Song, kanta

“My Name is Gaza“

Bideoa: https://x.com/i/status/1809903714389385382

***

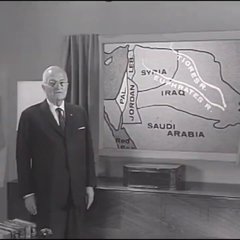

US President Harry Truman (1945-1953) stands next to a map showing the State of Palestine.

Israel is not real.

****

Ghazal was pulled from the rubble of her home that Israel bombed. Her shirt poetically says

“home is where i’m with you“.

Bideoa: https://x.com/i/status/1810993207519727862

*****

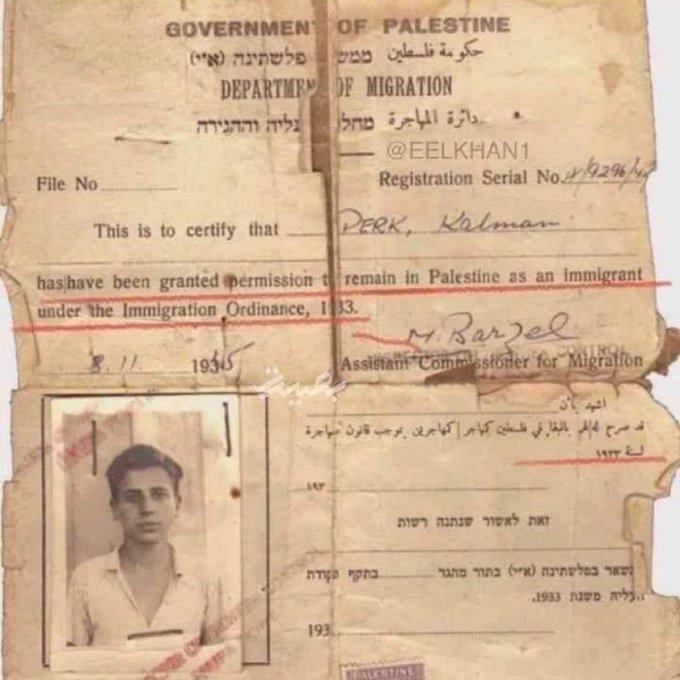

“I SWEAR TO BE LOYAL TO THE GOVERNMENT OF PALESTINE” SIGNED BY ISRAELIS WHEN EMIGRATING FROM EUROPE IN THE 1930s

oooooo

Don’t stop talking about Gaza

oooooo

This is a historical moment! The Ambassador of Egipt and the President of the General Assembly confirmed Palestine’s new official seating among the nations.

oooooo

Starmer said: “Israel does have that right” to cut off water and power from Gaza

Starmer gave cover to Netanyahu.

He’s complicit.

Don’t let anyone forget.

Bideoa: https://x.com/i/status/1835701335024427041

oooooo

Declassified UK@declassifiedUK

Pro-Israel lobby groups and individuals have donated to 13 out of Labour’s 25 cabinet members, Declassified has found.

The list of recipients includes Keir Starmer, his deputy Angela Rayner, chancellor Rachel Reeves, and foreign secretary David Lammy

oooooo

I drop some truth bombs at the UN

“Not only is the West complicit in the Genocide in Palestine, the ruling class of the West is so scared of its own citizens that it is now prepared to persecute its own citizens in support of a genocide”.

Bideoa: https://x.com/i/status/1835731415004024984

oooooo

The Germans are waking up the the insanity of Annalena Baerbock – the Marie Antoinette of German foreign policy

Bideoa: https://x.com/i/status/1835725521277129036

oooooo

BREAKING: ISRAEL ADMITS IT HAS BEEN KILLING ISRAELI HOSTAGES

Bideoa: https://x.com/i/status/1835432026549219800

oooooo

A thread to honor the children of my friends and relatives, deliberately killed by Israel without any justification. I will share their photos whenever I find time.

I pledge to live and die for one cause: justice and accountability.

1-Sham Khalil Al-Yazji

“George Orwell had a rich imagination, but even he could penetrate the depths of the totalitarianism that we see within the framework of the rules-based world order” — Sergey Lavrov

You know that 50 countries are fighting against Russia in a coalition with the United States. All these countries, including the United States, have no sovereignty, since they are controlled from one center. This center is usually called DeepState. So, this DeepState does not give a damn about the United States or any other countries. They do not care who will work for them in these countries – the indigenous population or migrants. They are only interested in profit and power over the world. Those countries that do not want to submit to this supranational power have to fight for their sovereignty. Russia is now leading this fight. This is a fight for the future of not only Russia itself, but the entire civilization.

Bideoa: https://x.com/i/status/1835645517356818461

oooooo

Palestinian woman gets BEATEN and KIDNAPPED in BROAD DAYLIGHT by ILLEGAL settlers in civilian clothes!

