Europako hurrengo krisia?

Bill Mitchell-en The Italian bank crisis – another Eurozone mess1

(a) Brexit erruduna?2

(b) Brexit eta ridikulua3

(c) Italiako bankugintzaren krisia4

(d) Lorenzo BS eta krisi hori5

(e) UK Guardian: Grezia eta Troika6

(f) Mr BS eta French Bank Societe Generale SA7

(g) Eta Italiako bankugintza?8

(h) Italiako ekonomia?9

(i) EBZ eta politika monetarioa10

(j) Alemania11 eta bail-in delakoa12

(k) Kasu tipikoa: Europako bankugintza batua13

(l) Txistea? Moneta subiranotasuna da afera14

(m) Urrats bat izan zitekeena…15

(n) …Baina Alemania atzean, beti bezala16

(o) Lortutakoa eta NMF (aka IMF)17

(p) Single Resolution Mechanism (SRM) eta ‘bail-in’18

(q) Eta bankugintzaren krisia?19

Ondorioak:

(i) Emaitzak zein diren itxarotea20

(ii) Nola erreskatatu DB?21

iii) Brexit-i kulpa botatzea? No way!22

2 Ingelesez: “So several investment funds based on real estate in the UK have suspended trading to stop people withdrawing their funds. Who would have thought that in a vastly overvalued UK property market that people would start to reassess the value of these investments, especially after working out (gosh!) that the mismatch in maturities in these type of funds was more or less extreme? And so the Leave vote is now being blamed on crashing a market when all that is happening is that the real estate market is starting to correct back to something less ridiculous.”

3 Ingelesez: “And talking about ridiculous. The Italian government is now coming headlong into conflict with the, now ridiculous, European Commission on the impending crash of its zombie banking sector. You might have thought we were still back in 2008 or something. No folks, this is 2016 and the Eurozone problems just keep on going.“

4 Ingelesez: “The Italian banking crisis was always going to happen – it was just a matter of when. Why? Simply because the single currency experiment has failed and the policy making process and the institutional machinery is so detached from reality – as in all cases of Groupthink – that it can no longer respond in an effective way to changing circumstances. The Eurozone is still crippled by its flawed monetary design and in more recent years the migrant issue has come over the top to reinforce this malaise. The Brexit vote outcome reflects the consequences of this dysfunction and demonstrates that a world contrived by the elites to benefit themselves is not the world of reality where things have a habit of turning sour if the rest of us are suppressed.”

5 Ingelesez: “In the past day or so we have seen the Italian Lorenzo Bini Smaghi parading on the financial media (TV etc) warning us about the impending collapse of the Italian banking system and its likely spread across banking in the Eurozone.

I discussed Mr Bini Smaghi’s views on the crisis when he was on the Executive Board of the ECB in this blog from 2011 – Default is the way forward.

He has been a prominent Eurozone commentator and during the crisis (early part) he lectured everyone on how fiscal austerity is the only way to proceed. Before the crisis he held out Ireland as the exemplar of the modern European nation and growth model. What he actually knows about macroeconomics and monetary systems is another matter.

He argued in 2010 that the prospect of long-lived and significant costs of a default has been understood by governments in “Greece, Ireland and several other European countries” and that is why they “have adopted tough recovery programmes and radical reforms. And that is why the other European countries are supporting them. They know that the alternative is much worse for their citizens” (see his December 16, 2010 Financial Times article – Europe cannot default its way back to health).

On May 10, 2011, in a speech – Monetary and financial stability in the euro area – he claimed that “default or debt restructuring” would punish a “certain categories of investors” (yes!) and would be “political suicide”.

He made the rather curious assertion that debt default punishes the people in general more than if the government advances the interests of the investors and maintains all liabilities intact, while at the same time, imposing draconian austerity on the people.

That is certainly not the experience of history.”

