Pobreziaren kontrako eguna, astea, hilabetea, urtea… unea.

Bill Mitchell-en Rising income and wealth inequality – 1% owns more than bottom 99%1.

Ideia nagusiak:

(i) Errenta eta aberastasunaren arteko desberdintasuna2

(ii) Errenta fluxu gisa; aberastasuna aktiboen metapen moduan3

(iii) Ezberdintasuna garrantzitsua da4

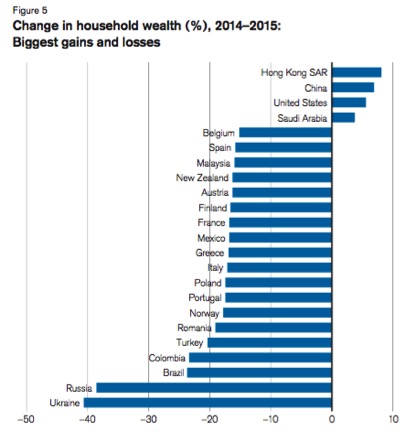

Begira diezaiogun aberastasunaren desberdintasunari. Hurrengo irudian irabaziak eta galerak azaltzen dira, nazioen arabera:

(iv) Harritzekoa da aberastasunaren banaketaz eta aberastasunaren desberdintasunaz kontsideratzen direnean, maila indibidualetan5

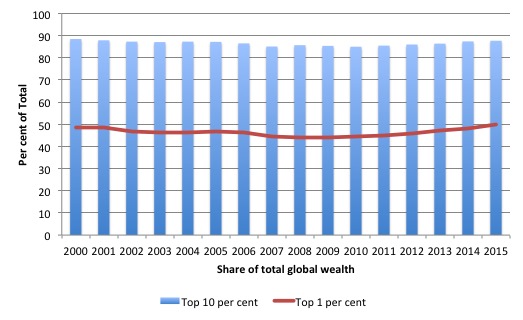

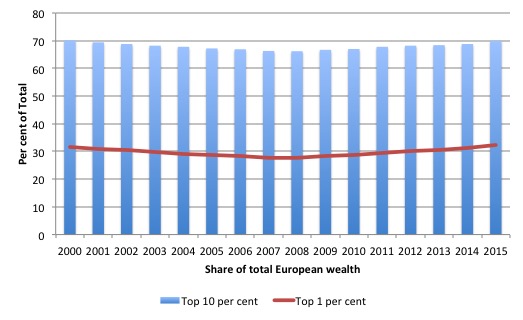

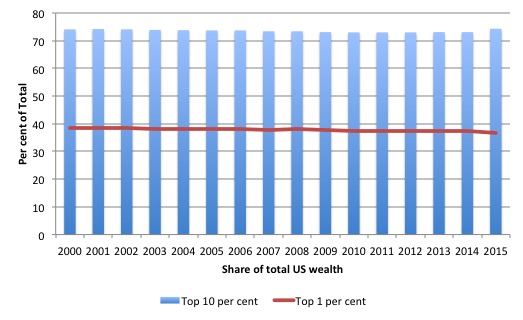

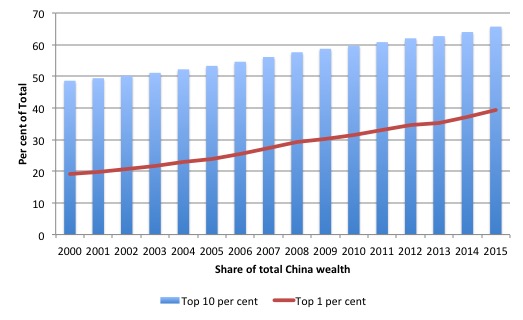

(v) Hurrengo irudian, aberastasun osoaren desberdintasuna ikus daiteke6 Munduan, Europan, AEBn eta Txinan

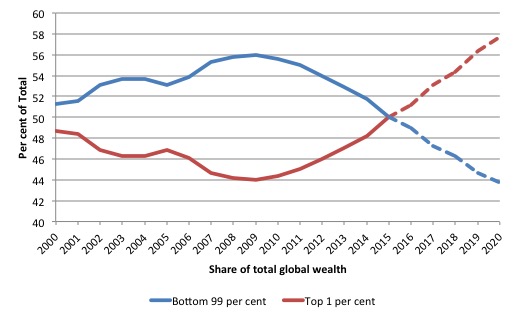

World Wealth Inequality

European Wealth Inequality

US Wealth Inequality

Chinese Wealth Inequality

Oharrak:

(vi) Goiko %17 eta %10

(vii) IMF8

(viii) %1 eta %999

(ix) 80 pertsona10

Ohar (eta desberdintasun) gehiago Mitchell-en artikuluan bertan…

(x) Merkatuaren miraria11

(xi) ‘Ebaluazio’ agentziak12

(xii) Ustelkeria eta kaosa13

Ikus Rising inequality – fundamental changes required delakoa ondokoaz jabetzeko, alegia, “to redress the trend towards higher inequality.”

Baina…

… ondorioa: “But when so-called progressives support the socialist parties and labour-type parties that denounce so-called deficit deniers and when in power manage and implement pernicious austerity programs there is little hope in the foreseeable future of such enlightened politicians getting their hands on power.”

Syriza. Tsipras. Orakulua (aka, Varoufakis)…

Eskozia…

Eta Katalunia?

Eta Euskal Herria?