Bideoa: https://x.com/i/status/1835851162479681579

oooooo

Why didn’t @ABC News fact-check Kamala Harris when she made this statement?

Bideoa: https://x.com/i/status/1835832548326552056

oooooo

“Africa Doesn’t Need the World Bank, IMF, Europe, or America. We have what it takes to grow our economy without loans and refuse to be financial slaves.”

~Ibrahim Traore (President of Burkina Faso)

Your comments on this

oooooo

In Starmer’s Britain, if you post your frustrations about children being murdered, you will go to jail.

If you have 41 sexual images of children, you will not go to jail.

At least we all know the Regime’s values now.

Bideoa: https://x.com/i/status/1835674356942246086

oooooo

Israelis assaulted and held a UN vaccination convoy hоstage at gunpoint

Bideoa: https://x.com/i/status/1835629282045165736

oooooo

Israel will grant permanent residency to around 30,000 refugees from Africa on the condition that they fight for the Israeli army in Gaza.

oooooo

Saul Staniforth@SaulStaniforth

@AyoCaesar: “Theirs no such thing as a free lunch… Keir Starmer has accepted more freebies as leader of the opposition than every other Labour leader combined since 1997”

Bideoa: https://x.com/i/status/1835641043363987912

oooooo

“The super-rich do not spend their money on MPs out of generosity and out of the goodness of their hearts. They want something in return. This wealth is used to buy influence in this House; to get this place to serve their interests and not the interests of our constituents.”

Aipamena

Zarah Sultana MP@zarahsultana

2021 api. 21

When I was first elected, one of the things that shocked me most was the lobbying from big business and the super-rich. From gifts, dinners, donations and – we know now – texts to the Prime Minister, they do it to get the government to work for them, not for you.

Bideoa: https://x.com/i/status/1384871798920126471

oooooo

Before and after.

This was always what Labour’s confected “antisemitism crisis” from 2015-19 was all about.

Future historians will study it as one of the most ferocious propaganda campaigns in peacetime British history.

The Azov Brigade was officially certified by the Blinken State Dept to receive US weapons in June of this year The same media that painted this neo-Nazi unit as heroic “defenders” is about to sweep Routh’s background under the rug and brand us all as conspiracy theorists

Ira. 16

EXCLUSIVE: Attempted Trump assassin Ryan Routh appeared in a propaganda video for the AZOV BATTALLION in May 2022

oooooo

PALESTINE ONLINE @OnlinePalEng

A Gazan teacher courageously resumed educating children in a simple tent despite the devastation of war, demonstrating resilience and a steadfast dedication to education.

Bideoa: https://x.com/i/status/1835373113137152406

oooooo

This is insane.

oooooo

Mariam Barghouti مريم البرغوثي@MariamBarghouti

The Israeli army just arrested a university student Dua Al Qadi from her home in Ramallah.

The army stormed the house and grabbed her and told the family one thing:

“Administrative detention”

Meaning she will be taken to Israeli detention (torture camps) with no trial or charge, and they know this. They’re essentially kidnapping her hostage.

جيش الاحتلال سرق حصان دوار جنين ونقلوه على الداخل المحتل “اسرائيل المزعومة“. قام بصناعة الحصان الفنان الألماني توماس كبلبر من بقايا سيارة الاسعاف التي استهدفها الاحتلال عام 2002 في جنين. الحصان كان يقف في المكان الذي ارتكبت فيه مذبحة في نيسان والتي ارتقى فيها 58 شهيداً ..

Okupazio armadak Jenin-en karroza zaldia lapurtu eta okupatutako barnealdera eraman zuen, «Israel deiturikora».

Zaldia Thomas Kpelber artista alemaniarrak egin zuen 2002an Jeninen okupazioaren xede zen anbulantziaren hondakinetatik.

Zaldia zutik zegoen apirilean sarraski bat egin zuten tokian, eta bertan 58 martiri hil ziren.

oooooo

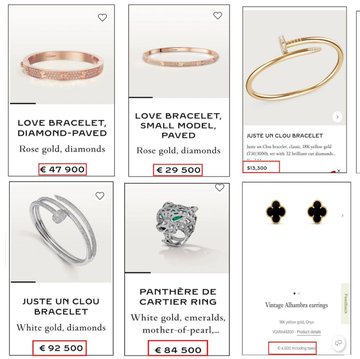

Ukrainian Journalist Diana Panchenko

@Panchenko_X has revealed videos of Ukrainian politicians partying at an exclusive luxury resort in the Maldives.

They are wearing hundreds of thousands of dollars in jewellery, including Rolex and Cartier.

Where did the money come from?

