“Britainia Handian egongo banintz, ez nuke Europar Batasunean egon nahiko.”

Bill Mitchell-en artikulua: If I was [were] in Britain I would not want to be in the EU1.

Hona hemen Mitchell-en artikuluaren punturik garrantzitsuenak:

(a) Subiranotasun nazionala2

(b) Demokraziaren oinarriak3

(c) Subiranotasun monetarioa, demokrazia eta eurogunea4

(d) Eurogunearen historia laburra5

(e) Katalunia eta Mitchell: Eurozone Dystopia liburuaren aurkezpena6

(Oharra: maiatz honetan Mitchell Espainian dago bere azken liburuaren espainierazko bertsioa aurkezten (ikus William (Bill) Mitchell-en La distopía del euro liburuaren aurkezpena Madrilen eta Bill Mitchell Badajoz-en. Hona hemen, linkean, liburuaren aurkezle batek dioena Kataluniaren independentziaz7.)

(f) Britainia Handia (BH) eta Katalunia: Margaret Thatcher8

(g) BH eta Europar Batasuna. Historia eta istorioak9

(h) BH hurrengo arauen azpian dago (linkean)10, eta “These rules have been demonstrated over the last 10 years to be highly destructive and dysfunctional”

(i) Gaur egungo egoera11

(j) Ezkerra erdi galdua12

(k) BH eta EB-ren arteko erlazio ekonomkioak13

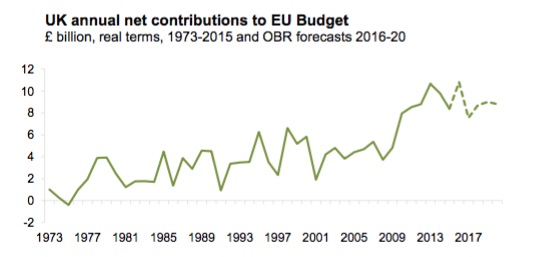

(l) BH-k Europar Batasunari (EB) egindako ordainketa netoak14

Britain’s real net contribution to the EU from 1973 to 2015 (with forecasts out to 2020)

In terms of Britain’s GDP, the 2015 contributions of £8,473 million will be around 0.5 per cent of GDP, a fairly small figure. Given Britain issues its own currency, … the quantum [is not] a major issue

(m) EB-rekiko merkataritza harremanak

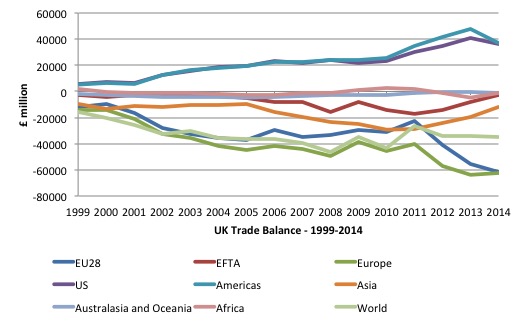

The following graph shows the UK trade balance from 1999 to 2014 in £ millions15

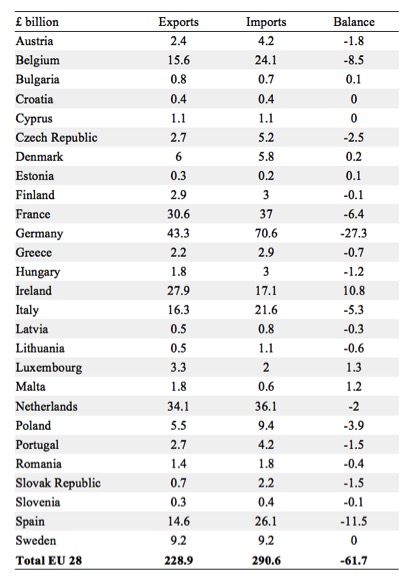

The following table shows total exports and imports and the trade balance in £ billions against the other 27 EU Member States in 201416

(n) EB-rekiko merkataritza harremanak: Mitchell-en iruzkinak17

(o) Ondorioa: Brexit, subiranotasun monetarioa18

(p) Oharra Varoufakis-i buruz19 eta Mitchell-en erantzuna20

2 Ingelesez: “The foundations of national sovereignty are the currency-issuing capacity of the national government.”

3 Ingelesez: “The foundations of a democracy include the ability of the citizens of that currency zone (the ‘national government’) to choose the political representatives at regular intervals who will make decisions on their behalf.”

