(1) Twitterrak:

Blog by grad students of @LevyEcon. Making out-of-the-box Economics approachable for all.

@bradvoracek of @TheMinskys at @LevyEcon explains why gov’ debt and avocados are both OK at http://bit.ly/1OqsQ3x pic.twitter.com/8otOhl7JTH

Stephanie Kelton @StephanieKelton

Stephanie Kelton(e)k Bertxiotua The Minskys

Neat. Are you behind this, @ptcherneva?

2016 mai. 16

Pavlina R Tcherneva @ptcherneva

@StephanieKelton @TheMinskys @bradvoracek @LevyEcon Grad students’ own initiative! Really great. Even the artwork is their own.

2016 mai. 16

(2) Artikulua: Bloated Bodies & Starved Economies: Two harmful misconceptions1

(a) AEB-k gizentasun arazo bat dauka2

(b) AEB-k beste arazo bat dauka: gobernu defizitari dagokiona3

(c) Gobernuak dirua zein den determinatzen du: (i) gordailuak sisteman sartzen dira aurrekontuaren bidez: Altxor Publikoko defizita gastatzen den heinean, banku kontuetan gordailuak sortzen dira; eta (ii) edo banku pribatuen bitartez: maileguak sortu eta gero, banku-sistemak bat egin behar ditu erreserba eskakizunak sisteman dagoen gordailuen kopuruarekin4

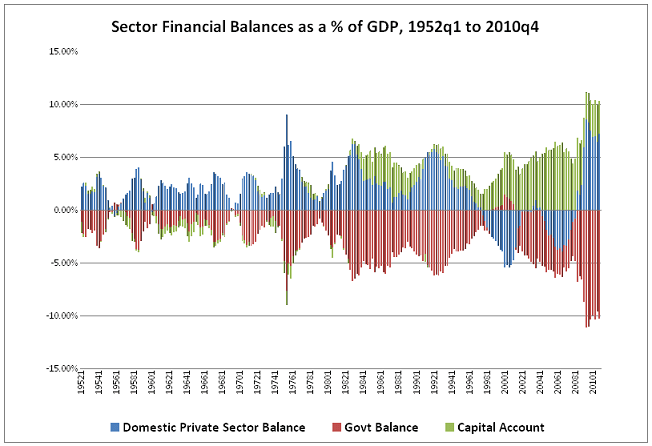

(d) Zergen bilketa eta zor pribatuen ordainketa. Zor pribatua eta zor publikoa. Gobernuaren gastu netoak (gorriz) berdintzen du gainontzako munduaren aurrezki totala (barnekoa urdina, atzerrikoa berdea)5

(e) Sektore pribatuko zorra eta gobernuko zorrak6

(f) Gobernuko defizitak, sektore pribatua. Enplegua sortzea, gobernuko zor handiagoa. Gobernu zorra ona da guretzat7

(Written by Bradley Voracek)

1 Ikus https://theminskys.wordpress.com/2016/05/12/bloated-bodies-starved-economies-two-harmful-misconceptions/.

2 Ingelesez: “America has an obesity problem. 35% of American adults are considered obese. These numbers are disproportionately higher in communities of color, whose access to healthy food is limited by time, money, and location. American Big Fast Food pushes “healthy” options which are laden with sugar, but advertised as “fat free”. The nutrition science community sold the idea that fat free meant free from creating fat, but the distinction is not quite true. Likewise, “low calorie” diets were sold on a similar idea that all calories are equal. The body in fact has different subsystems for digesting different types of calories. Carbohydrates go one place, proteins another, and fats themselves are digested separately. Carbohydrates are easily stored as glycogen and when present in the system the body prefers the quick use of them. When no carbohydrates are present, gluconeogenesis breaks down fats and proteins for use as energy. Looked at from this system perspective, the high carb low fat diet commonly advocated from the 1980s onward seems rather foolish if one wishes to burn fat stored on the body. In fact, the opposite should be advocated, a low-carbohydrate diet which starves the body of the fast glycogen deposits and forces it to switch into ketosis. The aphorism that “fat makes you fat” was wrongly sold to the public. While an understanding of the body system seems to clearly disprove the old ideas, the fact that the old paradigm pervaded common thought means communities continue to suffer from obesity without access to the new knowledge and healthy diets.”

