Bill Mitchell-en lana: Austerity is killing off the hopes of our youth1

Ametsak ala ameskeriak?2

Artikulua ukitutako puntuak:

(a) Lan-indarraren datuak, Europan3

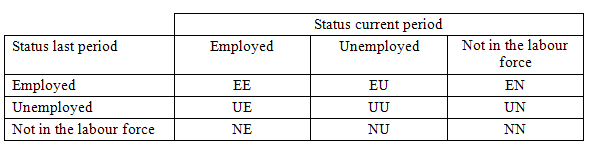

“The various stocks and flows are denoted as follows (single letters denote stocks, dual letters are flows between the stocks):

-

E = employment stock, with subscript t = now, t+1 the next period.

-

U = unemployment stock.

-

N = not in the labour force stock.

-

EE = flow from employment to employment (that is, the number of people who were employed last period who remain employment this period)

-

UU = flow of unemployment to unemployment (that is, the number of people who were unemployed last period who remain unemployed this period)

-

NN = flow of those not in the labour force last period who remain in that state this period

-

EU = flow from employment to unemployment

-

EN = flow from employment to not in the labour force

-

UE = flow from unemployment to employment

-

UN = flow from unemployment to not in the labour force

-

NE = flow from not in the labour force to employment

-

NU = flow from not in the labour force to unemployment

The following Matrix Table provides a schematic description of the flows that can occur between the three labour force framework states.”

(b) Probabilitate (sic) kontuak: Greziako egoera oso tamalgarria4

“The flows shows that in the aggregate (EU28) there is some movement between these labour force states, whereas for Greece there is virtually no movement.

The Greek labour market has ground to a halt!”

(c) Greziari buruzko NMF-ren txostena: diru laguntzak ez dira inoiz izan ekonomiaren hazkundeari laguntzeko5

(d) Langabeziaren proiekzioak: hazkundea soilik etorriko da produktibitatearen hazkundearekin6

“… scorch the economy with spending cuts, deregulation, privatisation, pension cuts, on-going unemployment and (…) economic growth will occur.

Unfortunately, history doesn’t bear kindly on this strategy”

(e) Egindako erreformak ez dira izan nahikoak: Greziak “requires continued structural reforms to be delivered at a much faster pace than achieved so far”7

(f) NMF-ren hitzak: “Greece will continue to struggle with high unemployment rates for decades to come”8

“… expects it to reach 18 percent by 2022, 12 percent by 2040, and 6 percent only by 2060”

(g) OECD delakoa eta Espainiako datu kezkagarriak9

Gauza bera Greziarako. “Here is a challenge to the IMF.”

(h) Greziako errendizio-tximino gobernua, gastuen areagotzea, diru laguntzak atzerriko bakariei eta eliteei doaz ez ekonomiaren hazkundea laguntzeari10

Gogoratu: Grezia: erabateko desastrea (1)

(i) Biloben etorkizuna ahulduz doa11

(j) Inkesta oso kezkagarriak12

Ondorioak:

(i) Europako Proiektua auto-deuseztatzailea da

(ii) Tartean, eskumako alderdiak ugarituz doaz

(iii) Eta Ezkerra amets eginez, “about the great vision of a united Europe and restoring democracy, etc. Pipe dreams!”

Greziari buruzko gehigarriak:

Grezia: erabateko desastrea (eta 3)

Greziari buruzko aspaldiko kontuak: Varoufakis eta Grexit

2 Ingelesez: “Sometimes, it is almost as if I have to pinch myself to establish that what I am reading is not a dream. A few reports lately have had that effect, not the least being the latest IMF report – Debt Sustainability Analysis (DSA) for Greece, which is forecasting unemployment will remain above 10 per cent for several decades to come. The latest Eurostat data on gross labour flows also paints a dire picture for a nation that has been deliberately ruined by neo-liberal ideology. And, the latest Eurobarometer studying Europe’s youth in 2016 tells us clearly how the next generation of adults feel about all this – they feel marginalised from social and economic life. The Troika and its corporate pals are doing a great job killing off the prospects for Europe’s children and their grandchildren, and further on – their grandchildren’s children. People in a few hundred years will reflect back on this period of history as being a dark age where power hungry maniacs dominated the people before the latter revolted and mayhem ensued.”

