(i) DEFIZITA

How the Government Deficit Helps the Economy1

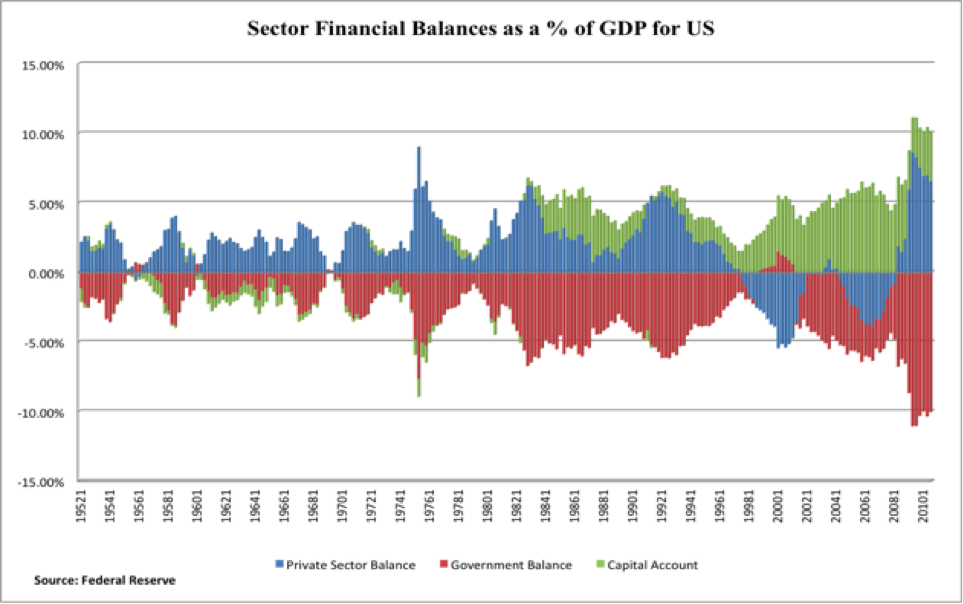

“This graph illustrates the perfect mirror image between the government’s financial balance, the private sector balance, and the inverse of the capital account (because we are looking at the surplus of the rest of the world).

The mirror image from the graph clearly illustrates how the government deficit is reflected into a private sector surplus. If the government is spending more than it is taxing, it is stimulating the economy, not taking away from it.”

(Buruz ikasi beharko genukeena!)

(ii) 1992: euroa, desastrea

The euro disaster — Wynne Godley was spot on already back in 1992! https://larspsyll.wordpress.com/2016/09/03/the-euro-disaster-wynne-godley-was-spot-on-already-back-in-1992/ … via @wordpressdotcom

2016 ira. 3

The euro disaster — Wynne Godley was spot on already back in 1992!3

(iii) ITALIA

ITALIA IN RECESSIONE/ Renzi ha fallito, arriverà la troika4

(iv) BRAZIL

‘Made in USA’: 3 key signs that point to Washington’s hand in Brazil’s ‘coup’5

Huge numbers of people on the streets of São Paulo tonight opposing the coup in Brazil. #ForaTemer

2016 ira. 4

(v) URRE STANDARRA

Why the Gold Standard Is the World’s Worst Economic Idea, in 2 Charts7

“The gold standard is a solution in search of a problem. Actually, it’s worse than that. It’s a problem in search of a problem. Prices would have to fall a great deal if we adopted the gold standard today. In other words, it would turn the imagined problem of price stability into a real problem of price stability. And, of course, this ensuing deflation would send the economy into a death spiral due to still high levels of household debt.”

(Gogoratu, DTM-koen ustez, QE ez dela inongo irtenbiderik. Nahikoa eta sobera hauxe: QE, Europar Batasuna, inflazioa eta deflazioa…, Schäuble, progreak eta abar)

(vi) SPAIN

No miracles in the Spanish economy: Gaps and contradictions in the Annual Report of the Bank of Spain8

“… at this point, Spain and the peripheral countries have only three options in order to be competitive: one, a very long period of very high unemployment and devaluation of wages, which is what has occurred since the beginning of the crisis; two, an exit from the euro, in a single or jointly negotiated way, and obviously the suspension of debt repayment; three, a German adjustment (which Germany refuses) to stimulate its domestic demand, and especially private consumption, which would mean the reverse and the reduction of its trade surplus, which would increase demand and therefore GDP in the peripheral countries.”

(Beraz?)

(vii) EBZ

Profit distribution and loss coverage rules for central banks9

14 or., 7. oharra:

“Central banks are protected from insolvency due to their ability to create money and can therefore

operate with negative equity.”

(Argi?)

3 Ikus https://larspsyll.wordpress.com/2016/09/03/the-euro-disaster-wynne-godley-was-spot-on-already-back-in-1992/.

4 Ikus http://www.ilsussidiario.net/mobile/Economia-e-Finanza/2016/9/3/ITALIA-IN-RECESSIONE-Renzi-ha-fallito-arrivera-la-troika/720965/.

7 Ikus http://www.theatlantic.com/business/archive/2012/08/why-the-gold-standard-is-the-worlds-worst-economic-idea-in-2-charts/261552/.

8 Ikus http://www.erensep.org/index.php/en/articles/economy/211-no-miracles-in-the-spanish-economy-gaps-and-contradictions-in-the-annual-report-of-the-bank-of-spain.