Bill MItchell-en The European Commission and ECB outdo themselves in their quest for absurdity1

Sarrera:

Istorio baten historia: EB, Maastritch-ekoa komikoa zen, Goldman Sachs eta Grezia, Alemania eta Frantzia Egonkortasun eta Hazkundearen Itunaren arauak urratzen 2003an, EB-ko Europar Komisioa eta EBZ beren burak gaindituz, absurdutasunaren bilaketan2.

Ondorioz: langabezia eta pobrezia, argitaratutako azken txostena eta hipokresia, ezagutzen ditugun austeritatea eta deflazioa helburu ontzat esportatu nahia3

Brexit dela eta4

Ukitutako puntuak:

(i) Prezio egonkortasuna5

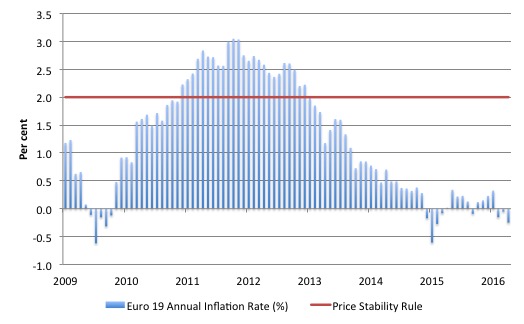

Lehen grafikoa6

(ii) Itunaren 140. artikulua7

(iii) Europar Komisioaren eta EBZ-ren Konbergentzia txostenak, 2016an8

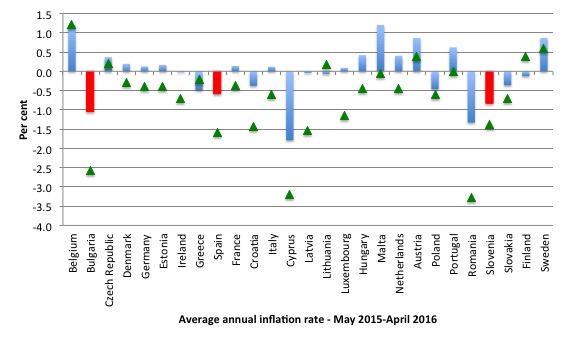

Bigarren grafikoa9

(iv) EBZ-k dioena10

Bigarren grafikoaren triangelu berdeez11

(v) Britainia Handia (BH) eta Brexit, ondorio gisa:

(a) BH-ko hiritarrak pozik egon beharko lirateke, EB-ko kidetzaz botoa emateko aukera daukaletako12

(b) EB-ko politika (deflazioa gehi langabezia goraipatuz) erokeria hutsa da13

(c) Xake pieza batzuk mugutuz, EB-ko teknokraten pozak milioika langileren sufrikarioa (langabezia gehi pobrezia) suposatzen du14

(d) Xake erreal bat behar da15

(e) BH-k aukera bat dauka: Get out now!

(vi) Iruzkinak16

(Hurrengo sarrera batean ikusiko ditugu iruzkin horiek)

2 Ingelesez: “As the years have passed, I have become inured to the depths of absurdity that the European Commission and the political elites its nurtures go to justify their existence. The Maastricht exercise in the late 1980s and early 1990s was comical. The convergence process towards Phase III of the Economic and Monetary Union in the 1990s was established a new norm for craziness. Who would believe the stuff that went on. Then the Goldman Sachs fiddle to allow Greece to enter the Eurozone two years later than the rest. What! Then the Stability and Growth Pact fudges in 2003 when Germany (and France) were clearly in violation of the rules they had bullied the other Member States into accepting. Look the other way and whistle! Then the GFC and the on-going mess. By now the Commission and the Council were outdoing themselves in pursuing absurdity.”

3 Ingelesez: “It was a pity that millions of innocent citizens have had their lives wrecked through unemployment and poverty as a result. And, now, perhaps, this lot have exceeded their own capacity for nonsense. I refer to the latest Convergence Reports published by the European Commission and the European Central Bank. Hypocrisy has no limit it seems. The Eurozone and EU is now firmly entrenched in austerity and deflation and the policy makers think that is the desirable benchmark for others to aspire to. Who could have invented this stuff!”

4 Ingelesez: “And, in relation to the upcoming vote in Britain – how the hell would any reasonable citizen want to be part of this sham outfit (EU) if they had a choice.”

5 Ingelesez: “Price Stability

The ECB is very explicit in defining price stability.

We read that – The definition of price stability:

Price stability is defined as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%.

This was the “quantitative definition” agreed on by the ECB’s Governing Council.

The ECB notes that this definition “makes the monetary policy more transparent” and “provides a clear and measurable yardstick against which the European citizens can hold the ECB accountable”.

To maintain price stability is the “focus of its monetary policy” for the “euro area as a whole”.

The definition is buttressed by further qualification.

1. “not only inflation above 2% but also deflation (i.e. price level declines) is inconsistent with price stability”.