4 Ingelesez: “A direct chain of responsibility between the elected officials to the voters is thus established and the citizens can take action accordingly if they feel they are being disadvantaged by the legislative outcomes. The anathema of this sort of direct responsibility and accountability is the European Union, which is cabal ruled by unelected officials (in the conventional sense) who are not held accountable for their decisions, no matter how poor they turn out to be.”

5 Ingelesez: “The history of the Eurozone is one of policy failure with millions of people rendered unemployed, in poverty, or otherwise disadvantaged by the destructive decisions made by successive European Commission administrations. There was a good reason why the French president Charles de Gaulle resisted the development of supranational power blocks in Brussels and elsewhere (for example, in Frankfurt under the Eurozone). His preference for Inter-Governmental relations, where large common issues such as climate change, migration, rule of law, etc could be decided upon by representatives of each Member State government, without surrendering national sovereignty, was sound. Given all of that, the United Kingdom should exit the dysfunctional European Union immediately and only negotiate with other states on a government to government basis.”

6 Ingelesez: “In May, I will be doing a two week lecture tour of Spain promoting the soon-to-be-released Spanish translation of my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale. Full details will be forthcoming soon, if you are interested.

I’ll spend some time in Barcelona and will meet with some of the protagonists pushing for independence of Catalonia.

My position on that issue hasn’t changed in recent years and I fully support their desire to break away from Spain. However, as I outlined in this blog – Catalonia’s vote largely misses the point – it can only achieve true sovereignty if it abandons the euro and all the destructive restrictions and rules that go with being a Member State of that dysfunctional monetary system.

My evaluation of the Catalonian position is that it should develop its own independent nation and use its own currency to build on its prosperity. It certainly has the economic structure in which to prosper materially.”

7 Stuart Medina Miltimore says:

“Bill: although I favor a referendum on the issue of Catalan independence (something that PSOE, PP & Ciudadanos oppose, which is a mistake because it fails to deliver a solution) I have never been sympathetic to nationalist movements. They are conservative and elitist. An example: the most common surnames in Catalonia do not coincide with the rarer ones sported by the members of the Catalan Parliament. The electoral system is rigged in favor of more conservative rural regions to the detriment of the working class districts. There has been a surge in nationalist sentiment due to the PP’s manoeuvres against their new statute and the economic crisis has been conveniently blamed on Spain. However, the Catalan conservative elite is as corrupt and pro Euro as the Spanish one. Only the CUP have been consistent about getting out of Spain and the Euro altogether. But they are a small party. Since my brother lives in Barcelona and I have good friends who live there I am not particularly keen on seeing our union break. I’d much rather get all of Spain of the Euro.”

Espainiar hori Espainiaren alde dagoen moduan ni neu Kataluniaren moneta propioaren alde nago Katalunia independente batean eta euskoaren alde Euskal Herri independentean.

8 Ingelesez: “Britain is in a better position than Catalonia, because as a result of the foresight by Margaret Thatcher they avoided entry into the monetary system.

Thatcher understood that the joining the Economic and Monetary Union would be an imposition on Britain’s sovereignty. Her Government ‘would not be prepared to have a single currency imposed upon us, nor to surrender the use of the pound sterling as our currency’ (House of Commons Hansard, 1990a).

She delivered her famous tirade, which produced the headline in the Sun tabloid newspaper two days later ‘Up yours, Delors’ (House of Commons Hansard, 1990a):

Yes, the Commission wants to increase its powers. Yes, it is a non-elected body and I do not want the Commission to increase its powers at the expense of the House, so of course we differ. The President of the Commission, Mr. Delors, said at a press conference the other day that he wanted the European Parliament to be the democratic body of the Community, he wanted the Commission to be the Executive and he wanted the Council of Ministers to be the Senate. No. No. No.

9 Ingelesez: “When Britain entered the European Union in 1973, it was still not much more than a ‘common market’. Subsequent treaty changes (in particular, the Treaty of Maastricht and what followed) have centralised power in the Commission and choked prosperity.

The Treaty of Lisbon, that came into force on December 1, 2009 accelerated the trend to increased EU power – broadening the scope of its regulative remit and further limiting the political sovereignty of the Member States.

Tony Blair dudded the British people at the time by refusing to hold a referendum on the Lisbon Treaty. France and the Netherlands did hold a popular vote on a prior version (the ‘Constitutional Treaty’) in 2005 and it was rejected. The Lisbon Treaty was around 96 per cent of the Constitutional Treaty (Source).

As an aside, we should not forget that Tony Blair would have had Britain in the Eurozone if he had have had his way.