3 Ingelesez: “Gross labour flows data – Europe

The latest Eurostat gross labour flows publication (released May 20, 2016) – 18% of unemployed persons in the EU found a job – tells a continuing story of a seriously underperforming Eurozone labour market.

The labour market flows data “show the movements of individuals between employment, unemployment, and economic inactivity and enrich the analysis of the net changes in stocks.”

Please read … – What can the gross flows tell us? – for more discussion on this point.

Gross flows analysis allows us to trace flows of workers between different labour market states (employment; unemployment; and non-participation) between months. So we can see the size of the flows in and out of the labour force more easily and into the respective labour force states (employment and unemployment).

Each period there are a large number of workers that flow between the labour market states – employment (E), unemployment (U) and not in the labour force (N). The stock measure of each state indicates the level at some point in time, while the flows measure the transitions between the states over two periods (for example, between two months).

The net changes each month – between the stock measures – are small relative to the absolute flows into and out of the labour market states.

National statisticians measure these flows in their regular labour force surveys – quarterly in the case of Eurostat.”

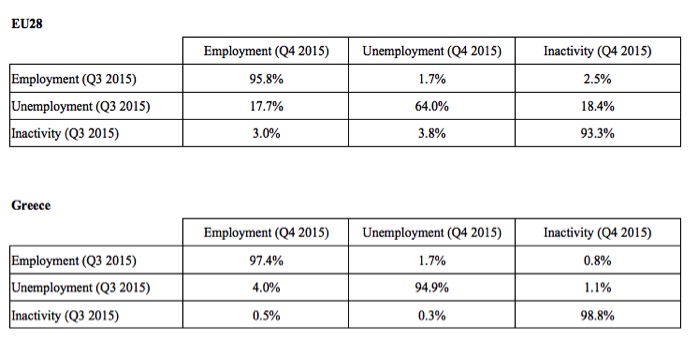

4 Ingelesez: “The various inflows and outflows between the labour force categories are expressed in terms of numbers of persons which can then be converted into so-called transition probabilities – the probabilities that transitions (changes of state) occur.

We can then answer questions like: What is the probability that a person who is unemployed now will enter employment next period?

So if a transition probability for the shift between employment to unemployment is 0.05, we say that a worker who is currently employed has a 5 per cent chance of becoming unemployed in the next month. If this probability fell to 0.01 then we would say that the labour market is improving (only a 1 per cent chance of making this transition).

So the 3 Labour Force states in the Matrix Table above allow us to compute 9 transition probabilities reflecting the inflows and outflows from each of the combinations.

Analysing movements in these probabilities over time provides a different insight into how the labour market is performing by way of flows of workers.

I compiled the following transition probabilities from the latest data for the EU28 as a whole and for Greece and expressed the cells in percentage form.

The comparison between the EU28 and Greece is quite telling, as you might expect.

An unemployed person in the European Union has a 64 per cent chance of remaining in that state between months (as at the end of 2015). The same person in Greece has a 95 per cent change of remaining unemployed.

That person in the EU28 overall has an 18 per cent chance of finding a job in the next month, whereas in Greece the likelihood is only 4 per cent (barely anything).

I computed the same probabilities over the 12 month period to the end of 2015 and the chance of an unemployed person in Greece finding a job over that period was ZERO!

The chance of a new entrant gaining a job (NE) in the EU28 was 3 per cent at the end of last year (very low). The same person in Greece had only a 0.5 per cent likelihood, in other words virtually zero.”

5 Ingelesez: “IMF Report on Greece

The IMF’s latest Debt Sustainability Analysis (DSA) for Greece is one of those documents that you have to take a breath before you realise they are being serious.

