Bill Mitchell-en artikulua: Fiscal policy is a potent instrument for productivity growth1

Historia berrian egindako esperimenturik makabroena: Grezia eta Troika2.

Artikuluan ukitutako punturik garrantzitsuenak:

(a) Euroaren aldeko propaganda, egiturazko erreformak eta austeritate fiskala3

(b) Alternatiba bakarra, produktibitate handiago ekarriko lukeena, baita nazioarteko lehiakortasun handiagoa ere4

(c) NMF-k (aka IMF) emandako bira garrantzitsua5

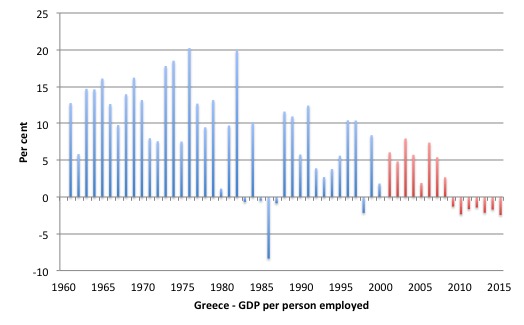

(d) BPG-ren hazkundea per hiritarra 1960tik 2015era6

(The red bars denote the period since Greece joined the Eurozone)

Argi dagoenez, lan-indarraren produktibitatea jaitsi da Grezia eurogunean sartu denetik, eta negatiboa izan da 2009tik, alegia, austeritateak eta ‘egiturazko erreformak’ hasi zirenetik.

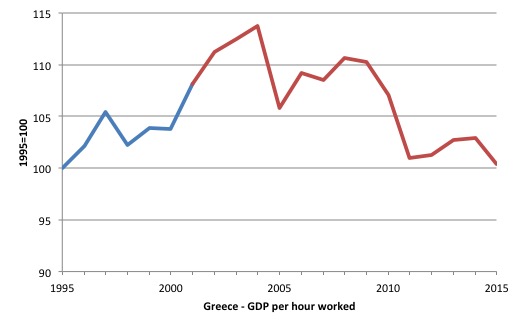

(e) BPG per lan egindako ordua, 1995etik (lehen konbergentzia prozesua martxan jarri zenetik) 20152ra

(The index is set to 100 at 1995)

Datuek erakusten dutenez, ez da egon inongo produktibitate-boomik ‘egiturazko erreformak’ eta austeritatea martxan jarri zirenetik. Alderantziz, produktibitateak per lan egindako ordua 1995an zeukan maila bera dauka 2015ean.

(f) NMF-k politika fiskalaz egindako aurre txosten berria7

(g) Grezian egindako triskantza eta gero, honela dio orain NMF-k:

“Fiscal policy can play an important role in stimulating innovation8”

(h) Orain eta ez hamarkada bat lehenago, edo 40 urte lehenago9

(i) NMF-k orain dioena BPG-z, inbertsio publikoaz, pizgarri fiskalaz eta oinarriko ikerketaz eta teknologiaz10

(j) Izan ere, NMF-k ikerketaz eta garapenaz bistakoa zena eta dena, orain adierazten du11

(k) Orain NMF-k gobernu gastuen garrantzia azpimarratzen du12

(l) Are gehiago, NMF berrikuntza publikoaren alde azaltzen da13

Beraz, Mitchell-en galdera,

“So why would we allow governments to cut spending in these areas, especially in times of recession, where growth is needed?”

