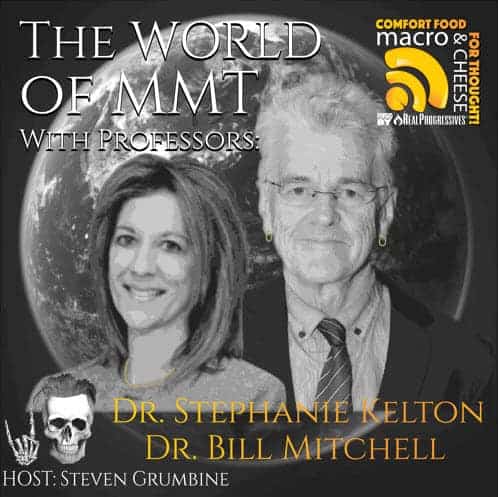

Drs Stephanie Kelton and Bill Mitchell join Real Progressives to present the world of #MMT

Bideoa: https://www.youtube.com/watch?v=uKlwVoyTB-Q

What is a blog? Mitchell in 2004

A Blog: Kelton in 2007

What is a blog? Wray in 2009

There is no Progressive Agenda without understanding MMT

Enjoy it!

UEUko glog: in 2006

Gure mailan, munduan dagoen hoberena, DTM alegia, euskal arlora ekartzea da helburu bakarra.

Episode 7 – The World of MMT with Professors Stephanie Kelton & Bill Mitchell

Transkripzioa:

Macro N Cheese – Episode 7

The World of MMT with Professors Stephanie Kelton & Bill Mitchell

March 16, 2019

Stephanie Kelton (00:00:03):

There is no progressive agenda with this deficit neutral CBO passing out permission slips for every piece of legislation that would give us universal health care or a Federal Job guarantee.

Bill Mitchell (00:00:21):

In 1968, I know, we’ve now got letters written by top industrialists in Australia to the treasurer, urging the treasurer to create some unemployment so that would take the wind out of the trade union’s sails.

Geoff Ginter [intro/music] (00:01:28):

Now let’s see if we can avoid the apocalypse altogether. Here’s another episode of Macro N Cheese with your host, Steve Grumbine.

Steve Grumbine (00:01:35):

Friends, it’s Steve with Real Progressives. Hopefully you all will enjoy this as much as I. We were able to get not one, but two of the original MMT development team. Two people who I have followed intensely for years and have found tremendous hope in the message that both of these individuals bring.

It is, singularly, the driving force in my life right now. And so the opportunity to have both Dr. Stephanie Kelton and William Bill Mitchell on here with me is just beyond words exciting. So I’m sure you guys didn’t come to hear Steve talk. Welcome to the show Dr. Kelton and Dr. Mitchell. How are you?

Bill Mitchell (00:02:26):

Very well, thank you.

Stephanie Kelton (00:02:26):

Thanks, Steve. Doing fine, how are you?

Steve Grumbine (00:02:29):

I’m doing great. You guys, thank you so much for this. I cannot tell you how much this means to not just myself, but the hundred plus that we have that volunteer for Real Progressives and the 120,000 that follow our page, et cetera. We are very, very grateful to have you both on here. So let me just start off real quickly.

I’ve had the opportunity to interview Dr. Mitchell several times and it never, ever, ever ceases to be exciting for me, but this is a first time for us to have you on, Stephanie. Can you tell me, kind of lay into how you came to this understanding, this lens of modern monetary theory and what its origins were and how you came to really put your passions behind it?

Kelton (00:03:25):

Well, I’ll let Bill go because I think what’ll happened is we will each have our own story and then we will, at some point we will meet and the story will continue, but I would like to hear Bill start if he’s.

Grumbine (00:03:33):

Okay, very good. Dr. Mitchell.

Mitchell (00:03:36):

Well, I’d also prefer to be Bill, if you’re calling Dr. Kelton, Stephanie.

Grumbine (00:03:43):

Oh, Bill, Bill. Just Bill.

Mitchell (00:03:45):

Very formal of you. Look it’s a, there’s vague origins. And in my fourth year at Melbourne University in 1978, so it’s in the honors year preparing for, to go on, to do postgraduate studies. I wrote a thesis about a buffer stock employment models. And, you know, this was really not MMT, but it was about how the state can use its spending capacity to run both the full employment scheme, plus a price stability scheme.

And for those that have read my work, it was, I got the idea sitting in a very wintery lecture theater in Melbourne, which you guys wouldn’t be very cold, but for me, it’s freezing. And it was the lecture was in agricultural economics. And it was about the Australian government’s buffer stock wool scheme, where to guarantee the price of wool to give farmers a guaranteed income, the government would buy up all the surplus wool if the market didn’t want to want it.

And they would sell it back into the market if the farm supply was deficient relative to demand. And I wasn’t so much interested in wool but it was clearly full employment of wool scheme. And I was interested in unemployment at the time because, in the late seventies, that was when, basically, the neoliberal period started in Australia and unemployment was starting to rise. You know, historically, it had been less than 2% and started to rise, five, six, and so on.

Now that, now that just sat there in my mind. I wrote that and sat there. And, of course, I was a, you know, Post-Keynesian and I believed in the use of deficits and all the rest of it. But then we met up in the early nineties, I think about history but, you know, the facts will correct me, but let’s say 93, 94, something around that date. The internet was becoming a reality and we’d moved beyond the early bulletin boards into email lists.

And then an email list began called the post Keynesian theory list, the PKT list. And this was, this was a fantastic thing because it completely eliminated the tyranny of distance between academics in, because Post-Keynesians are in the minority. We used to meet up maybe once or twice a year at different conferences, but we didn’t have regular, you know, exchanges. We’d have to wait three or four weeks if you’re in Australia for a letter to reach somebody or whatever.

And on that list, we started talking about things about Post-Keynesian theory. And one of the members of that list was Warren and Warren had just written a document. He came from banking and in, and financial markets and he’d written a document called soft currency economics. And within that document was, part of that document was an outline of a full employment scheme, which he called employer of last resort.

And, of course, that was the job guarantee scheme that I’d written about in 1978. And so that, that immediately was very interesting to me. And soon after, I got a call one Saturday from this very American chap on the phone saying, look, I’m in Sydney. I’, Warren Mosler. I can’t imitate an American accent. He said, I want to come and see you. And it was based upon what we’ve been writing in this mailing list.

And so Warren duly headed up the highway to where I, to Newcastle where I was at that stage. And we had a really nice lunch and we talked about things and Warren brought a lot of knowledge of banking that I didn’t have. You know, I had, I had the other, sort of, knowledge and, to me, that was the beginning of my involvement in what later has become called MMT.

Now, Warren, meanwhile, back at the ranch was building, was, was bringing together people like, as I understand it, Randy Wray and Stephanie, who was the very early ones he brought together and Stephanie will correct if I’m wrong, but soon, soon after, I think it was in 1996, I can’t remember the exact. It was in your winter, so it must, it was early in the year or late in year.

We all met up in New York. Now, I don’t know if Stephanie was there. It was a, it was a workshop sponsored by the New School. And that was the first time that we had all come together physically. And I’m saying all because the joke in those days was that you count, count the MMTers on one hand. So we were only talking three or four of us got together at that workshop. And that really began it. And that, so that’s the origin of it.

Then we started to write things and sequentially build a coherent body of literature, which, which you now have in which we now call MMT. Now I could talk later about the social media developments, but that was the, they came later in the sort of ran 2004, but around 1994, the, the, the network was starting to be put together by, by different interactions, which, which we now see as the sort of intellectual group that began or what is, 1994, I think.

