Honi erantzuten: @EconEmotions

It’s a ‘one man’s savings is another’s debt’ world, and the causation is from loans to deposits, etc. 😉

Honi erantzuten: @johnrlaughlin

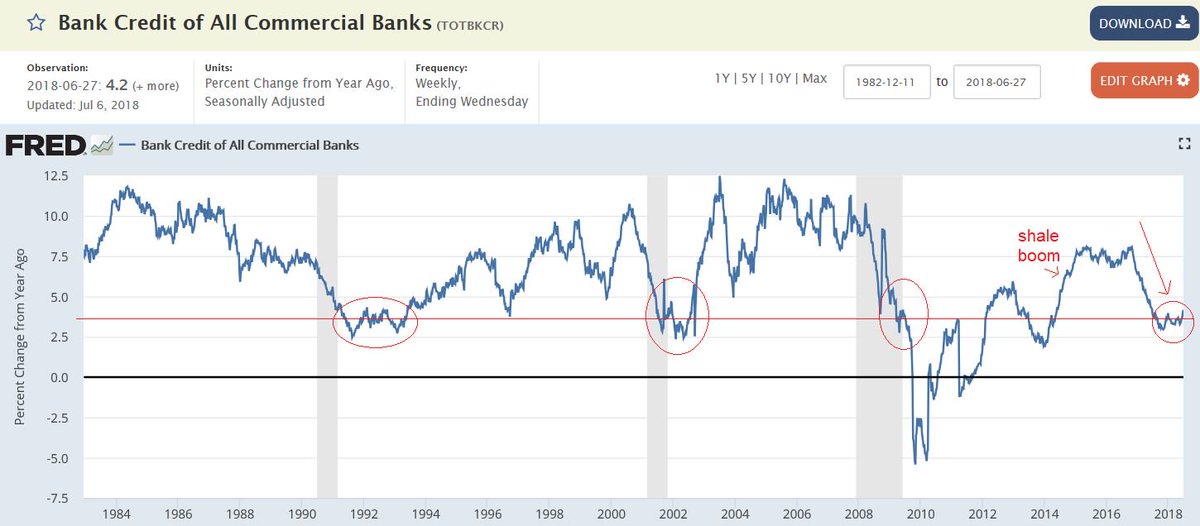

Yes, ‘savings desires’ grow and compound and need to be continually ‘offset’ by deficit spending- public or private- to sustain demand. See attached bank credit growth chart as a rough proxy for private sector deficit spending:

Hauei erantzuten: @RFrances2 @jessefelder

With my permanent 0% policy rate proposal risk adjusted returns on new investments go to 0.

Hauei erantzuten: @barua_ashish @katiecannon2 @organicfanatic5

Their policy options differ.

erabiltzaileri erantzuten @katiecannon2 @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

Yes, the tsy could mint the coin and sell it to the Fed. But either the Fed or Tsy has to pay interest on net spending if it wants a policy rate higher than 0%, so for all practical purposes nothing has changed?

erabiltzaileri erantzuten @netbacker @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

CB member banks are agents of the CB which is an agent of the state that legislates that said bank deposits will be accepted for payment of taxes.

erabiltzaileri erantzuten @netbacker @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

Tax liabilities are expressed in units of the state currency, so those units are best understood as tax credits. The state accepts its tax credits as the means of extinguishing its tax liabilities.

Hauei erantzuten: @MasaccioEW @runtodaylight

When the President was informed that there were 11 Brazilian children in detention he asked ‘how many zeros in a brazillion?‘ 😉

Warren B. Mosler @wbmosler uzt. 7

erabiltzaileri erantzuten @PDWriter @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

Banks debit and credit accounts on their own books. Banks don’t alter accounts on other bank’s books.

Warren B. Mosler @wbmosler uzt. 7

erabiltzaileri erantzuten @MineThis1 @PDWriter erabiltzaileari eta

erabiltzaileri erantzuten

“Deficit” and “surplus” are residual accounting information.

Warren B. Mosler @wbmosler uzt. 7

erabiltzaileri erantzuten @PDWriter @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

And the tsy then shifts those funds to its fed account as it doesn’t make payments from that commercial bank account?

Warren B. Mosler @wbmosler uzt. 7

Hauei erantzuten: @barua_ashish @netbacker

People confuse productivity stories (automation) with unspent income stories (unemployment).

Warren B. Mosler(e)k Bertxiotua

SerbanVCEnache @SerbanVCEnache uzt. 7

erabiltzaileri erantzuten @SerbanVCEnache @cullenroche erabiltzaileari eta

erabiltzaileri erantzuten

I guess the Chairman of the NY Fed back in ’46 was just drunk and writing fiction with this article? Right? http://bilbo.economicoutlook.net/blog/wp-content/uploads/2010/04/taxes-for-revenue-are-obsolete.pdf …