Bill Mitchell-en The ECB could stand on its head and not have much impact1

Ukitutako punturik garrantzitsuenak:

(a) EBZ-ren rola eurogunean

i) Komentatzen ez dena: austeritatea fiskala2

ii) Politika monetarioa eta ziklo ekonomikoa: bion arteko harremana ez da existitzen3

iii) Banku maileguak ez daude zuzenki lotuta EBZ-ren interes tasei4

iv) Neoliberalismoak ez du funtzionatzen5

v) Euroguneak hedakuntza fiskala behar du6

(b) 2015eko hasieran EBZ-k emandako txostena, inflazioa kontrolatzearren7

vi) Txostena kea da8

vii) Merkatu prezioa eta gobernua9

viii) Prezio egonkortasuna10

ix) EBZ-k Japoniako banku zentralak bezalaxe11

(c) Txostena 2015eko abenduan birmoldatu zen, hasierako programak deus gutxi lortu zuelako12

x) Inflazio baxua zen13

xi) Diru merkea, baina bezerorik ez14

(d) Politikaren esanahi operatiboa bestelakoa zen15

e) Porrot errepikakorrak16

xii) 2014ko abenduan17

xiii) 2015eko irailean18

(f) Arrakasta saltzen zuen Draghi-k19

(g) Errealitatea bestelakoa zen20

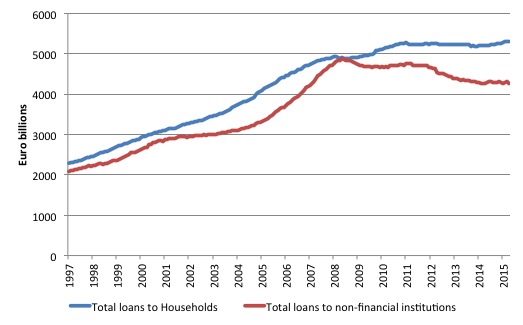

(The boom then the crash. While the household credit aggregate is now higher than before the crash, but only just; business borrowing remains well down and despite the ECB manoeuvres appears to be going nowhere up.)

(h) Europako gaixotasuna ez da konpondu21

(i) Ondorioak

xiv) Politika monetarioari dagokionez, EBZ-k moneta-jaulkitzearen ahalmena erabili ahal du “to prevent a massive financial meltdown.”

xv) Halaber, EBZ-k euroguneko gobernuak porrotera ez joateko geldiarazi ahal ditu, “as it did between 2010 and 2012 with the Securities Markets Program.”

xvi) Baina politika monetarioak ezin duena egin zera da, “(to) reverse a major recession where mass unemployment and income losses create deep pessimism among households and firms.22”

(j) Politika monetarioaz eta fiskalaz, azken hitzak

Esan dezagun berriz, ozenki,

“The big motor is fiscal policy and because of the flawed design in the Eurozone it is dysfunctional in the extreme. Central bank policy shifts can do little to counter the damage that fiscal austerity is doing in Europe.”

2 Ingelesez: “… the major factor that is not usually mentioned when commentators talk about ECB policy changes and the likely impacts is the on-going and manic fiscal austerity in the Eurozone, which puts the whole region in a recession-type straitjacket, where monetary policy changes, weak in impact at best, have little hope of achieving anything positive.“

3 Ingelesez: “The logic of the reliance on monetary policy for counter-stabilisation is also built on a failure to understand what drives the economic cycle.”

4 Ingelesez: “The belief that banks will suddenly lend just because the central bank imposes a tax on their reserve deposits (negative interest rates) or offers them cheap loans to on-lend to households and firms is misplaced.“

5 Ingelesez: “Banks do not loan out their reserves and firms will not borrow from banks no matter how cheap the money is if there are no profitable opportunities to pursue. It is time the authorities abandoned their neo-liberal myths and got real.”

6 Ingelesez: “The Eurozone needs a massive fiscal expansion and it needed it 7 or 8 years ago. The ECB is the only institution in the flawed system that can provide the financial resources to make that happen and it could, with Brussels approval, bypass the ‘no bailout’ clauses in the Treaty to make that happen. It won’t, and the Eurozone will muddle on with increased poverty rates and rising social instability. What folly!”

7 Ingelesez: “The ECB launched its – Expanded Asset Purchase Program (APP) – in early 2015 and announced that:

The programme is designed to push inflation and inflation expectations back to levels closer to the ECB’s objective in the euro area as a whole.

When the question – Is the asset purchase programme monetary financing is asked – the ECB replies (Source):

The ECB strictly adheres to the prohibition on monetary financing by not buying in the primary market. The ECB will only buy bonds after a market price has formed. This ensures that the ECB does not distort the market pricing of risk.“

8 Aurreko oharrean aipatutakoa “… is smoke and mirrors because the primary buyers of the government debt know with some certainty, given the size of the APP that the ECB will buy the debt they wish to off load.”

