Atzo goizean HamaikaTB-ko lagun batzuekin egon nintzen Santurtziko portuan, grabatzen. Grezia zen gaia. Esandakoa laster plazaratuko dute. Hurrengo astean agian?

Etxera itzuli eta Bill Mitchell-en artikulu mamitsua ikusi nuen. Hona hemen, elkarrizketa hura azaldu baino lehen, eta bera ongi eta sakon ulertu ahal izateko, Greziako azken bilakaeraz jabetzeko zenbait ideia argi.

(Bien bitartean eskerrak Nagore, Lander eta Anderri, bihotzez!)

Mitchell-en artikulua: The total Greek election farce – RIP democracy1

Punturik garrantzitsuenak:

(a) Azken hauteskundea fartsa zen2

(b) Demokraziak hiritarrei kalte egiten dien gobernuaren aldaketak suposatzen ditu3

(c) Boto emaileen apatia4

(d) Nor da nor? Tsipras eta Troika5

(e) Tsipras umiliatua izan da6

(f) Popular Unity delakoaren porrota7

(g) Troikaren eginbeharra eta zorra8

(h) Zorrak ez ote dauka irtenbiderik?9 Drakma berria

(i) Eurogunearekiko atxikimendu itsua10

(j) Ezkerra, non ote?11Galdua, erabat

(k) Grexit delakoarekiko beldurra12

(l) Drakma berria eta depreziazioa: nekez gertatzeko13

(m) Australiako esperientzia14

(n) Eszenatokirik okerrenean ere hobeto eurogunean baino15

(o) Greziako inportazioen igoera?16

(p) Autoritate fiskalaren gabezia eurogunean17

(q) M. Draghi18: erdigune politiko baten beharra, “that can take the relevant fiscal, economic and financial decisions for the euro area as a whole…”

(r) Mitchell eta Draghi19: gezurretan ote Draghi?

(s) Alemania eta Troika20: Alemaniak barnerako ahalbidetzen duena ez du permititzen eurogunerako

(t) Alemania eta eurogunea21: Alemaniak oso ongi ulertu zuen euroak zekarrena

Ondorioz, Mitchell-ekin batera, hauxe esan daiteke:

“The Greek election was a farce really. Whatever spin one wants to put on it – it was a farce22.”

2 Ingelesez: “Last weekend, the Greece people (or a declining proportion of them) elected a new national government. It was a farce. There was no competing electoral mandates sought. The population know what is in store for them. The policy mandate in force wasn’t even supported by popular vote. It comes from the Troika, which now effectively governs the Colony of Greece. The new Prime Minister, who sold the people out prior to the election, is now talking about making changes. Yeh, right! He is now just a tool for the Troika.”

3 Ingelesez: “Democracy is about the people being able to change governments that do them harm. In the Eurozone that is an old-fashioned idea. National elections have become a sop, a pretense. And the people knew it and stayed away in droves. The Greek election was a total farce – democracy died.”

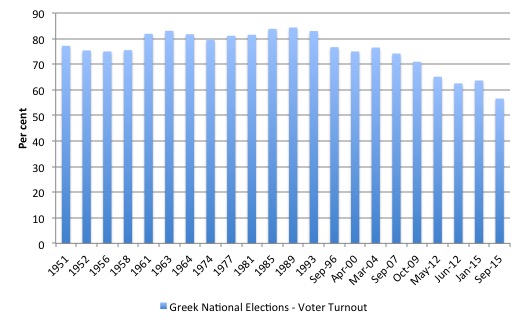

4 Ingelesez: “Data from the – Ministry of Interior and Administrative Reconstruction – shows that voter apathy is at an all-time high. The following graph shows the voter turnout as a percentage of total registered voters. In the January 2015 National Election 63.62 per cent of registrants voted. By September 2015, this proportion had dropped to 56.57 per cent, which can only be interpreted as Greeks giving up on the democratic process. To put that in perspective, in June 2015, 62.5 per cent of the registered voters turned out to vote in the so-called “bailout referendum”, which is the proportion that has been voting at national elections in recent years. The drop in votes between the January and September national elections amounts to some 694,610 people choosing not to vote (relative to the registrations in September).”