Bideoa: https://x.com/i/status/1835740129820029292

oooooo

BREAKING Yemen has shot down another American MQ-9 Reaper drone allegedly being used for surveillance for Israel A total of 10 MQ-9 Reapers have been shot down by Yemen so far

oooooo

Dr. Anastasia Maria Loupis@DrLoupis

Jacob Rothschild: “My family created Israel”

Israel is a fake state created by evil globalists.

Bideoa: https://x.com/i/status/1835237143465119783

oooooo

@tobararbulu # mmt@tobararbulu

UN General Assembly overwhelmingly calls for end of Israeli occupation https://youtu.be/EQROb8cQGw8?si=sAbYhepG6Bi4P-rW

ooo

UN General Assembly overwhelmingly calls for end of Israeli occupation

UN General Assembly passed on 18 September 2024 a resolution demanding an end to Israel’s occupation of Palestine within the next 12 months by an overwhelming margin. The nonbinding measure passed a 124-12 vote on Wednesday, with 43 countries abstaining. The resolution welcomes a July advisory opinion by the International Court of Justice that said Israel’s occupation of Palestinian territory and settlements is illegal and should be withdrawn. It also called on Israel to make reparations to Palestinians for damages incurred by the occupation.

Read the resolutions text here: https://www.un.org/unispal/icj-and-question-of-palestine/

Transkripzioa:

0:00

the general assembly is now voting on

0:02

draft resolution a es10 l31 revision 1

0:07

entitled advisory opinion of the

0:09

international court of justice on the

0:11

legal on the legal consequences arising

0:14

from Israel’s policies and practices in

0:17

the occupied Palestinian territory

0:19

including East Jerusalem and from the

0:22

illegality of Israel’s continued

0:24

presence in the occupied Palestinian

0:27

territory will all delegations confirm

0:30

that their votes are accurately

0:32

reflected on the

0:34

screen the voting has been

0:38

completed and please lock the machine

oooooo

Happy birthday to @wbmosler

youtube.com

Warren Mosler Says It Out Loud

From the 2013 debate between Warren Mosler and Robert Murphy. https://www.youtube.com/watch?v=c

ooo

From the 2013 debate between Warren Mosler and Robert Murphy. ![]()

Bideoa: https://www.youtube.com/watch?v=K-kK7Iqzucg

• MMT vs. Austrian School Debate

Transkripzioa:

I got my first banking job in 1973 in

0:02

1972 with 200 million people we had 2.6

0:06

million housing starts a few years ago

0:09

with the financial sector taking 30% of

0:12

the S&P earnings right is that what it

0:13

was okay 2 million housing starts with

0:16

300 million people was an unsustainable

0:19

bubble right clearly the financial

0:21

sector is entirely parasitic and we just

0:24

let it get way out of hand and it did

0:26

more with less back then for obvious

0:28

reason

0:34

try to now

oooooo

2 MINUTES AGO: CHINA Just DESTROYED the EU So BADLY It Won’t Recover! https://youtu.be/ekv2zTlfwO0?si=T24AX_Rv6lMBfYKh

ooo

2 MINUTES AGO: CHINA Just DESTROYED the EU So BADLY It Won’t Recover!

Bideoa: https://www.youtube.com/watch?v=ekv2zTlfwO0

The EU’s decision to impose tariffs on Chinese electric vehicles has sparked unexpected consequences, affecting not only European industries but also global trade dynamics. While the EU aimed to protect its local automobile sector, China’s strategic response targeted critical European exports, opening doors for Russia to capitalize. From electric vehicles to pork and dairy, this escalating trade war is reshaping alliances and threatening the EU’s economic stability. Will Europe be able to withstand China’s countermeasures, or will the ripple effects continue to disrupt global markets?

Transkripzioa:

the eu’s decision to impose tariffs on Chinese electric vehicles set off an unexpected Chain Reaction China’s

0:07

strategic response not only threatened European Industries but also exposed critical vulnerabilities in Western

0:13

Supply Chains It’s achieved this with breaket growth in the industry fueled by

0:19

government subsidies the problem with this is that the Europeans and Americans are saying that that’s given Chinese

0:26

Brands an unfair advantage on price that they’ve being able to flood markets in

0:32

other countries at rates that local Brands can’t compete with and they’re

0:37

threatening to put tariffs on Chinese cars to level the playing

0:43

field the counterargument to that though is that at the beginning you needed to

0:50

have such subsidies the European Union has been embroiled in a heated debate for several

0:56

months regarding the imposition of additional taxes on China’s new energy Vehicles the attitudes within the EU

1:03

have been notably divided with some countries advocating for higher taxes to protect their local automobile

1:09

Industries While others Express concerns about potential retaliation from China

1:14

in August 2024 the EU ultimately decided to impose additional taxes on Chinese

1:20

new energy Vehicles sold in the European market an action that has been perceived as a direct challenge to China however

