You Know Nothing About Economics

(https://realprogressives.org/you-know-nothing-about-economics/)

February 21, 2025

Did you know that the government can never run out of money, taxes don’t fund its spending, the national debt isn’t a debt, and printing money doesn’t cause inflation? Probably not, because your parents, teachers, politicians, and favorite journalists have always told you the opposite.

For most of my life, I didn’t know either. I have two PhDs, and if one of them were in economics, it wouldn’t have helped. The only people who know how government finances work are central bankers (who won’t tell you), traders with hands-on experience of the failure of economic norms, and those who stumble across their work (which I explain below).

Everyone else, from New York Times economists to the leaders of both major parties, reinforce common falsehoods, which may be why the economy is brutal and crashes every ten years. Some of these experts lie, others don’t want to rock the boat or jeopardize their careers, but most don’t have a clue.

That is why, if there is a conspiracy to stop us learning “why the government can never go broke,” for example, so that we don’t ask for nice things like public healthcare, climate action, and a basic income, it is almost effortless. Most people automatically treat the government like a big household that is subject to the same financial rules as themselves—balance income with spending, save for a rainy day, and avoid debt.

As responsible adults, that is our lived experience—the hard truth of budget living that accompanies adulthood—and it continues to guide every financial decision we make. When analogized to the government, disagreement appears infantile to us “adults in the room” who assiduously calculate how to pay for government programs with taxes and cuts.

What eventually caused me to stop basing my beliefs on assumptions, hearsay, and intuition were questions like “where does money come from?” And, how did the trillions1 of dollars that exist today actually get here? My intuition had only supported the ridiculous notion that money is an eternal object that circulates in the economy and cannot be created or destroyed.

In my examination of what seemed like a scholarly question, I discovered what may be the greatest cause of suffering in the developed world— politicians who falsely declare that a government “cannot afford” something or has “reached its debt ceiling” are creating opposition to social spending that would save lives and could save the planet we live on.

The remainder of this article will provide you with the knowledge to reject their misinformation and, I hope, facilitate the greatest societal change of the 21st century.

Where Does Money Come From?

Take the United States as an example. Every U.S. dollar in existence was created by the U.S. government (or by banks with government licenses), and this exclusive right to create the dollar is enshrined in the U.S. Constitution. It is even called a Federal Reserve Note to tell you it was created by the government’s bank.

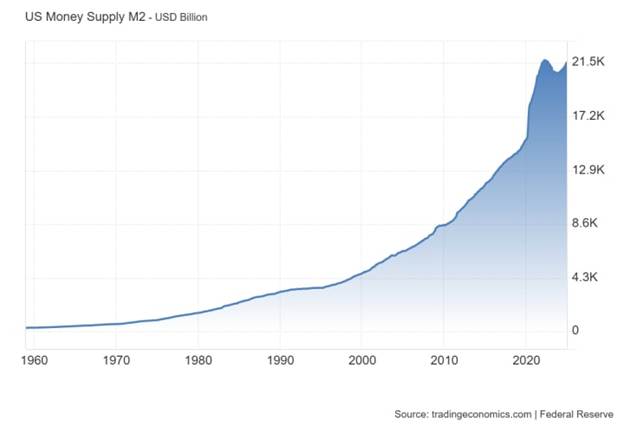

The first dollar was created in 1792 and trillions have been created since then. In fact, there are twice as many dollars in existence today compared to ten years ago (see graph). Although much of the new money is bank credit, the rest is created when the government passes spending bills.

Most national governments are currency issuers, including the U.K., Australia, and Canada, although some are not (e.g., European Union states such as Greece). Localities such as U.S. states also do not create currency and require some form of income.

This power to issue currency means that every statement from a politician, economist, or media personality about the government “running out of money” or being “unable to pay its bills” is a lie.

The Government Can Never Go Broke

In a rare and unreported admission, the Federal Reserve confirmed that the U.S. government issues the dollar and can never run out.

As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. — Federal Reserve Bank of St. Louis

Alan Greenspan also said the following under oath in front of Congress (see video for context).

There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody. — Alan Greenspan (Federal Reserve chairman, 1987–2006)

Bideoa:https://youtu.be/54fg-A1gCrM

Alan Greenspan can’t answer this question with a lie, so he tells the truth. It is an unpleasant truth for many politicians, economists, and media personalities who fear-monger about the government “running out of money” or having “insurmountable debt” in order to discourage government spending. Greenspan says that as long as the real resources are there, there is never a shortage of money.

Transkripzioa:

0:00

do you believe that personal retirement

0:01

accounts can help us achieve solvency

0:03

for the system and make those future

0:05

retiree benefits more secure well I

0:07

wouldn’t say that the

0:10

pay-as-you-go benefits are insecure in

0:13

the sense that oh

0:18

there’s nothing to prevent the federal

0:19

government from creating as much money

0:21

as it wants and paying it to somebody

0:22

the question is

0:24

how do you set up a system which assures

0:27

that the real assets

0:30

are created which those benefits

0:34

are employed to purchase

0:36

so it’s not a question of security it’s

0:39

a question of the structure

0:41

of a financial system which assures that

0:44

the real resources

0:46

are created for retirement

0:49

as distinct from the cash the cash

0:51

itself is nice to have

0:54

but it’s got to be in the context of the

0:58

real resources being created at the time

1:03

those benefits are paid so that you can

1:06

purchase real Resources with the

1:09

benefits which of course are cash

Another Fed chairman, Ben Bernanke, said something similar when he described how the government bailed out the banks after the 2008 financial crisis (see video below). As I said in the introduction, central bankers know how it works. They just almost never tell you.

Bideoa: https://youtu.be/hiCs_YHlKSI

Asked if it’s tax money the Fed is spending, Bernanke said, “It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.”

Transkripzioa:

0:00

is that tax money that the Fed is

0:01

spending it’s not tax money the banks

0:04

have accounts with the Fed much the same

0:08

way that you have an account in a

0:09

commercial bank so to lend to a bank we

0:12

simply use the computer to mark up the

0:14

size of the account that they have with

0:16

the Fed so it’s much more akin although

0:19

not exactly the same but it’s much more

0:20

akin to printing money than it is to

Taxes Do Not Fund Spending

In the previous video, Bernanke explained that tax money was not used to bail out the banks, and, logically, a currency-issuing government does not need taxes to fund itself.

On a practical level, economists who have studied the operations of the central bank know this to be true.

The proceeds from taxation and bond sales are technically incapable of financing government spending […] modern governments actually finance all of their spending through the direct creation of high-powered money. — Professor Stephanie Kelton

It makes no practical sense for governments to wait until they have accumulated enough in taxes. Or did you think the Treasury was waiting for your grandmother’s taxes to arrive before they could buy a warship?

Rather, they create money as they spend. As Bernanke explained, the government makes a payment by instructing the Federal Reserve to increase the number of dollars in a bank account. This happens by keystrokes on a computer. It doesn’t even need to be printed.

Taxes Are Deleted

There is a veiled admission from the Federal Reserve about the fate of our taxes. Essentially, they acknowledge in footnote 1 here that taxes paid to the U.S. Treasury are no longer part of the money supply (i.e., deleted).

Governments create money by spending and extinguish it via taxation. — Professor James K. Galbraith (former executive director of the Joint Economic Committee of Congress)

Why Tax At All?