Grumbine (00:09:43):

Very good. Alright. So Stephanie, let’s talk. How did you come into this mix?

Kelton (00:09:50):

Well, I, you know, I guess unlike you, I had the good fortune of, you know, sort of ending up in an economics program with some people who prevented me from getting my head fuddled with nonsense at a very early age. And so, I think that, you know, this story for me, this journey doesn’t begin without John Henry, who was my professor at California State University in Sacramento years before because he’s quite a bit older than I am.

Randy Wray was also John Henry’s student. So we have this, sort of, parallel at Cal State Sacramento where we were both trained by a professor who was our, you know, history of economic thought was the course that I think was most impactful. So, you know, I got exposed. I was reading original works of Veblen and Marx and Keynes and, you know, that sort of captured my attention. And that’s what drew me into economics.

That, and the fact that John Henry was just a tremendous influence intellectually and incredible professor and so forth. And so, through him, I ended up meeting Randy who at that time was a professor at the University of Denver and Randy, John Henry set up a lunch and introduced me to Randy just at the end of my undergraduate training. And he said, you should listen to this guy. He’s very smart. He’ll tell you what to do.

And John Henry said, you know, Stephanie’s going to go off to graduate school. Where should she go to school? And Randy said, she should go to Harvard. And John said, don’t listen to him and so I said, wait a minute. The lunch is for me to listen to him. He said, no, no, no, don’t listen to him. You need to go to Cambridge. And, the England Cambridge, not the Massachusetts Cambridge.

So off I went to Cambridge and that’s where I think I first ended up on this thought list, that bill was referring to earlier where people were dialoguing and Warren was part of that. And Randy was part of that. And so I, I did a degree at Cambridge University. I missed this 1996 gathering at the new school because I was there studying at Cambridge. But then I ended up on a fellowship from Cambridge University to the Levy Economics Institute.

By that time, Randy had left Denver and joined Levy. Wynne Godley was a scholar at the Levy Institute. I had this fellowship, I went to Levy and that’s when I really started to dig into Warren’s work and the soft currency economics, which Phil referred to earlier was this bizarre little pamphlet. And then not so little bit, but I say bizarre as someone who had an unconventional training, but Warren’s stuff, I have to say, it just struck me as wrong.

It struck me as wrong and Randy and I started going back and forth. Randy was working on his book, Understanding Modern Money and I kept saying this isn’t right, this isn’t right. And Randy said, well, write it up, you know, he would want to know if it’s wrong, he would want somebody to point it out so you should write it up. So I started digging into the really detailed stuff about government finance, operations, all this, you know, weedy stuff and I start tracing through the argument.

And I arrived at exactly the same place that Warren arrived, I just made a much more complicated argument out of it. And that’s how I persuaded myself that Warren had, that Warren was correct and that what he was describing about the way the modern monetary system works, the operations, the accounting, and so forth, that it was all very correct.

And that it really mattered that we were getting these things wrong. So that’s, I simultaneously encountered Warren and Wynne Godly and all of that at Levy, and then, you know, the rest is history, as they say. We all ended up at UMKC together, Randy, Mat Forstater, Pavlina and I. And then the burgeoning of the literature that Bill refers to, you know, it’s sort of funny that I think people still continue to treat MMT as an internet phenomenon.

It’s something that happens in front of tweets and blog posts and something that, in reality, it’s years of scholarly literature. And as Bill said, that’s what MMT is. It’s the label that we assigned to the body of scholarly work that a handful of us spent years developing and the internet stuff came later when we wanted to enter the fray, mostly for me anyway, as part of the financial, during the financial crisis and the aftermath. And we wanted to try to have a voice in those debates. And we used social media to have that immediate, impactful entry point to give us an opportunity to engage.

Grumbine (00:14:56):

I want to just say, you guys have the patience and stamina of gods. It’s amazing to me because I know just as a lay person that has a little bit of training, dueling with, with people that have run for president and people that are running for office and just the regular, you know, fanfare of the social media world. But just trying to crack through and break through old things.

I mean, I’ve been called a cult leader. I’ve been called all kinds of, like I’m selling a scam, a psy-op, a this, a that. I had no idea what you just said, which is it’s an incredible, huge body of scholarly work, real honest to goodness forensic work that has nothing to do with Facebook or Twitter or anything else. This is just the vehicle by which we have to use to get this word out, which brings me to the next thing.

When I first met you, Stephanie, you had told me a little bit about the orthodoxy and how difficult it was for economists who don’t toe the line of the standard narrative, how hard it was to get out there and get the word out there. And I’ve spoken with Bill as well about this, and quite frankly, every MMT economist, or post Keynesian who supports MMT and everyone to a fault has said how absolutely difficult it is to get this work published in mainstream journals to get through the myriad of politics within the academic structure.

You guys have been incredibly successful using heterodox communication methods to reach a heterodox community that’s getting a heterodox economic lesson. I guess this is a great opportunity now for both Bill and you to talk about that the internet phenomenon and some of the social media that you all have done over the years from new economic perspectives to Billy blog and some of the other tools that you have used to get the word out, to bypass some of these, to get the word to the people. I mean, you all have done great, great work. I’ll leave it up to both of you to talk about. Bill, what do you say?

Mitchell (00:17:12):

Well look, you know, for a long time, there’s a small group of us working on academic matters. And that is, that’s our natural bailiwick. We would, we would go to conferences around the world and not just heterodox conferences. You know, we’d go to the standard conferences around the world and give these papers. I remember once I was a guest speaker at a major conference and one of the panel discussants said, Oh, we’ve been visited by a man from Mars today.

And that was, you know, that was sort of standard fare for what we’re up against and often we’d just preach, to preach to the converted. Even within the post Keynesian community, there was, there was hostility and resentment and all these other things and resistance is the best word I think. And, you know, I mean, it’s quite clear that the general, we weren’t going to cut it with the general population pursuing that line.

We’d get a lot of publications or an amount and we’d retire and go off and deteriorate into our old age without ever having done anything much. And I remember for various reasons, I was fairly plugged into IT developments and I wrote a lot of code. I always have. I’m sort of a technician. And I got wind that there was this phenomenon called a blog. It was just a visitor who from the, from Europe, had come and said, you know, you should understand what these new developments are.

And this is pre Facebook, pre tweets, all of that stuff. And I sort of, because I’m IT oriented, I got interested in a blog. I remember I had a meeting in probably the Caribbean somewhere with Randy, Warren. I don’t think you were there, Stephanie, but there was definitely Warren and Randy there. And I announced it to the assemblage. I said, I’m going to start a blog. And I remember Randy looked at me as if I was insane and he say, what the hell is that?

I said to him, this is our path into the general discussion. This is our path to take our literature out of the academic area where nobody would read it, where there’ll be zero attraction in the public debate and this is our path into the public debate. 2004, that’s my first blog. I started my first blog in 2004 and that became my vehicle. I, at that stage, I don’t think I wrote it daily, but I wrote it a fair, fair amount, pretty much daily.

Grumbine (00:20:04):

Prolific, Bill.

Mitchell (00:20:06):

Yeah. But don’t overstate that. But, and then, then of course, I started to get Warren and Randy said to me, well, watch your traffic like? And I started to get a lot of traffic. I went from nearly 40 people reading my blog, who were in my academic network to literally thousands and then tens of thousands and then more.