1:28

the eu’s sanctions have not only failed to intimidate China but have inadvertently created a significant

1:34

opportunity for Russia the market share that originally belonged to the EU is now being seized by Russia which has

1:41

swiftly reached agreements with China in the field of new energy Vehicles

1:46

competition has intensified dramatically in recent years the gap between Europe and its

1:53

competitors particularly China and the United States has widened in key disruptive Technologies

2:00

China’s electric vehicles and Battery Technology have demonstrated Superior performance and price advantages

2:06

compared to similar products in Europe Chinese made models are approximately

2:11

20% cheaper than those produced in the EU this Competitive Edge has allowed

2:17

China to capture 8.2% of the EU electric vehicle Market in

2:22

2023 with projections indicating this share could exceed 20% by

2:27

2027 faced with this growing pressure the EU has implemented a series of

2:33

Economic Security and supply chain security strategies since last year these measures aim to reduce the eu’s

2:39

Strategic dependence on China in this drisking process the French government

2:45

has been particularly vocal about the need to remain competitive in the global new energy vehicle Market in response to

2:52

this challenge France along with several other EU countries imposed tariffs on major Chinese automakers in June 2024

3:00

for the tariffs were set at 17.4% 20% and 38.1% for byd gie and saic

3:09

group respectively additionally a general Tariff of 21% was imposed on

3:14

other manufacturers it’s another step in an escalating trade dispute between China and the West the European

3:21

commission drastically increased import tariffs on Chinese electric cars Chinese

3:27

automakers would face duties as highest 38% up 10 up from the current 10% the

3:35

block is reacting to China’s W widening its Reach In global EV markets Brands

3:41

like byd Gil and saic have been expanding abroad mostly due to their

3:48

lower prices both the EU and the US are accusing Beijing of illegally subsidizing Chinese car manufactures the

3:56

commission says the Tariff hike the European commission established a 10-day window for companies to request a

4:02

hearing if no hearing is requested or if a hearing is filed but no majority objection is obtained The Proposal will

4:09

be passed this effectively means that the eu’s taxation of Chinese electric

4:14

vehicles is almost a foregone conclusion with final measures expected to be implemented within 4 months after the

4:20

implementation of the temporary tax the eu’s Tariff increase will create unprecedented cost pressure for Chinese

4:27

electric vehicles exported to Europe data reveals that in 28 European countries 20% of newly registered

4:33

electric vehicles are made in China in 2023 China’s total automobile exports

4:39

reached 4.6 million of which approximately 900,000 were new energy Vehicles the total value of these

4:46

vehicles exported to Europe was us 11.5 billion accounting for nearly 57% of

4:51

China’s total automobile exports while Chinese automakers have shown impressive growth in the EU Market with exports

4:59

increasing by more than 100% year- on-year the situation is becoming more

5:04

complex the implementation of the eu’s new tariff policy will further increase the price of Chinese cars in Europe

5:11

widening the price Gap with local European cars this could potentially put Chinese manufacturers in a precarious

5:17

financial position if they operate at a loss for an extended period in response to the eu’s tough

5:24

stance on automobile taxation Beijing has not remained passive in June 2024

5:30

China launched an anti-dumping investigation on pork exported from the EU covering pork and its

5:37

byproducts this move is a significant blow to many EU countries as China is a

5:43

crucial market for their pork exports China as one of the world’s most

5:48

populous countries consumes more than 55 million tons of pork annually accounting

5:54

for almost half of global consumption despite being a major pork producer itself China still needs to import large

6:01

quantities of pork each year to meet domestic demand the majority of pork imported by China comes from EU

6:08

countries such as Spain the Netherlands France Germany and Denmark these

6:13

countries have traditionally enjoyed profitable pork exports to the Chinese market however the implementation of

6:19

anti-dumping Duties threatens this important market for EU pork producers for instance Spain one of the main pork

6:26

exporters in the EU exported 500 60,000 tons of pork to China in 2023 if

6:33

anti-dumping measures are implemented the Spanish pork industry could face losses of approximately $400

6:40

million industry experts predict that the entire eu’s pork market share in China May decline sharply with sales

6:46

volumes potentially dropping by 30% to 40% simultaneously pork prices are

6:53

expected to rise by at least 20% eliminating the previous price Advantage enjoyed by EU producers the situation

7:00

has created divisions within the EU countries such as Germany Denmark Italy

7:06

and Hungary have openly opposed the eu’s policy of imposing tariffs on Chinese

7:11

electric vehicles in an attempt to ease tensions the German minister of economy

7:17

actively promoted dialogue between China and Europe particularly regarding the sensitive topic of additional tariffs on

7:24

Chinese electric vehicles German economy Minister Robert HCK is in China to discuss trade