Unfortunately, taxation is necessary. When the government creates dollars, it needs you to value and accept those dollars as payment for your goods and labor. The government does this by forcing you to pay taxes only in dollars, which means that you have to obtain dollars from somewhere.

In other words, giving value to the government’s currency is the core reason for taxes, but there are other reasons, such as to reduce the money supply and to punish problematic industries (e.g., polluters). Funding government spending is not one of the reasons. Indeed, governments have to create and spend money before anyone can even pay their taxes.

Bideoa: https://youtu.be/tEiNLmg2tYA

Professor L. Randall Wray discussing government spending and taxation. From a point of logic, a government that issues its own currency must spend before it taxes, or else there would be no currency to collect. Therefore, taxes don’t pay for spending, but rather spending allows the government to collect taxes. Cash is basically an IOU [I owe you] from the government: if you present a dollar at tax time, they agree to redeem it, and extinguish your tax obligation. When the government spends, it is the same as you writing an IOU, except that most of the private sector accepts the government’s IOU and circulates it as money, while very little of the private sector accepts your IOU. This means the government can’t “borrow” dollars. Borrowing your own IOU doesn’t even make sense in terms of accounting. IOUs can either be created/issued or redeemed/destroyed, not borrowed by the person who issued them. The purpose of government “borrowing” is actually to sell bonds to drain reserves from the banking system, in order to allow the Fed to hit its interest rate target. More on that here: ![]() • MMT: Why Do Governments That Issue Their O…

• MMT: Why Do Governments That Issue Their O…

Transkripzioa:

0:10

some dollars.

0:11

What this means is, the government needs to spend the dollars so that you can pay

0:18

taxes. In other words, the logic tells us that the spending comes before the

0:28

government can collect the taxes. Because you can’t pay your taxes until you’ve

0:34

got the dollars. If the dollars come from government spending, the government needs to

0:39

spend befor you can pay your tax. So logically, the government doesn’t spend taxes.

0:47

Logically, the government spends so that you can pay taxes. The spending has to come first.

0:53

What that means is taxes actually don’t “finance” government spending.

0:58

Now of course, if the government has been spending for years and years and years,

1:03

a lot of dollars can accumulate in the hands of the non-government sector. Ok, and so

1:09

that you have accumulated dollars that you can pay taxes with. However, they all came

1:15

from the government spending originally. So, once we’ve developed a monetary

1:22

economy and there’s lots of dollars in circulation, then this logic

1:29

becomes less apparent. You say, “oh, I have a lot of dollars to pay my taxes, I

1:34

don’t need to wait for the government to spend. But the government had to spend from

1:38

inception in order to get the dollars into the economy so that taxes could be paid.

1:46

The sovereign government issues – oh, third thing. The sovereign government that issues its own

1:51

currency cannot be revenue-constrained. Because it issues the dollars as it

1:59

spends. If it wants to spend more, it issues more currency. It can’t be revenue

2:06

constrained. It can’t run out of its own currency…

2:12

If you issue your own currency,

2:16

you can’t run out.

2:18

Uncle Sam can’t run out of his own currency. He never needs to borrow his own

2:23

currency. And in fact if you think about it,

2:28

borrowing your own currency would make no sense. It would be like: you’ve written

2:33

an IOU to your neighbor, I owe you a cup of sugar. And you find out you need

2:38

another cup of sugar. Are going to go try to borrow that IOU back from your

2:43

neighbor, in order to get another cup of sugar?

2:47

No. You’re gonna write another IOU.

2:51

So I’ll come back to this, but sovereign countries don’t need to

2:58

borrow their own currency. In fact, there’s no balance sheet operation that you can

3:02

show me in which someone borrows back their own IOU.

3:08

And this was Warren Mosler’s

3:11

brilliant observation. Bond sales are not a borrowing operation. There’s

3:16

something else entirely. So I’ll come back to explain what that is.

3:20

Now sometimes countries borrow in foreign currency, ok. And you can borrow

3:26

foreign currencies. Again, the problem with borrowing foreign currencies is that

3:33

you have to pay back in a foreign currency

3:35

and so that will constrain your domestic policy space.

3:39

So that I would say, almost always, it’s a bad idea

3:43

for governments to issue debt in a foreign currency because that is similar to

3:48

adopting a fixed exchange rate. You’re going to have to operate your economy in

3:54

such a way that you get the foreign currency to service the debt.

3:57

It does face constraints.

4:00

The main constraint it faces is the resource constraint: it can run out of resources to buy.

4:06

It can push up the prices of resources. So too much government spending can

4:14

cause inflation, as people have long argued. But it can’t cause insolvency

4:24

It can’t cause insolvency of the government

4:27

It can’t cause the government to run out. So the fourth point is, there is no

4:33

solvency risk for a government issues its own currency. There is no possibility

4:38

of bankruptcy. When President Obama tells us that the U.S. government has run out

4:44

of currency, he is misinformed. Can’t happen.

4:48

The U.S. government can always issue more. It’s not possible to run out. There is no

4:54

chance that running budget deficits, spending more than tax revenue, is

4:59

going to bankrupt the United States government. It can’t happen because we can

5:04

always issue more. We can always make all payments as they come due.

Printing Money Does Not Cause Inflation

Intuition tells us that creating money reduces its value by the same amount, but this leads to the ridiculous notion that the first dollar ever created was as valuable as the collective trillions in existence today. It also forgets that the money supply is increasing all the time, usually without noticeable inflation.

In my case, I held this myopic belief about inflation because I saw a photograph of a wheelbarrow of money in a 7th grade history class about Weimar Germany and I assumed that correlation means causation.

The conventional wisdom that printing money causes inflation is not true. — Professor John T. Harvey

Public domain photo

Public domain photo

Although money creation could expedite inflation, it was not the cause of the historical examples that most people cite, such as Weimar Germany and Zimbabwe. Rather, the inflation was caused by supply shortages, or foreign debt, and money was created after to maintain the public sector.

The causation is that inflation increases the nominal need for cash and reserves, not that increased cash causes inflation. — Warren Mosler (hedge fund executive and professor of economics)

We can describe inflation with the equation, MV = Py. While increasing the money supply (M) could increase prices (P), the money may be saved, reducing the rate of spending (V). Alternatively, if the money is spent, businesses will seek to accumulate it by hiring workers and producing more goods and services (y). In either case, prices do not increase.

Inflation can occur if there is a lack of resources or labor, which is why it’s usually a supply issue, and why quintupling the money supply in the past thirty years has not brought about Armageddon.

The National “Debt” Is Not Debt

A national “debt” of more than $35 trillion sounds scary. So scary that people are paid great deals of money to tell you how scary it is. The more afraid you get, the less likely you are to want public healthcare or climate action. How could we possibly afford that?

Much of this “debt” is Treasuries, which are savings accounts with the U.S. government that earn interest. Countries like China and Japan buy Treasuries because they earn dollars through trade and have nowhere better to put them. What this tells us is:

- Holders of U.S. “debt” do not want it repaid for the same reason that you don’t want your bank to close your savings account.

- The government does not need the money. It creates all that it needs, and it created every dollar that has since been used to buy Treasuries.

- If the government wants to eliminate this “debt” it can phase out Treasuries and deposit the money into checking accounts.

- If anyone wants to withdraw their money, the government can create/print the withdrawal amount and give it to them (see video).

So the national “debt” is not a debt. When the government creates money, it offers people the chance to buy Treasuries of equal value. These Treasuries, plus cash left in the economy, are the money supply (the total of every budget deficit in history). Eliminating it, such as with less spending and more taxation would eliminate the money supply.

