(1) Grezia: diru laguntza banku- eta korporazioetara joaten da

Who would have thought? Nork pentsatu izango zukeen?

Bill Mitchell-en artikulua: Greek bailout money goes to banks and corporations – who would have thought?1

Artikuluan aipaturiko punturik garrantzitsuenak:

(a) Grexit dela eta: Greziako inkestak2

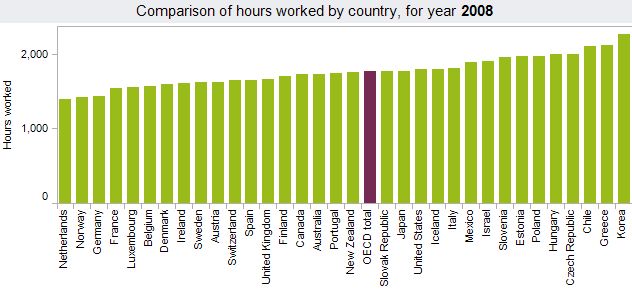

(b) Langile alferrak (greziarrak ote?)3

“Greek workers worked 2120 hours in 2008 while the German worker on average worked 1430 hours. The OECD average was 1764 hours.”

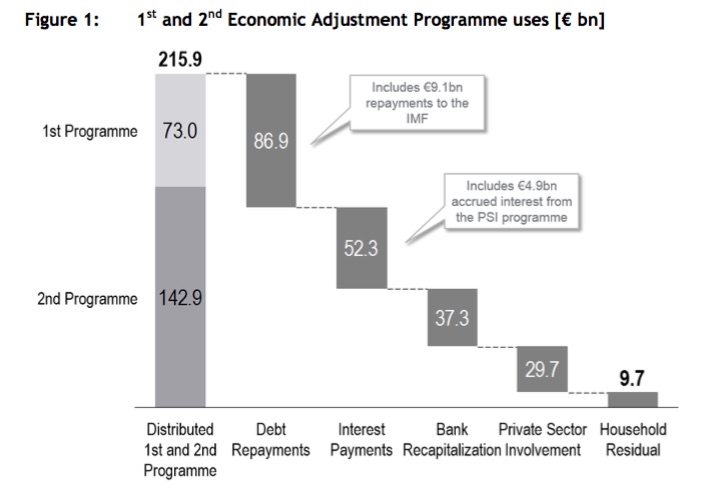

(c) Nora joan ziren Greziarako diru laguntzak?4

“Only €9.7 billion actually went into the Greek fiscal balance as ‘stimulus’. That is less than 5 per cent of the total funds went to help the Greek economy recover.”

(d) Nondik etorri ziren diru laguntzak5

(e) Nola erabili ziren lehengo bi diru laguntzak (ikus grafikoa)?6

(f) Autoreen ondorioak: irabaziak pribatizatu, galerak sozializatu7

“The point is that Greece urgently needs (and has done so for the last 7 years) a major fiscal stimulus”

(g) Mitchell-en ondorioak: puntako eskuinak, Syriza (neoliberalen alde) eta euroguneko munstroa8

Post Scriptum: Konparaketak

Konparatu, please, aurrean irakurritakoa Euskal Herrian gaur azaldu diren bi albisterekin:

(i) Greziarako akordioak desaktibatu du berehalako beste krisi baten arriskua

(ii) El Eurogrupo da luz verde a un nuevo desembolso de 10.300 millones para Grecia

Errealitatea (Mitchell-ek aurkeztu duena) eta gai berberari dagozkion EH-ko goiko bi albisteak bi mundu oso desberdinei dagozkie.

Hau dunk hau!

Segida:

(2) Desastre hutsa, totala

Artikulua: Europe’s liberal illusions shatter as Greek tragedy plays on9

(3) Varoufakis (the big bluff) tarte garrantzitsu baterako desastrearen kapitaina

Artikulua: Why Varoufakis’ DiEM2025 is fighting the wrong fight10

(Segituko du)

2 Ingelesez: “Earlier this week (May 23, 2016), the Greek public opinion polling agency – Public Issue – published its latest Political Barometer (No. 156) which reported on – Attitudes towards the European Union and the Euro. As at May 2015, the majority of Greeks polled did not believe that the EU has a future and a rising proportion now believe things would be better off in 1-2 years if Greece exited the euro and introduced its own currency (32 per cent as opposed to 18 per cent 6 months ago). Things are shifting. I also wonder what the next polls will say when the Greek people learn of the latest research that shows where all the Greek bailout money has gone? It is an appalling story really.”

3 Ingelesez: “Popular opinion, especially among the German population is that the Southern Europeans are to blame for their problems.

In the case of Greece, the view is that they cheated their way into the common currency, refuse to exert discipline on their public spending, refuse to pay taxes, and are lazy – prone to siesta.

Remember back in 2011 when the German Chancellor claimed at a CDU event that pensions and holidays were excessive in Greece (…)

For non-German reading readers – Merkel was attacking the early pension age and leave arrangements in Greece, Spain and Portugal.