5 Ingelesez: “Syriza leader Tsipras is now talking about overturning the oligarchs and gaining debt relief from his Eurozone masters in the North. The first is fanciful given it is the interests of the oligarchs that the Troika is really protecting. The second is largely irrelevant to the immediate plight of Greece a dramatic shortage of spending and income. With low interest rates on the outstanding debt, the issue of debt relief is rather moot. The constraint is the pernicious bailout agreement not the debt interest payments.”

6 Ingelesez: “He [Tsipras] was humiliated just a few months ago by the political elites in Europe. He accepted a bailout deal that has little hope of delivering any long-term prosperity and was worse than what was on the table before the January election.”

7 Ingelesez: “The lack of electoral support for LAE (Popular Unity), the left-wing breakaway from Syriza – they received 2.9 per cent of the vote and no seats (meaning all their Syriza parliamentarians from the January election are gone – probably demonstrates the fear of exit. Other factors might explain their lack of showing. For example, it is hard to mobilise a new political party in a few weeks.”

8 Ingelesez: “The Troika technicians overrule the elected officials. The elected officials only have ‘tenure’ as long as they are doing the bidding of the Troika which is made up of unelected, unaccountable and foreign elites. In this context, the debt relief argument is really somewhat secondary in importance.”

9 Ingelesez: “That is not to say that I would keep paying the debt. The best thing for Greece is to leave the Eurozone and redenominate the debt into the new currency. That is superior to defaulting. Then the debt holders have an incentive to keep the new currency as close to parity with the euro as possible.”

10 Ingelesez: “There will be many books written about this period and will focus on why the Greek people continue to vote for governments that overtly and obviously damage their prosperity and in some cases, drive people to suicide. How is it that the Greek people are so wedded to the membership of the Eurozone despite it delivering this sort of poverty and anguish? (…)

How is it that the left-wing political parties, like Syriza, can actually openly compete for power when they know they are just going to be operatives of the Troika and introduce policies that are the anathema to their stated policy agendas? These are not just trifling differences in policy emphasis. Syriza is now elected to push through policies that are totally at odds with the mission of the party. The whole process has made a mockery of what democratic politics is. The Eurozone bullies – the Troika – have now totally compromised the political process in Greece – it is nothing more than a colony.”

11 Ingelesez: “But what I learned from my brief visit to Portugal recently was that the ‘left’ (by which I mean those who advocate progressive views on almost everything) are lost when it comes to economic understanding about the alternatives to membership of the Eurozone. They know that Eurozone membership with its accompanying austerity is bad for the nation and especially the poor but have come to believe that life outside the Eurozone would be worse and the nation would be unviable. The same sort of syndrome is operating to condition the attitudes of the Greek voters and I identified it was prevalent among so-called ‘left-wingers’ in Italy when I was there in November 2014.”

12 Ingelesez. “They start with a plea – “what would happen to the currency?” and follow it with “where would the jobs be?” They have been led to believe that an exit would see the currency depreciate to ridiculously low levels, imparting hyperinflationary pressures and dramatically cutting their real wealth. They haven’t studied history closely.”

13 Ingelesez: “It is quite possible that the currency would not depreciate much in the early stages of the exit. Remember supply and demand. There is no Greek currency at present. The exit situation is quite different to a nation coming off a peg. In the latter case, there is already a substantial supply of the currency in the markets. As soon as the government announced the exit and that all tax liabilities (and other legal payments) had to be made in the new currency, then the demand would soar even if consumers continued to use the euro in daily transactions. They would soon work out that they had to get the new currency or go to prison for tax evasion! So initially, the supply would be short relative to demand. Additionally, (…) if all the outstanding public debt was redenominated into the new currecy, the debt holders would have an incentive to keep the exchange rate as close to unchanged as possible or else take losses on the conversion back into euros. Later on, as the currency became more widely available some realignment with the euro might occur depending on what happened to the external balance. If Greece started to run large currency account deficits then the currency would adjust downwards. But a collapse in the currency (whatever that actually means) is unlikely.”