Bideoa: https://youtu.be/9SW-hWqba1k

Alan Greenspan admits that the national debt isn’t a problem because we can always print/create more money to pay it. In other words, the federal government can never run out of money and can never go broke. His younger colleague knows that he shouldn’t have admitted this.

Transkripzioa:

0:00

our U.S treasury bonds still safe to

0:04

invest in very much so I think there’s a

0:07

this is not an issue of credit rating

0:11

the United States can pay any debt it

0:15

has because we can always print money to

0:18

do that so there is zero probability

0:21

of the fold

0:23

what I

Nevertheless, fear-mongering about the “debt” has persisted for at least 88 years, when it was a thousand times smaller (see video). Normally, when someone predicts the apocalypse, they are discredited when their prediction fails.

Bideoa: https://youtu.be/WS9nP-BKa3M

Our nation’s finances are a blistering topic. Democrats blame Republicans for “blowing up the deficit” with tax cuts, while Republicans insist that programs such as Social Security and Medicare are the real drivers of our fiscal mess. As politicians fight over who’s at fault, an important debate is getting lost in the fog.

Professor Kelton casts a different light on these fiscal feuds and the budget deficit, arguing that both sides are missing the bigger picture when it comes to paying for our future.

Stephanie Kelton is a professor of public policy and economics at Stony Brook University. Before joining Stony Brook, she chaired the Economics Department at the University of Missouri—Kansas City, where she taught for seventeen years. She served as chief economist on the U.S. Senate Budget Committee (Democratic staff) in 2015 and as a senior economic adviser to Bernie Sanders’s 2016 presidential campaign. She is a former editor-in-chief of the top-ranked blog New Economic Perspectives and member of the TopWonks network of the nation’s best thinkers.

Transkripzioa:

0:01

[Music]

0:08

please welcome the president of Stony Brook University dr. Samuel L Stanley

0:13

jr. thank you so much everyone and

0:22

welcome to the first presidential lecture of the year I’m so pleased to have one of Stony Brook’s own stars here

0:28

to challenge and inform us this is particularly this is going to be a particularly timely view of our nation’s

0:34

economy particularly as the midterms draw near dr. stephanie kelton is a

0:40

professor of economics and public policy in our College of Arts and Sciences she’s an expert in fiscal policy Social

0:48

Security International Finance and employment policy and is a leading voice in the urgent national conversation

0:55

about economic reform her economic ideas based on the modern monetary theory she

1:01

helped found are driving new concepts and influencing the direction of the Democratic Party she is often cited as

1:08

one of the leading economists in the country before joining Stony Brook in 2017 she shared the economics department

1:16

at the University of Missouri Kansas City where she taught for 17 years she serves as chief economist on the US

1:23

Senate Budget Committee in 2015 and was a senior economic adviser to Bernie

1:28

Sanders 2016 presidential campaign in 2016 Politico named her one of the 50

1:35

people most influencing the public debate in America in her talk professor

1:40

kellton will cast a different light on the on coin views over the budget deficit arguing that Democrats and

1:46

Republicans are both missing the bigger picture when it comes to paying for our future Matt Basler a Bloomberg recently

1:53

noted that if you watch only one lecture on economics it should be dr. Kelton’s take on the deficit well this is your

2:01

opportunity for that one lecture please join me in welcoming dr. stephanie kelton to the stage

2:11

thank you thank you very much thank you

2:16

very much Thank You president Stanley for the invitation to deliver presidential

2:22

lecture here at Stony Brook this year I am very very happy to be able to do this

2:27

and thank you to all of the staff and the many people who worked with me for the last month or so as we organized and

2:34

planned for this event so a lot of people worked very hard to make this an afternoon that I hope we can enjoy

2:42

together so and thank you to you for coming out on a sort-of rainy foggy Monday afternoon to listen to an

2:48

economist that you also deserve a big round of applause for doing that so I’m

2:54

gonna jump right in I only have about 20 minutes to get through some pretty

3:00

weighty arguments and so I’m gonna try to do it with some levity I hope this will be kind of a fun talk but I hope

3:06

that I can also be provocative and maybe get you to think about some pretty big

3:12

questions in a way that maybe nobody has presented them before for you so the big

3:19

question is how do we pay for it it’s really the trillion dollar question whatever the agenda item is whatever the

3:26

policy proposal is whether it’s infrastructure or free college or medicare for all or a green new deal you

3:34

get a politician who goes on a television show or sits down with a journalist and says I’ve introduced

3:40

legislation to do this thing and the journalist responds by saying what how are you gonna pay for it how are you

3:46

gonna pay for it as if that’s the most important question to begin with right you’re not debating the merits of the

3:52

proposal will tell me about Medicare for all what is it that you think is broken with our current health care delivery

3:57

system and why do you think moving to Medicare for all those aren’t the conversations we end up having it becomes the pay-for question first and

4:04

then we get bogged down in whose taxes have to go up and by how much and all of that stuff right so we never end up

4:09

having the really important debates because of this question so why do we

4:15

always start with this question what’s behind the question because there’s an ideological framework behind

4:22

that question the question presupposes certain things like for example that the government doesn’t have the money to do

4:28

these things where would the money come from right there’s implicit in the question a concern about the budget right there’s

4:36

all this stuff behind that question so we have to talk about that and then I want to see whether it’s possible for us

4:43

as a nation to move beyond this question to have better debates to have better dialogue to talk about the things that

4:50

really matter and stop focusing always and everywhere on this one question what

4:56

is the impact on the deficit or the national debt going to be how are we going to pay for it so getting beyond the money question is the goal here’s

5:05

the problem okay this is what in a sense we’re up against in trying to get there

5:10

so this is a very short video it’s a couple of minutes but it sets up the rest of the talk so here we go our

5:18

[Music]

5:24

children take out a credit card from the

5:29

Bank of China in the name of our children driving up our national debt that we are

5:36

gonna have to pay back that’s their responsible it’s unpatriotic the government’s

5:43

irresponsible spending is turning us into slaves you might well literally lock us into

5:50

Chains at least our children we’ve got to deal with this big long-term debt problem or it will deal with us and it

5:58

is a I think it’s I think it is I’m asking you join us to stop this fiscal

6:07

train wreck join us to protect our children from an inferior standard of

6:12

living from a crushing burden of debt and taxes okay I don’t believe in any of the tax cuts I didn’t unpack those words

6:18

I didn’t even want to hook the middle class okay cuz I ate you know why because it was a four hundred billion over budget we just can’t afford and as

6:25

we discuss deficit reduction which is clearly a major issue for decades we a

6:31

pile deficit upon deficit mortgaging our future and our children’s future and the

6:37

deficit thing is real and the debt thing is real we are really in trouble wanted at something is their need for comprehensive deficit reduction the

6:43

answer is not only yes but hell yeah this debt that hangs over our had a government that spends more money than

6:48

it takes in that’s not sustainable now you cannot cut taxes or increase spending unless you can pay for it the

6:55

math of federal spending does not add up and we are spending money we do not have

7:00

a Burton that that’s crushing us to me this is more of a moral issue you can’t

7:06

steal from your kids and grandkids we think the deficit and the national debt are right amaro what national debt is

7:13

America’s biggest problem Wow right bipartisan if you watched the

7:21

video the way that it was put together it essentially went Democrat Republican Democrat Republican Democrat Republican this is a bipartisan chorus when it

