Pro domo: PEN delakoaz, kontzeptuak argituz

PEN (“Poets, Essayists and Novelists”)

Agian Essayist izan naiteke, eta hori dela eta, Andolin Eguzkitza koinatuak sarrarazi ninduen Euskal Pen delakoan, 1987an, Euskal Herriko PEN historiaren bigarren fasean, baita Euskal Idazleen Elkartean ere bera presidentea izan zenean, bietan nire gogo eta iritziaren aurka.

Baina Andolinek konbentzitu ninduen esanez bi idazle mota zeudela (eta daudela), gutxienez: fikziozkoak eta ez-fikzioazkoak, eta biek Nazioarteko Pen klubean leku zeukatela.

Idaztea? Izkiribatzea?: https://es.scribd.com/doc/117722046/Idaztea-Izkiribatzea#download

Natur zientzietan, matematikan eta sorginkerietan

Sormenaz natur zientzietan (fisikan bereziki) eta matematikan idatzi dut:

Zergatik idazten duzu? https://www.scribd.com/doc/70356649/Zergatik-idazten-duzu

Makroekonomian

Zer gertatzen da gizarte zientzietan, batez ere ekonomia zientzian, zeren makroekonomiak moldatzen eta eratzen baitu gure bizitza osoa!

Hona hemen saiakera txiki bat, ekonomia dela eta, Andolin gogoratuz.

Gidaria, noski, Warren Mosler dut, aspaldiko urteetan izan dudan antzera:

“Any school of thought that is not ‘MMT consistent’ is inapplicable

with regards to any actual economy”

“MTM-rekin koherentea ez den edozein pentsamendu eskola

aplikaezina zaio gaur egungo edozein ekonomiari”

(Warren Mosler, 2013)

Hasiera tax liability da, alegia, zorpetze zerga, airetik sortzen dena, inolako kosturik gabe. (Gaur egunean ordenagailu baten teklatu baten bidez sortzen da.)

Afera hauxe da:

Zer da Moneta-Teoria Modernoa (MTM)?

MTM Makroekonomiaren ulermen zuzena da

Irudiak hemen ikus daitezke:

https://www.unibertsitatea.net/apunteak/gizarte-zientziak/ekonomia/arratsalde-bat-warren-mosler-ekin

Gehigarriak

(a) In https://www.unibertsitatea.net/blogak/heterodoxia/2020/08/06/diruaren-istorioa-warren-mosler/

Tax liability

What you do is you establish a tax liability. That’s what comes first

to put a tax liability on and something that nobody has

You put a tax liability, let’s say, on everybody’s house to keep it simple, in US Dollars

now they’re all out looking for work so they can earn US Dollars so they don’t have to lose their house

Worthless dollars, unemployment

Now the government can hire those people with its, what I call, otherwise worthless dollars.

When you see that term, otherwise worthless, you know that came from me because that’s how I started talking about it at the beginning.

So the tax liability creates people looking for paid work in that currency.

That is the definition of unemployment.

the dollars to pay taxes can only come from government agents, period.

Otherwise, it’s what’s called counterfeit and you go to jail for that. It’s always the case the government or its agents are the only source of the dollars to pay taxes. In the United States

(1) you establish a tax liability. That’s what comes first

to put a tax liability on and something that nobody has

You put a tax liability, let’s say, on everybody’s house …, in US Dollars

now they’re all out looking for work so they can earn US Dollars so they don’t have to lose their

house.

(2) Now the government can hire those people with its, what I call, otherwise worthless dollars.

So the tax liability creates people looking for paid work in that currency.

That is the definition of unemployment.

So, the dollars to pay taxes can only come from government agents, period.

(3) tax liabilities come first. And what do tax liabilities do? They create sellers of real goods and services.

And there are always sellers…

these are sellers who now want the thing they need to pay that tax. They want US dollars if they are

US dollar-denominated tax liabilities. So now we’ve got people looking for work that gets paid in US

dollars.

(4) they create this nominal demand for the currency and they create now people looking for paid work,

which is exactly why the government did it, because it wanted people looking for paid work so they

could go hire them with these – I’ve been calling them since way back – otherwise worthless dollars.

If you ever hear that term, that’s one of the original terms. But the government can now spend its

otherwise worthless dollars – without the tax liabilities they’re worthless – because they’re a tax

credit.

(5) The thing that you use to pay taxes is called the tax credit. So a dollar’s a tax credit. What’s the tax

credit worth without a tax? Not worth anything. You have tax liabilities, now these tax credits are

worth a lot because you need them so you don’t lose your house or your car or whatever, go to jail.

Yeah. So, yeah. That’s 30 years of practice. I didn’t say it this way the first time. … So it’s evolving. And if I’d said it this way the first time, it might not have been effective right?

Hortaz, zer?

(https://twitter.com/tobararbulu/status/1484089792224808961)

@tobararbulu # mmt@tobararbulu

1. Bill, Warren and Randy…

Our role was to create a body of work that would be there when the time was right.

That my role is to produce a body of work that’s there, can be drawn on with clarity, when the time is right.

Dualtasuna (Bill Mitchell-ekin) https://unibertsitatea.net/blogak/heterodoxia/2022/01/18/dualtasuna-bill-mitchell-ekin

(https://twitter.com/tobararbulu/status/1484091113766014980)

@tobararbulu # mmt@tobararbulu

2. Mutatis mutandis,

Hauxe izan da ene motorra, gutxienez, 2006tik.