6 Ingelesez: “On May 11, 2011, UK Guardian journalist Aditya Chakrabortty responded to Bini Smaghi in the article – Is defaulting really ‘political suicide’? – noting that:

From George Bush to George Osborne, many stupid and disingenuous things have been said during the financial crisis. But some sort of prize really ought to go to Lorenzo Bini Smaghi … When it comes to spouting conventional nonsense, Bini Smaghi has a fine pedigree. In 2007, he wrote: “The Irish example shows that it is possible to prosper in the monetary union while having a higher potential growth rate than the rest of the union.” It was the spectacular wrongness of this conclusion that prompted bloggers to award the eminent central banker a new name: BS.

Austerity has been an unmitigated disaster for those nations most subjected to it by the Troika or the European Commission working alone in its madness.

Aditya Chakrabortty said that the approach to the Greek crisis by the Troika reflected “the triumph of the banks … The lenders in Greece and abroad are being given preferential treatment over the Greek people”.

It was clear that the interests of the private corporate banks in France and Germany were being put ahead of the long-term interests of the Greek population.

The legacy the politicians are leaving the children of these nations is so diminished relative to the other options they have (default) – that it is simply astounding that the likes of Bini Smaghi, who has enjoyed a life of privilege, can be even taken seriously.”

7 Ingelesez: “Fast track to July 6, 2016. Mr Bini Smaghi (alias Mr BS) is now Chairman of the French bank Societe Generale SA (since May 2015) and in response to a question as to whether the European Commission should relax its ‘rules’ and bailout the Italian banks, he told Bloomberg that (Source):

The whole banking market is under pressure … We adopted rules on public money; these rules must be assessed in a market that has a potential crisis to decide whether some suspension needs to be applied.

He said that “that Europe’s banking market faces the risk of a system-wide crisis unless governments accept the idea of taxpayer money as the ultimate recourse. Any intervention should be as swift as possible”

So those rigid European Commission rules are not fixed and bailouts rather than austerity is preferred, now he is in the private sector and defending the interests of a private bank that might get caught up in the Italian banking fiasco.

This is typically of the cant that has characterised the whole Eurozone history to date. Ideologues and vested interests parading under the guise of sensible rules which are relaxed, broken, ignored when convenient and applied with ruthless efficiency when the victim is too small or powerless to fight back.”

8 Ingelesez: “And so we come to Italy.

The Italian banks are now teetering on the edge of insolvency. The share value in one of the leading banks Banca Monte Dei Paschi Di Siena have fallen by 45 per cent since late June and other Italian banks are going in the same direction.

The Italian banking system is carrying an estimated 360 billion euros worth of bad loans, which precede the Brexit vote by some years! In case you are looking for a cause of the current crisis.”

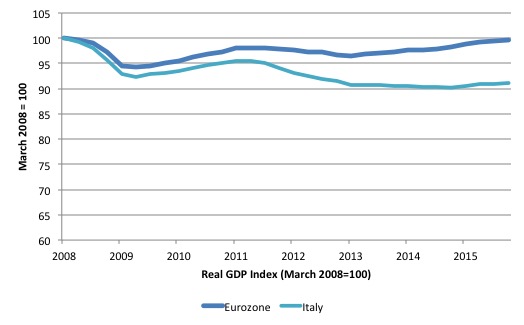

9 Ingelesez: “The Italian economy is still some 8 per cent below the level real GDP reached in March 2008 as the crisis hit. Here is a graph comparing the parlous performance of the Eurozone 19 Member States (in terms of real GDP) and the disastrous performance of the Italian economy up to the end of last year.

The situation has changed much in the course of the last six months. More recent retail sales data shows growth has been negative in each of the first six months of 2016.

The low to negative interest rate environment in the Eurozone coupled with rising bankruptcy rates driven by the near zero growth and the buildup from the massive collapse in 2009 means that the banks are carrying increasing bad debts on their books.”

10 Ingelesez: “The masters at the ECB think the solution is to cut interests rates further into negative territory – which only exacerbates the banking problem for Italy.

The solution offered by the Italian government, looking increasingly unstable (more so than usual) is in the words of the Financial Times article (July 3, 2016) – Renzi ready to defy Brussels and bail out Italy’s troubled banks:

… to defy the EU and unilaterally pump billions of euros into its troubled banking system if it comes under severe systemic distress, a last-resort move that would smash through the bloc’s nascent regime for handling ailing banks.

