Gogoratu Stephanie Kelton-en lana1:

Gehigarriak:

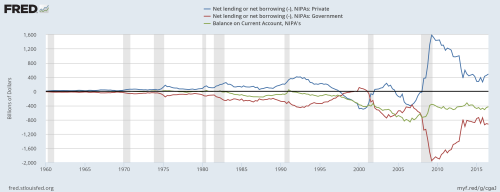

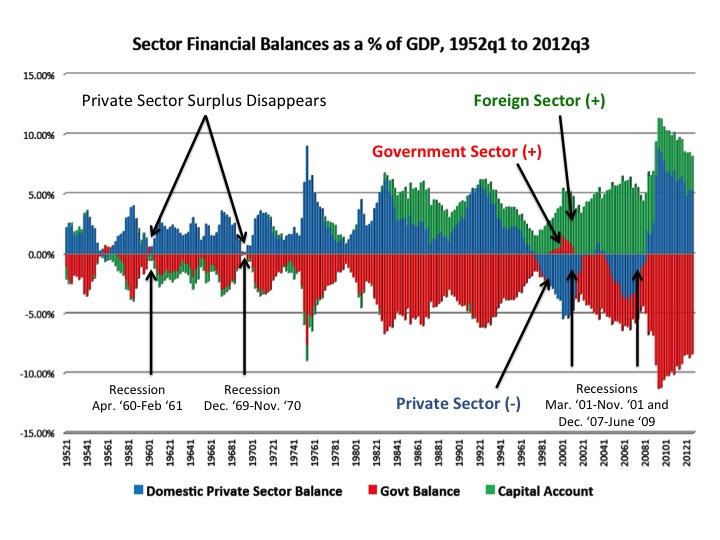

(i) Sektore balantzeak AEBn

Dirk H. Ehnts-en Data source for US sectoral balances (links to data and updated graph)2

A new year, a new look at the US economy:

These are the sectoral balances for the US, which can be accessed through FRED here:

ROTW (rest of the world = current account)

To get an updated version of the graph above you can click here to go to the FRED2 website.

It looks like the private sector is starting to save more and/or invest less. The government deficit has stabilized, and so has the current account deficit. Given that the dollar is expensive and global growth weak, demand from the rest of the world will be relatively weak. In order to grow demand must come from domestic sources then. The private sector, as I just wrote, does not seem to go on a spending binge (and into debt) right now, so it seems like expansionary fiscal policy is the way forward. Let’s see what 2017 brings.

(ii) Sektore balantzeak Europar Batasunean

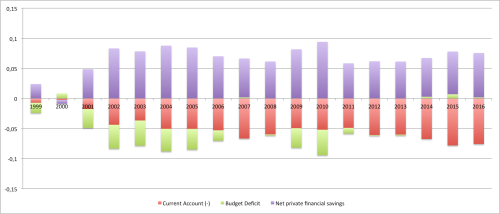

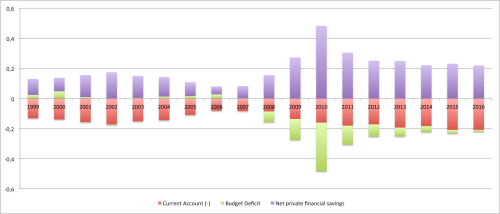

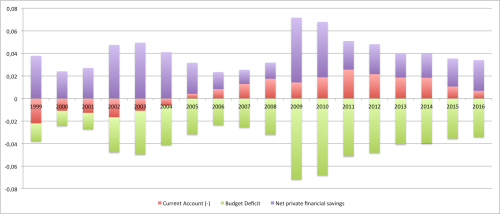

Dirk H. Ehnts-en Sectoral balances of the eurozone3

(…) the sectoral balances of the eurozone. The current account is inverted, the public deficit a deficit and the private sector financial surplus a surplus. Some of the recent data is probably a forecast. I let the data speak for itself for now. Just one comment: the only country not able to run a consistent and significant surplus in the private sector is Greece. This is situation is hardly sustainable as debts are more easily repaid when a surplus exists. Continuation of the debt structure into the future is hence possible, but not likely.

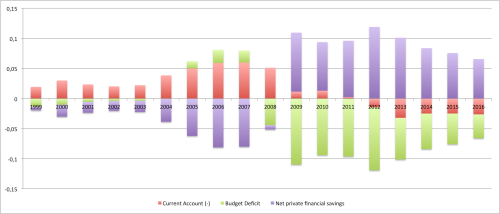

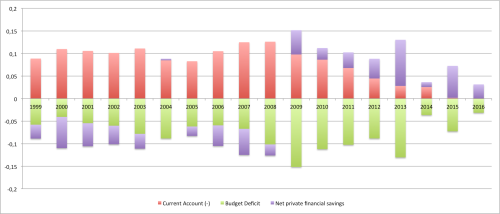

Here the sectoral balances (in % of GDP; data from AMECO):

Germany

Ireland

France

Italy

Spain

Greece