Warren Mosler-en The Fed and the Interest Income Channel

May 14, 2009

The following is a little quoted section from the widely read 2004 Fed paper on ‘unconventional monetary policy.’ It discusses how interest rates work through the fiscal channel to reduce interest income.

This means the Fed should be fully aware that any presumed benefits of lower interest rates can be offset by the reduction of interest payments by the Treasury unless the federal deficit is increased.

Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment

Ben S. Bernanke, Vincent R. Reinhart, and Brian P. Sack 2004-48

A second possible channel for quantitative easing to influence the economy is the fiscal channel. This channel relies on the observation that sufficiently large monetary injections will materially relieve the government’s budget constraint, permitting tax reductions or increases in government spending without increasing public holdings of government debt. (Bernanke, 2003; Auerbach and Obstfeld, 2004).

In other words, the lower rates from the Fed and building the Fed’s balance sheet reduce federal interest payments to the non government sectors. This reduced federal spending is a contractionary bias that can be offset by tax cuts and/or government spending increases.

…Thus, it seems reasonable to expect that the fiscal channel of quantitative easing would work if pursued sufficiently aggressively.

This analysis can be taken further. Over the last two years the Fed funds rate has been cut by about 5%, with savers losing about that much in money market funds and other short term holdings, as well as accepting lower yields on longer term holdings that matured.

Additionally, with the Fed’s balance sheet at about $2 trillion1 and assuming an average coupon of 3%, the Fed is removing an additional $60 billion2 per year of interest income from the non government sectors.

And while some borrowers have saved some interest expense, many have not as net interest margins for the banking system widened to perhaps something over 4%, and those operating profits are replenishing bank reserves and not adding to aggregate demand.

As a consequence, the Fed’s cutting of rates may have removed perhaps $200 billion per year in net interest income from the non government sectors. And while the somewhat lower rates may help some borrowers, it looks to me like the cut in interest income is a much larger factor, as banks shy away from borrowers whose income is declining.

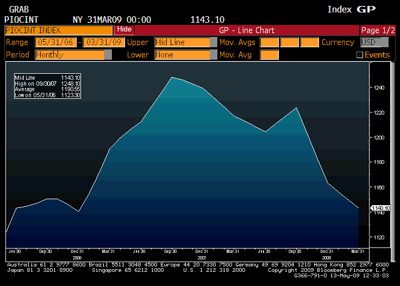

(Chart is on the interest income component of personal income, which is one of the net recipients of interest income. Others include the foreign and corporate sectors.)

Therefore, over the last two years, Fed rate cuts look to me like they’ve probably been restrictive, and not accommodating as is universally presumed.

And that means the automatic stabilizers have to work that much harder creating unemployment and cutting tax revenues to get the deficit high enough to effect a turnaround.

It also means that as long as the Fed keeps the fed funds rate near 0 we will be able to enjoy a deficit that much higher than otherwise. (Lower taxes for a given level of public spending are a good thing in humble opinion!)

Additionally zero interest rates are deflationary through the cost channel. Much of US business uses ‘mark up’ pricing and with a lower cost of funds their costs of production for both investment and consumption are that much lower, resulting in lower prices than otherwise. Lower costs and lower demand tend to result in lower prices.

However, with the current aversion to federal deficits of our political leaders and the economic mainstream, the recovery is at risk if they support policy that both reduces the federal deficit and keeps rates low.

See also: “Zero is the Natural Rate of Interest” (1996) at MoslerEconomics.com under ‘mandatory readings’.

1 Amerikar trilioi bat = Europar bilioi bat.

2 Amerikar bilioi bat = Mila europar milioi.