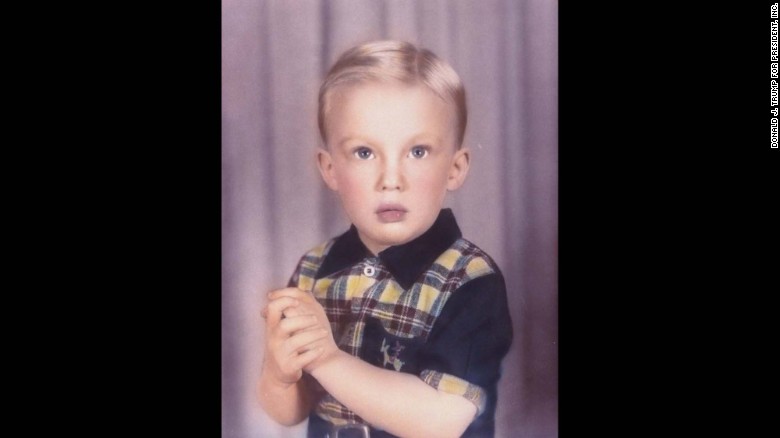

As previously discussed, President Trump is a case of arrested development, incapable of any adult thought:

Michael D’Antonio-ren The little boy president2

“Like most little boys, Donald Trump can be disarmingly honest, as when he once said, “When I look at myself in the first grade and I look at myself now, I’m basically the same. The temperament is not that different.” The trouble is that the first grader is now President of the United States, and his temperament is on display for the world to see.”

2017 mai. 13

Segida:

Shop to Win! My post about the President and trade policy: https://m.facebook.com/story.php?story_fbid=10213402304550859&id=1196858889 …

2017 mai. 27

Warren Mosler-en Shop to Win!4

Shop to Win!

(i) Inportazioak erosten direnean, lanpostuak galtzen dira

“The President no doubt knows that when you go shopping, buying at the lowest price is the mark of a winner, while paying too much is the mark of a loser. Yet when it comes to buying lumber from Canada and cars from Germany, the President viciously attacked those nations for not charging us enough for their products!

And while everyone knows that buying at the lowest price is a good thing, there is no serious pushback from Democrats, the ‘free trade’ Republicans, the media or any of the headline mainstream analysts. There is something very wrong with their underlying logic that leads to this type of costly Presidential blunder.

Yes, when we buy imports jobs are lost, just as when we replace workers with machines, including lawn mowers, vacuum cleaners, and power washers, jobs are lost. And yet somehow we’ve survived all that. We went from needing 99% of the people working to grow our food to less than 1%, and manufacturing jobs are down to only 7% of the labor force as well. And yet the remaining 90% of us are not all unemployed, as jobs have proliferated in the service sector, where most of those jobs are now considered to be better jobs and generally pay more than agricultural and manufacturing jobs. Nor has a trade deficit necessarily resulted in higher unemployment or lower pay. In 1999, for example, we had record imports with unemployment under 4% and inflation under 2%, and students were getting recruited for good paying jobs well before graduation.”

(ii) Enpleguko maila handiak sostengatzeko erantzuna ezaguna dugu, jadanik ikusita eta ukitua gure blogean, alegia, politika fiskala (zerga moztea edo gastu handitzea) erabiltzea, zor publikoaz arduratu gabe

“The answer to sustaining high levels of employment and pay is policy response. Yes, we are better off if we do the obvious and buy our imports at the lowest possible prices. And if weak demand at home is keeping unemployment too high or wages too low, the appropriate policy response is fiscal relaxation- either a tax cut or spending increase- and not to tax or otherwise drive up the cost of imports, even if that results in a higher public debt.

Yes, the right move in response to a slow economy is to cut taxes or increase public spending and let the public debt increase accordingly. Unfortunately however, the policy that allows us to pay the lowest prices for imports and have good paying jobs to replace those lost because of imports has been taken entirely off the table by both Republicans and Democrat. And this is the case even though lowering taxes or increasing public spending are direct benefits for their voters.

Sadly, a very good thing for America- lower prices of imports- has been turned into a bad thing- unemployment- due to an aversion to cutting taxes or increasing public spending. And we are at this counterproductive place for only one reason– fake news about the public debt that is supported by Republicans and Democrats.”

(iii) AEBko zor publikoa hauxe da: gobernu federalak gastatutako dolarrak eta zergak ordaintzeko erabili izan ez diren dolarrak

“The US public debt is nothing more than the dollars spent by the federal government that have not yet been used to pay taxes. Those dollars spent and not yet taxed sit in bank accounts at the Federal Reserve Bank that are called ‘reserve accounts’ and ‘securities accounts’, along with the actual cash in circulation. Treasury securities (bonds, notes, and bills) are nothing more than dollars in securities accounts at the Federal Reserve Bank, functionally the same as dollars in savings accounts or CD’s at commercial banks.”

(iv) Gobernuak dolar bat gastatzen duenean, dolar hori zergak ordaintzeko erabiltzen da eta galduta dago ekonomian, ala ez da erabiltzen zergak ordaintzeko eta ekonomian segitzen du

“Think of it this way- when the government spends a dollar, that dollar either is used to pay taxes and is lost to the economy, or it’s not used to pay taxes and remains in the economy. Deficit spending adds to those dollars spent but not yet taxed, which is called the public debt.“

(v) Zer ote da ‘zorra ordaintzea’, zer gertatzen zaie hilero Altxor Publikoko tituluei? FED-ek dolarrak aldatzen ditu, bere kontuetan, titulu kontuetatik erreserba kontuetara, zor bat eta kreditu bat besterik ez

“So how about what’s called ‘paying off the debt’ as happens to 10’s of billions5 of Treasury securities every month? That’s just a matter of the Fed shifting dollars from securities accounts to reserve accounts- a simple debit and a credit- all on its own books. And there are no tax payers or grand children in sight when that happens.”

(vi) Zor publikoa diru hornikuntza dei daitekeeneko osagai bat besterik ez da, ordaintze ezeko egoeran egoteko inongo arriskurik gabe

“Note that the ‘ability to pay’ is always there- it’s just a debit and a credit to accounts on the books of the Federal Reserve Bank. The fear mongering about the US running out of money or constraints by foreigners is simply not applicable to today’s monetary system. However, the ‘willingness to pay’ is a very different story, as Congress from time to time argues over the debt ceiling and threatens to block the Fed from doing its normal job. Default because Congress decides to default, even though it has the unrestricted ability to pay, is an entirely different and political matter.

Point is, once it’s understood that the public debt is nothing more than a component of what can be called the money supply, that there is no risk of default, there is no dependence on foreign or any other lenders, there is no burden being put on future generations, or any other of those trumped up fears both sides freely toss around, the President will be free to make us all better off by a great shopper who works to get us the lowest possible prices.”

PS: Gogoratu ondokoa: (In Prest gaude! Zertarako?)

”.. benetako ezkertiarrok, geure eginkizuna bete dugu, Donald Trump-en garaipena zorionduz behar den lekuan eta moduan…”

5 Amerikar bilioi bat = mila milioi europar.