And that, then, Stephanie developed the Kansas city blog, New Economic Perspectives. And it went from there and now we get millions of hits across our network on a daily basis. And then, of course, other forms of social media came along and Stephanie has exploited Twitter much more than I have. And that’s just a taste thing I think. And even Warren sends out tweets these days. Randy doesn’t.

Kelton (00:21:03):

Randy started on, oh, it’s funny because your blog was very much the pioneer for us. But years later, 2009, after the financial crisis, after it became clear that this was not going to be a garden variety recession, we were dealing with something very different here. I wanted us to have a voice in the policy debate in particular.

And I knew that blogging was, you know, like a full time job. I knew that it took a lot of dedication. I was paying attention to what Bill was doing and I understood that I did not have the bandwidth to do what he does or the dedication, so I went to Randy and to Bill Black. And I said, if I start a blog will… and it’s the three of us and we take turns and we’re all contributing would you two contribute? And Randy said to me, what’s a blog?

So after five years, he still apparently had not figured out exactly what this, what this platform was. But yeah, so that’s when I launched, I think, July of 2009, specifically in response to the crisis and as a way to get, you know, you can’t, does no good to work on a paper, send it in, have it go under review a year and a half, two years later, if you’re lucky it comes out in print. You can’t engage in policy debates like that, you know, in the midst of a crisis, you have to be in the moment. It was the perfect platform for us.

Grumbine (00:22:33):

Very good. So let me, let me ask this next question. In terms of the flavor of both of your writing, I’m going to tell you from the outside, you all have unique styles, obviously. But the one thing that you both consistently do is you consistently dress down neoliberalism. You consistently talk about, you know, knocking down the pay-fors and eliminating wasted efforts. And, Stephanie, you have one of my favorite – and I’m going to butcher it – but the point is you’ve talked about the folks especially within the democratic party, “leaving the headstones,” I have this almost memorized.

I’m going to butcher it now: the headstones of the progressive agenda, basically trying to find ways to pay for it. And, Bill, you wrote one of my favorite articles of all time is, like, about taxpayers literally fund nothing. But going back, Stephanie, you wrote what is obviously the ‘go to’ paper and you sent it to me when I asked you, do taxes fund spending?

Then you said, uh, no, and you gave me your link to the white paper to Stephanie Bell. I think it was 1998, white paper where you, it was titled, do taxes and bonds finance government spending. And it was incredible. It was a dense read for sure, it’s not just for light reading. But it was incredibly detailed and it is absolutely life-changing once the light bulb goes on.

Can you all talk to the audience a little bit about what neoliberalism is and how we have leveraged, or you have, particularly your work has leveraged, MMT to eliminate the pain and suffering of the neoliberal push to privatization, etc. Stephanie, I’ll let you start, if you don’t mind.

Kelton (00:24:35):

Well, I’ll start. I’ll say something about that paper but Bill has written so much, I mean he’s written extensively and an ongoing on neoliberalism. I’m going to let him take this question, but it’s funny that paper that you’re referring to is a peer review journal article that I wrote. That’s the paper I started working on to show Warren why he was wrong. That’s what that paper was.

And so I thought if, you know, he took a couple of what I perceived to be shortcuts, and I thought, well, if you fill in all the gaps that, you know, he sort of glosses over a step here or a set there, you’ll arrive at a different place. And so it’s funny that paper was impactful for you because it was impactful for me because it’s what allowed me to convince myself.

And that’s what I had to do. I actually wasn’t enough for me to have Warren say, this is how it works. I had to convince myself that everything I thought I understood about government finance and operations was incorrect, and I had to do the work to persuade myself I was wrong. So, anyway, I’ll let Bill and hit the neo-liberal question.

Mitchell (00:25:45):

Well, that’s, that paper, by the way, Stephanie, is a great paper. That was one, there were several early keystone sort of papers that we all, individually or together wrote in different co-authoring arrangements. And that was one of the sort of pillars I think, great paper.

Look, it’s quite obvious that the narrative that began in different countries at different times in the 1970s, that self-regulating markets will deliver prosperity for all was an ideological statement, rather than a factual statement. Now, if you trace the history and in both the last two books I’ve written, I’ve written a bit about this.

It all began in the late sixties, when, you know, profits were being squeezed by what the corporate, let’s call it the capital sector, saw as being an excessive welfare state. Full employment had empowered trade unions, allegedly. Welfare State had giving options to workers to resist pernicious working conditions and that, taken together, this sort of government program to undermine the advantages that capital enjoys by being capital had gone far too far.

And like, you know, in the Australian setting, for example, the release of archive cabinet papers, you know, 50 year rules where they get released after 50 years or something in 1968, you know, we’ve now got letters written by top industrialists in Australia to the treasurer, urging the treasurer to create some unemployment. So that it would take the wind out of the trade union sails.

So this is, this was a conspiracy. And it is now, you know, I’m not, I know I’m not a paranoid type, but this was a clear, coordinated effort by capital to undermine the things that have been gained by the rest of the population, the workers and their families in the post Second World War period up to the mid seventies or something.

And, you know, Lewis Powell manifesto in the US context, 1971, you know, he later became, soon afterwards, appointed by President Nixon’s to the supreme court as you all know in America and became the most conservative supreme court judge in history, as I understand. But his manifesto laid out a very coherent plan to regained the hegemony or the capacity of capital to exploit the economy in their own interests without compromising it with workers.

You know, he was, he told capitol they had to take over the media. They had to take over educational programs, infiltrate educational programs, and had to take again a voice on the Supreme court to turn that into a pro capitol conservative organization. And very, very importantly, he outlined a strategy for the development and funding of think tanks, which were a relatively unknown phenomenon at that stage.

And, of course, in the seventies, after that, you saw the springing up like mushrooms, all of these conservative think tanks all around the world, which were well founded by financial capital and industrial capital in the, you know, the Koch brothers case in America. And these were full time, 24/7 propaganda machines pumping out all of this stuff.

And included in that stuff was not only that workers were lazy and, you know, the Ayn Rand type narrative, but were also all of this macroeconomic stuff that was squarely in our bailiwick. And so, you know, MMT, the development of our literature had to meet that square on, had to address those macroeconomic myths because, to be fair, the mainstream post Keynesian literature before MMT hadn’t really nailed the myths of neo-liberalism.

So in that mainstream post Keynesian literature, and Stephanie talks about owls, well we had the deficit doves. And these were, this was a concession to the mainstream in my view that, you know, we can run deficit sometimes but we’ve always got to pay for them and go back to surplus to pay for them because, otherwise, you know, financial markets will attack the government’s ability and, you know, stop funding them and blah, blah.

So up until, you know, the point that we came along to develop this literature, there hadn’t, in my opinion, been a square on, head-on attack on all of those macroeconomic myths. The post Keynesians up until then, in my view, presented a compromise picture. And so that’s been in our agenda for sure. And because that’s the main game, all of these other things about identities and identity issues and not unimportant, you know, like gays and gender and ethnicity, they’re very important things.

But for us, the main game was the macroeconomics, which forms the sort of basis of all of those other attacks on disadvantaged groups.

Intermission (00:32:01):

You are listening to Macro N Cheese, a podcast, brought to you by Real Progressives, a nonprofit organization dedicated to teaching the masses about MMT or Modern Monetary Theory. Please help our efforts and become a monthly donor at PayPal or Patreon, like and follow our pages on Facebook and YouTube and follow us on Periscope, Twitter, and Instagram.