On the Lisbon Treaty, only Ireland held a popular vote and 53 per cent voted no in the first instance.

One aspect of the Lisbon Treaty was the declaration of “exclusive competencies”, which mean that the EU is the only body that can create law in these areas.

So, democracy took the back seat in this increased centralisation of power in the EU bureaucracy.

While Britain negotiated so-called Opt out clauses in the Treaties that govern the EU, it is still subject to a host of rules that compromise its economic sovereignty.

Protocol No 15 of the Treaty on the Functioning of the European Union relates to the “certain provisions” that apply to Britain.

We read that while the UK does not have to join the euro it:

… shall endeavour to avoid an excessive government deficit.

It is also bound by Articles 143 and 144 of the Treaty on the Functioning of the European Union, which relate to Balance of Payments issues.

The reference to excessive government deficits has a specific meaning within the Stability and Growth Pact (SGP) rules governing fiscal deficits under Article 126 of the Treaty and Protocol 12, which accompanies the Treaty.

Protocol 12 details the “reference values” for the fiscal rules, specified in Article 126:

– 3 % for the ratio of the planned or actual government deficit to gross domestic product at market prices;

– 60 % for the ratio of government debt to gross domestic product at market prices.”

10 Ingelesez: “Britain is thus subject to:

1. Monitoring from the EC.

2. Action from the EC under the so-called ‘Correction Arm’ of the SGP.

3. Detailed orders to reduce a deficit if considered ‘excessive’ under the rules.

4. The imposition of fines if in continued default of the rules.

5. Exclusion from certain benefits of membership while in default of the rules (for example, loans from the European Investment Bank).

6. The requirement to make a “non-interest-bearing deposit of an appropriate size with the Union until the excessive deficit has, in the view of the Council, been corrected …”

And more.

These rules have been demonstrated over the last 10 years to be highly destructive and dysfunctional.”

11 Ingelesez: “At present, the UK is caught up in this ‘corrective arm’ and has until the financial year 2016/17 to correct the excessive deficit as judged by the European Council.

You can read all the stifling and ridiculous reports about the UK and the excessive deficit mechanism – HERE.

You could not make this stuff up.

The most recent report was released on November 16, 2015 – Commission communication to the Council on action taken.

These rules alone are enough to justify the departure from the EU. However, there are countless other rules and requirements that compromise the British people as a result of their membership of the EU, which the people have no discretion over nor ability to override by throwing their elected Government out.”

12 Ingelesez: “I thought this article was in the New Statesman (june 11, 2015) made some arguments that I would make – The left wing case for leaving the EU.

There is a lot wrong with this article – especially about ‘having more money to spend on other things’ type errors. But, in general, his intent is supportable.

The author, John King writes that:

The EU will influence the future of the NHS just as it helped smooth Tory privatisation of the Post Office and the organisational break-up of the railways; it is in tune with austerity and drives a larger and more deadly version in the eurozone; it escalates problems linked to housing, work, wages and education; creates worry and stirs up anger and threatens people’s sense of self. A lazy acceptance of establishment propaganda and a fear of being branded “xenophobic” have silenced many liberals and left-wingers. And yet the EU is driven by big business. This is a very corporate coup.

I think his reference to the “establishment propaganda” is relevant to the recent announcement that the British Labour Party will campaign against exit.

Here we have the Left once again eulogising about some dream world they call ‘Europe’, which in reality, has turned into a disintegrating and dysfunctional amalgamation of Member States, devoid of their own national sovereignty and quite clearly not serving the interests of their citizens.

When the citizens do express dismay through the political process, one or more of the EU institutions (Council, Commission, ECB) exacts its toll on the nation in particular, in recent times with the IMF in tow or leading the charge. Think back to June last year and the way the ECB treated Greece and turned Syriza into a front-line, neo-liberal austerity attack dog.

John King notes that at the core of the EU is a “undemocratic and distant” central authority, which is “a threat to all those living in its shadow. However sweet the propaganda, it is a tool for multinationals …”

The other point he makes is that the EU is not “synonymous with ‘Europe’”. It was claimed that if Greece left the Eurozone it would forfeit its status in Europe.

Europe is a geographic and cultural mass that goes far beyond the shrouded and protected bureaucracy in Brussels. King notes that the “European Enlightenment was about the collectivisation of political power in the hands of the masses, then the EU model is the antithesis of this: centralising decision-taking in the hands of an unaccountable technocratic elite”.”

