Bill Mitchell-en The planned destruction of Greece continues1…

(i) Sarrera: azkenean onartu behar izan da Greziako egoera oso tamalgarria dela2

(ii) Data batzuk3

(iii) Hurrengo grafikoa4

Begiratu Greziari (eta Espainiari ere!)

(iv) Grafiko gehiago5

In the latest WEO forecasts (April 2016), the IMF predicted that:

|

Indicator |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Real GDP growth (% pa) |

2.662 |

3.106 |

2.792 |

2.361 |

1.533 |

|

Unemployment rate (%) |

25.028 |

23.358 |

21.677 |

18.856 |

18.000 |

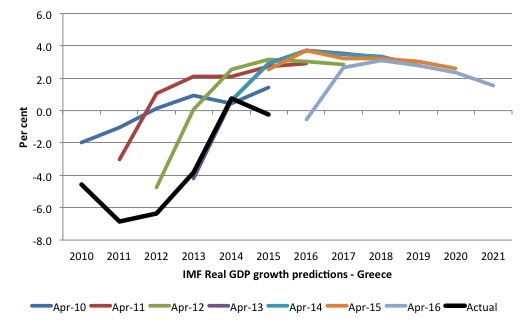

The first shows the evolution of its predictions in each April World Economic Outlook release from April 2010 for real GDP growth in Greece6

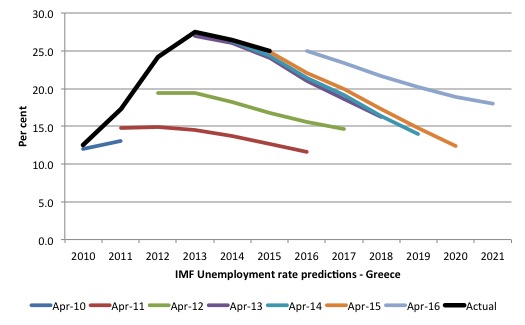

The second graph is even more stark. It shows the evolution of its predictions in each April World Economic Outlook release from April 2010 for Greek unemployment7

Ondorioak:

(a) Etsigarria da Greziari buruz pentsatzea8

(b) NMF-k eta Bruselak ordaindu beharko lukete9

2 Ingelesez: “After all the hoopla last year with the rise and fall of Syriza one’s attention span strays from what is happening in Greece at present and how it demonstrates the continued (and permanent) failure of the Eurozone. We also become inured to badness after badness is normalised. I was reminded of the depth of the malaise in that nation last week when I was in Kansas City. I won’t disclose confidences but an influential person (in the Greek context) I spoke to now regard their previous support for remaining within the Eurozone as a mistake and they consider my assessment of the situation (which they opposed at the time) to be closer to reality. That was an interesting conversation and credit to them for being able to recognise an error of judgement. I was also reminded of the absurdity of the Eurozone when the IMF released its latest – Greece: Staff Concluding Statement of the 2016 Article IV Mission (September 23, 2016). This is normalisation of badness in bold! The current thinking is that the Greek unemployment rate will remain in double figures until at least 2050, that business investment has collapsed, real GDP is around 27 per cent below its pre-GFC level – and – more significant and accelerated austerity is required. If an organisation can exhibit psychopathy then the IMF has it!”

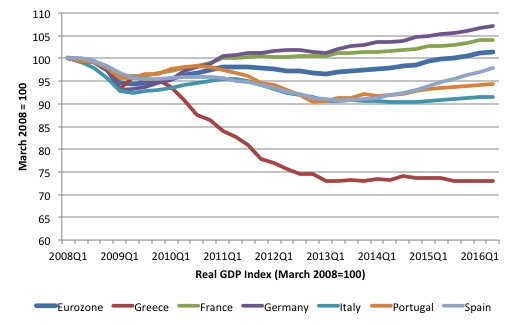

3 Ingelesez: “(…) The next graph shows real GDP indexes (March 2008 = 100) for various nations within the Eurozone and the currency union in total.

