

very young age

0:24

it begins with barter we’ve got Robinson

0:27

Crusoe

0:28

he’s shipwrecked he meets Friday

0:32

Crusoe knows how to grow grain Friday

0:35

knows how to fish so they barter but

0:38

this can be very inconvenient because it

0:41

requires that on the day that a Friday

0:45

wants to deliver a fish Crusoe actually

0:50

wants a fish and he’s willing to trade

0:53

grain for it so the story is that it

0:56

requires a double coincidence of wants

0:58

so it’s inconvenient

1:00

they search around for something to act

1:05

as a medium of exchange they might begin

1:08

with seashells but through some

1:10

evolutionary process they end up with

1:13

gold which has some nice characteristics

1:15

that make it a very good medium of

1:17

exchange it’s very valuable it doesn’t

1:21

rot and on and on and on so this greatly

1:23

reduces the transactions costs involved

1:26

in barter there is one problem with gold

1:29

it is extremely valuable you got to

1:32

worry about people who will try to take

1:34

away your gold stock so you start

1:37

storing it with the Goldsmith’s

1:40

the Goldsmith’s already had that problem

1:42

they had to protect the gold stock that

1:44

they’re using to make jewelry they have

1:46

safes and so on and so you would deposit

1:48

your gold with the gold stuff with the

1:51

Goldsmith the Goldsmith gives you a

1:53

receipt people discover that they

1:56

actually can use those receipts and

1:58

payments rather than using the gold

2:00

because individuals who accept them know

2:03

that they can go get the gold out of the

2:05

Goldsmith’s safe whenever they want the

2:08

Goldsmith in turn realizes that he

2:10

actually doesn’t have to keep the gold

2:12

in the same

2:13

he only needs to keep a little bit

2:15

because those receipts are not all going

2:17

to come back on the same day okay so he

2:20

discovers what we now call the deposit

2:22

expansion process you can issue lots of

2:25

receipts and hold just a little bit of

2:26

gold maybe 10% for safekeeping to redeem

2:31

on demand those Goldsmith’s become the

2:34

banks so that’s the story okay what is

2:38

money in this view I want to say

2:40

something about the nature of money and

2:42

I’m going to contrast it with the MMT

2:45

view money comes about to lubricate the

2:49

market it’s more efficient than barter

2:53

specific money denominated assets

2:56

fulfill that function medium of exchange

2:59

exactly which kinds of things fulfill

3:03

that function changes over time for a

3:06

very long time it was supposedly was

3:08

gold okay but gradually we have changed

3:12

those money things that fulfill that

3:16

function but still today the focus is on

3:19

money as a medium of exchange there are

3:22

other functions that money serves but

3:25

those derived from the medium of

3:26

exchange function so medium of exchange

3:29

is the most important function of money

3:33

okay what is wrong with this Orthodox

3:36

story I know that I am being very quick

3:38

explaining the dominant paradigm on

3:42

money and banking what’s wrong with it

3:48

first there’s actually no evidence of

3:50

barter based markets and I don’t know if

3:53

any of you have read David Graeber book

3:57

this was just a fantastic success and

4:01

unimaginable success debt the first

4:06

5,000 years everybody bought this book

4:08

okay it was a runaway bestseller

4:11

it’s like 5,000 pages long it’s the kind

4:15

of book everybody buys and probably

4:17

hardly anybody reads including me I’ve

4:20

got it on my shelf maybe when I retire

4:22

I’ll finally get the time to read it

4:24

okay but what David

4:27

shows is that as when we look around the

4:31

world as far back as we go you just do

4:33

not find any economies anywhere

4:36

based on barter they just do not exist

4:40

and what we actually find when we look

4:43

at history and I knew this long long

4:45

long before Graber is that money

4:49

actually pre-exists markets money was

4:53

not invented as a transactions cost

4:56

minimizing device for markets that

4:58

already existed money pre-exists markets

5:02

okay

5:03

money is as old as writing how do we

5:08

know that the very first written records

5:10

are all about money okay

5:14

basically writing was not invented by

5:17

poets it was invented by accountants to

5:21

keep track of money values so money