This article is interesting – German public opinion is caught between scapegoating Greeks and love-bombing them.

But the ‘lazy southerners who do not work hard enough’ has been an on-going narrative for those who have tried to justify the vicious austerity that has keep the nation in depression for around 8 years already, with no end in sight.

For other evidence, please read these blogs:

2. I wonder what they will do with the new building.

In the latter blog, I posted this graph, which comes from the OECD and shows comparative data on working hours.

Greek workers worked 2120 hours in 2008 while the German worker on average worked 1430 hours. The OECD average was 1764 hours.

(…)

So they are not that lazy (at least in relative terms). Portugal’s workers also work harder than Australia and a lot harder than the Germans. And spare the thought … even those lazy latino Spaniards work harder than the Germans!”

4 Ingelesez: “The paper – Where did the Greek Bailout Money Go? – was written by the EMST researchers Jörg Rocholl and Axel Stahmer and makes for depressing reading.

The aim of the research was to trace “the flow of money for the different Greek bailout funds” and answer two questions:

1. Where did the money come from?

2. Where did the money go to?

The researchers produce this graph (Figure 1) which traces the first and second bailouts which taken together summed to €215.9 billion.

The breakdown is obvious – Only €9.7 billion actually went into the Greek fiscal balance as ‘stimulus’. That is less than 5 per cent of the total funds went to help the Greek economy recover.

It is no wonder it kept going backwards.” (Caveat: 1 bilioi = Europako mila milioi)

5 Ingelesez: “Of the €215.9 billion disbursed under the first two bailout programs, €183.9 billion came from the EU and the rest (€32 billion) came from the IMF.

The study does not trace the €86 billion that was promised under the third bailout in August 2015. However, they suggest that the “major part of the programme serves again to cover the debt repayment and interest payments to existing creditors, this time mainly the European Central Bank (ECB) and the IMF”.”

6 Ingelesez: “In relation to the first two bailouts, we also learn (see the graph above) that:

1. “€86.9 billion were used to repay maturing government debt”, which included €9.1 billion to the IMF.

2. “€52.3 billion were paid for interest on existing government debt”.

3. “€37.3 billion were paid to the … [Hellenic Financial Stability Fund]… HFSF” – which ,

4. “€29.7 billion were paid for the PSI” (Private Sector Involvement or the ‘haircut’ or the ‘default’). In other words, handouts “to allow and provide appropriate incentives for the Greek government debt restructuring in March 2012.”

THE HFSF was “created in July 2010 as a private legal entity to stabilize the Greek banking sector” and

The researchers also do some interesting calculations on the PSI component.

They show that after all the gymnastics:

… the nominal gross debt relief resulting from the €107.1 billion haircut and from the €20.6 billion bond buyback programme was significantly reduced by the need to finance the HFSF and PSI payments of €37.3 billion and €34.6 billion, respectively. The overall debt burden only decreased €51.3 billion from 2011 to 2012…”

7 Ingelesez: “The authors conclude among other things that financial institutions (banks etc) went wild (incurred a lot of debt) as a result of the “rather low risk spreads on Greek government bonds before 2010” and were “helped in their investments by the fact that the regulation on investing in (Greek) sovereign debt was mild or non-existing.”

European banks failed to have adequate capital to justify the lending they engaged in.

The study clearly shows that the bailout money was used to “transfer risks from private creditors to public creditors … [the] … money was used to repay the private creditors by taking on more debts that were taken by private creditors.”

The old saying is apt: Privatise the gains, socialise the losses.

Now the Greek government (people) are in debt to the ECB and the IMF and the gluttonous European banks have been secured by the bailout funds.

The German daily newspaper Handelsblatt concluded (Source – Behind Paywall) that:

For six years Europe has tried in vain to put an end to the crisis in Greece through loans, and keeps demanding ever harder measures and reforms. The cause of the failure obviously lies less on the side of the Greek government and more on the planning of the bailout programs.

The point is that Greece urgently needs (and has done so for the last 7 years) a major fiscal stimulus. Piling up more debt obligations on the government and forcing it to cut net spending even further is counterproductive and extremely damaging.”

8 Ingelesez: “It has surprised me how long it has taken for the Greek people to begin to change their opinions about Europe and the Eurozone. The polling data is now revealing a strong trend towards favouring a return to their own currency and a lack of hope in the European Project.

Political developments across Europe are reflecting that this sentiment is not confined to Greece. The Austrian Presidential elections have altered the mainstream politics in that country which has nearly gone with a far right lunatic.

The European elites have created a monster which is steadily coming home to haunt them.

The problem for the Greeks is that the political party that might have steered them out of this mess – Syriza – has turned into a pack of surrender monkeys who now do the bidding for the neo-liberal elites (banks, corporations) and further undermine the prosperity of the Greek people.

The problem then is that parties like Golden Dawn become the vehicle to channel the anti-euro sentiment and merge it into other sentiments that are less than desirable.”