3 Ingelesez: “America has another problem caused by a common misconception. There is a pervasive view that the government should not have a deficit, and should in fact run a surplus and pay down all of its debt. Of course, any good American pays down their debts. The banking system is gracious enough to give us loans to buy houses, cars, and get educations. We pay them back for the opportunity, never wanting to default on payments and enter bankruptcy. It makes sense that we think that our government, which so well represents us, should similarly pay back its debts. It is not quite that simple. Much like the fat in food being different from the fat in our bodies, the idea that government debt is the same as household debt is a harmful misconception. Like not all calories are the same, not all debts are the same. When the government runs a deficit, and spends more than it collects in taxes, it is engaging in an act of money creation. When it runs a surplus, and spends less than it collects in taxes, it is engaging in an act of money deletion. Like understanding the subsystems of the body helped us understand how different calories are used, understanding the economic subsystem of money helps us understand how different debts are used and created.”

4 Ingelesez: “The government determines what is used for money. Today, USD denominated deposits within the banking system are the main thing we use for money. They are widely accepted and we use them to pay taxes. Deposits enter into the system in two ways. The first is through the budget process which determines the amount of fiscal spending, most of it largely mandatory based on existing law. The budget has some discretionary spending which can be increased by Congress, which can go towards things like education, public jobs, and infrastructure. As the Treasury deficit spends deposits in bank accounts are created, and the Treasury issues a bond as the matching liability on its balance sheet (“the debt”). The other way deposits enter the system is through private banks making loans to households and firms. Banks can always extend loans if they think the venture will be profitable. They make the loan, which creates a deposit as a liability in another bank. After loans are created, the banking system needs to meet reserve requirements for the amount of deposits in the system. If they are not holding enough reserves they can sell assets to the Fed to get them. So banks make loans whenever they see profitable business ventures, and the government accommodates with enough reserves for them to do so.”

5 Ingelesez: “After deposits are created, they circulate hopefully a few times within the banking system but ultimately are collected as taxes or used to pay down private debts. When taxes are collected the Treasury extinguishes some bonds as the debt is now paid. So running a surplus means the government is removing deposits from the system (“paying down the debt”). What happens if we rely on only the private sector to add deposits? Bill Clinton tried in the 1990s when he ran an unprecedented surplus for a couple years. It turns out however that Americans are stubborn and still wanted to buy houses, cars, and get educations. So as our real incomes fell rather than reduce our standards of living we graciously racked up debt with the banking sector. The banks saw us as profitable ventures and gave us loans as deposits, causing the central bank to create the reserves to accommodate this lending. This debt that households accumulated is fundamentally different than the debt pinned on the government as this process unfolds. This is because the government can never be forced to default. Looking at the net flows of financial balances yearly sheds some light into this process. Every year, the net amount spent by the government (red line) matches the net amount saved (or dissaved) by the rest of the world (blue is domestic, green is foreign). This exact mirroring is the result of accounting identities within the system.”

6 Ingelesez: “In the 1990s and 2000s you see the private sector as a whole taking on debt and dissaving for the first time in recent history, as the government ran a surplus and other countries bought up large amounts of US securities. Today many US households are still holding onto these debts. The misconception that government debt is the same as these private debts has starved our economy. Much like the mistake of the nutritional science community in prescribing low fat diets to reduce fat, it has been the mistake of the economic science community to prescribe low government debts in order to fix our household debts.”

7 Ingelesez: “In order for households to get enough deposits so they can pay back their debts, the government should run deficits that end up in their hands. The reliance on the private sector has taken priority over the public good, and most of the deposits have landed in the hands of the top 1%. They were supposed to “trickle-down” the wealth to the rest of us, but after forty years of trying this has not happened. The private sector only employs as many people as it finds profitable to do so, and if they can deploy their capital in financial casinos to make more profit than employing people to build stuff that enhances society, they will do just that. So how can we get money into the hands of the financially responsible Americans who just want to work and pay back their debts? An answer to this problem is to rely on direct government job creation, much like the New Deal after the Great Depression. This spending will cause the government to accumulate more debt in the short term, but if spent on education, infrastructure, public jobs, worker co-ops, and raising the minimum wage then these new deposits would funnel into the bottom of the income distribution, and American households could pay down their own debts. Maybe then we’ll realize: government debt, like a nice fatty avocado, is good for us.”