5:26

exists before markets so there’s

5:27

something wrong with that part of the

5:28

story and even the Austrians who pushed

5:32

for a very long time this barter story

5:34

they now admit that once you get beyond

5:37

about ten people and ten different

5:39

commodities it’s very hard for market

5:42

higgling and haggling to settle on a a

5:46

single commodity that will serve as

5:48

money if you’re talking about many

5:50

commodities and many people involved

5:53

unless you add modern computing power

5:57

you’re not going to select a single

6:00

commodity to serve as your money

6:02

commodity and finally from the very

6:06

beginning the evidence shows that

6:08

authorities were always involved in the

6:10

monetary system in creating the monies

6:13

of account I’ll come back to that

6:15

so authorities were always there it

6:18

wasn’t Robinson Crusoe and Friday that

6:21

invented money it came out of the

6:23

authorities another problem story is

6:27

modern money has no intrinsic value this

6:29

is a little bit hard to explain when

6:31

your whole story was about choosing a

6:33

commodity that was very valuable that

6:35

could serve as your money commodity okay

6:39

today’s monies

6:40

are not attached to any commodities they

6:43

have no intrinsic values and neither did

6:46

ancient money in spite of the goldsmith

6:49

story as far back as you go the money

6:52

things did not have intrinsic values

6:55

usually okay there’s an infinite regress

6:59

problem what people will do then as they

7:01

say well yes in the past it was gold

7:03

that gave money value but today it is

7:05

trust asking what is the trust and the

7:09

money they say well I trust that Billy

7:13

Bob will take it from me in payment I

7:15

trust I can go to the grocery store and

7:18

someone will take it okay in my view

7:20

that’s a very thin argument to base the

7:26

most important institution we have in

7:28

modern economies which is money on trust

7:33

and also there is no circular flow that

7:38

can explain where the money comes from

7:39

how does it get into the economy so I’m

7:42

going to present an alternative this is

7:43

sort of it so where did money come from

7:51

we do not know and we will not know

7:54

nobody sat down and wrote a memo today I

7:59

invented money in this house this is how

8:01

I did it we’re not gonna find that

8:03

because money pre-existed writing as I

8:07

said the first writing already is

8:09

talking about money so we’re not gonna

8:12

know we have to speculate the most

8:15

convincing speculating I’ve ever seen is

8:17

done by the most famous coin collector

8:21

in the world who’s I mean he beyond

8:24

collecting studied coins was a guy named

8:28

Philip Grierson at University of

8:30

Cambridge in England when he died he

8:32

donated all the coins which were worth a

8:34

fortune to the University of Cambridge

8:36

he speculated that actually money came

8:40

out of the ancient tribal practice

8:43

that’s called vert gild now that was

8:46

applied to the Germans Roman society was

8:48

civilized Germany was still a tribal

8:50

society the Romans studied the German

8:53

tribal society so we know a lot about

8:55

how it functioned but anthropologists

8:58

find that every tribal society they come

9:00

across also has this very geld tradition

9:03

if you cause an injury to someone else

9:08

okay here whoops

9:10

killed the guy a fine is imposed on you

9:14

and you have to pay a fine to the

9:17

victim’s family

9:19

okay these fines were in kind it would

9:23

depend on what the injury was that would

9:26

determine what you had to pay whether

9:27

it’s a goat or a cow or a horse or sheep

9:30

or chicken

9:35

Oh as far back as there was tribal

9:38

society and humans came out of tribal

9:40

society so it’s as old as humans okay

9:43

when did they come up with the idea and

9:44

why did they come up with it we don’t

9:46

know when but it’s obvious why they did

9:48

it to stop blood feuds otherwise you

9:52

have the Hatfields and the McCoys

9:53

killing each other so this is to stop

9:56

retribution you had to pay a fine so

10:00

Grierson’s

10:01

notion was that the concept of valuing

10:06

things came out of the very guild

10:08

tradition it was a huge jump because

10:11

very guild you pay a cow versus a

10:14

chicken depending on the damages you had