14 Ingelesez: “I note that Australian dollar is currently at 70.3 cents against the US dollar (as of yesterday). This time two years ago it was at 93 cents and in April 2013 was above parity. Is that a ‘collapse’? Has the sky fallen in on us? The weather has been bad the last few days but the sky is still up there! Similarly, in November 1996 it was at 80 cents and by March 2001 it was at 49 cents. Was that a ‘collapse’? I was around at that time and didn’t notice the sky fall in. I did notice that travel abroad became more expensive as did imported luxury cars. But not a lot of angst! I realise the factors that drive the Australian dollar are probably quite different to those which might drive the value of Greece’s new currency...”

15 Ingelesez: “But can anyone seriously believe that exchange rate movements that would accompany an exit really wipe of more than 25 per cent of real GDP and national income? Even in ‘value’ terms, if the terms of trade swung so far, prices in Greece relative to the rest of Europe would be so low that the German tourists would be flooding into the place to holiday even if the tourist infrastructure has been degraded somewhat by the years of austerity and underinvestment. In other words, even a worst case scenario on the exchange rate front would probably not go anywhere near eroding national income in the way that membership of the Eurozone has.”

16 Ingelesez: “The second question relates to the decline of manufacturing and industry in general and the reliance on imports for a good proportion of the consumed goods and services. What would Greece produce? Well, lots of things. And a floating exchange rate would generate new opportunities. (…) it exports its world class olives to Germany and Italy for processing into olive oil. If the exchange rate depreciated somewhat, then it would provide incentives to local processors to start up and investment would be attractive in that sector. There are many examples such as that.

But Greece still has factories. It still has a world class shipping (construction, maintenance, transport) sector. It still has the sun shining over its beautiful islands. The people still have skills. In the adjustment period, real standards of living measured in imported goods and services might lag domestic growth (as the terms of trade move against Greece – if that happens). But I cannot see that being sustained given the natural assets that the nation has. It is clear though that Greece is just part of the disaster. Some 7 years into the crisis and the Eurozone elites really haven’t come to terms with the fundamental problem nor any viable and timely solutions.”

17 Ingelesez: “The creation of a federal fiscal authority embedded in the European Parliament, which would have resources to deal with asymmetric spending collapses such as the GFC, would solve the dreadful design flaws in the monetary union, as long as the fiscal rules were relaxed so that fiscal policy had sufficient amplitude to operate effectively. But such an authority will never emerge given the cultural differences among nations and their unwillingness to give up what they mistakenly see as their economic policy sovereignty. It is a curious concept of sovereignty. None of them issue their own currency. None of them can float the currency they use. None of them have the capacity to set interest rates. None of them can protect the integrity of their own financial systems (banks etc).”

18 Ingelesez: “So the suggest made by Mario Draghi (ECB boss) in his – President’s introductory remarks at the regular ECON hearing – to the Economic and Monetary Affairs Committee of the European Parliament yesterday (September 23, 2015) seems rather fanciful – more grandstanding than commitment.

Draghi said that:

… despite the best efforts of all actors involved, the crisis has shown that monetary union requires a political centre; a centre that can take the relevant fiscal, economic and financial decisions for the euro area as a whole in a swift and transparent manner with full democratic legitimacy and a clear set of responsibilities given to it by the legislators. It is in this spirit that I have called repeatedly for a move from rules-based coordination to sharing of sovereignty within common institutions.

He was referring to the proposals outlined in the so-called Five President’s Report – Completing Europe’s Economic and Monetary Union – which was released on June 22, 2015.”