7:29

comes to this issue I know they say that Washington can’t agree on anything that’s baloney there is widespread

7:34

agreement when it comes to the national debt and deficit spending right both

7:39

parties now they’ll blame each other for who’s responsible for having a national debt but both of them at least

7:46

rhetorically will tell you that this is a this is a disaster for the nation right bad things are gonna happen as a

7:53

result and what I want to do is remind you that it’s always been this way okay

7:58

this isn’t new the rhetoric isn’t new you saw Reagan but it goes far back in history before Ronald Reagan this is a

8:05

cartoon from a newspaper in 1937 okay this is when oh my god the national debt

8:12

is 36 billion with a B billion dollars right hi is a skyscraper taller than

8:19

Mount Everest and all that kind of stuff right so then from 1937 moved through

8:24

the 1940s financing World War two the national debt grows all of a sudden it’s

8:29

49 true 49 billion with an expectation we’re going up to 65 billion oh the

8:35

water’s fine don’t worry right it’s all a big joke gloom and doom Ronald Reagan

8:41

finishes and they erect a monument in this cartoon this is Reagan’s legacy 1.5 trillion now with a tea and then three

8:48

trillion and then when Clinton leaves office five point seven trillion and then it’s seven and a half trillion and

8:54

then it’s up to nine and then 10 and then 13 14 the poor child 15 it’s eating

9:03

through the country 16 trillion the monsters are upon us 17 trillion the

9:09

Democrats and Republicans are kicking the can down the curb 17 trillion in on our children and grandchildren 18

9:18

trillion now so big it no longer fits on earth it is an interstellar problem 18

9:23

trillion dollars 19 trillion a cancer on America 20 trillion the Titanic

9:31

catastrophe ahead and where we are today gross national debt 21 trillion dollars

9:37

all along the way year after year after year the debt continues to grow the cartoonists the pundits the warnings the

9:45

hysteria it’s always been with us it’s always been with us okay the sky is always falling and so

9:53

what I would like this afternoon to be is essentially a form of group therapy because we need it okay because they’re

10:01

scaring us with these stories about how it’s unpatriotic how it’s burdening the

10:06

next generation how its dooming us to a future of higher taxes catastrophe for

10:12

the nation right and I want to try to lower the temperature get us to the point where we can at whatever age it’s

10:19

legal to do so open a nice bottle of red wine read the newspaper see the headline national debt isn’t an all-time high and

10:26

have that nice glow about us and feel at peace with the world right there’s no reason to panic and I’ll try to walk you

10:33

through how I think we should be looking at some of these things but it does require a change in the way we think a

10:40

paradigm shift right we have to begin to see these things not as problems but in

10:46

a different light and so that’s what I want to try to do I think the biggest mistake that we make is thinking of the

10:54

federal government like a household it’s that household analogy it’s the idea that Uncle Sam is just like one of

11:01

us right the federal government operates like a household I have a budget I have

11:06

a budget constraint I can’t spend more than I make year after year I can’t continue to take on more and more debt

11:12

and end up okay at the end of the day therefore the federal government can’t do that either right i analogize from my

11:19

individual personal household to the nation as a whole and i say if i can’t

11:24

do it they can’t do it if it’s bad for me it’s for everyone right the government’s budget is nothing like a household

11:32

budget this is the problem they’re not like us their budget doesn’t work the way our budgets work deficit spending by the

11:39

federal government isn’t the same as you and I spending more than we make year after year borrowing by the federal

11:45

government isn’t the same as you and I going out putting money on a credit card one of us issues the currency they do

11:52

the other one of us you and I are merely using the US dollar so we have a

11:58

distinction to make between currency issuers and currency users the issuer of

12:04

the currency the federal government in this case can never run out of it can never go broke can never have bills

12:12

coming due that he can’t afford to pay can’t become insolvent can’t end up like

12:18

people you may know right who took on too much debt and got into trouble and were forced into bankruptcy so this is

12:24

the biggest hurdle is getting beyond thinking the go of the government as a household like you know personalizing it

12:31

so I want to try and the time that remains to tackle five big questions I’m going to try to do it in close to five

12:39

minutes it’s going to take a little bit longer but these are the five big questions that I want us to look at first what is the deficit most people

12:47

who have very strong emotional reactions to the idea of a government deficit can’t tell you what it is okay so we

12:54

want to talk about that same thing goes with the national debt in fact people often conflate the two the deficit and

13:01

the debt so what is this deficit what is the national debt what is this obsession with China you heard it again and again

13:08

borrowing from China take out a credit card and Bank of China in the name of our children China China China so let’s

13:14

talk about China don’t we eventually have to pay it back and if 21 trillion becomes 22 then 23

13:22

then 25 and 30 then how are we ever gonna retire this thing right do we have

13:27

to eventually pay it back and then the question which is what I organized the

13:32

talk around what can we afford right what can we afford if we have all of

13:38

these ambitious things that we as in a might like to do if there’s broad support for programs for repairing and

13:45

rebuilding crumbling infrastructure do we have the resources to do it and how do we pay for it what can we afford to

13:51

do okay so those are the five big questions the first one is the deficit

13:57

question what is the deficit so I want us to suppose that I’m the federal

14:03

government and I’m going to spend ten of these into the economy and you’re gonna

14:09

be my economy so I’m gonna spend these ten into the economy and this handsome

14:14

young man my husband it’s gonna take these ten right and so I just spent ten

14:21

into the economy so there they are right they’re there and they’re here with him

14:27

but now I’m the government so I’m gonna tack some of those away so give me back four I’m going to take four one two

14:34

three four okay thank you for participating I have taxed away four okay so this is a

14:47

government deficit that’s what the deficit is it means the government spends more into the economy then it

14:52

taxes back out so I did this thing called deficit spending and my record my

14:58

budget is going to record a deficit minus six right that is my deficit but

15:04

guess what the economy has a record as well and the economy’s record is going

15:10

to show what plus six show me that six there it is it’s real that’s the surplus

15:19

that was created as a result of my deficit spending so my deficit my red

15:25

ink is your black ink okay here it is with actual historical data for the u.s.

15:31

going back to 1960 the red line is my account balance okay the red line is my

15:37

financial balance the black line is the private sector in the u.s. it’s all the households it’s all the businesses in

15:44

the US combined and what do you notice I’m almost always in the red my budget

15:49

is almost always in deficit and yours is almost always in surplus and not only that they tend to

15:56

move opposite one another meaning when I run bigger deficits you all end up with

16:01

bigger surpluses okay so my reading is you’re blacking so

16:08

when you see a headline like this one right from The Wall Street Journal just a few days ago trillion-dollar deficits

16:16

could be the new normal this is meant to shock and frighten trillion dollar deficits could be the

16:23

new normal but take a breath and read it this way watch the word deficit don’t

16:29

you feel better don’t you feel better trillion dollar surplus this could be

16:34

the new normal oh all right I’m down I’m okay right maybe that’s not a bad thing

16:39

is what I’m suggesting look at the problem or is it a problem from a different angle okay I see a surplus I

16:47

see a deficit well stand over here right because if you see a deficit you’re

16:52

looking at it from the perspective of the federal government but look at it

16:57

from your perspective you’re in the private sector if you look at it from your perspective you don’t see the deficit you see the surplus okay because

17:05

that’s what’s accumulating as a result so whoops want to back up just one so now let’s talk about we know what the