2. “Inflation rates of below, but close to, 2% are low enough for the economy to fully reap the benefits of price stability” So the 2 per cent is the upper bound but deviations below that limit are increasingly undesirable. The ECB thus desires inflation in the euro area to be around 2 per cent recognising that some Member States will deviate from that euro area-wide target.

As an aside, the reality is that the ECB is a failing institution irrespective of what is happening in individual Member States such as Greece and Spain.”

6Ingelesez: “The following graph shows the annual inflation rate for the Eurozone 19 Member States from January 2009 to April 2016 (blue bars) with the red price stability rule shown for ease of comparison.

Since December 2014, the Eurozone has been enduring deflation (that is, price levels falling) 41 per cent of the time (7 months out of 17) and a further 2 months where the HICP (price) level was on the cusp of deflating. So inflation was only positive in 48 per cent of the months since December 2014.

It is clear from the graph that the ECB hasn’t achieved outcomes close to its price stability charter over the last seven years (at least) and irrespective of all the other problems the Eurozone has at present, it is obvious that we would give the ECB a fail grade in terms of its own benchmarks.

It has failed to maintain price stability even on its own logic.

(Ikus grafikoa)

The fact that it is pumping something like 80 billion euros a month into bank reserves under its latest QE exercise as a strategy to push the inflation rate back up to around 2 per cent is a clear statement that they think their policy settings have failed.

The problem is that pumping up bank reserves will do very little for the aggregate inflation rate while economies are mired in stagnation in their real economies (production, employment etc).

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.” (1 bilioi = europar mila milioi)

7 Ingelesez: “Article 140 of the Treaty and Protocol No 13

Article 140 of the Treaty ion the Functioning of the European Union is straightforward enough.

It relates to how the European Commission deals with nations that “are committed under the Treaty … to adopt the euro”.

It reads:

1. At least once every two years, or at the request of a Member State with a derogation, the Commission and the European Central Bank shall report to the Council on the progress made by the Member States with a derogation in fulfilling their obligations regarding the achievement of economic and monetary union. These reports shall include an examination of the compatibility between the national legislation of each of these Member States, including the statutes of its national central bank, and Articles 130 and 131 and the Statute of the ESCB and of the ECB. The reports shall also examine the achievement of a high degree of sustainable convergence by reference to the fulfilment by each Member State of the following criteria:

— the durability of convergence achieved by the Member State with a derogation and of its participation in the exchange-rate mechanism being reflected in the long-term interest-rate levels.

….

The related Article 1 of Protocol (No 13), which gives operation to Article 140 in relation to the convergence criteria says that:

The criterion on price stability referred to in the first indent of Article 140(1) of the Treaty on the Functioning of the European Union shall mean that a Member State has a price performance that is sustainable and an average rate of inflation, observed over a period of one year before the examination, that does not exceed by more than 11⁄2 percentage points that of, at most, the three best performing Member States in terms of price stability. Inflation shall be measured by means of the consumer price index on a comparable basis taking into account differences in national definitions.

Note the use of the term “that is sustainable”.

The European Council has to consult with the European Parliament and then determine if any of the Member States “fulfill the necessary conditions on the basis of the criteria in paragraph 1 …”

So the “Convergence Reports examine whether the Member States satisfy the necessary conditions to adopt the single currency.”

This blog addresses the first of the criteria noted above:

the achievement of a high degree of price stability; this will be apparent from a rate of inflation which is close to that of, at most, the three best performing Member States in terms of price stability …

Both the ECB and the European Commission produce Convergence Reports under the Treaty.”

8 Ingelesez: “The European Commission and ECB Convergence Reports 2016

The EC and ECB 2016 Reports are available as at June 7, 2016:

1. ECB Convergence Report 2016.

2. European Commission Convergence Report 2016

The ECB (and EC) methodology is as follows:

1. Calculate the annual percentage changes in the HICP for each monthly observation.

2. Average these monthly observations (annual inflation rate) over the period May 2015 to April 2016 which forms the reference period.

3. Select the three nations with the lowest ‘inflation’ rate, which might lead you to think that rate would have to be positive. You would be wrong. The lowest ‘inflation’ rate includes deflation. So in this era of deflation, The ECB and the EC were looking for the nations with the highest rate of deflation as their “best-performing Member States” according to Article 140.

4. Average the deflation rates of these three ‘superlative’ nations.

5. Add 1.5 percentage points to that result to come up with the benchmark for assessing the nations convergence performance to join the euro based on the ‘price stability’ criterion.

But hidden, pretty close to the surface of this arithmetical exercise is the ideology of the political elites that are destroying the prosperity of citizens within the European Union and the Eurozone, in particular.”

9 Ingelesez: “Here are the empirics of the exercise.

The following graph shows those average annual inflation rates for the monthly observations in the reference period (columns). I will come back to the little green triangles shortly.

