1) Krak baino lehenagoko sarrerak

Why Not Tell Greece How To Run A Democracy?

http://www.zerohedge.com/news/2015-05-14/why-not-tell-greece-how-run-democracy

Varoufakis refuses any bailout plan that would send Greece into ‘death spiral’

http://www.theguardian.com/business/2015/may/14/yanis-varoufakis-refuses-bailout-plan-send-greece-into-death-spiral

Greece Shows Nazi Video To Commuters In Desperate War Reparations Bid

When Europe Gets Greece’s Jingle Mail: Dealing With Default

http://www.zerohedge.com/news/2015-05-15/when-europe-gets-greeces-jingle-mail-dealing-default

Guest Post: Why Syriza Will Blink

http://www.zerohedge.com/news/2015-05-17/guest-post-why-syriza-will-blink

Shape Of Greek Endgame Emerges: IMF Discussed “Cyprus-Like” Plan After Tsipras Warned Of Looming Default

Why Did The IMF Leak The Greek Default Details?

http://www.zerohedge.com/news/2015-05-18/why-did-imf-leak-greek-default-details

Merkel Faces German Parliament “Revolt” On Greece

http://www.zerohedge.com/news/2015-05-19/merkel-faces-german-parliament-revolt-greece

Over 200,000 Greeks Apply For Humanitarian Crisis Relief

http://www.zerohedge.com/news/2015-05-19/over-200000-greeks-apply-humanitarian-crisis-relief

Each Day Without Debt Deal Costs Greek Economy €22 Million And 613 Full-Time Jobs

Are They About To Confiscate Money From Bank Accounts In Greece Just Like They Did In Cyprus?

The Gloves Come Off: Moody’s Warns Of Greek “Deposit Freeze” As Schauble “Won’t Rule Out Default”

Democracy Under Fire: Troika Looks To Force Greek Political “Reshuffle”

Tick Tock, The Greek Time Bomb Is About To Go Off

http://www.zerohedge.com/news/2015-05-22/tick-tock-greek-time-bomb-about-go

Greece May Need To Issue IOUs Schaeuble Says After Latest Failure To Reach A Deal

2) Greziako pentsioen mitoak

B. Mitchell-en artikulua: Friday lay day – Greek pension myths1

Pentsio edo erretiroen afera Syriza eta Troikaren arteko borrokaren gai berezia da. Troikak pentsioetan mozketa gehiago nahi du. Syriza erresistentzian dago, eta badirudi ezin duela azken hauteskundeetan esandakoa bete, alegia, politika pizgarriak martxan jartzekoa, eurogunean segitzen duten bitartean.

Mitchell Greziako jubilazioak ikertzen aritu da, The Guardian egunkariaren artikulu bat oinarritzat hartuz2.

Artikuluak dioenez,

“Nearly 45% of Greece’s 2.5 million retirees now live on incomes of less than €665 a month – below the poverty line defined by the EU.”

Greziako gobernuak pentsioen mailak mantendu nahi ditu3.

The Guardian Greziako defizit publikoaren aurka aritzen da4.

Baina aipaturiko iruzkinak ez dauka inongo zentzurik, zeren Greziako gobernua subiranoa zenean esatea gobernuak, arrazoi politikoak zirela eta, pentsio plan bati diru laguntza eman ziola ez du zentzurik.

Izan ere, gastu guztiak politikoki motibatuak dira. Baina, era berean, gobernu subirano baterako, gastu guztia ezin da subsidiatua izan, ez da behar inolako diru laguntzarik, zeren ez baitago inongo finantza muga beharrezkorik. Pentsio planak ez zuen behar inolako errenta irabazi behar.5

Belaunaldi bakoitzak gobernu gastuaren osaera aukeratu dezake, eta berak nahi duen zergen maila jarri. Beraz, baldin eta Greziako pentsio plana eskuzabala bazen, hori egindako aukera politikoei zegokien, eta bizitzan zehar lan egin eta gero populazioak ez badu nahi arrazoizko jubilazioa edukitzea, orduan plana aldatu dezakete.

Baina eurogunean sartzearekin batera, greziarrek galdu zuten autonomia mota hori eta Troika soilik diru kontaketa ikusten du eta ez jendea eta tradizioa.

The Guardian-eko artikulua hauxe dio pentsioei buruz:

“Greece spends more than any other EU member state on pensions. Close to 18% of national outlay was still being allocated at the height of the crisis in 2012.”

Mitchell-ek Eurostat erabili du, baieztapen hori argitzeko.