9 Ingelesez: “The claim about not distorting “the market pricing of risk” is largely relevant to the fact that the ECB is keeping governments afloat in the Eurozone.”

10 Ingelesez: “While the ECB says the APP is all about “maintaining price stability” it also says that the program will:

… also help businesses across Europe to enjoy better access to credit, boost investment, create jobs and thus support overall economic growth, which is a precondition for inflation to return to and stabilise at levels close to 2%. Subject to price stability, these are also important objectives to which the ECB contributes in line with the Treaty. “

11 Ingelesez: “So like the bank of Japan, the ECB claims that pushing more reserves into the banking system will act as a stimulus measure to lending.

The ECB says that there will “Monthly purchases in public and private sector securities will amount to €60 billion” and they “are intended to be carried out until the end of March 2017”, on current estimates of the inflation trajectory towards their desired target of 2 per cent.”

12 Ingelesez: “The initial program was ‘recalibrated’ by the ECB in December (hence the ‘expanded APP’ nomenclature) after the intital program didn’t seem to do too much and so-called “new downside risks” have “threatened the outlook for price stability” (see January 25, 2016 Speech by Mario Draghi – How domestic economic strength can prevail over global weakness).”

13 Ingelesez: “Draghi said that:

With inflation already low for some time, we saw a danger that a continued period of low inflation – even if oil-driven – might destabilise inflation expectations and become persistent.”

14 Ingelesez: “The ECB essentially is providing cheap money to banks as long as they on-lend to targetted businesses (small and medium-size).

The presumption was that banks are not lending enough because they do not have sufficient funds, which, of course, is a nonsense. The banks have not been lending because there are not huge swags of borrowers knocking on their doors to borrow given the disastrous shape the Eurozone has been in.

Accomapnying (…) was the ECB introduction of negative interest rates on bank reserves deposited at the ECB. The ECB’s Deposit Facility Rate (DFR) was set at minus 0.10 per cent on that day, lowered to -0.2 per cent on September 4, 2015 and then to -0.3 per cent on December 9, 2015.”

15 Ingelesez: “The operational significance of the policy shift is that the:

… banks that have more funds in their account with the ECB than what they need to fulfil their reserve requirement lose some money. Suppose, for instance, that a bank has €100 million of excess reserves continuously for one year, then at an interest rate of -0.20% it receives back € 99.8 million, so the cost of depositing funds with the ECB for a full year is € 200,000.

So if the cost of holding physical notes and coins exceeds the tax (negative interest rate), then banks will pay the tax. Otherwise, they will convert excess reserves into physical currency.

The logic expressed at the time was the same as the Bank of Japan used last week – to create an incentive for the banks to lend more instead of paying the tax (the negative interest rate).

It also was intended to reduce the deposit rates paid to individual bank customers which would apparently stimulate more spending.”

16 Ingelesez: “You will find a sequence of speeches from ECB senior officials over the last several years with the same message of failure being repeated, although you will not read or hear them talk of failure.”

17 Ingelesez: “For example, ECB Executive Board member Peter Praet told the Peterson Institute in Washington, D.C. on December 9, 2014, that:

The fact is that – despite our broad-based measures and the associated fall in private borrowing costs – inflation has not stopped trending down.”

18 Ingelesez: “By September 9, 2015, he was telling a conference in Luxembourg that:

During the second quarter of 2015 credit standards continued to ease for firms, and even more so for households. Reflecting the endogenous relationship between credit supply and demand, credit demand also increased among both groups driven mostly by the low level of interest rates.”

19 Ingelesez: “Certainly Mario Draghi and his officials are touting success – or were a few months ago. Draghi told a German audience last week (January 25, 2016) that “bank lending rates have fallen by 80 basis points for the euro area, and by between 100 and 140 basis points in the countries hit hardest by the crisis” and:

What this shows is that, even when rates are at zero, we can achieve the effect of a sizeable rate cut through unconventional measures. Overall, it’s clear that the impact of the APP on confidence, credit and the economy has been substantial.“

20 Mitchell-en hitzak: “Well I studied the latest monetary data from the ECB yesterday and wondered whether all these unconventional monetary policy initatives have shown any fruit.

Well what the data shows is something different.”

21 Ingelesez: “It is clear that the malaise in Europe has not yet lifted: firms are reluctant to invest (and hence borrow) because of slow sales, while households have also been subdued in their borrowing given the elevated and persistent levels of mass unemployment, the hangover of the credit binge (that is too much debt already), and the general policy uncertainty where Brussels appears not to have a clue as to which way to turn.”

22 Izan ere, “This is especially the case where the relevant fiscal authority (a questionable term in the case of the Eurozone) is intent on maintaining a straitjacket of austerity, which chokes off any green shoots in economic activity.”