Grumbine (00:32:50):

Let me ask you all a couple of questions. Obviously, when you look across politically, we’re not making progress. I’m not seeing legislation passed. We’re not seeing the people taken care of. We’re seeing a lot of energy. We’re seeing the people growing weary of the same tired, do nothing, gridlock, whatever.

But when you talk at the non academic level and you go down a few pegs into the activist world, et cetera, we were stricken with a million forms of hieroglyphics on caveman walls, like worries about the petrodollar. Oh my God, the US is going to implode, the petrodollar, we’re all going to die. And then it’s like, well, if you just keep spending money on everybody, we’re all going to die from hyper inflation.

Look at Zimbabwe, look at, you know, Argentina, Venezuela, you know, Weimar Republic. And you’ve got these traditional go to’s that people think they’re clever. They throw this at you like we’ve never heard it before. But, in fairness, you guys have written extensively about this as well. One of the things that I don’t think I can find anywhere, however, is kind of like a description of MMT’s view of the petrodollar.

Since this seems to be something that comes from the Ron Paul world and the sound money world and, quite frankly, you even hear media personalities like Lee Camp and Jimmy Dore, and others talk about this as well. Can you address what the petrodollar is, what it is not, and whether it’s anything to be of great concern about? Any one of you. Stephanie, would you like to take a crack at it?

Kelton (00:34:34):

I will give you that that is an area I know that I have not contributed much of anything, maybe in some of the public speaking that I do with investment groups and things like that. Questions about the role of the dollar as a reserve currency, Petro status, and this sort of stuff will come up. I think Bill has written some on this, and I know Warren has, occasionally, had, shared thoughts.

I don’t think maybe developed in a, in the form of a post or anything like that. But, look, at the end of the day, what MMT has argued is that the value of the currency is driven by its acceptability in payment to the state, right? Mostly in the form of taxes, but other forms of payment as well. Does it matter whether the rest of the world prices oil in dollars in order for the US to be, to have the fiscal capacity to maintain full employment domestically, to avoid austerity to have, and the answer is no, right.

Am I getting, like, the point of your question, right? The idea, people will sometimes say this, right? Well, what if the rest of the world refuses to take dollars? What if they begin pricing oil in euros or some other currency or basket of currencies? Doesn’t that then threaten the MMT narrative, which says that the government is not constrained in the way of households or private businesses, that it can always maintain full employment, domestically, by relaxing fiscal policy to the point where you’re maximizing employment and production at home?

And so, we explained that, no, it doesn’t matter whether the US dollar is the quote unquote reserve currency. That’s not what makes MMT work in the US. It doesn’t matter whether the rest of the world prices oil in US dollars. That’s not what makes MMT work in the US.

Your comment earlier, I did want to just say something about this because this idea, or maybe this was Bill talking about, you know, these intense debates that we have in the US between the deficit hawks and the deficit doves. And where he characterized as, in a sense, shortcomings in the literature before MMT.

Economists came into the debate where, you know, Jamie Galbraith described it as a debate between Tweedledum and Tweedledee, where, you know, it was basically austerity now versus austerity later. And the best that the deficit doves could offer was an argument that deficits are okay. It would sure be nice if we could avoid them, but sometimes the economy just gets out of whack and things, you know, aggregate demand gets so weak that you need government to step in and essentially prime the pump.

Do a little bit of deficit spending. Put the foot on the gas but then recognize that as the economy begins to recover as Paul Krugman said just last week, that now is not the time to have fiscal stimulus in the form of the recent tax cuts. And then the budget deal between, you know, the house and Senate for 300 billion. And now top of infrastructure, he said, if anything, right now we should be paying down debt. Which is crazy, right?

Which is to say that we, the budget should actually be in surplus right now. So I know I touched on your question, but I tried to wrap in a little bit of comment that I wanted to get in about what Bill was saying about, you know, this deficit doves don’t take us very far. Essentially, the debate is austerity now, Paul Ryan types, or austerity later, you know, the deficit dove types. And that doesn’t get you very good macroeconomics policy.

Grumbine (00:38:27):

No, it does not. Bill, what do you have on the petrodollar?

Mitchell (00:38:33):

Well, it’s sorta not much. It’s irrelevant. Look, you know, at the end of the day, any nation, ultimately, is as, the basic you starts with, is that any country is only able to achieve the prosperity with its own real resource base independent of trade. That’s the sort of base, the limiting condition. So then you’ve, if you’ve hardly got any real resources, then you’re likely to be poor, and there’s not much you can, you can.

But you can do some trading to get some other real resources and swap them and you can perhaps improve that real resource capacity. But, ultimately, a country that can’t get access to essential resources say like energy petrol, for example, is going to have difficulties. That’s a reality. That doesn’t say anything about MMT.

What MMT tells us, is that irrespective of your real resource endowments, a national government can ensure that all of the real resources that are for sale in the currency that the issues can be fully used in a productive way. Now that doesn’t mean that every country can be highly prosperous. It means that they can achieve whatever the limiting prosperity is. That’s the first point. The second point is that this idea, and I read it even on the progressive side, that the only reason the U S government can run deficits is because it’s, in some way, the reserve currency.

That’s just a nonsensical statement. The Australian dollar isn’t a reserve currency. We’ve been running deficits 80 or 90% of our history and other countries don’t have any attraction to speculators or people who want to, you know, conduct holding trades or whatever in that particular currency. They can run deficits.

A national government that issues its own currency can always run a deficit and never needs to, and I hope you can see these commas fund it, never needs to fund it irrespective. And so this idea that the MMT is sort of just a US construction is really, really wrong. And the corollary of that or the related statement, is that I’ve often heard over the last 20 years now, MMT just applies to large closed economies like the US.

Well, no, it doesn’t. I happen to live in a relatively small, very open economy, which can have terms of trade shifts that knock out, you know, 10% of GDP in two quarters in value terms, because of revaluing exports and imports. And MMT applies to every nation that issues its currency, and every nation that doesn’t issue its currency likely Eurozone countries.

It’s just that the implications of the currency issuance will change across those two types of currency arrangement. So I just think the whole idea that, look, the US might find that its energy resources become more expensive over time and it will have to make decisions. But that’s got nothing to do with the capacity of the national government to fully utilize all the available resources that are for sale in US dollars, whether they be priced at, in foreign markets or just available in the US.

Grumbine (00:42:18):

So Bill just finished up talking about the reserve currency and the fact that we, as nations, rely on our real resources, our access to real resources. The whole idea of reserve currency and petrodollar, et cetera, is just nonsense. It doesn’t really have anything to play here. So let me bring this up here because this is probably the most important thing to me anyway, is the concept of a progressive agenda and being able to do something truly bold and not just dinking and dunking around the edges, but really making an impact in people’s lives.

And, you know, we, I go back and I feel like we’ve got a very, very solid basis by which to leverage a progressive agenda, going back to FDR second bill of rights, going back to, you know, Martin Luther King talking about a job guarantee coming through here even recently during 2016, we had a remarkable agenda that everybody loved through the primaries. And here we are now today going into 2018, let’s talk.

What does a progressive agenda look like and how does one get a new deal? What types of energy and factors would we need to push forward to get such a wonderful thing for our lives? And, quite frankly, MMT, to me, is the magic silver bullet, if you will, in overcoming all the objections that are typically thrown at us in order to have a robust, progressive agenda.

Stephanie, can you talk about, you know, from the student debt elimination paper that you guys recently wrote through some of the other policy prescriptions. What are we looking at here? What does a progressive agenda look like with an understanding of MMT beneath it?