19 Ingelesez: “If Draghi is trying to suggesting that the Report provided a pathway to a full fiscal union for the Eurozone then he is misleading the public and/or deluded( The five presidents of the Eurozone remain firmly in denial).

In the – Four President’s Report – released in December 2012, there was a suggestion that “an appropriate fiscal capacity, for the euro area” be investigated, including “common debt issuance”.

Nothing happened in that regard and by the time the fifth President (European Parliament head) was added to the cosy little group, lal mention of the possible establishment of a federal fiscal capacity has disappeared.

Further, any notion that there might be “common debt issuance” has been deleted with the regime change at the top of the European Commission (…)

The idea that the major economic policy decisions should be retained at the national level but be subjected to strict rules imposed by Brussels is as alive today as it was in 1991 when the whole fiasco was agreed upon.”

20 Ingelesez: “There was an interesting article by the German economist Michael Burda yesterday (September 23, 2013) – Dispelling three myths on economics in Germany – which put things into some perspective. He … noted that if one of the German states floundered (and he points to Bremen and Saarland as examples) then “While it appears plausible and perhaps unavoidable to bail out Bremen, Saarland (or Berlin), doing the same for ten million Greeks is another question”. So Germany is fine operating as a true federal system and will use the national coffers to ensure no state suffers disproportionately. But it is not prepared to place the nation (Germany) within a federation of Europe. It will never cede their sense of national purpose to a European-level fiscal authority. Nor will any of the other nations. They will allow the Troika to declare one of their own a colony with all the negative implications for citizens in that particular nation if it means their national interest is protected. They will tolerate pernicious policy regimes being imposed on other Member States of the Eurozone which they would not tolerate within their own federation of states...”

21 Ingelesez: “I have written before how German policy makers (and their advisers) clearly understood the implications of surrendering their currency long before the other nations seemed to cotton on.

They imposed internal devaluation in 2003 (Hartz labour market changes) to ensure their real exchange rate (international competitive) would remain even though the exchange rate would now be shared. The problem is that these early changes within Germany, that were introduced to advance German interests (of the elites but not the workers) set up destructive dynamics that eventually made the GFC worse. I have dealt with all that before. The suppression of domestic demand (spending) in Germany through real wage restraint and low investment rates, the export of profits as speculative loans to the peripheral Eurozone economies, the property booms and growing external deficits in these nations, and then the collapse. The point is that none of the Eurozone Member States will cede what little policy autonomy they have to the European Parliament.”

22 Izan ere, “The bailout package that Tsipras agreed to requires accelerated and very nasty policy changes to be executed in October. The idea that a left-wing government would oversee that pernicious regime under direction from outsiders (the Troika) renders the democratic process in Greece void.”

joseba says:

Clinging to Power

https://www.jacobinmag.com/2015/09/greece-austerity-syriza-election-tsipras-varoufakis/

… Popular Unity member Stathis Kouvelakis analyzes Syriza’s trajectory, Alexis Tsipras’s leadership, and what was at stake in the ballot.

… But there was an alternative, the one that we proposed, namely to take our monetary sovereignty back in hand by leaving the euro.

(…)

Does Popular Unity have contacts with Yanis Varoufakis?

Yes, we have had contacts with Yanis Varoufakis, but for our part we considered that there were not enough points held in common in order for us to be able to go forward together. With Yanis Varoufakis it is difficult to say what we agree on and what we don’t. His statements are too contradictory — you don’t know what to expect with him.”

joseba says:

The Path not taken

https://www.jacobinmag.com/2015/10/greece-debt-tsipras-eurozone-syriza-draghi/

“What is required in Europe at present is more national work on exiting the EMU — French, Spanish, Italian, and, dare I say it, German.”

joseba says:

Defeat and Demoralization in Greece

http://therealnews.com/t2/index.php?option=com_content&task=view&id=31&Itemid=74&jumival=14835