10:17

done money allows you to compare those

10:20

things Oh chick it takes a hundred

10:24

chickens value to equal one cow he

10:29

thinks that’s where money came from it’s

10:30

a big intellectual jump bigger than any

10:33

measuring jump we had ever done before

10:35

because the measurements before money

10:37

always were lengths what’s the link foot

10:42

whose foot the King’s foot okay or qubit

10:47

and so on those were those are

10:49

relatively easy now a hint is that every

10:52

ancient money unit was the name of a

10:57

great grain weight unit shekel lira

11:01

pound those are all weight units they

11:04

all came out of measuring grain so

11:08

someone had the idea let’s use the grain

11:11

measurement in order to measure the

11:14

value of everything by Babylonian times

11:18

this is exactly what they did and then

11:20

the price lists the equivalents to the

11:23

mina which was a grain weight unit was

11:26

posted at the temple that is how you

11:30

knew the value of everything it was set

11:33

by the temple’s authorities I’ll come

11:36

back to religion because it’s important

11:38

for money

11:39

okay alternative what is money

11:43

yeah I will it is a state monopoly it is

11:50

a social unit of measurement if you’re

11:52

in America you can point to anything you

11:54

can ask people what is that worth

11:56

they’re not gonna tell you in terms of

11:58

chickens they’re gonna tell you in terms

12:00

of dollars almost everything can be

12:04

valued in terms of dollars now not quite

12:06

everything but as capitalism develops a

12:09

greater and greater range of things are

12:12

measured in terms of money it is a state

12:15

money of account almost without

12:16

exception the money unit of account that

12:19

we use comes from the state every time a

12:21

new country is formed it chooses its own

12:25

money of account why did we get the

12:27

dollar in the u.s. because we didn’t

12:29

want the pound okay we just revolted

12:34

we chose the dollar and we modeled our

12:36

currency after the Spanish currency to

12:40

thumb our nose is it England and then we

12:45

have money records there’s a hierarchy

12:46

of these io u–‘s denominated in the

12:50

state money of account there is bank

12:52

money okay and there are your io u–‘s

12:56

they’re all denominated in the US dollar

12:58

in America the form that they take

13:01

depends on technology I’ll come back to

13:03

this paper money coin money electronic

13:08

money that is just the technological way

13:11

of recording the tally sticks the use of

13:15

the currency and value money are based

13:16

on the power of the issuing authority

13:18

not on the intrinsic value okay

13:23

the currency does not have to have any

13:26

intrinsic value it’s based on the power

13:28

of the issuing authority the the

13:31

currency itself R is a record of debts

13:35

whether it’s printed on paper or stamped

13:38

on a coin it’s a record of a debt it is

13:41

a promise to redeem and I’ll say more

13:44

about what Redemption means the state

13:47

played the central role in the evolution

13:49

of money from the very beginning it

13:51

always has played the central role what

13:55

we typically find

13:57

we look around the world today and we

13:59

look back as far back as we can go about

14:03

five to six thousand years into the past

14:05

what we find is the one state or one

14:10

nation one currency rule each nation or

14:15

state has its own currency when the

14:17

Soviet Union falls apart every one of

14:19

the former members chooses its own

14:21

currency okay in the past the exceptions

14:26

to this rule were extremely small and

14:29

virtually irrelevant the Vatican State

14:32

used the Italian lira okay that was an

14:37

exception minor

14:38

the only major exception to this rule is

14:42

euro land it was an experiment in an

14:47

exception and it’s been disastrous okay

14:51

before the euro this is what we find

14:54

it’s not a coincidence it’s tied up with

14:56

sovereign power political independence

14:58

and fiscal authority this is why every

15:02

new nation adopts own currency and

15:05

finally taxes drive money taxes are what

15:10

gives value it’s money it is the power

15:12

to impose taxes that is the important

15:16

sovereign power that insures the

15:18

currency has value

15:27

you