(https://twitter.com/tymoignee/status/1086105249872470016)

Hauei erantzuten: @dandolfa @NathanTankus

This probably will get long so bear with me. There are 2 aspects to taxes, first, the real side and, second, the financial side. Traditional economists focus on the first one & leave aside the second or blur it with the first. I’ll look each side, first financial 1/n.

2019 urt. 17

Hauei erantzuten: @tymoignee @dandolfa @NathanTankus

1 FINANCIAL SIDE has two aspects a) Taxes do not finance the US government b) Taxes cannot proceed G, G must preceed T. Again each in turn starting with 1a and then 1b

1a) has two versions. 1aa) A consolidated gov version (Treasury and central bank are one economic unit) 1ab) an unconsolidated version

MMTers prefer to use 1aa to make an argument because it gets to the point quickly. 1ab is more realistic but complicates 1aa w/out changing implications.1ab requires dwelving into the details of cb and treas coordination. Very ineffective for policy debates(but will do it here)

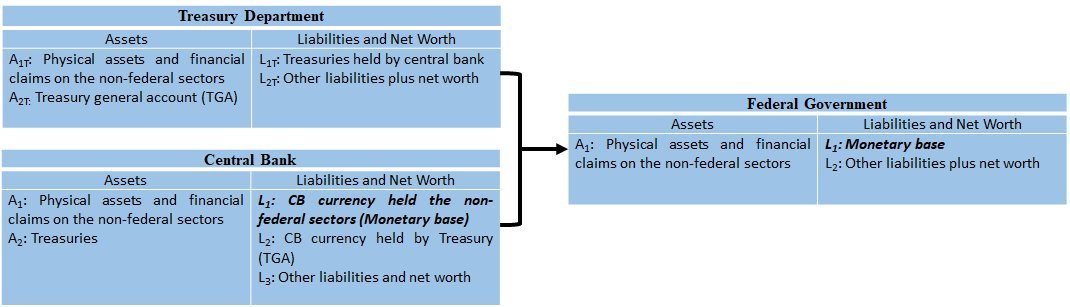

Regarding 1aa (Financial side of taxes, consolidated version). Consolidation means putting trea and cb into one balance sheet and so all claims they have against one another are eliminated.