The Report is largely about the IMF’s belief that Greece will not be able to sustain a primary surplus of 3.5 per cent as is required under the bailout projections.

The IMF say that:

Even if Greece through a heroic effort could temporarily reach a surplus close to 31⁄2 percent of GDP, few countries have managed to reach and sustain such high levels of primary balances for a decade or more, and it is highly unlikely that Greece can do so … and projections suggesting that unemployment will remain at double digits for several decades.

Overall conclusion: long-term growth projections will be low and debt restructuring will be required.

In other words, Greece cannot meet the Troika demands on debt repayments, bank stability and the rest of it.

One doesn’t have to have been trained in rocket science to have known that – back in 2010 – when the Troika entered the picture.

The purpose of the bailouts was to transfer private debt into public hands – it was never to help the Greek economy grow again.”

6 Ingelesez: “But apropos of the unemployment projections, on Page 13, we are presented with a Box 2. What is Driving Greek Growth in the Long-Term? which breaks down the three factors that we know contribute to the growth of an economy.

1. Labour force developments (population growth, participation rates, and utilisation rates).

2. Capital accumulation (investment in productive capacity).

3. Total Factor Productivity (TFP) – how much output the economy gets from its productive inputs – if utilised.

The IMF claim that the first two factors will undermine growth – “a decline in working-age population” and “investment rates that are unlikely to return to the unsustainable pre-crisis levels”.

The current investment ratio (as a percent of GDP) is down to 11 per cent. It has dropped from just over 20 per cent in 2008 – a massive slowdown in productive capacity growth.

The ratio is well below what other advanced countries are recording and signifies the depression that Greece has become stuck in due to the deliberate policies of the Troika aided and abetted by a sequence of Greek governments, who really should be tried in the courts for treason against their own people.

The IMF claims that growth will only come from productivity growth, which they assert will be “driven by structural reforms” – same old mantra.

That is, scorch the economy with spending cuts, deregulation, privatisation, pension cuts, on-going unemployment and, Bob’s your uncle – economic growth will occur.

Unfortunately, history doesn’t bear kindly on this strategy.”

7 Ingelesez: “The IMF claim that the reason Greece is still in depression is because the scorched earth hasn’t been scorched enough. The reasonable world abandoned the ‘shock doctrine’ when Sachs and his morons blew up Eastern Europe.

But the IMF claim that to restore growth Greece:

… requires continued structural reforms to be delivered at a much faster pace than achieved so far.

That is, blame the Greek people and their governments for failing to toe the Troika line fully.

Never mind that these policies have seen the economy shrink by nearly 30 per cent so far and the end of the contraction is not in sight yet.

This is an organisation that has outlived its usefulness (by decades) and should be the target of austerity among its funding governments and closed!

But their commentary on the prospects for the labour market in Greece are nothing short of hypnagogic – a really bad dream at that.”

8 Ingelesez: “Here is the IMF in their own words:

At the same time, Greece will continue to struggle with high unemployment rates for decades to come. Its current unemployment rate is around 25 percent, the highest in the OECD, and, after seven years of recession, its structural component is estimated at around 20 percent. Consequently, it will take significant time for unemployment to come down. Staff expects it to reach 18 percent by 2022, 12 percent by 2040, and 6 percent only by 2060.

Note the claim that 80 per cent of the unemployment is ‘structural’ and therefore not amenable to policies that might aim to increase employment through spending.

This is one of those confidence tricks that the mainstream play to avoid the obvious.

Please read my blogs – European Commission is once again bereft of credibility and The confidence tricksters in the economics profession– for more discussion on this point.”

9 Ingelesez: “The OECD did it in 2013 when they claimed that most of the Spanish unemployment was ‘structural’.

They claimed that the Spanish full employment unemployment rate had risen to 23 per cent in September 2013 after having estimated it to be 8 per cent in 2010.

Any reasonable interpretation of the dramatic rise in Spanish unemployment rates as real output growth collapsed, would lead to the conclusion that the post-2007 period was a cyclical event.