The sample is from March-quarter 2008 to the June-quarter 2016 (latest data). A change in the index from quarter to quarter signifies growth (or contraction).

Germany and France lead the way although their growth over the 8 or so years shown is pathetic – 7.2 per cent overall for Germany and 4 per cent overall for France.

The Eurozone has grown by only 1.4 per cent in the 34 quarters shown. Barely at all.

Then we see Spain (-2.2 per cent), Portugal (-5.6 per cent) and Italy (-8.4 per cent) form the next group. They have still not regained the level of output that they were achieving at the outset of the GFC.

But Greece has now contracted by 26.9 per cent from its March-quarter 2008 level and there appears no end in sight. It has sort of entered a period of stagnation – no Depression – and the policy settings in place are holding it there.

Years of unnecessary suffering for its people.”

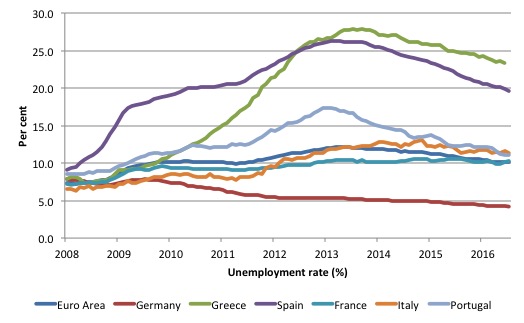

4 Ingelesez: “The next graph shows the evolution of the unemployment rate (%) from January 2008 to July 2016 for the same set of countries within the Eurozone.

While the Eurozone as a whole still endures unemployment above 10 per cent (10.1), Greece has been stuck around the mid-20s for some years now.

The IMF thinks it will not get below 10 per cent until 2050.”

5 Ingelesez: “(…) these two graphs will let you see how poorly the IMF predictions are.”

6 Ingelesez: “The first shows the evolution of its predictions in each April World Economic Outlook release from April 2010 for real GDP growth in Greece.

The black thick line is the actual outcome in each of the years.

Each WEO predicts out several years (as the Table above shows for the April 2016 WEO). But even in the light of catastrophic forecasting errors the IMF fails to make significant adjustments to their forecasting approach.

They also have admitted using spending multipliers that predicted growth in the face of spending cuts whereas they now acknowledge that the actual multipliers would lead to the conclusion that austerity kills growth.

This admission was revealed in October 2012 – see blog – The culpability lies elsewhere … always!.

But they are still bullying Greece into more austerity.”

7 Ingelesez: “Between 2010 and 2012, as the IMF and the Troika were inflicting austerity on Greece they consistently failed (by a huge factor) to realise what damage they were doing.

Their more recent forecasts have clearly been re-calibrated at the higher level but even as late as 2015, they were predicting a steady fall to around the same levels by 2020 that they thought would be achieved by now back in 2011.

Their most recent forecasts are more dire for sure but probably optimistic.”

8 Ingelesez: “I haven’t written about Greece (or the Eurozone) for a while – it is depressing thinking about it really and I cannot imagine how the citizens in Greece are dealing with the planned destruction of their prosperity by highly paid officials in Brussels, Frankfurt and, particularly Washington.”

9 Ingelesez: “The scale of the destruction is beyond belief really and constitutes in my non-legal brain a crime against humanity.

Someone in the IMF and Brussels should be paying for the professional incompetence that has created this human disaster.”

joseba says:

The Greek Analyst @GreekAnalyst

https://twitter.com/dgatopoulos/status/782870158901665792.

The Greek Analyst(e)k Bertxiotua Derek Gatopoulos

When Tsipras was leader of opposition and this happened, he called the govt an “autocracy.” Awkward.

The Greek Analyst(e)k gehitu du,

Derek Gatopoulos @dgatopoulos

This man falls to his knees coughing after police fire pepper spray at pensioners challenging cordon #Greece

2016 urr. 3

Gennaro Zezza @GennaroZezza

https://twitter.com/GennaroZezza/status/782895015852990464.

Coming out later today, a new @LevyEcon Strategic Analysis for Greece

2016 urr. 3