17:11

deficit is we know that my deficits become your financial surpluses let’s talk about the national debt

17:17

what is the national debt so remember I ran this thing called a budget deficit I

17:23

spent 10 into the economy I only taxed for back I left him with 6 but when I

17:29

run deficits I borrow ok that’s how the federal government currently does things

17:35

and so if I deficit spend 6 then I borrow 6 so I’ve got six of these things

17:43

yes I do six of these things and I’m gonna sell him these things called Treasury bonds

17:49

so he’s gonna give me the money that I gave him and I’m gonna give him the

17:55

Treasury bonds so that that cash now is gone and we have swapped it for Treasury

18:03

bonds and that’s what the national debt is the national debt is all of the

18:09

outstanding Treasury bonds that the government spent the money into the

18:14

economy didn’t tax it back and then traded the cash for a different

18:19

financial instrument called a security a government bond okay so the entire

18:25

national debt is nothing more than a record a historical record of all of the

18:31

dollars that were spent into the economy not taxed back and are currently being

18:37

held in the form of US Treasuries that’s all the national debt is alright so if

18:43

you happen to hold some of those things they’re your assets they’re in your portfolio if you’re investor you might

18:50

have some of those things okay they’re very nice to have they’re safe they’re liquid they’re default risk free they

18:57

help you diversify your portfolio you can take risks elsewhere but you can hold some Treasuries right and they pay

19:03

interest and so if you see this clock up here I took a snapshot yesterday so this

19:10

thing runs in real time and it’s meant to scare people right the national debt tick tick tick tick tick tick those numbers just keep

19:16

getting bigger and bigger and bigger well look now that you know what the national debt is nothing more than the

19:22

historical record of all of the dollars that were spent into the economy and not taxed back currently being held in a

19:28

form of Treasury securities you can look at that debt clock and watch the name it

19:34

becomes the US dollar savings clock so now we don’t have to get so anxious because it doesn’t have the word debt

19:40

any longer now we know it’s just an asset clock okay it’s recording all of the dollars that are currently being

19:46

held in the form of Treasuries as somebody savings so now don’t you feel better ok see I see smiles and heads

19:53

nodding so we’re already making progress in group therapy number 3 China what are we

19:59

gonna do with China so here here’s the question people say I don’t China holds

20:06

so much of our debt though and then they just leave it there as if that’s supposed to automatically explain why

20:11

that’s a bad thing say so ok China holds some US Treasuries

20:17

currently so where did they get them where did China get US Treasuries so I’m

20:24

going to show you so China I would like to buy I would like to buy some of the

20:33

things that are made in China hey and I’m gonna pay with US dollars this is my daughter she plays with these they’re

20:41

squishies they’re made in China so we import things from China they

20:47

manufacture they put on containers they ship to us we get them we import them

20:53

they export them to us we pay with dollars so I have the stuff right

20:58

China’s people the Chinese are working in factories manufacturing giving their

21:04

time using their resources producing this stuff they don’t keep and consume and enjoy for themselves they ship it to

21:11

us and we pay with dollars so now China has a checking account at the Federal

21:18

Reserve okay they have dollars in their account at a bank here in the US called the Fed so now China has a decision to

21:26

make I can sit and hold my dollars in my checking account or I can spend them

21:31

right I could buy some of the stuff that US manufacturers I could buy real estate

21:36

or other things priced in dollars or I could buy Treasuries because Treasuries

21:42

pay interest so maybe I don’t want to keep my dollars in a checking account maybe I would prefer to transfer my

21:48

dollars into a savings account which is nothing more than a securities account

21:53

at the fetch so this is borrowing from China watch I’m borrowing from China

21:59

there I did it I borrowed from China okay now China has the Treasury bond I

22:04

have the stuff and I’ve borrowed from China okay that’s what borrowing from China means so the question that becomes

22:11

what if they won’t buy our bonds any longer what if they because we think that somehow everything is made in China

22:18

including the US dollar and to get more dollars to spend we need China right no we don’t okay so

22:27

what if China decides I don’t want to buy Treasuries any more well that’s perfectly fine China

22:34

could decide to just keep their dollars in their checking account at the Fed it’d be kind of silly to give up the

22:39

interest you know they could decide to do that with that harm the US would it

22:46

prevent us from you know being able to finance other projects infrastructure and so forth the answer is no okay I

22:53

think we’re gonna get to explore that a little bit more maybe in the QA but I just want to give it away here is

22:58

secretary minuchin Treasury secretary just the other day in Reuters article

23:04

this is just from three days ago minuchin is asked are you worried about China refusing to buy Treasuries and so

23:11

forth he says I don’t lose any sleep over it okay and he’s right not to what

23:16

do we really owe China so I have a friend who’s a bond trader is he’s a fixed income guy trades government bonds

23:24

and his name is Warren Mosler and Warren will often say the only thing we owed China is a bank statement okay it’s he’s

23:30

being a little bit funny but essentially at the end of the day that’s about it okay what are we gonna Bank statement we

23:37

already got the stuff we traded it for a Treasury and at the end of the day as long as China wants to orient its

23:44

economy around exporting in order to grow in order to create jobs then we’re

23:51

the beneficiary in this bargain right and we can talk as I said we can talk more about that so there are politics

23:58

involved in all of this and look when it comes to the national debt both sides do

24:04

this and the deficit too you blew up the national debt you did this bad thing that added to deficits the Democrats are

24:11

doing it to the Republicans now because of the tax cuts that were recently passed right you added to the national

24:16

debt you blew up deficits and all this kind of stuff when the shoe is on the other foot the Republicans do the same thing to the

24:23

Democrats so it is again it’s both sides pointing fingers when I was working on

24:29

the hill in the Senate one of my favorite things to do was to ask elected officials or their staffers if you had a

24:35

magic wand and you could wave the magic wand and eliminate the national debt

24:41

tomorrow would you do it everyone said what do you think of

24:46

course yes I would eliminate the national debt with my magic wand no hesitation whatsoever and I say okay

24:52

what if I give you a different wand and I ask you if you would like to you can

24:58

wave this magic wand and you can eliminate US Treasuries they’ll just be gone from the face of the earth tomorrow

25:04

how many people do you think would wave the wand how many members of the Senate would wave the wand to eradicate the

25:10

world of Treasury securities and you just get a total look of like why are you I I don’t understand the question

25:16

you said that’s okay you already answered it right eliminating the national debt means eliminating all of

25:22

those safe securities called US Treasuries that people like to hold in their portfolios because that’s what the

25:29

national debt is you pay off the debt you eliminate the debt there are no more Treasury securities anywhere they’re

25:36

done all right so here is a historical lesson there have been seven times in

25:42

our nation’s history when we have when the government has begun to run budget

25:47

surpluses and pay down the debt seven times in our nation’s history we did it

25:53

from 1817 to 1821 the federal government’s budget was in surplus it’s collecting more in taxes than it’s

26:00

putting back into the economy by spending and so the national debt is being paid down and we did it for a

26:05

period of time what happened had a depression that started in 1819 we did

26:11

it again from 1823 to 1836 under Andrew Jackson actually paid off the national

26:17

debt what happened depression in 1837 then we did it again began to pay down

26:23

the national debt depression depression not recession depression deep protracted

26:30

write contraction in the economy bad situation the last time we did it was under President Bill Clinton 98 through

26:37

2001 the budget was in surplus the government began to pay down the debt what happened the economy went into