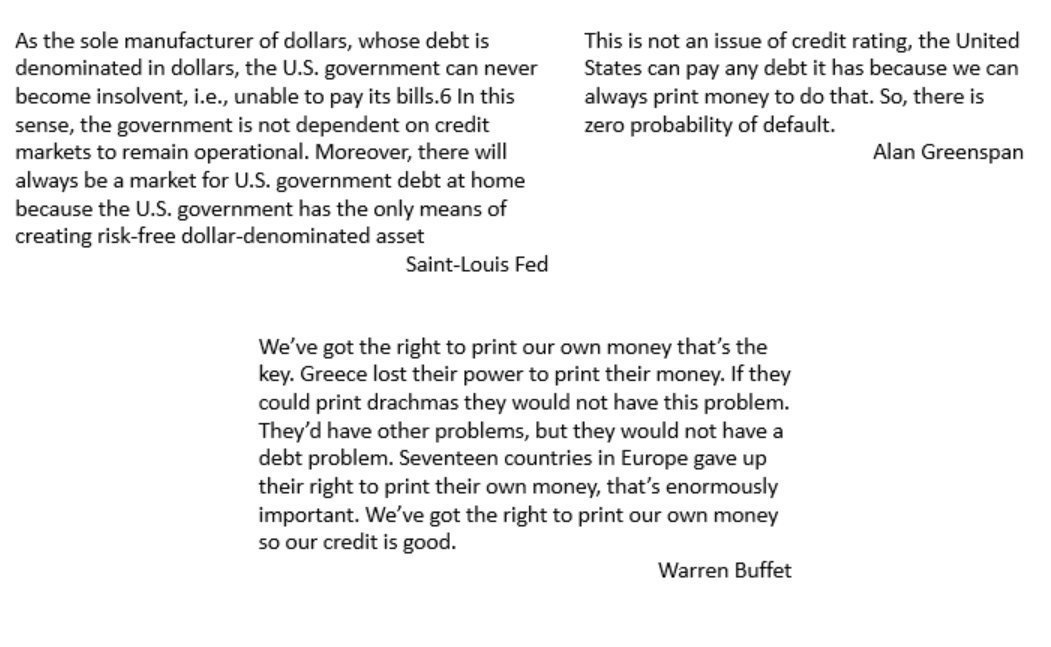

Consolidation is actually not an uncommon way to make arguments both in theories and in policy talks. Below are examples of well-known individuals using consolidation while discussing policy issues.

MMT goes further than most in analyzing the implications of consolidation. One implication involves the role of taxes. Going back to the consolidated bs, for the US Gov,taxes destroy currency(L1 falls) and claims on non-fed sectors falls (A1 falls).

When US spends, it credits accounts(L1 rises). Given that G injects monetary base and T removes mon base. Thus T can’t finance G. DONE WITH 1a (Taxes don’t finance the US government).Also G must precede T(one cannot remove something that has not been injected first).DONE WITH 1b

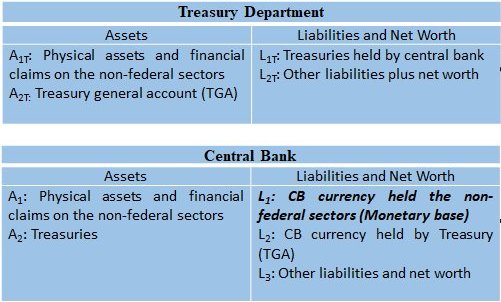

Now let’s go for the unconsolidated version of 1ab. Here are the treas and cb balance sheet (note: the word “currency” is used loosely to simplify the analysis)

Tax payments lead to: – On central bank balance sheet: ΔL1 < 0, ΔL2 > 0: Destruction of monetary base – On Treasury balance sheet: ΔA2T > 0, ΔL2T > 0 (or ΔA1T < 0 if taxes liabilities are on-balance sheet claims)

Treasury’s spending (fiscal policy: : ΔA2T < 0, ΔA1T > 0 ) and central bank’s advances (monetary policy: ΔA1 > 0) injects monetary base: ΔL1 > 0.

Now taxes do have a fiscal component (Taxes fund Treasury by crediting TGA) that they do not have in the consolidated version. However, the fiscal component also has a monetary-policy component and so tax payments to Treasury require Treas/Fed coordination.

Note first that injection of monetary base (ΔL1 > 0), via Treasury or Fed, MUST occur before taxing because taxing requires monetary base to be able to finance Treasury spending (taxing is not completed until ΔL1 < 0). DONE WITH 1bb WITH UNCONSOLIDATED VERSION.

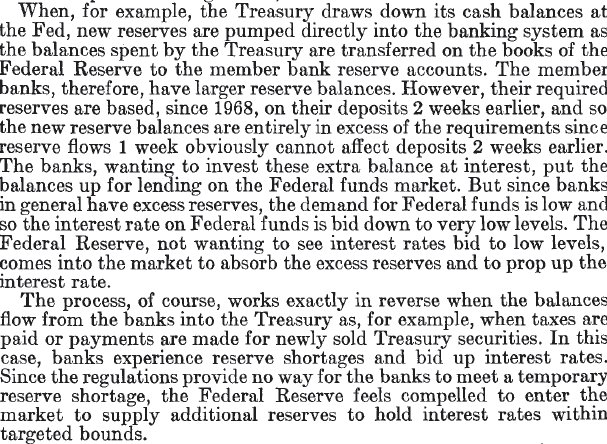

In terms of coordination induced by taxes, taxes drain reserves. On any given day if G > T (deficit) there is an net injection of reserve so FFR falls, and if T > G (surplus) there is an net destruction of reserve and so FFR rises. Here is Pool on the issue.

This has led to strange behaviors by the Treasury and the Fed if one only see the fiscal aspect of taxes such as: – Treasury has requested advances from Fed even when it had plenty of funds for spending – Fed has provided reserves to banks to settle taxes.