13 Ingelesez: “We learn that:

1. The EU “is the UK’s major trading partner, accounting for 45% of exports and 53% of imports of goods and services in 2014”.

2. “The share of UK trade accounted for by the EU 28 is lower than a decade ago”.

3. The “‘Rotterdam effect’” overstates this share because “trade recorded as being with the Netherlands is actually with non-EU countries”.

4. “The EU is a major source of inward investment into the UK. In 2014, EU countries accounted for £496 billion of the stock of inward Foreign Direct Investment, 48% of the total”. However, is that due to its membership status or because it has been growing while the Eurozone has been stagnating?

5. “Various studies have attempted to quantify the benefit or cost to the UK of its membership of the EU. This is a very difficult exercise and depends on a wide range of assumptions. Estimates vary significantly. For example, a 2005 study by the Institute for Economic Affairs found a cost of between 3% and 4% of GDP while a 2013 study by the CBI found a net benefit of between 4% and 5% of GDP. A 2015 study by Open Europe found that the cost of the 100 most burdensome EU regulations was £33.3 billion a year.”

The last point is important. The doomsayers are out in force at present obscuring their real intent with horror stories of the collapse of the British economy if the nation leaves the EU.

The fact is that none of the studies are definitive and swing wildly between large gains and large losses.

The reality is that no-one really knows but the smart money would be on minimal impact other than saving some public funds (see next section) and a going free of a heap of regulative costs that businesses and other organisations are forced to incur as a result of EU rules.”

14 Ingelesez: “Under Treaty of Lisbon, each Member State makes contributions to the EU, which run the bloated bureaucracy and provide resources for transfers between States.

These contributions are worked out on the basis of a complicated formula which includes VAT and customs duties receipts, gross national income and sugar levies.

Even though Margaret Thatcher negotiated a special ‘abatement’ on Britain’s contributions in 1985 (which amounted to about a third rebate on the assessed contribution), subsequent policy changes (excluded items that attract the abatement) have substantially increased the net real contribution.

The contribution is extremely volatile on a year-to-year basis (see this UK Treasury Report – European Union Finances 2015

The contribution is also sensitive to exchange rate movements between the sterling and the euro.

In 2014, Britain was the third-largest net contributor to the EU (after Germany and France), although on a per capita basis, Britain slips well down the rankings.

The … graph is taken from official data compiled by UK House of Commons Library and shows the Britain’s real net contribution to the EU from 1973 to 2015 (with forecasts out to 2020). Britain’s contribution in real terms has risen sharply in recent years as a consequence of changes in rules etc.

In terms of Britain’s GDP, the 2015 contributions of £8,473 million will be around 0.5 per cent of GDP, a fairly small figure. Given Britain issues its own currency, I do not consider the quantum to be a major issue.

Unfortunately, the pro-exit lobby often lies about how significant this contribution is in the scale of things. But then we are dealing with the likes of UKIP who lie about most things.

It is what Britain is buying into with that contribution that is the issue.”

15 Ingelesez: “There is also a lot of misinformation about trade between the EU and Britain and how it would dry up should Britain leaves.

The latest data from the British Office for National Statistics – United Kingdom Balance of Payments – The Pink Book, 2015 – was published in December 2015.

From Table 9.3 of the 2015 Pink Book, we can compute Britain’s trade position with a major regions. The following graph shows the UK trade balance from 1999 to 2014 in £ millions.

It clearly runs a surplus with the Americas (read mostly the US) but a substantial deficit against the EU 28 Member States.”

16 Ingelesez: “From Table 9.3 of the 2015 Pink Book we can compute the UK trade position with the EU Member States. The following table shows total exports and imports and the trade balance in £ billions against the other 27 EU Member States in 2014.

It’s quite clear that Britain ran a £61.7 billion deficit against the other EU Member States in 2014. It ran a surplus with only six of the Member States and the magnitudes were inconsequential other than with Ireland. The latter surplus reflects historical connections rather than EU connections.”

17 Ingelesez: “The point is that it is highly unlikely that these trade patterns and FDI flows would alter much if Britain was outside the formal apparatus of the EU.

Geographic proximity, superior economic performance, global multilateral (outside of the EU ambit) rules are all more relevant to Britain than the membership of the EU in this regard.

When thinking about the so-called ‘damage’ that exit of the EU would bring to Britain, it is worth considering Switzerland, which adopts no EU rules or regulations as a matter of course, although it sometimes implements the same rules as a global commitment.

