Albistea: China mantiene en sus manos gran parte de la deuda de Estados Unidos

Erdara batuan:

“China ha cedido su puesto como mayor tenedor de deuda estadounidense al registrar en octubre un descenso de 41.300 millones de dólares (39.334 millones de euros). Pese a ello, sigue siendo un importe considerable, ya que representa el 18,5% del total de la deuda de EEUU en manos extranjeras”

(1) Eta, zer?

Arazoa teklatuen bidez konpontzen da!

(v) DTM-k esaten duena gobernuaren gastuaz, atzerriko maileguz hartzeaz, hyper-inflazioaz, Eurolandiaz, Europar Batasuneko estatuez eta Europako Banku Zentralez1

(vi) DTM eta zor nazionala, Altxor publikoko tituluez eta Banku Zentraleko aurrezki kontuez2

(vii) Txinatik maileguz hartzea(sic)! Fed-en funtzionamendua (checking account delakotik savings account delakora) eta Altxor Publikoko tituluen epe-mugako funtzionamenduaz (Fed-ek dolar horiek -gehi interesak- aldatzen ditu Fed-en Txinak daukan savings account delakotik Fed-en Txinak daukan checking account delakora)3

Hortaz, gutxiegi (suspentsoa) ekonomian, albiste a-kritiko horri!

(2) Zorra (Warren Mosler)

@eachus @netbacker $ are tax credits. The debt is the $ spent by gov that haven’t yet been used to pay taxes, in $ accounts at the Fed.

2016 abe. 26

(3) Ez astotzeko zipriztin batzuk, askoren artean:

Sektore balantzeak eta gobernu defizitak

Globalizazioa, neoliberalismoa, nazio-estatua eta ezkerra

(4) Bukatzeko:

Sektore balantzeak direla eta, gogoratu ondoko hauek (in Euskoaren sormena, hutsetik):

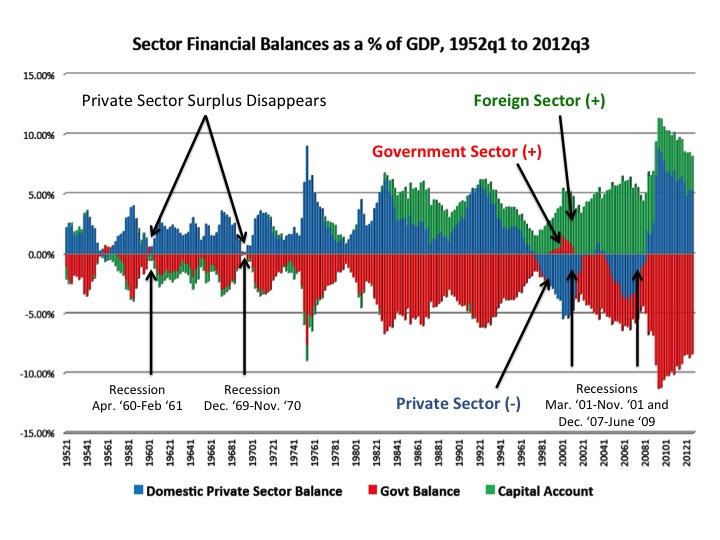

(i) Azken Atzerapen Globalaz: sektore pribatua defizitean, aktiboak galduz, eta gero eta zordunago bilakatuz. Zorrak azkenean ezin direlako ordaindu, krak edo hondamendia gertatu zen

Professor Kelton then goes on to show the graph of United States sectoral balances. Modern Money Theorists were predicting the Great Recession as early as the 1990s, because the private sector had gone into deficit, meaning the private sector was losing assets and becoming more and more indebted. That kind of thing is unsustainable for very long, and eventually results in a crash as debts can no longer be paid.

(ii) Bonoen salmentak, aurreztaileei interesak ordaintzearren. Dolarrak metatzen dituzten atzerritar inbertitzaileek zein atzerritar herrialdeek ez dute zamatzen barneko sektore pribatua. Gobernuak ez du behar zergak altxatzea bono-edukitzaileei atzera ordaintzearren.

And finally, Kelton demonstrate how bond sales work. First, a bond sale by the government is NOT “borrowing money,” but rather is a service to pay interest to savers. (The government doesn’t need its own currency back in order to spend, and you can’t even buy a bond until the government has first spent some currency into existence so that you have the bond). Investors and foreign nations who accumulate our currency (because they run trade surpluses against us) choose to buy our bonds because the bonds pay interest, while the cash they hold doesn’t. This in no way burdens the domestic private sector though: the government does not need to raise taxes in order to spend or pay back bondholders.”

Askoz gehiago UEUko blogean.

Ikasiko ote dute? Noiz?

1 Ingelesez: “In other words MMT teaches us there is no such thing as the U.S. Government running out of dollars, that the U.S. Government is not dependent on foreign borrowing to be able to spend, and that hyperinflation comes only from sustained over spending far beyond full employment and our capacity to produce. Nor can the U.S. government become the next Greece or Ireland. MMT teaches that financially, joining the euro zone put those nations into the positions of U.S. states. So while California or Illinois can become the next Greece or Ireland, and need a federal bailout to avoid default, just like Greece and Ireland needed a bailout from the European Central Bank, the widely proclaimed analogy of Greece and the U.S. Government is entirely false, and tragically counterproductive.”

2 Ingelesez: “And as for the U.S. national debt and all the talk about borrowing from China, MMT recognizes that U.S. Treasury securities are, functionally, nothing more than savings accounts at the Fed, which the Fed in fact happens to call securities accounts. Yes, the trillions of dollars of U.S. national debt is nothing more than that many dollars in savings accounts at the Fed. (…)” (1 trilio amerikar = 1 bilioi europar)

3 Ingelesez: “So when China buys Treasury securities, which we call going into debt to China, all that happens is the dollars they got from selling things to us that went into their checking account at the Fed, get shifted to their savings account at the Fed. And when we pay back China, which happens every month as some of their Treasury securities come due, all the happens is the Fed shifts those dollars (plus interest) from China’s savings account back to China’s checking account, all on the Fed’s books. (note: there are no grandchildren involved in this process!)”

joseba says:

MMT: US debt is a myth

https://www.youtube.com/watch?v=t3oZ21QG1dg