Kelton (00:44:17):

Yeah, it’s not possible without an understanding of MMT. I think, I believe that completely. There is no progressive agenda with this, you know, deficit neutral CBO passing out permission slips for every piece of legislation that would give us universal health care or a Federal Job guarantee or, you know, free, making public colleges and universities, tuition free, whatever the case may be climate, let’s say climate change.

If you think that you’re going to do anything meaningful, which is the only thing we can do when it comes to climate and responding appropriately to the threat that we face with respect to climate change, we’re not going to do it in a deficit neutral way. It just isn’t going to happen. And we’re never going to have a piece of legislation that the congressional budget office will run through its models and give a budget score that tells members of Congress, you know what? It’s okay to vote for this because it doesn’t add too much to deficits in the national debt over time.

That will never happen. So either you recognize that you’ve got to go beyond the conventional self-imposed constraints with respect to the way we think about money and financing of government operations, the dangers regarding running budget deficits, or adding to the national debt. We got to move beyond all of that or there is no progressive agenda.

And in a very real way, the clock is ticking on this and we can’t mess around. So, and I put climate at the time top of the list, but there are other imminent dangers. You mentioned student loan debt. Yes, Scott Fullwiler, Marshall Steinbaum and Catherine Ruetschlin and I spent over a year and a half working on this paper. It was a labor of love, but it examines a real problem facing millions people in this country.

There are 44 million people who have outstanding student loan debt. Not all of them are struggling to make their payments but a great many of them are. And this is a significant issue for millions of people, not just those that have student loan debt, but their loved ones, their partners, their siblings, their parents, grandparents in some cases who co-signed on student loans.

And so what does the progressive agenda look like? You mentioned second bill of rights. I like that very much. A right to a job, FDR put first on the list. Everyone in America who is, who wants to work should be afforded the right to employment, the right to a job. And then he goes on to say at a wage that is a living wage, at a wage that has proper remuneration, that you can sub, that you can subsist, right? You’re not in poverty if you’re working full time.

A right to housing, a right to healthcare, a right to a secure retirement and just go down the list. I think the progressive agenda is mostly there. Now, he didn’t have climate. I would definitely add that. But this is the unfinished business for the democratic party. This is a man who was elected four times and he left us the blueprint and said, this is the direction that I would like to see party move in. And we can round that out with things that address student loan debt and climate and other things.

But I think we have a pretty good sketch of what a progressive agenda would look like but we can’t get there from here. In other words, you know, I worked for Senator Sanders, you know this. He talked nonstop about the problems with establishment economics. Establishment economics does not provide you a framework that’s compatible with the progressive agenda and MMT does.

It is the framework, the macroeconomic framework that is a companion that’s compatible with that big, bold agenda that would give us a progressive agenda like the one I think you would like to see an I would like to see.

Grumbine (00:48:36):

That’s fantastic. I mean, I want to stand up and cheer. Bill, we have talked at length about this. You have, I’m very, very much in line with both you and Dr. Kelton, Stephanie, excuse me. Talk to us a little bit, because this is one of the things I wanted to weave in here and we’ve done it over and over again. So I feel really good about it. But MMT is not a US phenomenon.

It’s a global phenomenon and a progressive agenda doesn’t just live within the borders of the United States. We have Jeremy Corbin in the UK that needs to get a little MMT into his world. We’ve got the Australian government that needs to get a little MMT in their world and all across the world, we have a little bit of MMT that needs to penetrate so that people lead a better life.

And, you know, obviously, Fadhel Kaboub and Binzagr have done great work in trying to leverage a job guarantee for developing nations, et cetera. Talk to me a little bit about what your vision as an Australian who travels around. What does a progressive agenda look like to you sir?

Mitchell (00:49:45):

Yeah, well, I read overnight that Jeremy Corbin was a secret Czechoslovakian spy for the Warsaw pact. And, fortunately, the Czech government has now said that the archives don’t say anything of the sort. So it’s a tabloid UK beat up when they’re basically losing the battle. That’s what’s happening these days. Look, I would just take what Stephanie has said except to say that different nations have different histories and different institutional structures.

And so what constitutes a progressive agenda will be conditioned a bit by that. So in the Australian, you know, the US is a particular Anglo country. Whereas say the UK, Australia, New Zealand and Canada are more alike as Anglo countries in institutional structure, et cetera. And one of the examples of that, for example, is the extent of public enterprise, history of public enterprises within the other Anglo countries I mentioned relative to, say, the US.

And so we’ve had a history of public transport, public energy provision, public water provision, and these large infrastructures that delivered very reliable, very good services to people at prices that they could afford. And those sort of agendas were, those sort of services were bastardized by the neoliberals, have been, by privatization, by outsourcing.

They’ve become fragmented, profit seeking, unreliable, inefficient, destructive for prosperity type services. And so, you know, a progressive agenda in my country or the UK, I mean, Jeremy Corbin want to renationalize the railways and the water delivery systems. And that’s not inconsistent with what Stephanie says. It’s just a specific nuance for different institutional histories, if you like.

That we’ve got, and what the overarching goal of a progressive agenda has to be is that the government is us and the economy is us. And that our agent, the government has to stop being the agent of capital, which it has become under neoliberalism and become a mediator in the capital/labor struggles and work so that it uses its capacity as our agent, the people, not the 1% or the 10%, but the people, to deliver prosperity with the resources available to us for all people.

And that includes inclusion, equity, eliminate social exclusion, eliminate transfer of national income to profits and all of those things and make sure that we’ve all got that our labor is rewarded. And we’ve all got a stake in the real resources that are being used. That’s sort of the overarching progressive aim in my view.

And what that means in specifics will depend upon what country you’re in. But there’s some things that affect us all and climate change is huge and that’s not historic or institutionally specific. But, you know, the things that Stephanie mentioned are pretty common all around the world.

Grumbine (00:53:32):

Okay. So let’s go ahead and we’re a little over time but if we’re okay, we’ll keep going for a little bit longer. Stephanie, one of the things that everybody wants to know, and this is because this is the, it’s almost hilarious that it keeps coming up, but do taxes fund spending? Just simple answer.

Kelton (00:53:59):

At what level?

Grumbine (00:54:01):

Federal level, do taxes fund federal spending?

Kelton (00:54:05):

You know what’s funny? I had a guy, I bet this is coming from this guy. He won’t let this go. I had a guy mail me. I think he asked me on Twitter, do taxes fund government spending, federal government? And I responded no and he printed it out and mailed it to me in a really beautiful, like, so it wouldn’t bend or crinkle at all.

And send me a note and asked me to sign the printed response to his tweet and mail it back to him in the same repackaged what apparently this is something that they need reinforced. And I don’t know how else to say it. This is the point of the paper we talked about earlier, do taxes and bonds finance government spending. That was the title of the paper. And the response is no, they do not. And, operationally, they can not.

Grumbine (00:55:01):

That’s right. Alright. Thank you so much. That was beautiful. And, Bill, let me ask you, let’s get you on the…

Mitchell (00:55:10):

Well, I want to comment on that.

Grumbine (00:55:11):

Oh, please do, yes.

Mitchell (00:55:13):

And, you know, I’m sent a, among the several hundred emails I get a day, I got one the other day telling me that I was, had rocks in my head. And they sent me to some monetary site in America that said, MMT is just plain wrong. This is a, you know, the monetary group in America. And they said that MMT is completely wrong because, quite obviously, the federal treasury can’t spend it.