7:31

relations but a planned meeting with Premier leech young was cancelled at the last minute without explanation the

7:38

cancellation comes amid growing Chinese anger over EU plans to increase tariffs

7:44

on Chinese electric vehicles habc said the EU was open to negotiate but said

7:50

that China’s backing for Russia’s war on Ukraine was what was really damaging

7:55

trade relations despite negotiations between the two sides the EU made only

8:00

Minor Adjustments to the Tariff rates saic’s Tariff was reduced from

8:06

38.1% to 36.3% still the highest among all

8:11

manufacturers while byd’s Tariff was reduced from 17.4% to

8:17

177% the EU Justified these high tariffs by citing excessive subsidies provided

8:22

by the Chinese government to domestic car companies the issue has reached a deadlock to stop the decision at least

8:30

15 member states need to vote against it however based on previous voting patterns within the EU only four

8:37

countries clearly oppose the measure far short of the required number in an unexpected turn of events Russia has

8:45

seized the opportunity created by this trade dispute when China announced potential sanctions on European pork

8:52

Russia immediately took action signing numerous trade contracts with Chinese pork suppliers Russian pork companies

8:59

responded positively welcoming increased cooperation with China to ensure smooth pork exports according to Chinese

9:06

Customs data China signed contracts with three Russian pork export companies in August 2024 resulting in the export of

9:14

approximately 50,000 to 60,000 tons of pork to China Russia has stated that if China

9:20

implements anti-dumping measures on EU pork products Russian pork will quickly

9:25

fill the Gap the head of the Russian pig farm Enterprise Union revealed plans to

9:31

capture 10% of China’s pork import market within the next 3 to 4

9:36

years this development poses a significant threat to European pork companies potentially leading to their

9:43

exclusion from the Chinese market for EU pork producers heavily reliant on Chinese demand this could be devastating

9:50

the concerns of EU countries are growing German economic experts have pointed out that if Russia successfully replaces the

9:57

EU as China’s Main pork supplier EU pork exporters will face a surplus this

10:03

oversupply could lead to a sharp fall in pork prices impacting the entire European pork Market China’s counter

10:11

measures extend beyond the pork industry on 20 August 20124 following the

10:17

European commission’s announcement of its draft final decision on the anti-subsidy investigation of Chinese

10:22

electric vehicles China’s Ministry of Commerce announced an anti-subsidy investigation on dairy products imported

10:29

from the EU the China Dairy and dairy products Association submitted applications to the ministry of Commerce

10:36

which after a preliminary investigation deemed the evidence reasonable and officially launched an investigation on

10:42

August 21st Russia has also made inroads into the Chinese dairy market as early

10:48

as May 2024 one of Russia’s largest Dairy companies began shipping milk to

10:53

China by rail however the longdistance and complicated Customs procedures

10:58

result in a 23-day Transit time from Moscow to China Russian companies are

11:04

actively seeking to improve Transportation methods to expand the range of dairy products they can export

11:09

to China the eu’s attempt to use sanctions to Target China’s electric vehicle industry has inadvertently

11:16

affected its own important Supply chains China’s counter measures have been strategic avoiding overreaction while

11:23

accurately targeting the eu’s vulnerabilities the current situation has provided Russia with an opportunity

11:30

to strengthen its economy in the face of the ongoing Russian Ukrainian conflict and Western sanctions in addition to the

11:37

investigations on pork and dairy products the Chinese Ministry of Commerce has also initiated anti-dumping

11:43

investigations on EU products such as Brandy if these investigations confirm

11:50

issues China is likely to impose anti-dumping duties on these EU products

11:55

as well Russia’s opportunistic response to the trade dispute between China and the EU has been Swift and

12:03

strategic recognizing the potential Gap in China’s pork Supply due to the anti-dumping investigation on EU pork

12:10

Russian pork companies have moved quickly to establish themselves as alternative suppliers this chain of events

12:17

highlights the interconnected nature of global trade and the potential for unintended consequences when

12:23

implementing protectionist measures the eu’s decision to impose

12:29

tariffs on Chinese electric vehicles intended to protect its domestic industry has instead led to threats to

12:35

other key export sectors such as pork Dairy and Brandy China’s recent decision

12:41

to implement export controls on antimony and related items marks a significant development in the ongoing trade

12:48

tensions between China and the United States this move announced by China’s

12:53

Ministry of Commerce mofcom and the general administration of Customs is set

12:58

to take effect from September 15th 2024 antimon a critical non-renewable

13:05

resource plays a crucial role in various Industries including Electronics solar photovoltaic components

13:12

telecommunications petrochemicals Vehicles Aerospace and notably military

13:18

applications approximately 50% of global antimony usage is in flame retardants

13:24

while another 20% is used in photovoltaic glass for solar cells it’s it’s also essential in lead acid