There’s much more on the coordination of Treasury and CB.The point is that the Fed gets involved in fiscal operations and the Treas gets involves in monetary policy operations.Taxes have fiscal and monetary policy components in the unconsolidated version (as do treasuries).

2.REAL SIDE there r two cases 2a)the economy isn’t at full employment 2b)the economy is at full employment. Here MMT differs from the standard framework because MMT follows Keynes: 2a usually prevails in both the short and long run. Demand leads the way in both time frames.

Below full emp (under the PPF), there is no opportunity cost (don’t have to give up anything to produce something else, can produce more of everything: abundance prevails) & so policy choices aren’t based on technological constraints. Policy choices are political economy choices.

MMT brings that to the table upfront in two ways. It recognizes that the policy narrative has been shaped to profit certain interests and MMT wants to debunk that policy narrative.

E.g. social security can’t go bankrupt (it doesn’t have a financial problem: see FINANCIAL SIDE) but there’s aging-population problem.Financialization of retirement(private retirement accounts)&generating fiscal surpluses to put funds in a locked box don’t help to solve aging pb

Financialization serves the interest of wall street and so Pete Peterson and Co. have been pushing that lie that SS is going bankrupt. We do need much more government involvement in solving the again problem (and so more G) (and many more problem: environment anyone)

Now we have the money to do that. It is just a matter of crediting account: (consolidated version) or of fed/treasury consolidation (Fed ensures Treasury funding goes on as needed…leave aside political infighting). The question is do we have the real resources?

Usually we do. Why don’t we do it then? Political economy, the socioeconomic interest of the majority of the population usually aren’t accounted for in political agenda (if they were we would have had medicare for all, free college, strong environmental policies, a long time ago)

Starting with abundance has also many more implications, some too radical for my MMT companions. It is another topic.

Now, how does have anything to do with taxes? What are taxes for? Do we still need to tax? Yes we do because taxes have some purposes but “Tax for Revenues are Obsolete” are former NYFed direct noted.

Taxes are to “stabilize the purchasing power of the dollar”, to “express public policy in the distribution of wealth and of income”, “in subsidizing or in penalizing various industries and economic groups” &to “isolate and assess directly the costs of certain national benefits”.

Wray has a post that develop all this. https://www.nakedcapitalism.com/2014/05/randy-wray-taxes-mmt-approach.html … Basically, it is about stabilizing the business cycle, prevent the formation of dynasties, changing “bad” behaviors, assess costs of some programs. One at a time.

Randy Wray: What are Taxes For? The MMT Approach

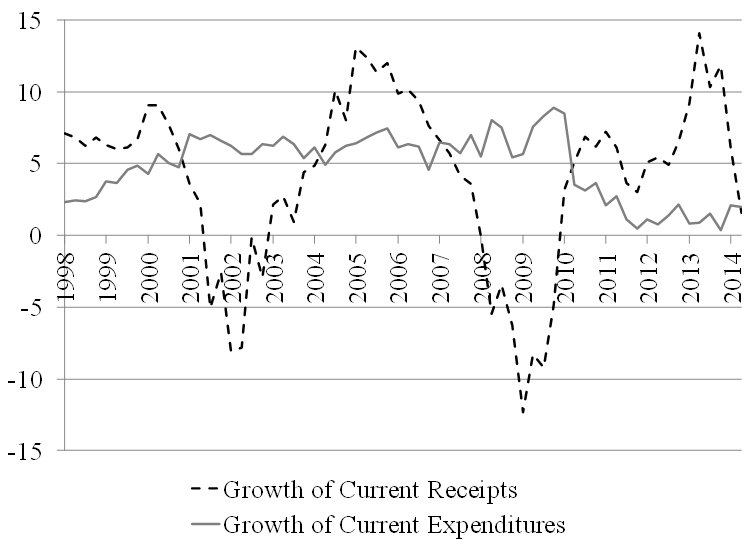

Now in terms of smooth the business cycles, taxes usually do the heavy lifting as shown below (growth rate of T and G, %). Note that T = tax rate*income. Most of the variability in T comes from income not tax rate: positive growth rate does NOT mean government is increasing taxes

Tax burden is the same usually throughout the cycle for a given income level. It is income that rises and fall with the cycle so T goes up and down. So MMT is not saying with should raise taxes during an expansion through proactive policies. Tax revenue will rise by themselves.