26:43

recession in 2001 and we ended up with a great recession just a handful of years later so why does that happen why does

26:52

something that sounds so good and fiscally responsible budget surpluses and paying down debt

26:59

why does it tend to coincide with bad economic consequences why do we end up

27:04

with depressions in the great recession and very quickly because we could talk for an hour just about I could about

27:10

this picture but I would just show you this is where this is where we were with

27:16

Bill Clinton that is the government’s budget moving into surplus you can see

27:21

the red that’s the government’s deficit government’s almost always in deficit but there were those four years right

27:27

there under Bill Clinton when the government’s budget moved into surplus and there was great celebration right

27:33

this is the first time in generations that the budget has been in surplus this is the fiscally responsible thing to do

27:39

you know Democrats delivered this well yeah but guess what look what happened

27:44

to the private sector’s financial position right that it was the built on the backs of the private sector the

27:50

private sectors financial balance went deeply in the red and that’s what allowed the public sectors balance to

27:57

move temporarily into the black but it didn’t last and it can’t last why because it was driven by primarily

28:05

households spending more than their income borrowing on the back of a

28:10

dot-com bubble and then a housing bubble and eventually the whole thing unravels

28:15

too much debt mostly for households okay and so it’s unsustainable when the

28:22

private sector does it with households driving but it’s perfectly sustainable for the federal government’s budget to

28:29

remain in deficit for a period of decades it’s the last question here what

28:34

can we afford this is how we think

28:39

government spending works we think that the government is broke we think that

28:46

they need our money we think that they come first to us either to tax or to

28:53

borrow the tab taxing and borrowing the government raises revenue by taxing us

29:00

and by borrowing money then it has money that it can then spend into the economy

29:06

so the fight is always who’s gonna pick up the tab who’s gonna pay for it because the

29:13

financing has to come from somewhere the money has to come from somewhere and it will be the taxpayers or it will be

29:19

borrowing which is the same as saying deficit spending which is the same as saying putting it on the credit card

29:26

adding to the debt okay because this is how we think it’s gonna this is how it’s supposed to work and so the fights are

29:33

all about who’s gonna pay for it whose taxes are gonna go up who’s gonna be paying for it right so you get somebody

29:42

like senator Sanders who put forward an ambitious economic platform right wants

29:50

to do a trillion dollars of infrastructure wants to make public colleges and universities tuition-free wants to transition to a health care

29:58

system based on built around medicare for all want to be in it you’ve heard right this ambitious program and his

30:05

opponent in the Democratic primary you know kind of in her book this is from

30:11

her book what happened she says you know it was like every time we tried to offer

30:16

something he offered something bigger and it was like you know hey I think you know Bernie’s saying I think America

30:22

should get a pony and Hillary says how are you gonna pay for the pony because it’s also fantastical it’s so out of

30:28

reach it’s a pony right it’s not realistic so in DC where I worked on the

30:36

budget committee there is a great deal of pressure to pay for things there’s a lot of pressure for people especially

30:43

when they’re running for president to show that they have the money to make good on whatever policies they’re

30:49

putting forward so if you say you’re going to make public public colleges and universities tuition-free somebody wants

30:55

you to draw a line to the source of revenue where’s the money coming from and so senator Sanders did that and he

31:01

said well we’ll pay for it with a tax on Wall Street speculation of financial transactions tax Wall Street will pay

31:08

for it he did it with infrastructure and with other programs when he said well

31:13

we’ll close tax loopholes or we’ll have you know raise the cap on FICA withholdings and we’ll find the

31:20

billionaires and corporations and the rich will pay for it right when we talk about the wall President

31:27

Trump did the same thing Mexico will pay for it right there the money has to come from somewhere and so everybody’s trying

31:33

to pay for it so here’s where I wish we were and this is very close to the end where I wish we were was having an

31:41

entirely different conversation and a very different national debate and if I

31:47

had a little bit more time I would show you this video clip but I’ve seen it so many times I’m just gonna tell you what

31:52

it does so that is Alan Greenspan who was

31:57

chairman of the Federal Reserve for a period of time before Ben Bernanke right you may remember so here’s Alan

32:04

Greenspan under oath before Congress answering a question from Congressman

32:09

Paul Ryan and Paul Ryan is asking him a question about Social Security because

32:14

whenever these discussions and debates come up about the national debt and our budget picture national budget people

32:22

say it’s entitlements that are the problem it’s Medicare it’s Social Security it’s Medicaid these are the

32:28

real drivers of our long-term fiscal crisis or challenge right they point to

32:34

entitlements so here’s Greenspan sitting there under oath and he’s asked this

32:39

question by Congressman Paul Ryan don’t you agree with me that now is the time

32:45

to begin to move toward a system of personal retirement accounts this is

32:50

privatizing Social Security now is the time to begin to transition to a system of personal retirement accounts because

32:57

we all know Social Security’s going broke and we can’t afford to make good on promises okay that’s what Ryan asked

33:03

Greenspan and Greenspan said no I don’t agree with you I don’t agree with you at

33:08

all and then he goes on to say and the quote is here all right so the first part is here there’s nothing to prevent

33:16

the federal government from creating as much money as it wants and paying it to

33:21

someone whoa when did anybody ever go on TV and tell you that right there’s

33:28

nothing to prevent the federal government from creating as much money as it wants to in paying it to someone so he has completely taken the

33:35

affordability question off the table we don’t have to ask whether we can make good on promises to future retirees their

33:42

dependents and the disabled we can we can make good on every promise in perpetuity nothing to stop us from doing

33:49

that then he goes on to make the really important point that we should be having an entire national debate around and his

33:55

next cent next sentence is this the question is how do you set up a system

34:01

which assures that the real assets are created which those benefits are

34:07

employed to purchase what does that mean it means that we have demographic

34:14

changes taking place in this country more and more people who are today working are going to be moving into

34:20

retirement this year next year the following year the boomers right they’re already leaving the labor force and

34:26

moving into retirement and that’s going to continue for some time and it’s gonna leave behind fewer and fewer people who

34:33

are working and producing the stuff but the boomers once they retire they don’t stop consuming they continue to consume

34:40

they just stop helping us to produce the stuff so Greenspan’s point is how do you

34:45

set up a system which assures that the real assets the stuff is created so that

34:52

when those benefit payments go out to future retirees their dependents and the

34:57

disabled they can do what spend that money into an economy that is productive

35:03

enough there is enough stuff being produced that we don’t get what kind of a problem inflation I heard it because

35:11

if the economy is not productive enough five years ten years twenty years thirty years from now and the checks go out

35:17

then we’re all going to be competing for a limited a smaller and smaller quantity

35:22

of actual stuff and we’re going to create an inflation problem and inflation is every central bankers

35:28

public enemy number one that’s what he’s worried about okay so can you imagine if

35:33

instead of saying Social Security is going broke we have to cut benefits the system is unsustainable forget all of

35:40

that if instead of that we were saying what are the things that we can do today

35:46

what are the investments we can make today to increase the odds that in

35:52

five ten twenty years the US economy is productive enough that we can make good

35:58

on all of those promises without causing an inflation problem the Republicans

36:03

would say what tax cuts and deregulation are the best ways to produce an economy

36:08

that is you know maximum growth and high productivity the Democrats would say what education infrastructure R&D but at

36:15

least we would be having the right debate right at least we would be having a good constructive productive debate