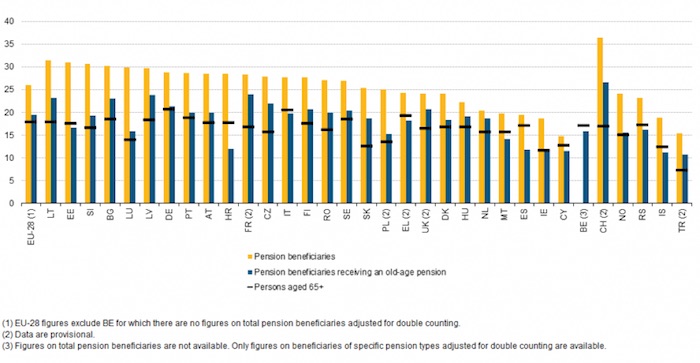

Ondoko taulak erakusten du Europan, populazio osoaren zein proportziok eduki zuen pentsio bat 2012an.

Grezia (EL) ez dago talderik handienean, Alemania bai.

Egia da Greziak bere BPGren proportziorik handiena pentsioetan erabiltzen duela. Baina ez dago Italia, Frantzia, Austria, Portugal eta Danimarkatik oso urrun.

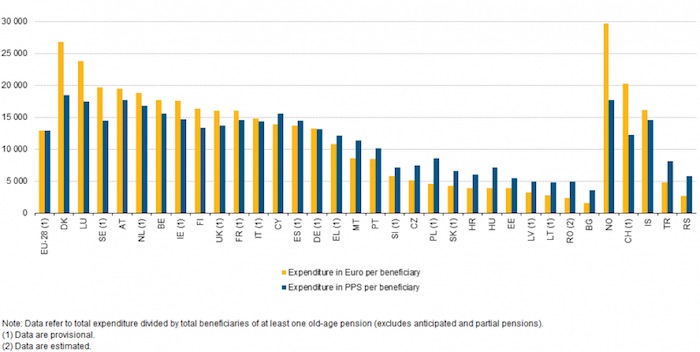

Hurrengo taulan EB-28rako, 2012an (eurotan) pentsio osoa per onuraduna ikus daiteke.

Hortxe dago Grezia taldearen erdian, Alemaniako gastua per onuraduna baino baxuago.

Bai, Greziako plana jubilazio goiztiarraren aldeko da. Baina zer dago gaizki aukera horrekin?6

Errealitatea hauxe erakusten du: jubilazo hartzeko greziarren batez besteko adina 62,4 urte dira, alemaniarren adina 63,2 urte diren bitartean, nahiko parekoa. Hortaz, greziarrek laster uzten dutela lana, luxuz bizi direla pentsio puztu batean eta gero itxaroten dutela Alemaniako langileek haien bizitza estandarreko aukera hori ordaintzeko, diru laguntzen bidez, benetan oso urrun dago.

Are gehiago, estatu pentsio plana antolatzeko kostu erreala hartzaileek, bizitza lanarekin bukatu eta gero, kontsumitzen dituzten baliabide errealak dira.

Eurogunearen barruan, eta dirua kontatzeko enfasiarekin (finantza ratioak direla eta), eta diru hori benetako baliabide kostuarekin nahasiz, kostu errealaren kontzeptua galtzen da eta elkarrizketa guztia euroei buruzkoa bilakatzen da.

Hori dela eta, hona hemen Mitchell-en artikuluari egindako bi iruzkin argi:

Lehen iruzkina: Greece HAS to recover its monetary sovereignty.

Bigarrena: The problem is that for some unfathomable reason the Greek people do not want to leave the Eurozone.

Hortaz, aspaldiko dilema bera: erabateko kapitulazioa ala Grexit?

2 Hona hemen artikulua: Guardian (May 21, 2015), Fight to save the Greek pension takes centre stage in Brussels and Athens.

3 Honela esanez, ingelesez: “… the last social safety net preventing Greek society from completely falling apart. The elderly population is literally feeding the rest of the family.”

4 Ingelesez: “The Guardian then trots out the stereotyped line – “Few areas reflect the dysfunctionality of the Greek state more, or its inability to rein in budgets”.

They quote some LSE academic (political scientist) who worries about fiscal deficit and has long railed about the excessive generosity of the Greek pension scheme as saying that “Since the 1990s, successive governments have always subsidised the shortfall of pension funds for political reasons. That in turn has removed any kind of financial discipline from the system.””

5 Ingelesez: “… when the Greek government was sovereign, the notion that it “subsidises” a pension scheme for political reasons is nonsensical. All spending is politically-motivated. But equally, all spending for a sovereign cannot be considered a subsidy because there are no financial constraints necessary so in what sense does the pension scheme have to ‘earn income’. Quite stupid.”

6 Honela segitzen du Mitchell-ek, ingelesez: “One could argue that forcing people to work into their dotage is anti-happiness and society would be much more productive and relaxed if people were encouraged earlier in life to explore their freedom from work.”

joseba says:

Is Greece Still A Country If Someone Else Owns Its Assets?

http://www.zerohedge.com/news/2015-05-23/greece-still-country-if-someone-else-owns-its-assets

joseba says:

Greece Is On The Ragged Edge: Bloodied Idealogues Vs. Bloodthirsty Technocrats

http://www.zerohedge.com/news/2015-05-24/greece-ragged-edge-bloodied-idealogues-vs-bloodthirsty-technocrats