Alarm bells are ringing in Brussels because if the Italian government went ahead with this plan then it would:

… devastate the credibility of the union’s newly implemented banking rule book during its first real test.

Oh dear, the banking rules and the state aid rules! These must be obeyed or the sky will fall in!”

11 Ingelesez: “Already the Germans are shouting from up North that the “Die Regeln müssen befolgt werden” (excuse my German). Angela Merkel response was that “any suspension of the bail-in rules would spell the end of the banking union ‘as we know it’”.

Renzi responded by saying he would reject being “lectured by the school teacher”. Hmm.

The fact is that the collapse of the banking union – “as we know it” – would represent progress given how poorly designed the plan is.”

12 Bail-In Definition DEFINITION of ‘Bail-In’: “Rescuing a financial institution that is on the brink of failure by forcing its creditors and depositors to take a haircut on their holdings. A bail-in can be regarded as a rescue of last resort, since present creditors are unlikely to willingly accede to it, while the institution’s ability to attract business from future stakeholders is also very likely to be impeded. A bail-in is the opposite of a bail-out, which involves the rescue of a financial institution by external parties, typically governments.”

13 Ingelesez: “It is a typical case of Eurozone fumbling – see a problem, identify the obvious solution (a federal guarantee system), back away from the obvious solution (because Germany objects), talk for months about nothing, announce a grand plan (the banking union) which will fail the first test. Brilliant manouvreing. The Eurozone all over.

The so-called European Union banking union began operation on January 1, 2016 and represented the Commission’s plan to supervise banks and resolve banking crises.

It was announced with great fanfare as a bold new initiative – a symbol that the European Commission was a progressive force capable of meeting the challenges before it.

It was a joke.”

14 Ingelesez: “Just like the continuation of fiscal austerity in the face of collapsing private spending, the banking union has no capacity to solve a full-scale banking crisis that is looming in Italy – and then spreading throughout the Eurozone (see below).

It was first announced on June 29, 2012 at a Euro Area Summit in Brussels. The official – Statement said the proposed banking union would introduce a “single supervisory mechanism” to:

… to break the vicious circle between banks and sovereigns.

Which was sensible because the “sovereigns”, all of which are actually non-sovereign because they use a foreign currency (the euro), are incapable of maintaining financial stability in the face of a banking collapse within their borders.

The Summit concluded that:

When an effective single supervisory mechanism is established, involving the ECB, for banks in the euro area the ESM could, following a regular decision, have the possibility to recapitalize banks directly.”

15 Ingelesez: “The move to a Eurozone-wide system of prudential supervision and lender of last resort would have been a step in the right direction for the monetary union.”

16 Ingelesez: “But, this is the European Commission we are talking about (with Germany constantly ‘breathing down its neck’) – a sensible plan like that would have been a little too much to ask.

Anyway, the Summit set the train on its way and the plans for a banking union gradually emerged.

But somewhere along the way, the Germans flexed their muscle and their disdain for anything resembling a federal bail-out capacity and the banking union emerged without the necessary capacity to do much more than oversee the banks rather than stop them from becoming insolvent.

The final – Banking Union – proposed a “single rulebook for all financial actors” in the EU, which is the “foundation on which the Banking Union sits”.

There was surely a “Single Supervisory Mechanism (SSM)” which “places the European Central Bank (ECB) as the central prudential supervisor of financial institutions in the euro area”. We can tick that!

That just means that the ECB ensures that “banks comply with the EU banking rules”. A minimum condition.

Then there is a Single Resolution Mechanism (SRM) to cope with bank failure. It is the “resolution” framework “to be managed effectively through a Single Resolution Board and a Single Resolution Fund, financed by the banking sector.”

The purpose of the SRM is to:

… ensure an orderly resolution of failing banks with minimal costs for taxpayers and to the real economy.”

17 Ingelesez: “It became fully operational on January 1, 2016.

The Single Resolution Fund (SRF) would be capitalised to “€55 billion within eight years” and “will be financed by all the banks in the banking union countries”. A pittance in other words.