Izan ere, ikerketa eta garapenerako, kontra-ziklotasun (countercyclicality) fiskala ona da:

(m) NMF txapelduna izan da zikloaren aurka gastu publikoa mozteko, gastu pribatu murrizten edo ahul denean14

(n) DTM-k, eta Michell-ek berak, erakutsi duenez, gastu pribatua murrizten edo ahul denean, egoera fiskalak defizitera mugitzea gomendatzen du15

(o) Baina 2016ko Fiscal Monitor delakoan, aldaketa irakurri ahal da16

(p) Aspaldian ezagutu genuen17

(q) Gauzak argi fiskalitatea dela eta18

(r) Politika fiskala eta merkatuaren porrota19

(s) NMF-ren ondorioak eta Mitchell-en iruzkinak20

Ondorioak:

(u) Hasteko, begira berriz goiko irudiak, Troikak Greziari, produktibitate-hazkundea dela eta, inposaturiko politiken emaitzak

(v) Parekatu hori, orain NMF-k berak dionenarekin, politika fiskala dela eta

(x) NMF-ren Imagine What Fiscal Policy Could Do For Innovation irakur daitekeenez,

“Can you imagine Keynes and Schumpeter smiling together?”

Horrela esplikatu al da orain dela gutxi eta orain Grezian egindako triskantzak edo eta aspaldian Hirugarren Mundu osoan zehar egindakoak?

Keynes eta Schumpeter barik, orain DTM21 (eta Bill Mitchell, noski) eta Mariana Mazzucato22 ditugu gidari. Nahiko eta sobera!

2 Mitchell-en hitzez: “Greece has been a living experiment for the neo-liberal Groupthink machine that is the Troika. (…) The Troika is conducting different types of experiments on the citizens of Greece, which defy reason, and which also have had devastating effects.”

3 Ingelesez: “… in Europe and its technocratic squawk squad (SS) embedded in the European Commission bureaucracy, the ECB, the IMF and various so-called ‘think tanks’ that continually pump out pro-Euro propaganda disguised as research – more structural reform, more fiscal austerity.”

4 Ingelesez: “Apparently, this scorched earth approach is the only alternative and will deliver higher productivity, increased international competitiveness and underpin a return to prosperity. Greece is on the front line of this approach.”

5 Ingelesez: “IMF, or at least segments within the IMF, are admitting that and producing research that supports the opposite case – the Modern Monetary Theory (MMT) case – that expansive “fiscal policy is a potent instrument for productivity growth through innovation”. Correct!”

6 Ingelesez: “… a graph produced using data from the European Commission’s – AMECO Database – which shows the growth in Gross Domestic Product per person employed for Greece from 1960 to 2015.”

7 Ingelesez: “Last week (March 31, 2016), the IMF published a pre-release of their next – Fiscal Monitor April 2016 – which comprised the complete – Chapter 2: Fiscal Policies for Innovation and Growth.”

8 Ingelesez: “After years of inflicting massive hardship on Greece in the form of harsh fiscal cutbacks and huge attacks on the working pay and conditions, income support and pensions and other aspects of Greek society that help to make it inclusive and supportive of the disadvantaged, the IMF now has the temerity to write:

Against a backdrop of mediocre medium-term growth prospects, identifying policies that could lift productivity growth by promoting innovation is critical. Fiscal policy can play an important role in stimulating innovation through its effects on research and development (R&D), entrepreneurship, and technology transfer.

It makes one think that this institution is living in a parallel universe.”

9 Ingelesez: “They now claim that “New analysis … identifies areas in which fiscal policy should do more”. It is a pity they didn’t understand this a decade or so ago.

But even more so, it is a pity they didn’t understand this 40 years ago as they embarked on their so-called ‘structural adjustment programs’ (SAPs), which they inflicted at great cost on the poorest nations in this world.”

10 Ingelesez: “The IMF now claims that:

1. Advanced economies can boost their long-term GDP by 5 per cent and “can achieve this dividend through well-designed policies that include fiscal R&D incentives and complimentary public investments in basic research.”

2. “fiscal R&D incentives … particularly during recessions … play an important role in supporting R&D investment”.

3. “In emerging market and developing economies, investment in education and infrastructure strengthens their capacity to absorb technologies from abroad.”

All of these claims would represent the antithesis of fiscal austerity and the harsh SAPs that the IMF has pushed for years.”