36:22

over the real issues that matter instead of this phony you know where the money

36:27

is running out sort of debate so that’s where I wish we were the US government is never going to run out of the US

36:34

dollar the US government is the scorekeeper for the dollar it can’t run out of dollars any more than a carpenter

36:41

can run out of inches or the scorekeeper here at Stonybrook can run out of points

36:46

when the football team is putting up 77 points in a game and all the fans are sitting in the audience going oh my god

36:52

what happens if they score again they’re never gonna have enough points to put up yes they will they can’t run out the

36:58

stadium can’t run out of points the US government can’t run out of dollars it’s a unit right the government spends by

37:05

instructing its bank to change the numbers in someone’s account upward that’s how we pay for things it’s not

37:11

actually by physically printing money and making payments it’s all done electronically okay so that’s how it

37:18

really works the spending comes first Congress authorizes a budget that’s how

37:24

it’s supposed to work the House and the Senate write a budget there’s a budget resolution the president signs the

37:31

budget and there’s authorization is given right budgetary authorization comes through appropriations and the

37:38

agencies are told this is how much money you have to spend and the government begins spending I the spending happens

37:45

first and once people receive income from the government’s spending people

37:50

start paying taxes and now there’s money to also buy those bonds remember I spent it before I taxed it back or sold the

37:58

bonds so this is from a talk a series of talks I gave just over this summer in London one at the British public library

38:04

and one in the house Lorde’s this is the debate I wish we were having instead of getting bogged down in the pay for a question focus on

38:12

the real things that matter what can we afford the answer isn’t in financial

38:18

terms the answer is in real terms if we want to do a trillion dollars of

38:23

infrastructure and somebody says how are you going to pay for it you should say I’m gonna pay for it by hiring 300,000

38:32

construction workers by using X tons of steel by using 2 or 3% of our unused

38:39

spare capacity in our factories by mobilizing this many machines and heavy

38:44

equipment and so that’s how you pay for it real resources and if you don’t have

38:50

them if the economy is already operating at full employment and everybody’s being

38:55

used all the workers are already employed all the resources are currently being used then you can’t afford it

39:03

right but if you have spare capacity if you have idle people if you have idle

39:08

machines if the recent raw materials are there then the government can step in and say now would be a good time because

39:16

we can mobilize these resources in a responsible way that means without causing inflation without competing for

39:23

those resources with other people who are currently using they’re not being used we can hire them put them to work

39:29

and improve the standard of living right in the interest of the public of the public good so thank you very much so

39:36

thank you so much that was spectacular and I think my head’s still spinning a

39:42

little bit and trying to get my rounded all the way who’s listening I mean this

39:48

is obviously a novel idea who’s listening and are you seeing progress as you’re putting these ideas out yes

39:55

well lots of people are listening so I think you know just in the last I would say a year and a half to two years there

40:02

seems to have been a real lurch forward with these ideas both in terms of you

40:08

know the media interest cover stories headline you know pick kind of feature pieces just on the ideas themselves

40:16

then people running for office who are trying to find a better way to dialogue with their constituents they’re going to

40:23

debates and they’re running for public office or elected officials who are just reaching out and saying look I want to

40:28

talk about this stuff in a better way can you help me find ways that you know I can be comfortable with but

40:35

recognizing that it’s a departure from the way they’ve been doing it so I think lots of people are listening so to go

40:44

back to one of your central points if the deficit is really not the right guide and you kind of answered part part

40:49

of this question but what really should policymakers be looking at when they’re trying to make a decision I think again

40:55

in your wrap-up I think you kind of manage of some of their other things besides just understanding what the costs are going to be interesting so

41:01

yeah so one of the things I mentioned inflation but that’s not the only consideration so I mean you know right

41:08

now legislation is run by the Congressional Budget Office and that’s the sort of Washington scorekeeper they

41:15

look at legislation that’s been proposed and they give members of Congress feedback and they try to help them

41:20

figure out am I going to vote for or against this piece of legislation but most of the feedback they give is this

41:26

will be the impact on deficits going forward and this will be the impact on the national debt what I’m suggesting is

41:31

that it would be useful to have CBO go beyond and maybe not even do that but

41:37

certainly to go beyond and say look you want to expand the Earned Income Tax Credit this is how many kids would be

41:44

lifted out of poverty if you were to do that this is you want to provide these tax cuts and you know look at the

41:49

Republican tax cuts and say there’s this measure called the Gini coefficient it’s a measure of income inequality or wealth

41:55

inequality in the country let us talk about what that might do to inequality if we pass this legislation so that I

42:02

think that would be useful feedback so the u.s. obviously has the still I guess

42:08

he wasn’t trying to now have the dominant economies in the world but can any sovereign nation adopt this policy

42:14

in terms of you know your your producing the money you’re going to spend it or is it constricted by you know the markets

42:19

for currencies things like that in terms of who can do this I’m thinking of Greece for example clearly they ran into

42:25

problems in the U with the overspending and so on so can any nation do this yeah so you use the magic

42:31

words which are sovereign currency and so what happened with Greece is that Greece was you know operating with the

42:37

drachma they had a sovereign currency until they didn’t until they gave it up in favor of this new thing called the

42:44

euro and once Greece gave up the sovereign currency and started borrowing in a currency that’s essentially foreign

42:51

to them it invites all kinds of problems but the US has a sovereign currency the UK does Japan Canada Mexico

42:59

so those countries could could make maximum use of their domestic resources

43:05

they can afford to buy whatever’s for sale in their domestic currency so we’ve

43:11

been hearing for years and years obviously and you showed it so well in your video this the debts terrible the

43:17

deficits terrible and so on how do we do a better job of educating the public on monetary policy because you’re really

43:23

it’s different what you’re talking about it’s quite different Julian tasks because there’s so much disinformation

43:30

that it takes to coin a phrase or to turn a phrase it takes a village sense

43:37

to combat this I mean you really do need it’s not enough for just academia to come aboard you know I think that part

43:45

of what helped push this message forward was when financial journalists in particular came became interested in mmm

43:53

tea and started writing about these ideas so you know people putting better

43:58

questions to our politicians writing better articles for people to digest

44:03

telling better stories on the news it’s gonna take a lot of work so you

44:09

mentioned and I think I mentioned my introduction that you were an economic advisor for the Sanders campaign in 2016

44:15

how did that happen how did you get engaged with it I had well so I didn’t

44:20

start advising the campaign until after I left the Budget Committee so it was a what two weeks there’s my husband two

44:27

weeks before Christmas 2014 and I got a phone call from him and the Democrats

44:34

had just lost the Senate and so the Senate was going to flip and he was going to be the ranking member of

44:40

the Budget Committee starting in 2015 and he needed to hire a chief economist to advise members of the

44:47

Democratic caucus on the budget committee so he called and we had a conversation and then he called two days

44:53

later and we had almost the same conversation at the end of that call he asked if I would come in and do this job

45:01

in Washington so just a couple of weeks before Christmas with kids that were much younger I picked up and moved to

45:07

Washington and worked on the budget committee so we knew each other from from that time and then when he decided

45:13

to run for president and I finished my year and a bit on the budget committee then I started advising the campaign but

45:20

it sounds like from what you said it was still difficult to get him at least in the current political environment to not

45:25

point to ways in which things would be paid for is that fair yeah and and it’s

45:30

tough because you know I show up in January and I think he announced he was going to run for president in May so and

45:37

you know this is someone who I think has prided himself on consistency in message