There’s not money in a certain account. Now it’s really important for MMT people not to fall into traps when they’re out there at dinner parties or wherever, arguing it out. And the important point is that you’ve got to distinguish between intrinsic characteristics of a monetary system, which MMT is clearly, the work we’ve done is clearly exposed. Very, you know, very detailed way.

We’ve, you’ve to distinguish between those intrinsic characteristics and whatever accounting follies or tricks or conventions governments impose upon themselves at any particular time. So maybe, and it certainly is in Australia and I know it is elsewhere, that the government has a rule that says, okay, X, this will account for these tax receipts into this account.

And then when that account is in a certain state, we’ll spend from this account. And that’s just an accounting fiction, if you like. And that then leads people to say that, oh well, obviously, these taxpayer, the tax receipts are necessary to fund the government spending because there’s some sort of voluntary tax convention, accounting convention that the departments of finance or whatever for whichever country we’re talking about, have imposed upon themselves.

Well, that’s such a superficial, that’s no understanding of the intrinsic characteristics of the monetary system. That’s just a description of the, and, you know, typically these are ideological constructs, these accounting conventions, and they change over history. We’ve got examples in Australia where they altered the way they auctioned off government bonds to take them, take the central banks ability to directly purchase government bonds for non-monetary purposes, to make sure they’re purely auctioned to the private sector.

And when it was asked, when the official in charge was asked, well, why did you do that? He said, well, we wanted to impose discipline on government spending. That’s ideological. It’s just an institutional structure imposed upon the reality. And so when we say the taxpayers fund spending, well, of course the government doesn’t need receipts from the non-government sector in order to spend. That’s ridiculous to think that but the accounting structures that they put in place, lead people who only want a superficial awareness to make that conclusion.

Grumbine (00:58:47):

Very good. All right, so let’s finish this thing off here real quick because we’re over time and I do appreciate both of your time. Our team is built to deliver policy, education, activism, and media. We try our best to pull an all the best people that we possibly can and we try, desperately, to get as much information out as often as we can to Progressives wherever they are.

That’s the whole point of quote, unquote, Real Progressives is that we’re the true north, we’re progressive, and we don’t care what party you’re in because, you know, one of the great things that started this movement, if you will, this progressive movement, going through the 2016 primaries and into present is the fact that it wasn’t just one party or another. It was independents pouring into this. It was Greens and other groups, so believing in this idea and this mission and this concept of a progressive revolution, if you will, that we were all one, and I want to get that back no matter what, come hell or high water.

I want Progressives to unite behind what we all know and love, which is, like you said, Stephanie, the environment, healthcare, normal living things like we don’t want to drive her car over a bridge that falls apart in the midway. We need our infrastructure built out. We don’t want to be carrying a second mortgage just so that we can go to college so we can get a job.

So education’s a big deal there. How would you suggest to individuals? Obviously, voting, but what would you impart to them as to how they can impact races to get the word out to people? What is the best one? We have a motto called each one, teach one. It’s the best we can do. I don’t know what more to do. Any insights there on how to spread the word.

Kelton (01:00:50):

I mean, I think that you’re exactly thinking in the right direction. You’re doing it correctly. You’re getting people engaged. You’re talking about issues. I think that that’s exactly the right thing to do. People are deeply concerned. Americans understand that something’s not right. They do. They understood it with the last election as well. They did not choose the candidate who said, America is already great and things are fine, and we’re just gonna leave it on autopilot.

And, you know, there’s no, there are no real big problems to fix. We can tinker around the edges. I think that many people understand that something is fundamentally wrong. And how do you change the system? You know, I think you’re doing it right. I think that I’m persuaded by the argument that big change does not come from the top down.

It comes from the bottom up, that it takes people getting engaged, that it takes people mobilizing, organizing, meetups, chat groups. Talking each one, teach one is a terrific sounding motto and even better in practice. Look at these young people in Florida. Look what they’re doing, right? Just a small group of teenagers after this horrible mass shooting. And they took to social media.

They’ve taken the narrative by its throat. They’re not letting go of it. They’re going to pound away and pound away. They’re organizing events and they’re saying, this is our future, right? I think young people have a particularly important role to play here. And so I think it’s not, what is the best way is I think what your question was, I don’t think there is a best way.

I just think there are a lot of ways and people need to be engaged on a lot of different fronts, running for office, talking with their friends and their colleagues, getting engaged, little things, knocking on doors, writing letters, making phone calls, pushing, pushing, pushing. And when you hear the wrong arguments being made and you’ve arrived at the point where you can see that clearly, and you understand why they’re wrong, say something.

You know, when you see something, say something. That goes for economics as well. You don’t have to have an advanced degree in this stuff to be able to call out wrong economic arguments when you see and hear them. Write a letter to the editor. Stand up in a town hall meeting and say, that’s wrong and I know why it’s wrong. You’re in a gold standard world, or you’re feeding us a line. You know, there’s, this isn’t the way it works and force the narrative to change.

Mitchell (01:03:37):

Look, I think the first thing is patience. And I remember back to our early group in the early nineties and it might’ve been a cultural thing, but my American colleagues, Warren and Randy and Stephanie, were very enthusiastic. And I said, look, this is going to take a long time because, you know, and that enthusiasm was sort of understandable because it’s just a self evident.

The understandings that MMT delivers are just so self evident. It just becomes unbelievable that the whole world trades on fake knowledge. It’s delivered by my profession. The students go to universities and they learned fake knowledge and they take it into their jobs in the government, into financial markets, into industry. And they trade on fake knowledge. It’s an unbelievable thing.

And so that natural enthusiasm for our early group was understandable, but, you know, I’m, I was less optimistic. I thought it was going to take a long time. And someone once said, isn’t it that if you want to have big changes, all the old people have to die off first? And what I understood to be my role would be to, you know, I’ve got no marketing skills or stuff like that. I’m a writer and, you know, that’s my role.

And so I saw my, and I’ve often been, you know, well, why aren’t you doing more to market this? And I said, well, I don’t, I’m not a marketer. I’m a writer. I’m an intellectual, like, I’m an academic. And so I think what we’re seeing is, over time as this agenda’s unfolding, we’re now seeing second generation MMTers, you guys, Steve, and all of your followers who have a broader, a broad range of skills and capacities that I don’t think that I have and, certainly, Randy and Warren haven’t got and Stephanie sort of bridges the gap better than we do.

But there’s a multitude of, if you think about the way the monetarists and the neo-liberals took dominance in the seventies, they didn’t do it through just the work of Milton Friedman and his gang. They did it through the think tanks, which were, and other organizations, which had incredible array of very sophisticated skills to create narratives, to create frames, to create new languages. They use social psychology and all the rest of it.

And we’re now in the midst of all of that. And it’s really important that guys like you broaden your skill bases and bring in more and more people that can distill a sort of intellectual ideas that us, we developed into narratives for people. And I try to do it on my blog, but I know that it’s, that it doesn’t succeed in the same way as a pithy one sentence statement on Twitter does.

But that’s my role and your role is different and very important and equally important now. And you’re doing fine in my view. We just got to do more of it and, as Stephanie said, I think that people are starting, there was a reason in the late 19th century that trade unions form and welfare states became realities. There was a reason and that is because people got sick to death of poverty and oppression arising from the classical liberal period.

That’s why trade unions formed. Workers got pissed off by being sent under cotton ginnies and their children dying and all of that. And we’re back to that again, in a way, you know, the right or whatever you want to call it. The neoliberals have got, are starting to get well ahead of themselves and the people are pissed off.