13:30

batteries which are widely used in vehicles and backup Power Systems the timing of China’s announcement coming in

13:37

the wake of us tariffs on Chinese electric vehicles suggests that this move may be at least in part a response

13:44

to those tariffs while China has not explicitly linked the antimony export

13:49

controls to the EV tariffs the sequence of events and the Strategic nature of the resource involved point to a

13:55

potential connection the ongoing situation raises question questions about the effectiveness of using tariffs

14:01

as a tool for protecting domestic Industries in a globalized economy while the eu’s tariffs May provide some

14:08

protection for its electric vehicle manufacturers in the short term the retaliatory measures by China could

14:14

potentially cause more harm to other sectors of the EU economy think EVS are

14:19

just about zero emissions think again they’re now the spark igniting a billion

14:24

dooll battle between East and West how China’s about to hit Europe where it hurts and why the EU never saw it coming

14:31

into the details how bad can a trade dispute between Brussels and Beijing get well uh we saw during the Trump

14:38

Administration that actually a trade dispute can get completely out of hand

14:43

but frankly we are not really there yet well basically what we are seeing is that the European Union has announced

14:49

that it is investigating Chinese uh Chinese Imports of electrical Vehicles

14:57

whereas China has basically responded in kind and saying that they are investigating Brandy uh so this is

15:04

really just a warning shot and where both sides are looking at each other’s

15:09

position and see and who’s going to Flinch first the global economic landscape is witnessing a seismic shift

15:16

as China and the European Union engage in an escalating trade dispute that threatens to reshape their long-standing

15:22

economic relationship in a move that has sent shock waves through the automotive industry the EU has imposed Hefty

15:29

tariffs on Chinese electric vehicles sparking fears of potential retaliation

15:34

from Beijing that could hit Europe where it hurts most the eu’s decision to slap

15:40

tariffs of up to 38.1% on Chinese EVS marks a significant

15:45

turning point in the Block’s approach to China’s rapidly growing Automotive sector this move is aimed at curbing the

15:51

flood of Cheaper Chinese electric vehicles into the European market which has been posing a serious threat to

15:57

European automakers the tariffs are set to affect major Chinese players like G

16:02

byd and saic with duties ranging from 17.4% to

16:08

38.1% depending on the manufacturer EU officials argue that these tariffs are

16:13

necessary to level the playing field citing concerns over unfair subsidies provided by the Chinese government to

16:20

its EV manufacturers these subsidies they claim have allowed Chinese companies to offer

16:25

their vehicles at substantially lower prices in Europe potentially undermining the competitiveness of european-made EVS

16:33

you argued um you could argue I should say that maybe these sides these two sides actually need each other more than

16:39

ever given the shape of their economies right now if we look at Germany for example um you know huge companies with

16:45

relian is on China the Chinese economy really struggling in this past year to recover completely from covid um what is

16:52

it that’s driving them apart exactly if you had to sum it up well you’re AB absolutely right uh

17:00

they are quite interdependent and if you look at the European economy since the

17:05

EU and Germany doesn’t have much of its own growth it needs to look at large overseas markets uh that can absorb a

17:12

lot of European export what a lot of people don’t actually know is that actually Europe is more export dependent

17:18

than China so in other words if you think China exports too much Europe is actually even exporting even far more

17:25

and now the Chinese economy has been relatively stagnant uh since the the pandemic yet there are

17:32

no other major Market openings or major pockets of growth out there for a large

17:37

economy like the European Union that needs roughly an economy of the same size in order to basically make a dent

17:45

in its GDP and conversely if you look at the Chinese economy it still relies on

17:51

Imports of uh Hightech uh not least in aviation and Advanced Materials and such

17:59

which goes into upgrading its economy and also if you look at services for example like in banking and other

18:06

Professional Services that China is extremely dependent on Europe especially given the trade war that has been going

18:13

on between the US and China however China has not taken this move lightly in

18:18

a Swift and Stern response Beijing has accused the EU of blatant protectionism and urged the block to reconsider its

18:26

decision Chinese officials have made it clear that they do everything in their power to protect the interests of their

18:31

automakers raising the Spectre of retaliatory measures that could severely impact key European sectors the

18:39

potential areas of Chinese retaliation are diverse and could hit Europe in unexpected ways one sector that’s

18:45

already feeling the heat is the alcoholic beverages industry China has initiated an anti-dumping investigation

18:52

into Brandy imported from the EU a move that’s seen as a direct response to the EV tariffs this investigation primarily

19:00

targets major European players like perau Ricard and Remy quantro sending ripples of concern through the European

19:07

Spirits industry but the retaliation might not stop there the eu’s food industry could be next in line with

19:14

China potentially imposing tariffs on European pork and dairy products this move could be particularly painful for