…euskaraz lehengo DTMz eta oraingo MTMz Euskal Herria osoa bustituz, hitzaldietan, ikastaroetan, liburuekin, artikuluekin, ia 4.200 sarrerarekin webgunean (UEUkoei esker!!), …

https://unibertsitatea.net/blogak/heterodoxia/2022/01/18/dualtasuna-bill-mitchell-ekin

(https://twitter.com/tobararbulu/status/1484091707159425026)

@tobararbulu # mmt@tobararbulu

3. Horixe da nire estrategia, besterik ez: Euskal Herrian “to produce a body of work that’s there, can be drawn on with clarity, when the time is righ”.

Mila esker, thanks a lot UEU!!

Dualtasuna (Bill Mitchell-ekin) https://unibertsitatea.net/blogak/heterodoxia/2022/01/18/dualtasuna-bill-mitchell-ekin

Ondorioak

Hona hemen emaitza batzuk:

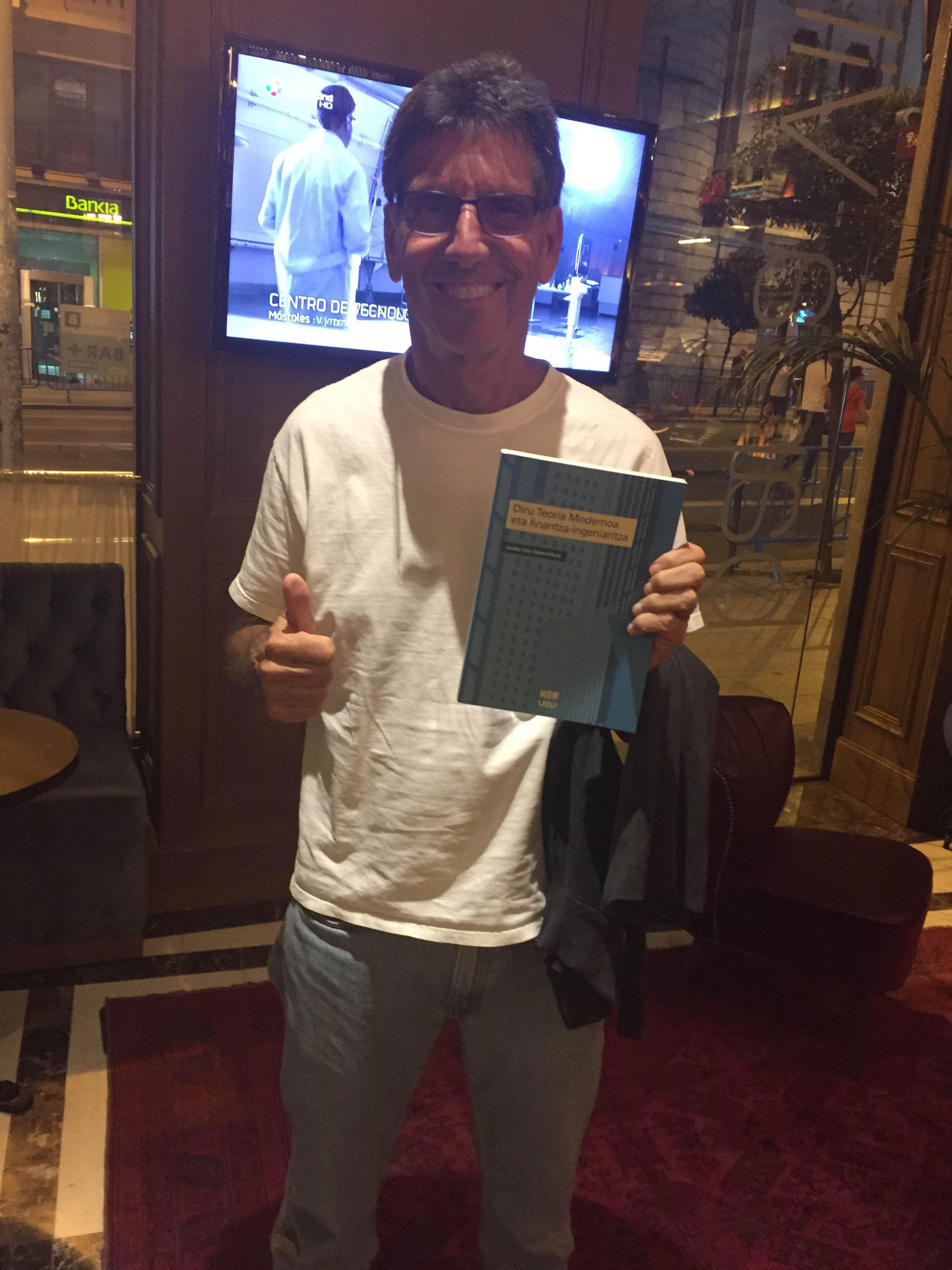

Liburua

Diru Teoria Modernoa eta finantza ingeniaritza: http://www.buruxkak.eus/liburua/diru-teoria-modernoa-eta-finantza-ingeniaritza/2278 —> Deskargatu

Liburuak on line

(1) DTM hasiberrientzat. Independentzia garaiko ekonomia: Diru Teoria Modernoa hasiberrientzat. Independentzia garairako ekonomia

(2) Mosler Ekonomia: Mosler Ekonomia

(3) Mosler Ekonomia, Mosler magister: Mosler Ekonomia (Mosler magister)

(4) Warren Mosler, gidari, prozesuan: Warren Mosler, gidari (prozesuan)

1 Hut tax: The hut tax was a form of taxation introduced by British in their African possessions on a “per hut” (or other forms of household) basis. (https://encyclopedia.thefreedictionary.com/hut+tax)

joseba says:

MMT Green

https://docs.google.com/presentation/d/1x2SW1L1giSb6QSUD9RqY_40wu_qt1imm1EVnaXXbUps/edit#slide=id.p