And so there’s a massive capacity now to change the narrative, to change the frames. And I’m not seeing it on the internet, all the nice MMT sites a nice little graphics and cartoons and, you know, pithy little explanations. That’s the next generation and we’re there now, just do more of it.

Grumbine (01:08:18):

Let me take this moment. I want to thank my team. I want to thank you to both for joining us, but we have a huge amount of volunteers that work their butts off seven days a week, and really, really do everything. Things that you don’t even see working in spreadsheets, making phone calls, making memes, creating videos, sharing, tweet, and everything.

And they show up to events and they fly around on their own dime and they’re really, really working hard. And Stephanie and Bill, it was a pleasure meeting you both in Kansas. You guys are truly, and I say this without an ounce of fanboy, I am in awe of you both. You guys have done tremendous work and you’ve given me a tremendous amount of hope. And I will do everything in my power, for what it’s worth, to help get this message out and about. You have my word on that. I’ll do the best I can to get it going.

Kelton (01:09:25):

Thanks, Steve, tireless advocate. Thanks so much for everything, all of your team and you.

Grumbine (01:09:25):

And Bill, thank you, sir, as well. I’m going to go ahead and bid you guys both a farewell and thank you so much for coming to us. Have a great time, travel safely, and we’ll talk soon.

Mitchell (01:09:39):

See you later.

Kelton (01:09:39):

Good night, Steve. Thank you.

Grumbine (01:09:39):

Alright, bye, bye, everybody.

Ending Credits (01:09:39):

Macro N Cheese is produced by Andy Kennedy, descriptive writing by Virginia Cotts and promotional artwork by Mindy Donham. Macro N Cheese is publicly funded by our Real Progressives Patreon account. If you would like to donate to Macro N Cheese, please visit patreon.com/realprogressives. patreon.com/realprogressives.

joseba says:

DTM-ko historiaz eta istorioez

Bill Mitchell-en I wonder what the hell I have been writing all these years

(http://bilbo.economicoutlook.net/blog/?p=22701)

(i) Mitchell-en bizitza akademikoa eta ezjakintasuna

I have spent almost the entire time I have been in academic life – from the time I was a fourth-year student, onto Masters, then PhD and subsequently as an teaching and research academic – studying, writing, publishing, and teaching about the Phillips curve and the link between labour markets and inflation. I have published many articles on how full employment was abandoned and how it can be restored taking care to consider how an economy that approaches high pressure might cope with the increasing nominal demands on real output. I have advanced various policy options to resolve the problem of incompatible nominal demands on such output and provided the pro and con of each. I have published some very detailed papers on those questions and my recent book – Full Employment abandoned – went into all the tedious detail of how inflation occurs and what can be done about it. But, apparently, Modern Monetary Theory (MMT) ignores “the dilemmas posed by Phillips curve analysis” as one of its many alleged sins. I wonder what the hell I have been writing all these years

Further, as well as my work on Phillips curves I also live in a small, open economy which means I have a different experience to say Americans who live in a relatively closed and very large economy. The interactions between the external and domestic sectors are different and sometimes the things Americans say about economics need to be recast when considering what will happen in a small, open economy.

I have published lots of papers on the dynamics of such economies and placed my analysis within what we are now calling Modern Monetary Theory (MMT). But apparently MMT ignores the “dilemmas confronting open economies”.

My other MMT colleagues have equally written lots about inflation. The MMT framework is built around an explicit recognition that inflation is the principle risk posed by government (and non-government spending).

So it is a great surprise to me that we have ignored that issue among other things that I thought we central to the way we reason and the arguments we present.

The most usual usage of the word – Ignore is given by Google:

(ii) DTM-ren aurkako erasoak korronte nagusiko ekonomialariengandik

Many people on the progressive side are now feeling the pinch because they have failed to let go of what is essentially mainstream macroeconomic theory, which means they are part of the problem rather than the solution.

They are beginning to attack Modern Monetary Theory (MMT) because it threatens their security as self-styled progressive gurus – wandering around pretending to present meaningful and distinct alternatives the current orthodoxy when, in fact, it takes less than a few minutes to distill everything they say back into mainstream textbook land. That makes them uncomfortable.

There is a growing claim that there is nothing new about MMT – that everything we write about is “well-understood” or “widely understood and acknowledged”. Further, apparently “everybody knows” and New Keynesians are “fully aware” that the government is not financially constrained.

It is very strange – if all the major features of MMT were so widely shared and understood – how do we explain statements from politicians, central bankers, private executives, lobbyists, media commentators etc etc that appear to not accept or understand the basic MMT claims?

Where in the vast body of macroeconomic literature – mainstream or otherwise – do we see regular acknowledgement that there is no financial constraint, for example?

Why is there mass unemployment if government officials understood all our claims? It would be the ultimate example of venal dysfunctional politics to hold that that everybody knows all this stuff but are deliberately disregarding it – for what?

Why do economists still claim that banks lend out their reserves? Why do they think that an asset swap (liquid for near liquid) engineered by the central bank will provide banks with more funds to lend as if banks wait around for deposits before they make loans?

Why don’t papers on banking indicate that loans create deposits rather than engage in the fiction that it is the other way around?

Why do economists still claim there is a monetary multiplier operating when bank reserves respond to broad monetary movements?

I could pose hundreds of like questions. I am not stupid. But I couldn’t answer any of these questions if the claim that everything MMT has proposed is passe in the extreme.

(iii) Ez omen dago ezer berririk DTM-n

These sorts of claims then lead to statements that there is “nothing new” about MMT – a sort of put down to suggest we are just a bunch of misguided, politically naive, self-aggrandising intellectual minions.

Please note that MMT does not include the word “new” in its descriptor. Also, if some person out there can find any literature written by one of the major MMT academics or authors where there is a claim that the theoretical structure proposed and integrated by the writers is “new” please let me know. I wouldn’t waste my time by the way.

The descriptor of import is “Modern” which like all descriptors can be interpreted in a number of ways. But the way the MMT literature discusses the economy and integrates components from banking, the national account accounts, a deep understanding of the way bond, currency and labour markets work – is certainly modern.

If you think of the New Keynesian literature it employs all the dated concepts that have constrained the applicability of mainstream economics – and leaves all the essential understandings to be drawn from Keynes out of the analysis. They prefer to present a false version of Keynes based on sticky prices. Please read my blog – Mainstream macroeconomic fads – just a waste of time – for more discussion on this point.

It is clear that MMT writers borrow, absorb, integrate strands of theory dating back to Marx and before. There has never been a denial of that. But there are truly novel aspects of our approach that the vast majority of economists progressive or otherwise – who are slaves of the textbook framework – still do not understand despite the claims that everything is understood.

(iv) Korronte nagusiko ereduak

For example, they still talk of the “government budget restraint” and call on the neo-classical literature of the 1960s (for example, the work of Carl Christ) as the authorities in this regard.

They still think that it is the monetary operations that accompany government spending rather than the spending itself that matter. If we are worried about the inflation risk, which is what the mainstream (and the progressives that use the same framework) focus on, then whether the government sells debt to the private markets, or the central bank or to no-one, is of no consequence to the impact of the spending on inflation.

The mainstream macroeconomic textbooks all have a chapter on fiscal policy (and it is often written in the context of the so-called IS-LM model but not always).

The chapters always introduces the so-called Government Budget Constraint that alleges that governments have to “finance” all spending either through taxation; debt-issuance; or money creation. The framework never acknowledges that government spending is performed in the same way irrespective of the accompanying monetary operations.