19:21

European farmers and food producers who have come to rely heavily on the Chinese market in 2023 China imported about 36%

19:29

of its dairy products from the EU making it the Block’s second biggest import partner in this sector the luxury goods

19:36

sector a crown jewel of European exports is also bracing for impact China has

19:42

been a major market for European luxury brands with companies like lvmh Gucci

19:47

and Prada enjoying strong demand for their products any retaliatory measures targeting this sector could deal a

19:53

significant blow to these companies especially at a time when they’re already grappling with falling demand

19:58

due to post-pandemic economic challenges perhaps most concerning is the potential for China to leverage its dominance in

20:05

the critical mineral supply chain China has previously shown willingness to use its control over Rare Earth minerals as

20:12

a geopolitical tool as seen in its past disputes with Japan if Beijing decides

20:17

to restrict the export of these crucial materials to Europe it could severely hamper the eu’s green transition goals

20:24

and technological advancement this escalating trade tension comes at a time when EU China relations are already

20:31

strained the two economic Giants have been grappling with increased distrust and disagreements on various issues

20:38

including the ongoing conflict in Ukraine China’s stance on the Ukraine crisis has been a major point of

20:44

contention with EU officials expressing frustration over beijing’s refusal to condemn Russia’s actions and its

20:50

insistence on keeping the issue separate from EU China discussions in response to these challenges the EU has been

20:57

developing a a drisking strategy aimed at reducing its dependence on China in

21:03

critical sectors this approach championed by European commission president Ursula vonder lean seeks to

21:10

strike a balance between maintaining economic ties with China and protecting European interests and values the

21:17

strategy reflects growing concerns in Brussels about China’s economic practices and geopolitical Ambitions the

21:24

eu’s shift towards a more defensive stance is evident in recent policy doents and statements from Top officials

21:31

in March 2023 vonder liion delivered a landmark speech outlining the eu’s

21:37

approach to China emphasizing the need for drisking not decoupling and highlighting concerns about China’s

21:43

strategic intentions this was followed by the European council’s conclusions on China in May which stressed the

21:50

importance of reducing critical dependencies and vulnerabilities in EU Supply chains however this hardening

21:56

stance from the EU presents significant challenges for both sides the economic interdependence between China and Europe

22:02

is deep rooted and complex China remains one of the eu’s largest trading partners

22:08

and many European companies have substantial Investments and operations in China similarly Chinese companies

22:14

have made significant inroads into European markets across various sectors the geopolitical considerations at play

22:21

further complicate the situation both China and the EU are navigating a delicate balance in their relations with

22:27

the United States for the EU maintaining strong ties with its traditional Ally

22:32

while pursuing its own interests VAV China is a challenging diplomatic feat

22:37

China on the other hand is Keen to prevent a united front between the EU and the US that could further isolate

22:44

Beijing on the global stage as tensions escalate the Spectre of a full-blown trade War looms large such a scenario

22:51

could have far-reaching consequences for both economies and the global trade system at large it could disrupt supply

22:58

chain increase costs for businesses and consumers and potentially slow down economic growth on both sides the

23:05

importance of dialogue and negotiation in resolving these issues cannot be overstated both China and the EU have

23:12

much to lose from a prolonged trade dispute and finding common ground will be crucial in preventing further

23:18

escalation however this will require both sides to address each other’s concerns seriously and be willing to

23:24

make compromises looking ahead the future of EU China relations remains

23:30

uncertain the outcome of this current dispute over EV tariffs could set the tone for their economic relationship in

23:37

the years to come will China’s potential retaliation Force the EU to reconsider its approach or will it push Europe

23:44

further towards reducing its economic Reliance on China One thing is clear the global economic landscape is Shifting

23:52

and the Dynamics between China and the EU are at the Forefront of this change as both sides manage these turbulent

23:59

Waters the decisions they make will have profound implications not just for their own economies but for the global

24:05

economic order as a whole the eu’s move to impose tariffs on Chinese EVs and

24:10

China’s potential retaliation marks a critical juncture in their economic relationship it highlights the growing

24:17

tensions between maintaining open trade and protecting domestic Industries a challenge that many countries are

24:23

grappling with in today’s interconnected global economy for the EU this situ

24:28

ation presents a test of its ability to protect its economic interests while maintaining its commitment to free trade

24:35

principles it also raises questions about the Block’s long-term strategy for dealing with China’s growing economic

24:41

influence will the eu’s drisking approach prove effective in balancing economic engagement with strategic

24:48

autonomy on the Chinese side the response to these tariffs will be closely watched how Beijing chooses to

24:55

retaliate if at all could have significant lications for its relationships not just with the EU but

25:01

with other major trading partners as well it will also be a test of China’s ability to navigate trade disputes