Structural events are typically slow moving. A nation doesn’t suddenly lose its productive capacity (unless there is an extraordinary event like a tsunami or earthquake or war). Labour forces do not suddenly alter their preferences between their desire to work and their desire to retire early, or work less, or “enjoy leisure”.

Labour forces do not suddenly become indolent. Inasmuch as these attitudinal changes ever occur, they occur over time and are not discernable on a month to month basis.

So it would be hard to consider the rise in unemployment in Spain from its average between 2000 and 2007 of around 10 per cent or 8.7 per cent between 2005 and 2007, to 16 per cent in early 2009 and 26 per cent or so in early 2012 could be explained in structural terms.”

10 Ingelesez: “If the Greek surrender-monkey government was to announce today that they would provide a job at a decent minimum wage to anyone who wanted to work in community development, environment care, personal care etc – that is, a Job Guarantee – how many of the unemployed would line up?

Only five of the current 25 per cent?

My bet is that the Government would be flooded with workers wanting to work and establish some sort of income security.

In other words, a spending expansion (JG) would wipe out most of the Greek unemployment within a few months – which means the unemployment is not structural and immune to spending increases.

But that point aside, this is a nation being ruined by policy ideologues, who refuse to acknowledge that more spending is required in the economy.

Bailouts that mostly go to foreign bankers and the elites do not add spending to the Greek economy.

Please read my blog – Greek bailout money goes to banks and corporations – who would have thought? – for more discussion on this point.”

11 Ingelesez: “Undermining the grandkids future!

There is a lot of hot air exuded by mainstream economists about how on-going fiscal deficits and the associated public debt (because government, unnecessarily, continue to provide corporate welfare in the form of debt-issuance) undermine our children and their children’s future.

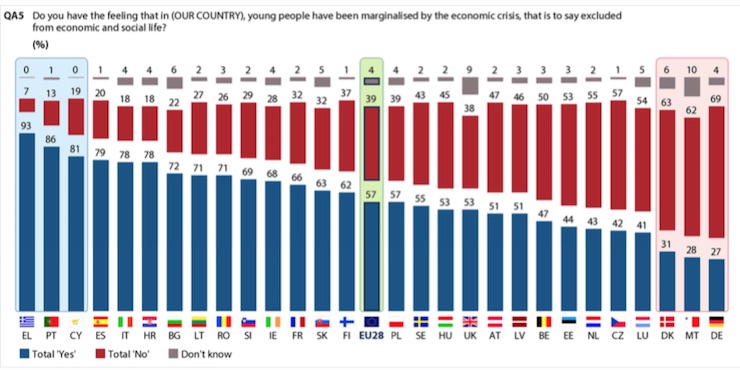

The latest Eurobarometer poll – European Youth in 2016 – provides a solid indication that the mainstream policy of austerity is undermining their future.”

12 Ingelesez: “One should link this sort of evidence with the polling I reported in this blog – Greek bailout money goes to banks and corporations – who would have thought? – which shows a fast increasing proportion of Greek people are against the euro and think they would be better off with their own currency. (Gogoratu: Grezia: erabateko desastrea (1))

The lastest Eurobarometer results tell us that:

1. “More than half of young people in Europe have the impression that, in their country, the young have been marginalised and excluded from economic and social life by the crisis (57%).”

2. “An absolute majority of respondents feel excluded in 20 countries, though there are wide national differences and divergences of up to 66 points. Unsurprisingly, the rates are very high in the countries worst affected by the crisis, and where there is high youth unemployment.”

Here is the graphic that summarises the results of the question about Youth and Jobs.

93 per cent Greek youth fell that the crisis has marginalised them – excluded them from “economic and social life”. 86 per cent in Portugal. 79 per cent in Spain. 78 per cent in Italy … and so on.

This is the handy work of the European Commission and the IMF. It is inconceivable that after 8 years of crisis that the elites could still hold sway.

And we know that the political instability is starting to reflect the growing social instability. The elites can only batter a people down for so long.”