45:43

for many many years and and there’s so much pressure as I said in the talk there’s so much pressure to show

45:49

everyone exactly where the money is going to come from and if you don’t do that they say you’re not serious and then when you do do that they tell you

45:56

the math doesn’t add up so it’s just sort of can’t win what are some of the

46:01

other constraints kind of in getting this done and and what are some of the incentives that you know you can give to

46:06

people to try and adopt this in leadership well the constraints I mean there’s

46:12

they’re all self-imposed that’s the worst part of this is that the constraints aren’t real they’re just you

46:19

know and there’s their self impose they’re sort of you know this is the way we these are the expectations of people

46:26

who put forward legislation that there will be a pay for attached and I think that you know one of the funny things

46:33

that happened is with the Republican tax cuts I think it pushes the door open for

46:38

the Democrats and so a lot of them are calling me now and saying things like well if they don’t have to pay for

46:43

anything we don’t have to pay for anything and so in a way I think the Democratic ins

46:49

kind of advanced the agenda here with their tax cuts do you think the the

46:55

infrastructure argument is is stronger or versus the tax cutter and sent as

47:00

incentive argument for economic growth I mean have you have you thought about that or that because obviously you

47:05

talked about that could play out now in a public debate which would be much more productive than talking about the idea of the deficit but you have a so

47:12

economists will say they’re the multiplier effect how much bang for the buck so if government does a trillion

47:18

dollars of infrastructure investment what are the benefits to the economy as a whole in terms of where does the money

47:24

go in whose hands does the money find itself and then how much of it do they respond in to the economy and so you get

47:30

a multiplier effect versus tax cuts that are skewed disproportionately to the

47:35

people at the top who then turn around and spend you know only a very little amount back into the economy so you know

47:42

if you’re comparing a trillion dollars of infrastructure alongside a trillion dollar tax cut most economists would say

47:48

the infrastructure is more bang for the buck so so you mentioned one of the the

47:55

risk being inflation potentially in terms of this and so and of course inflation more acutely affects lower

48:01

income lower asset individuals so how does that risk kind of weigh in to the monetary fiscal policy as you think

48:07

about it so the point that I’m trying to make here is that you want to make

48:12

efficient use judicious use of the budget and efficient use of the resources that you have without putting

48:19

a strain on the economy and so really the goal is to avoid the kind of

48:25

inflation that can be punishing I mean that’s a good question to note that people low income people can feel the

48:32

pinch the worst as prices especially food prices and and rent to those sorts of things accelerate but the whole point is to be

48:39

sensitive to the limitations and to avoid that kind of inflating off that kind of inflation as a result of

48:45

government policy so it’s a one last question from our registers it’s been

48:51

said that the governor could pay government could pay for things like universal health care for example by

48:58

simply increasing taxes on the richest one is that really enough and is that is the

49:04

vision that bernie sanders had plausible without resulting without with by just tax increases without resorting to a

49:11

different approach to monetary policy so you know what he’ll say with respect to

49:17

jet you asked about healthcare inversion yes yeah so you know right now he would say that we are already paying people

49:24

say well how are you gonna pay for Medicare for all and the answer really is we’re already paying for it we’re just paying more than any other country

49:30

in the world so moving to a system of medicare for all means paying less than we’re already paying and you know

49:37

getting to the point where you say right now people are paying in the form of co-pays and deductibles and premiums and

49:43

instead of doing that they’re gonna make some other type of payment whether we call it a health care premium or a tax

49:49

and there it does matter by the way why do you call it but that we would end up paying less for it at

49:56

the end of the day and whether taxes have to increase or not is again it

50:02

comes down to the real economy it’s can you do it without creating an inflation problem and if you can’t then there’s an

50:07

economic reason for cooling things off by taking some income away from people by taxing well again this has been

50:14

fantastic I think many in the audience for you know hopefully your are feeling a little more optimism perhaps than they

50:21

were coming in which is wonderful I think in these times and I look forward to learning and hearing more as you put

50:28

forward these very provocative but also very important um conversation for our country please join me again at Thank

50:33

You Jessica you

Budget Surpluses Cause Recessions

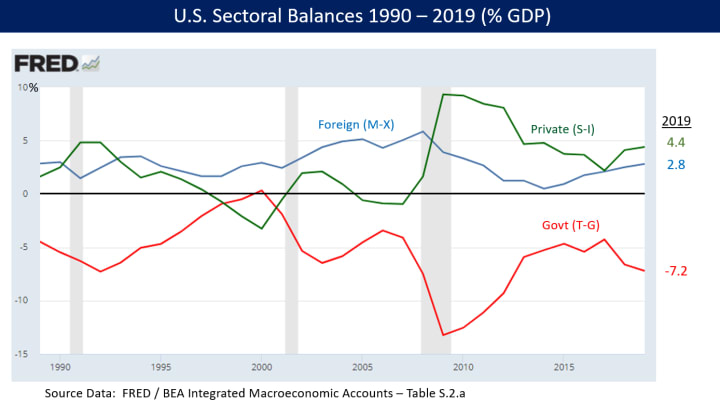

A budget deficit occurs when the government has created and spent more money into the economy than it has removed in taxes. A budget deficit therefore puts more money into your pocket than it takes out.

A budget surplus occurs when more money is taxed out of your pocket than is spent in. This is not good for you, and it doesn’t help the government either because taxes are not saved. But that doesn’t stop corrupt politicians from appealing to popular intuitions about “saving for a rainy day” or the fact that surplus sounds positive and deficit sounds negative.

Politicians do this to discourage social spending. Furthermore, attempts to “balance the budget” or have a budget surplus cause cash-strapped people to accumulate private debt (i.e., realdebt) that is held by the wealthy donors of these politicians. Unfortunately, this situation (see graph when the green line drops below zero) almost always triggers a recession (shaded areas of the graph).

Historical data shows that a government deficit (the red line, below zero) is a private sector surplus (the green and blue lines, above zero). Basic accounting tells us that the lines balance out every year and sum to zero.

Why Learning Economics Is Important

Every time a policy is proposed that could save lives, such as public healthcare or climate action, it is belittled with the following eight words: “how are you going to pay for it?”

Liberals propose taxes or cuts that conservatives disagree with, and the two sides have argued about these imaginary financial constraints for decades while millions have died.

The truth is that the government has no financial constraints. It only has resource constraints and the risk that its spending might cause a demand for resources that exceeds the economy’s productive capacity (inflation). However, there is nearly always room to expand that capacity with construction, imports, education, and innovation.

In recent years, Modern Monetary Theory (MMT) and its advocates have popularized and informed people about the ideas presented here. Eventually, these ideas could transform society, causing it to focus less on the importance of money and more on what can be achieved with the real resources at its disposal.

It is no coincidence that every modern historical triumph, from reaching space to winning WW2, acknowledged the triviality of money. We did not say “we can’t afford to fight Germany.” Rather, we looked at what we could do with the resources we had and used money to incentivize people to contribute. A government can create as much incentive as it wants.

In my view, our collective understanding of these paradigm-changing ideas will bring about the greatest societal change of the 21st century. The imaginary financial constraints that our leadership class places upon itself will be removed. Instead of “we can’t afford that” we will say “how do we resource that?” and reduce suffering on a massive scale.

Of course, MMT already has its critics. Typically, they either do not understand the theory or do not want you to understand it. They create straw man versions to make it appear unreasonable, uncomplicated, and not the work of highly-credentialed academics and economists.