Its exporters supply into various markets and have to meet the standards applicable. This is what all exporters do around the world.

Which country do you think has the highest share of its exports into the EU? Britain or Switzerland?

By 2014, 44.4 per cent of Britain’s total exports went to the EU (noting this is an overstatement given the ‘Rotterdam Effect’ – the figure is closer to 41 per cent).

In 2014, 59.2 per cent of Switzerland’s total exports went to the EU and they ran a surplus against the EU, unlike Britain (Source).

I don’t want to suggest that a trade surplus is a desirable target – it clearly means that a nation is giving away more of its real resources than it is getting back from abroad. In some cases, that might not be as problematic if the exports are bits of iron ore and the imports are flash consumer items. But generally, exports are a cost to local residents (they could be using those resources themselves) and imports are a benefit.

The point is that Switzerland maintains its complete fiscal sovereignty by staying out of the EU and doesn’t appear to be shunned by the EU Member States.

And when you think about the trade deficit that Britain runs with the rest of the EU, the day that it exited, it would become the EU’s largest export market.

So, pure self-interest would prevent the remaining 27 EU Member States from trying to ‘punish’ Britain in some way, not to mention that fact that all nations are bound by World Trade Organisation rules that prevent discriminating trade arrangements.

It is just far fetched to think that these flows of goods and services and income payments will be seriously affected at all by an exit.

And if Britain needs another example of how staying out of restrictive arrangements such as the Eurozone and the EU, in general, then it just has to look northward to Iceland, which suffered the worst banking collapse of all (courtesy of ridiculous era of neo-liberal policies), yet came out of it the best.”

18 Ingelesez: “As a Modern Monetary Theory (MMT) proponent, the sovereignty of the currency-issuer is an overwhelming priority in terms of organising the monetary system.

Once the government has that capacity it can always do the best for the people given external circumstances. The best might in some cases not be very good but that would reflect real resource constraints etc, something that Britain is not particularly troubled by.

The next priority is to ensure that all economic policy institutions are accountable and responsible to the people who can regularly cast votes to affirm their approval or otherwise of the economic direction the nation is taking.

A currency-issuing government should never cede policy-making powers to an external body unless it is via intergovernmental agreement and is ratified (implicitly or by referendum) by the domestic political process.

The EU membership for Britain is the anathema of these principles.

Further, it is clear that the original European Project is dead as the EU and the Eurozone teeter on the edge of chaos as a result of years of incompetent policy making by the entrenched elites who have sold the people out to the corporations.

(…)

But then the same characters on the Left, in the next sentence, extol the virtues of remaining in the EU. Same deal really. Don’t they know that.

And equating exit with xenophobia and nationalism is another sideshow that should be ignored for what it is – a ridiculous ploy to obscure what is going on.

I am not big on national identity. But I am huge on sovereign currency capacities and unless nations decide to merge or break away (such as South Sudan, and hopefully Catalonia and Scotland) then the current geography is it!”

19 Iruzkinetan JWM-k honela dio:

“J W M says:

I prefer Yanis Varoufakis’ approach: to democratise the EU. To start a break up of the EU experiment because monetary policy isn’t working for all members is a failure of imagination and guts. Having said that though, I am not sure how discretionary monetary policy could be accommodated within a democratic EU to account for particular macroeconomic problems that different countries may be experiencing. But I’m sure it isn’t an impossible problem if you put aside the slight matter of bureaucracies entrenched in the status quo.

My attitude on the EU changed when “it” received the Nobel Peace Prize. It’s about peace. And a thing that works contrary to idiotic nationalist tendencies (which can lead to violence and war) should not be casually set aside.”

20 Mitchell-ek hauxe dio:

“bill says:

Dear JWM (at 2016/02/23 at 17:27) and others. As to Yanis Varoufakis’s grand plan for a Pan European Left Movement – please read the critique from my current co-author Thomas Fazi – https://www.socialeurope.eu/2016/02/a-critique-of-yanis-varoufakis-democracy-in-europe-movement-diem25/

The plan is a pipe dream.

best wishes

bill”

joseba says:

IMF chief Christine Lagarde: Idea of Brexit causing anxiety around the world

IMF says Brexit ‘pretty bad to very, very bad’

joseba says:

BREXIT THE MOVIE FULL FILM

https://www.youtube.com/watch?v=UTMxfAkxfQ0

Lexit The Movie: The left wing case for Brexit

https://www.indiegogo.com/projects/lexit-the-movie-the-left-wing-case-for-brexit#/