Hasiera:

(https://twitter.com/wbmosler/status/1409594117756174338)

Warren B. Mosler #MMT@wbmosler

@SandyDarity erabiltzaileari erantzuten

Suppose the foundational starting point of a monetary economy is a state desiring to provision itself, and it begins by levying a tax to create a scarcity of the tax credit of which it is the sole supplier, creating sellers of goods and services it can then purchase, etc. 😉

Segida:

(https://twitter.com/migueldeicaza/status/1409326356580741127)

Imagine a small town with 100 people with different complementary jobs: the plumber gives an IOU today to the farmer in exchange for eggs he can eat today. The plumber later can request payment back when his toilet breaks or he can exchange it for gas

Miguel de Icaza@migueldeicaza

The amount of IOUs in circulation that our town can produce is bound by how many people can make those promises and the value of those promises. If a new family of painters moves in, they can make promises for painting people’s homes. So the IOU supply increases

Miguel de Icaza@migueldeicaza

The amount of IOUs in circulation that our town can produce is bound by how many people can make those promises and the value of those promises. If a new family of painters moves in, they can make promises for painting people’s homes. So the IOU supply increases

Miguel de Icaza@migueldeicaza

A town that sells computers and collects a lot of IOUs per computer has more stores capacity than a town that doesn’t produce high valued services.

Miguel de Icaza@migueldeicaza

Keeping track of promises and the value of a promise is hard, so we snap those promises into coins. And we issue a bunch of those into the market to meet the output of IOUs. So now we got our currency going.

Miguel de Icaza@migueldeicaza

We are going to leave on the side the discussion of how many coins our town of 100 people should issue initially: let us just assume our 100 people are happy at this point and economic activity is working as intended.

Miguel de Icaza@migueldeicaza

Assume you had 1,000 coins I circulation. What happens when new families grow or families move in? The existing supply of coins is not enough: clearly the larger population is capable of issuing more IOUs; So we do need to mint additional coins to keep up with our growth

Miguel de Icaza@migueldeicaza

If your town doubles, then the coins need to grow with it. Because the coins are merely a proxy for the work that the community can produce as a whole. Larger and more capable communities can make more promises, so we need more coins.

Miguel de Icaza@migueldeicaza

What happens if you mint more coins than you have people capable of fulfilling those promises? You end up with inflation. So you want to find the sweet spot where you keep economic activity flowing, but don’t want to cause prices to go up.

Miguel de Icaza@migueldeicaza

Our little town now has their coins going by paying teaches and builders, and the central government will be taxing people on April 15th for whatever economic activity they engage in during the year. But how many coins should be in circulation?

Miguel de Icaza@migueldeicaza

The US likes to keep the amount in circulation to meet an arbitrary unemployment percentage. So they tax and inject money into the economy to meet this target.

This policy sadly means that the US is not operating at its full potential. We are leaving skills and potential on the table by keeping people unemployed.

Miguel de Icaza@migueldeicaza

Now you are probably thinking “I would like to subscribe to your newsletter mr. Twitter economist”. I have bad news, I don’t have a Substack or newsletter and I am not an economist. But I can give you some fun pointers to learn more:

Miguel de Icaza@migueldeicaza

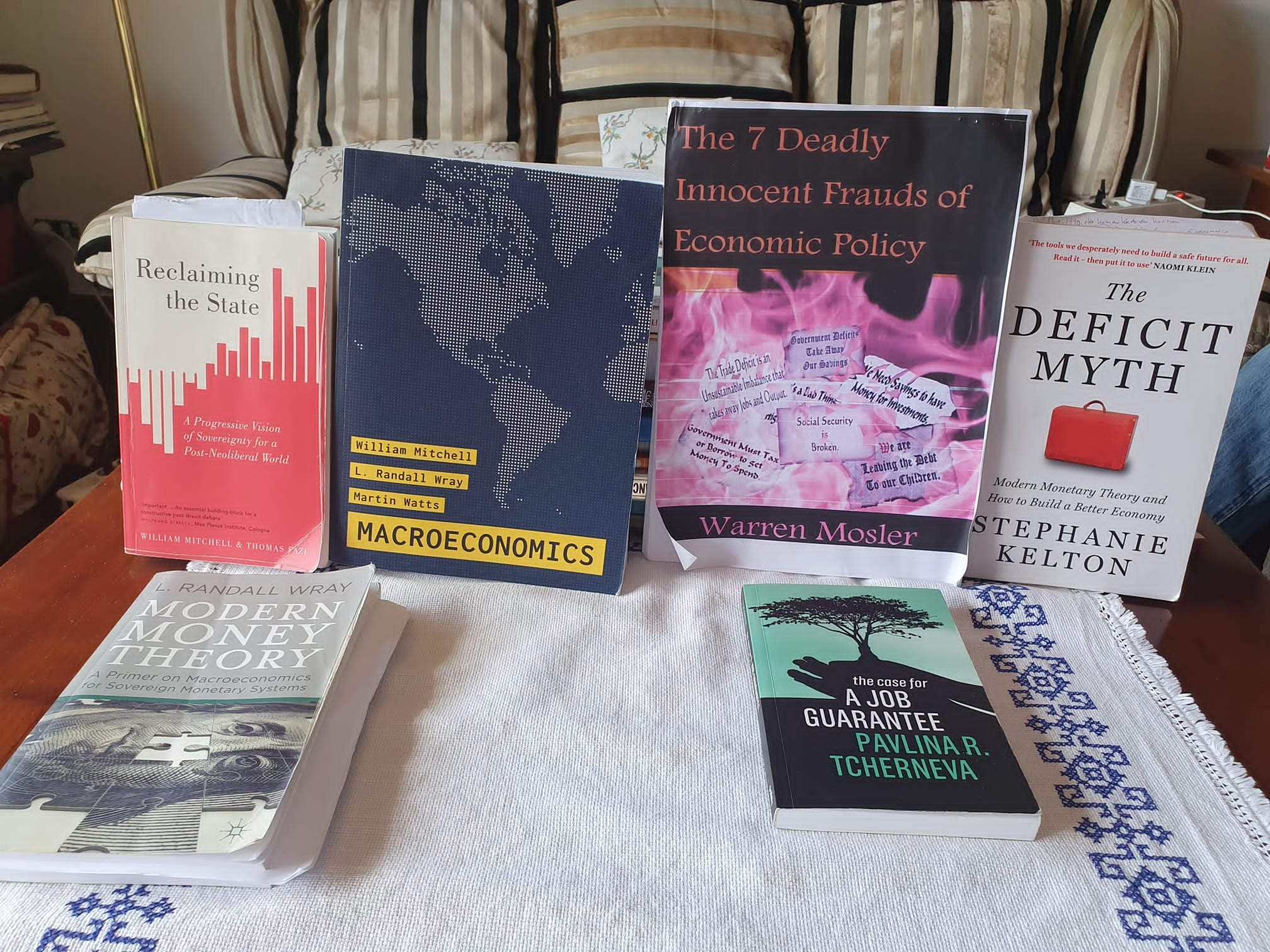

First, start with @StephanieKelton‘s incredibly easy, approachable and NYT best seller “the deficit myth”. Then you can read “modern monetary theory” by Randall Wray.

Miguel de Icaza@migueldeicaza

@migueldeicazaerabiltzaileari erantzuten

If you thought “there has got to be a better way than keeping people unemployed”, then “the case for a job guarantee” by @ptcherneva is for you. And lastly, if you feel like you should go back to college, read “macroeconomics” by William Mitchell.

@migueldeicaza erabiltzaileari erantzuten

As to cryptocurrencies- they are not like the dollar. You can’t pay your taxes with it, you first need to exchange them for US dollars, so they are closer to expensive and rare cards from “magic the gathering”

Miguel de Icaza@migueldeicaza

They are valuable to the extent that you can do something with them. Currently, driven by hype they are useful tools for speculation; and they are useful tools for cyber extortion. Other applications are just rare or poorly served.

Miguel de Icaza@migueldeicaza

Going back to our tiny town, the “debt” of the tiny town that minted their coins are the coins in the people’s pockets. Same with the US federal debt: it is the money in our pockets.

If your town doubles, then the coins need to grow with it. Because the coins are merely a proxy for the work that the community can produce as a whole. Larger and more capable communities can make more promises, so we need more coins.

Miguel de Icaza@migueldeicaza

What happens if you mint more coins than you have people capable of fulfilling those promises? You end up with inflation. So you want to find the sweet spot where you keep economic activity flowing, but don’t want to cause prices to go up.

Miguel de Icaza@migueldeicaza

Our little town now has their coins going by paying teaches and builders, and the central government will be taxing people on April 15th for whatever economic activity they engage in during the year. But how many coins should be in circulation?

Miguel de Icaza@migueldeicaza

The US likes to keep the amount in circulation to meet an arbitrary unemployment percentage. So they tax and inject money into the economy to meet this target.

Miguel de Icaza@migueldeicaza

This policy sadly means that the US is not operating at its full potential. We are leaving skills and potential on the table by keeping people unemployed.

Gehigarria:

Erabil, bereziki, Warren Mosler-en lanak.

Hastekoa hona hemen bat: The 7 Deadly Innocent Frauds of Economic Policy