As you see, the three red columns, plunging well into the negative territory of the y-axis are Bulgaria (-1.0 average annual inflation rate), Spain (-1.6 average annual inflation rate), and Slovenia (-1.4 average annual inflation rate).

These nations form what the ECB and the European Commission judge as being their best-performing Member States

It is almost impossible to believe these technocrats are serious.

They try to make themselves look ‘scientific’ and real-world grounded by their decision to exclude Cyprus and Romania, which as you can see from the graph are seriously deflating.”

10 Ingelesez: “The ECB wrote:

The inflation rates of Cyprus and Romania have been excluded from the calculation of the reference value. Price developments in these countries over the reference period resulted in a 12-month average inflation rate in April 2016 of -1.8% and -1.3% respectively. These two countries have been treated as “outliers” for the calculation of the reference value, as in both countries inflation rates were significantly lower than the comparable rates in other Member States over the reference period and this was due, in both countries, to exceptional factors. Cyprus has been undergoing an extraordinarily deep recession, with the result that its price developments have been dampened by an exceptionally large negative output gap. In Romania, the successive VAT cuts introduced recently are strongly affecting price developments, keeping HICP inflation in negative territory.

So, the good old Eurozone institutions remain up to their ‘arbitrary’ best. A special rule for this, an outlier for that!

The same deal that they gave Germany in 2003 when it should have been fined under the Stability and Growth Pact rules for on-going violation of the (ridiculous) 3 per cent fiscal deficit threshold.

The same deal they have recently given Spain which is running a fiscal deficit of 5.2 per cent or thereabouts. Brussels turned a blind eye to the PP government and allowed them to introduce an old-fashioned fiscal stimulus, which spawned the current growth spurt, because they knew an election was coming up late last year and didn’t want any pony-tailed politicians or, worse, communists, seizing power. They already have Portugal to deal with.

The same deal that has never seen a nation fined under the SGP rules.

“Exceptional factors” – the ‘out’ clause. How convenient.

Of course, they would have further exposed their idiocy if they had have used Cyprus and Romania as their benchmarks, so they thought that by excluding them their other ‘best-peformed’ deflating nations would look like representing a reasonable benchmark for their crazy assessments.

This outfit (the Eurozone institutions) is a joke! A vicious, venal joke, but a joke nonetheless!”

11 Ingelesez: “What about those green triangles? Well they are the actual inflation rate between May 2015 and April 2016 – (taking the percentage difference between the two observations) and thus giving the latest result more importance in the assessment.

What you see is that the best-performing Member States have deflated much more than the averaging process indicates. We also see how widespread the deflation has come across all the Member States (shown).

The ECB claims that:

The average rate of HICP inflation over the 12-month reference period from May 2015 to April 2016 is reviewed in the light of the country’s economic performance over the last ten years in terms of price stability. This allows a more detailed examination of the sustainability of price developments in the country under review. In this connection, attention is paid to the orientation of monetary policy, in particular to whether the focus of the monetary authorities has been primarily on achieving and maintaining price stability, as well as to the contribution of other areas of economic policy to this objective.

So under that review they must have concluded that the central bank in Bulgaria has failed as badly as the ECB, itself has failed in the Eurozone.

A deflation rate of -2.5 per cent (Bulgaria over May 2015 and April 2016) is hardly close to a 2 per cent inflation rate, which is the price stability benchmark as espoused by the ECB.

I also note that the unemployment rate in 2015 for Bulgaria was 9.2 per cent, Spain 22.1 per cent, and Slovenia 9 per cent. The EU average was 9.4 per cent and the Eurozone average was 10.9 per cent.

The conclusion of the ECB was that:

All Member States except Sweden meet the price stability criterion.

That sinful inflationary Sweden! What did it do wrong?

Well its benchmark inflation rate between May 2015 and April 2016 was 0.9 per cent, which apart from Belgium and Malta (1.2 per cent) made it the closest nation (along with Austria – 0.9 per cent) to the ECB’s own definition of price stability (2 per cent).

The citizens of Sweden should be breathing a sigh of relief that they will not yet be allowed to join this exclusive club of deflationary nations.”

12 Ingelesez: “The citizens of Britain might wonder what luck they have being able to vote next week on their on-going membership of this crazy (and failed) political construct (the European Union).”

13 Ingelesez: “When policy becomes so distorted that nations with rampant deflation and elevated levels of unemployment (particularly youth) are held out as the “best-performing Member States” you know that reality has fallen off the cliff and neoliberal Groupthink is dominant”

14 Ingelesez: “You know that well-paid technocrats in nice offices in Brussels and Frankfurt have moved a few chess pieces and congratulated themselves on their genius without realising that those chess pieces are really millions of people without jobs and fast entering the growing ranks of the impoverished.”

15 Ingelesez: “A reality check is needed! Groupthink thwarts that.”

16 Ikus https://www.blogger.com/comment.g?blogID=2761684730989137546&postID=6012720322152700558&bpli=1.