Even the IMF commented in its – 2014 Article IV Consultation with the Euro Area Concluding Statement of the IMF Mission – that:

Work needs to continue to establish a common backstop to sever effectively sovereign-bank links. The current planned backstop may prove insufficient to break decisively bank-sovereign links. While the proposal for ESM direct recapitalization is a step in the right direction, as currently envisaged, the thresholds for such support are too high. Overall, centralized resolution resources may not be sufficient to handle stress in large banks.

For once, we can agree with the IMF on that point.”

18 Ingelesez: “But the SRM only kicks in after the so-called ‘bail-in’ is initiated (up to a level of 8 per cent of the bank’s liabilities). The 8 per cent rule was the work of German Finance Minister, Wolfgang Schäuble.

The ‘bail-in’ forces unsecured senior bondholders and large depositors are forced to cover the bank’s losses in a number of different ways (outright loss, debt to equity conversions etc).

So if I was a large depositor in a bank that was in trouble what would I do? Get the money out quick smart to avoid being caught up in the ‘bail-in’. And that ladies and gentlemen is how runs on banks begin.

What is missing is any European-wide deposit insurance capacity (rejected by the Germans). The Germans also forced the EU to sequester previous ‘debts’ (so-called ‘legacy assets’) from being able to participate in the SRM.

So all the old debts that precede the creation of the union are fancy free!

There is more to it than this. My current co-author Thomas Fazi wrote an extensive critique of the banking union in his article (February 1, 2016) – EU Banking Union: Recipe For Renewed Disaster.”

19 Ingelesez: “But what of the Italian banking crisis?

The inimitable German Finance Minister, Wolfgang Schäuble, never one to disappoint, told a press conference in Berlin yesterday (July 6, 2016) that “Italy intends to stick to the banking rules”.

German Chancellor Angela Merkel also was reported as saying that “new rules for bank rescues, which reduce governments’ room for manoeuvre, had to be respected” (see Report.

I guess we will see if Germany does given that scathing IMF report on the German banking and insurance system – Germany : Financial Sector Assessment Program-Financial System Stability Assessment – published on June 29, 2016.

You have to read the 118 pages in some detail to get to the real message.

For example, on page 29, we read:

Both Deutsche Bank and Commerzbank are the source of outward spillovers to most other publicly-listed banks and insurers … Network analysis suggests a higher degree of outward spillovers from the German banking sector than inward spillovers … In particular, Germany, France, the U.K. and the U.S. have the highest degree of outward spillovers as measured by the average percentage of capital loss of other banking systems due to banking sector shock in the source country …

The BBC concluded from the IMF analysis that Deutsche Bank was now the “most dangerous bank in the world” (Source).

Deutsche Bank’s US subsidiary “was one of only two of 33 big banks to fail tests of financial strength set by the US central bank earlier this year”.

In the last 24 hours, its share value has slid to historical lows.

Wolfgang Schäuble claimed the Bank is “rock solid” and the suggestion is that the German government will make sure it survives although we take that to mean the salaries of its top executives and the interests of the owners rather than the workers – tens of thousands have lost their jobs in the last year alone as the bank struggles with its derivatives exposure in an environment of zero and negative interest rates.

Italy’s prime minister Matteo Renzi was reported yesterday (July 6, 2016) by Reuters as saying that “The difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives” see report – Report.

Renzi had previously said that “he would not swap Italian banks for their German peers” a snipe at Deutsche Bank.”

20 Ingelesez: “Clearly, if Germany blocks the Italian plan to bailout its own banks then the failure of those banks will probably bring Deutsche Bank to the brink, given its derivative exposure (huge relative to the size of the German and Eurozone economies).”

21 Ingelesez: “Then how to rescue DB becomes the issue and the solution would not be simple.

In other words, standby for another round of public bailouts.”

22 Ingelesez: “But the Eurozone banking insolvency threats have nothing to do with the Brexit vote, even though all and sundry are lining up to blame it. It has all to do with a dysfunctional European Commission with rules that cannot work in practice and an out of control financial sector.

Both have to change dramatically and now!”

joseba says:

Gogoratu:

Warren Mosler-ek Italiako bankugintzaz