The point here is that managing the cycle does not require to raise tax rate. We often hear that MMT view of managing the cycle with fiscal policy is not feasible b/c of politics (people don’t like to pay more taxes). MMT just lets the stabilizers operate, tax rates don’t change.

On the income and wealth distribution issue. Taxes help reduce them. The point here is NOT to transfer real resources from wealthy to “poor”, that is done with G and G is done independently from T (G comes first, see FINANCIAL SIDE, paygo is insane for a monetarily sovereign gov)

Hauei erantzuten: @tymoignee @dandolfa @NathanTankus

Sorry will finish to tomorrow. 3 year old is calling… Hold your thoughts! Good night

Hauei erantzuten: @tymoignee @dandolfa @NathanTankus

This is so great, thank you! Really terrific.

You are welcome.

Segida:

Hauei erantzuten: @tymoignee @dandolfa @NathanTankus

On the income and wealth distribution issue. Taxes help reduce them. The point here is NOT to transfer real resources from wealthy to “poor”, that is done with G and G is done independently from T (G comes first, see FINANCIAL SIDE, paygo is insane for a monetarily sovereign gov)

Hauei erantzuten: @tymoignee @dandolfa @NathanTankus

So if one puts an argument to tax rich, don’t do it by saying that we are going to redistribute wealth. The point is to destroy wealth/income, period. Why would we do that? Again political economy.

High inequalities reduce democratic process (role of money in politics) and some may view wealth inheritance as unfair. A more radical view would be that wealth as its origins in exploitation (probably not to the taste of most MMTers).

The point is that tax rate on wealth and high income has to be debated in a society, not on the basis of provision for the gov but in terms of what is considered just.That’s a choice that each society must debate for itself, KNOWING WHAT THE POINT OF MAKING THE CHOICE IS ALL ABOUT

Role of tax in changing “bad” behavior is pretty straightforward. MMT shares this with standard economy. The critical question of course is to define “bad”. Again a societal choice to be considered with the view of reducing “bad” behavior, not with a view of funding the gov.

Assessing the cost is also pretty straightforward. The point is yet again to figure out what society we want for ourselves. Do we want a rugged individual view or a more cooperative society? Should schooling, shelter, health, food be cooperatively provided? Only some of those? none?

Again these questions and the tax associated to them (if any) should be answered in terms of what society we want, not in terms of funding the government. Implementation of whatever is chosen will come from congress appropriation and then fed/treasury coordination (keystrokes)

The last case for the real side is full employment (aggregate supply leads). Opportunity costs become important and tax rates may need to be increased to prevent inflation. There are other options that Keynes’s presented in “How to Pay for the War”.

CONCLUSION: Financial side: Taxes don’t finance the gov, taxes comes after G. US gov can always finance spending (consolidated view). Fed&Treas coordinate to ensure that fiscal and monetary policies run smoothly (unconsolidated view). Probs come from political gridlock not finances

Real side: Decide what society u want. Should gov play a big or a small role? How well should the democratic process work? What is a “good/bad” behavior? Are large inequalities ok? Resources (goods, services, people) are usually there. It is a matter of using them for what u want

I appreciate that MMT is not political, but It seemingly puts the traditional ‘small government’ arguments to rest since most every one I hear is based on financial affordability. No one WANTS their kids to be burdened with huge student loans or the environment trashed.

No one (more like a majority) does but it has been done anyway. That tells you a lot about how much democracy there actually has been in the US. That would be another long thread. Have a look at Thomas Ferguson’s Golden Rule (elections in the US are basically bought since day1)

Gehigarriak:

How Money Drives US Congressional Elections: More Evidence …