Ikus:

Birbanaketarik ala aurre-banaketarik?

https://www.unibertsitatea.net/blogak/heterodoxia/2013/07/08/banaketarik-ala-aurre-banaketarik/

Errenta unibertsala? Ez, lan unibertsala!

https://www.unibertsitatea.net/blogak/heterodoxia/2014/10/21/errenta-unibertsala-ez-lan-unibertsala/

Pobreziaren aurka, lan postuak, hots, lan bermea

2 Ingelesez: “When we talk about inequality it is important to differentiate between income and wealth inequality.

Together they constitute one of the clearest examples of how the neo-liberal policy structures that have been in place over the last 30 odd years are failing and are pushing the world toward an unsustainable reckoning where it is anybody’s guess what the manifestation will look like...”

3 Ingelesez: “Income is a flow of cash that is received over time. For most of us, our incomes come from work. For some, it is the absence of work that generates income flow – as a result of wealth holdings.

Incomes are distributed in a skewed fashion with inequality rising.

High incomes which allow for high rates of saving tend to spawn growing stocks of wealth. The flow of saving feeds into the stock of wealth.

Low income earners tend to have low to zero saving ratios and hence never accumulate any wealth over their life time.

Wealth is a stock of owned assets (real and financial) which may or may not generate a flow of income. A person can be income rich and asset poor (say a young educated professional worker) or, conversely, asset rich and income poor (an older person who has retired or a wealthy person employing tax minimisation strategies.

Income inequality is typically much smaller than it is for wealth, which is why we have to consider both aspects.”

4 Ingelesez: “Inequality matters. Why? First, it undermines the notion of a collective in society which is necessary for social stablity and cohesion.

Second, rising inequality undermines the growth potential of a nation and introduces greater propensity to economic crisis.

Third, taken together, these factors tend to meant that nations will higher levels of income and wealth inequality endure more social violence and higher crime rates, higher rates of suicide, poorer mental and physical health standards, shorter life expectancies, and other pathologies.

Fourth, human potential is stifled in nations with higher inequality. Access to education, health and other services are improved when there is less inequality.

You may ask why? The answer lies in how the resources of the nation are made available to the people. Nations with high levels of income and wealth inequality have systems in place which restrict the capacity of a significant portion of the population to access the nation’s resources.”

5 Ingelesez: “1. “Once debts have been subtracted, a person needs only USD 3,210 to be among the wealthiest half of world citizens in mid-2015”.

2. “USD 68,800 is required to be a member of the top 10% of global wealth holders, and USD 759,900 to belong to the top 1%.”

3. “While the bottom half of adults collectively own less than 1% of total wealth, the richest decile holds 87.7% of assets, and the top percentile alone accounts for half of total household wealth.”

(…) … the top percentile alone accounts for half of total household wealth.”

6 Ingelesez: “The following graphs show the proportion of total wealth held by the top 10 per cent of the distribution (blue bars) and the top 1 per cent (red line) for the World, then Europe, then the US and finally China.”

7 Ingelesez: “Wealth inequality is rising despite the GFC and there is an increasing concentration among the top 1 per cent. That pattern is noted in Europe and particularly China, but the top 1 per cent have seen a small decline in their share between 2014 and 2015 while the top 10 per cent gained share.

There has been a marked concentration of wealth at the top end of the distribution in Europe despite the prolonged crisis that has caused millions to lose their jobs.”

8 Ingelesez: “When the IMF talks about ‘structural reforms’ I think about these distributional outcomes that result from the typical IMF programs that are inflicted on nations.”

9 Ingelesez: “… the following graph (…), which compares the top 1 per cent and the bottom 99 per cent of the global wealth distribution and extrapolated it out to 2020.

They actually underestimated the rate at which the top 1 per cent are accumulating wealth relative to the rest. They predicted that it would be 2016 before “the top 1% will have more wealth than the remaining 99% of people”. That outcome happened in 2015.

I updated the exercise given the latest wealth distribution estimates. If the current trends are maintained then the top 1 per cent will own around 58 per cent of the total global wealth by 2020.”

10 Ingelesez: “… in 2014 the wealth of the richest 80 people in the world “is now the same as that owned by the bottom 50% of the global population … 3.5 billion people”.”

11 Ingelesez: “The deficit mania is part of the myth that free market allocations are the most efficient because they respond to the preferences of all consumers.

But it is obvious that a system of allocation that responds to spending will distort the allocations in favour of those who spend the most.

The market is driven by dollar votes. The more one spends the more power one has. So even at the most elementary level the concept of a free market is flawed. There is no such thing. It is preferences backed by cash rather than the latent desires that the market responds to, even in the abstract theoretical models.

But then once the inequality reality is overlaid onto that narrative and we recognise the massive spending that is designed to lobby for particular policy environments, which further distort the market allocations, we realise that the concept of the free market that is taught in economics programs throughout the world is a myth.”

12 Ingelesez: “… the most obvious cases of Enron or the rating agencies being paid to give the top ratings to financial products that were never able to justify that sort of quality rating nor the conflict of interest being disclosed. Remember the shameless behaviour of Goldman Sachs deliberately conniving with the Greek government to deceive the European Commission during its transition into the common currency?

And the countless other examples of corruption that combined to create the GFC and its aftermath? We only know about the tip of the iceberg.”

13 Ingelesez: “If the extrapolations that I produced in the last graph above then these levels of corruption and chaos will worsen.

One of the consequences of the rising inequality in income and wealth is that the bastion of social stability – the middle-class – is being eroded.

It is a trend that is occuring in all nations.”