11 Ingelesez: “The IMF states the obvious that: R&D expenditures are widely seen as a key driver of TFP [Total factor productivity] growth. To promote these expenditures, governments can either invest directly in R&D (through public universities, government research institutes, and defense-related research) or design policies that encourage firms to undertake more private R&D.”

12 Ingelesez: “But now the IMF is stating the importance of government expenditure in this area, these mainstream economists will forget their previous exhortations for government to cut public expenditure.

The IMF quotes data that shows that US firms “shifted away from doing basic scientific research” between 1980 and 2007.”

13 Ingelesez: “The IMF also notes that:

Private R&D investments chosen by individual firms might be lower than the socially efficient level because of two important market failures: credit constraints and externalities.

Heterodox economists have long understood the importance of public support from research and authors such as Mariana Mazzucato have recently brought into relief the facts that the major innovations and advances in our time are spawned by strong state involvement – both direct and in terms of funding.

The private ‘market’ does a bad job in this area without strong fiscal support.”

14 Ingelesez: “The IMF has been one of the champions of so-called ‘fiscal consolidation’ – which really means cutting net public spending against the cycle – when private spending is also contracting or weak.”

15 Ingelesez: “As we know, when private spending is contracting or weak, the fiscal position will move further into deficit (typically) as a result of the automatic stabilisers (falling tax revenue and rising welfare spending) without any discretionary change in government fiscal policy parameters.

The rising fiscal deficit has been held out by the likes of the IMF as a precursor to government insolvency, which has to be avoided by so-called ‘fiscal consolidation’. The IMF has led the way in what we call pro cyclical fiscal adjustment.

Please read my blogs – IMF agreements pro-cyclical in low income countries and Exploring pro-cyclical budget positions – for more discussion on this point.”

16 Ingelesez: “In the April 2016 Fiscal Monitor, they write instead that:

Fiscal stabilization policies can promote R&D investments by helping dampen recessions. Firms may encounter difficulties in obtaining funding for R&D investments because R&D often involves a high level of risk, significant fixed costs, and returns that materialize only in the medium to long term. Firms’ ability to borrow can be especially impaired during recessions, when liquidity risks are more prevalent. By reducing business cycle volatility, a more countercyclical scal policy can pave the way for greater private R&D.”

17 Ingelesez: “But then we knew all this all along, which is one of the advantages of discretionary increases in the fiscal deficit when times are tough to provide sufficient spending to improve confidence and, more specifically, promote R&D.

The IMF produce “new analysis” which shows that “that higher fiscal countercyclicality increases R&D expenditure significantly more in industries that are highly dependent on external finance.””

18 Ingelesez: “Let us be clear:

1. Fiscal austerity equals fiscal procyclicality.

2. Fiscal countercyclicality means discretionary increases in government net spending in times of lower activity – that is, higher fiscal deficits. The anathema of what the IMF has been pushing on beleagured nations.”

19 Ingelesez: “Fiscal policy is essential to correct market failure

The IMF also argue (NOW!) that “domestic social rates of return to private R&D are generally estimated to be two to three times the private return” and “that market forces will lead to an underinvestment in R&D compared with the level that is socially efficient”.

Who would have ever though!

So the market is incapable of delivering sufficient R&D. Solution?

We knew all along …

The IMF say:

This underinvestment can be addressed by corrective fiscal instruments that provide incentives for private R&D. Fiscal incentives such as tax credits and direct subsidies can lower the private cost of R&D so that firms are inclined to invest more, which is socially desirable because other firms will benefit, too.“

20 Ingelesez: “The upshot is that the IMF conclude:

1. “Good fiscal stabilization policies promote R&D” – so why would we continue to support pro-cyclical fiscal cuts?

2. “Governments should do more to boost R&D” – by increasing deficits!

3. “Governments can invest more in public R&D, such as basic scientific research, which will advance firms’ own research activities”.

4. “Technology transfer in emerging market and developing economies requires better institutions, education, and infrastructure.” So why would we support policies (advocated in the past by the IMF) that attack basic education, training and health infrastructure in poorer economies?”

21 Ikus Fidei defensor.