The model claims that money creation (borrowing from central bank) is inflationary while the latter (private bond sales) is less so. These conclusions are based on their erroneous claim that “money creation” adds more to aggregate demand than bond sales, because the latter forces up interest rates which crowd out some private spending.

All these claims are without foundation in a fiat monetary system and an understanding of the banking operations that occur when governments spend and issue debt helps to show why.

(v) Defizitak, Altxor Publikoa, merkataritza bankuak, Banku zentrala, zergapetzea, bonoak, zorrak, interes tasak, …

So what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a budget deficit without issuing debt?

Like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet).

Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

There is no sense that these debt sales have anything to do with “financing” government net spending. The sales are a monetary operation aimed at interest-rate maintenance. So M1 (deposits in the non-government sector) rise as a result of the deficit without a corresponding increase in liabilities. It is this result that leads to the conclusion that that deficits increase net financial assets in the non-government sector.

What happens when there are bond sales? All that happens is that the bank reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

(vi) Korronte nagusiko ekonomialariak eta errealitatea

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

Building bank reserves does not increase the ability of the banks to lend.

The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

But it is totally fallacious to think that private placement of debt reduces the inflation risk. It does not.

If you can find that body of thought and logic in a mainstream (or non-MMT so-called progressive) literature please let me know. I wouldn’t waste my time though on such a futile search.

That sort of logic and thinking is very “modern” and quite novel in that it is not widely acknowledged or understood. If we polled 500,000 economists on whether selling bonds reduced the expansionary effects of government spending almost every one of them would say yes. That means they do not understand how these monetary operations work. MMT emphatically does and adds that understanding to the knowledge base.

(vii) Elkarrizketa defizitaz eta inflazioaz

In a telephone interview I gave to the Harvard International Review (published on-line on October 16, 2011) – Debt, Deficits, and Modern Monetary Theory – I said the following:

Particular budget outcomes should never be a policy target. What the government should be targeting is real goals, by which I mean a sustainable growth rate buoyed by full employment.

Why do we want governments? We want them because they can do things that improve our welfare that we can’t do individually. In that context, it becomes clear that public policy should be devoted wholly to making sure that there are enough jobs, that poverty is eliminated, that the public health and public education systems are first class, that people who are less well off are able to become better off, etc.

From a macroeconomic point of view, the spending and tax decisions of government should be such that total spending in the economy is sufficient to produce the level of real output at which firms will employ the available labor force. This is the goal, and the particular budget outcomes must serve this goal.

None of this is to say that budget deficits don’t matter at all. The fundamental point that the original developers of MMT would make—myself or Randall Wray or Warren Mosler— is that the risk of budget deficits is not insolvency but inflation. In saying that, however, we would also stress that inflation is the risk of any kind of overspending, whether investment, consumption, export, or government spending. Any component of aggregate demand could push the economy to that point where we get inflation. Excessive government spending is not always to blame.

In sum, we’re quite categorical that we believe that budget deficits can be excessive and can be deficient as well. Deficits can be too large, just as they can be too small, and the aim of government is to make sure that they’re just right to employ all available productive capacity.

(viii) Banku zentrala eta Altxor publikoa

This sort of discussion then leads to the fact that some so-called progressives like the neo-liberal contrivance that central banks are apparently depoliticised and stand as independent entities. Apparently, if governments entered a partnership with its central bank to ensure all government spending was backed by appropriate bank reserve operations (with no debt issued to the private bond markets) this would severely undermine financial stability.

That sort of concern is a heartland phobia of the neo-liberals. No progressive worth their salt would sign up to it.

Please read my blog – Central bank independence – another faux agenda – for more discussion on this point.

Apparently, it is good to have a central bank that can stand up to a government because the latter has a propensity to get drunk and the former has to take the “punchbowl” away.

What the hell does that mean? Does it mean that we want a system where the democratically elected government operating within the legal framework of the nation and is pursuing a mandate can be stopped by an unelected and largely unaccountable set of officials in the central bank? Since when has that been an exemplar of progressive thought?

My view of democracy is that we vote out governments who fail. We don’t want elites (corporate or central banking or otherwise) to exercise their own agendas. They were not elected. They are not accountable in the way we construct that term in political life.

But, in fact, the “independence” is a chimera anyway. Treasuries and the central bank have to work together on a daily basis to ensure that the cash system is coherent and no financial instability occurs.

Please read my blog – The consolidated government – treasury and central bank– for more discussion on this point.

Further, it is not an act of political naivety or an act of “dismissiveness of these political economy considerations” to recommend that that we make the central banks more accountable and work more closely with treasury to deal the private bond markets out of the equation.

(ix) Defizitak

Clearly, the elites have created a system that works for them. That is what elites do. To then say that progressives are naive for suggesting an alternative is the ultimate wimp out. That is, after all, what a progressive position is – to challenge the orthodoxy whatever it is if there is evidence that the status quo undermines the aims of progressive society.

In the current setting – the way governments operate – both arms (bank and treasury) – is clearly undermining reasonable progressive goals. There has to be a change. Are we just going to lie down and say – well the political economy is stacked up against us so we better have another pina colada and chill out – and not be so naive as to suggest that politics by its very nature is a moving feast and paradigm changes (and even smaller) changes occur with regular historical frequency.

And then we get back to inflation.

Apparently there is no “formal modelling” to explain our ideas. Did Marx, Keynes, and many other great economists use the sort of trivial formality that pervades neo-classical approaches. No? Does that mean these economists or thinkers have “failed woefully”? I doubt it.

I remind readers of the lovely observation by American (Marxist) economist Paul Sweezy who wrote in the 1972 – Monthly Review Press – article entitled Towards a Critique of Economics that orthodoxy (mainstream) economics:

… remained within the same fundamental limits … of the C19th century free market economist … they had … therefore tended … to yield diminishing returns. It has concerned itself with smaller and decreasingly significant questions … To compensate for this trivialisation of content, it has paid increasing attention to elaborating and refining its techniques. The consequence is that today we often find a truly stupefying gap between the questions posed and the techniques employed to answer them.

I talked about these issues in the following blogs – GIGO and OECD – GIGO Part 2.

Mathematics is just a language – one of many. Sometimes it helps to sort out problems that other languages cannot solve. Usually that is not the case, especially is a social science like economics.

Further, the mathematics deployed relentlessly by mainstream economics to hide the lack of substance (the “trivialisation of content”) is second-rate anyway and laughed at by the professional mathematicians. We could write a lot about that.

The sensible principle is to use more accessible language when that is adequate to convey the idea. Some formalism is useful and we have certainly deployed it at times.

But evidently our macroeconomic framework is distilled to a Keynesian expenditure system where the government can use expansionary fiscal policy to “push the economy to full employment” but after that “taxes … must be raised to ensure a balanced budget” is created.

Apparently this “balanced budget condition must be satisfied in order to maintain the value of fiat money”. I wondered where that fiction came from. I might not have read everything my MMT colleagues have published but I know most of it and I know, in detail, everything I have written.

It is plain wrong to think that at full employment the government has to run a balanced budget to ensure there is no inflation.

The non-inflationary condition is that nominal aggregate demand has to be consistent with the real capacity to produce goods and services. What the sectoral balances might be at the point where there is full employment is contingent on many things and the government’s discretionary capacity to ensure all balances equalled zero at that point is next to zero.

It would be an extraordinary coincidence if that was the conjunction of outcomes. My understanding of the historical time series for many nations is that that conjunction has never occurred.