Draghi’s words:

Whatever It Takes (Jul-12)

Whatever We Must (Nov-15)

Without Undue Delay; No Limits (Dec-15)

We Don’t Give Up (Jan-16)

2016 urt. 21

Frederik Ducrozet(e)k Bertxiotua Frederik Ducrozet

From “without undue delay” to “patience and persistence”. From “whatever it takes” to “it will take less and less”.

2017 uzt. 4

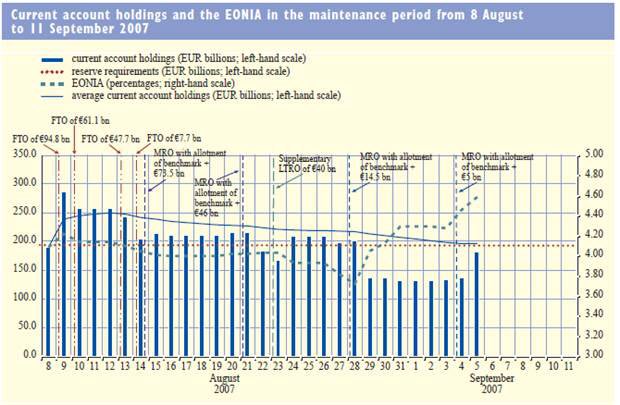

On this day 10 years ago, the ECB launched a fine-tuning operation injecting €94.8bn in the banking system. And so it all started.

2017 abu. 8

joseba says:

Gogoratu:

Mario Draghi eta EBZ

joseba says:

The secret history of the banking crisis

https://www.prospectmagazine.co.uk/magazine/the-secret-history-of-the-banking-crisis

“The Fed effectively established itself as a lender of last resort to the entire global financial system”

“In the 60s, swaps were about stabilising exchange rates. Now they’re all about stabilising oversized banks”

“The swap lines were central bank to central bank. But who did they really help? The reality, as all those involved understood, was that the Fed was providing preferential access to liquidity not to the “euro area” or “the Swiss economy” as a whole, but to Deutsche Bank and Credit Suisse. Of course, the justification was “systemic risk.” The mantra in Washington was: you have to help Wall Street to help Main Street. But the immediate beneficiaries were the banks, their staff, especially their highly-remunerated senior staff and their shareholders.

The swap lines were central bank to central bank. But who did they really help? The reality, as all those involved understood, was that the Fed was providing preferential access to liquidity not to the “euro area” or “the Swiss economy” as a whole, but to Deutsche Bank and Credit Suisse. Of course, the justification was “systemic risk.” The mantra in Washington was: you have to help Wall Street to help Main Street. But the immediate beneficiaries were the banks, their staff, especially their highly-remunerated senior staff and their shareholders.”