25:08

without resorting to measures that could further isolate it on the global stage as this situation evolves both China and

25:15

the EU are entering Uncharted Territory in their economic relationship the

25:21

outcome of this dispute could set important precedents for how similar conflicts are handled in the future not

25:26

just between these two powers but in the broader context of global trade relations the unthinkable has happened

25:33

the Chinese Yuan has officially outpaced the US dollar in Global Payments by

25:38

2.5% and the big question on the world’s mind these days is the Chinese Yuan

25:46

going to overtake the dollar in the world economy its role and if so when

25:54

and how and with what consequences might this happen rise of China is absolutely

26:01

crucial now it is the second economy in the world it’s roughly 2third the size

26:08

of the United States economy and gaining fast it has been growing faster than the

26:14

United States for the last 25 years two to three times faster every year that’s

26:21

why it is as big as it is now and that’s why most predictions have it be a bigger

26:27

economy at the end of this decade than the United States citizens who are

26:33

planning to do all kinds of growth and expansion and trade now need to have

26:39

yuan in their wallets yuan in their bank accounts because more and more countries

26:46

are saying we want to be paid in that currency because we do more business with China than we do with the United

26:53

States countries are doing the same with what the reserve is to back up their

26:58

currency people will have confidence in their currency not now only because they also have dollars but because they also

27:07

have Yuan and with the prospect of the Yuan becoming a bigger Factor connected

27:13

to the biggest economy in the world within a few years it will diminish the

27:19

subsidy we get as a nation it will squeeze American capitalism it will be a

27:25

boon to the Chinese cap ISM in just the ways the dollar Supremacy was for the

27:32

United States the sanctions imposed on Russia are speeding up the importance of

27:40

the uan because the Russians with their Alliance on the Chinese are doing more

27:46

and more trade with the uan because they are shut out of the United States this

27:52

shift is largely attributed to the Strategic moves made by China and its allies particularly Within the brics

27:58

block the founding members of brics Brazil Russia India China and South Africa have been increasingly adopting

28:05

the Chinese one for crossb trade effectively reducing their Reliance on the US dollar the rise of the yuan in

28:12

international trade is not merely a coincidence but a result of careful planning and execution by China and its

28:19

Partners China and Russia two of the most influential bricks members have joined forces to make uniz a reality

28:26

their Master strategy aims to to replace the Dollar by providing the world with a living example of how the Yuan can be

28:32

used for all kinds of trade transactions Russia has played a pivotal role in this shift following Western sanctions

28:38

imposed on its economy in February 2022 Russia began fully accepting the Chinese

28:43

Yuan for payments this move was not just a reaction to sanctions but a calculated step in the larger plan to challenge

28:50

dollar hegemony the results have been striking in 2023 and 2024 the Chinese

28:56

Juan accounted for 4 2% of all International transactions initiated in Russia while the US dollar represented

29:05

39.5% this 2.5% difference marks a significant milestone in the yuan’s

29:10

ascendency the adoption of the Yuan extends Beyond Russia other developing

29:16

countries including brics members like India and Brazil have also started using the Yuan for their trade especially for

29:23

Commodities like crude oil India for instance saved an impressive $7 billion

29:29

in currency exchange fees by using the Yuan instead of the US dollar to purchase oil at discounted rates between

29:36

2023 and 2024 the appeal of the Yuan to developing countries is multifaceted it

29:44

not only offers a way to circumvent potential Western sanctions but also strengthens their local currencies and

29:50

domestic economies this strategy aligns perfectly with the broader goals of dollarization and economic sovereignty

29:57

pursued by many emerging economies the yuan’s performance in international trade has been nothing short of

30:03

remarkable according to data from the society for worldwide interbank Financial telecommunication the world’s

30:10

largest interbank messaging service the W’s usage in international trade reached an all-time high in July 2024 the one

30:18

maintained its position as the fourth most traded currency globally with its share of global transactions increasing

30:25

to 4.74% from 4.6 61% in June this marked the ninth consecutive month that the

30:32

yuan’s share remained above 4% a clear indicator of its growing importance in the Global Financial system Swift

30:39

payment data is crucial in measuring a currency’s standing in the international Arena it reflects not only the frequency

30:46

of use in foreign exchange markets but also in commodity trading and inclusion in government foreign reserves the

30:52

recent data shows that the value of transactions conducted in Yuan Rose by 13 4% compared to June outpacing the

31:01

10.3% growth recorded for all currencies combined China’s efforts to internationalize the Yuan have been

31:07

Relentless and multifaceted in a significant development the Yuan became the most widely used currency for crossb

31:14

transactions in China in March surpassing the US dollar for the first time according to data from the state

31:21

administration of Foreign Exchange crossborder payments and receipts in Yan hit a record 549 .95 billion in February

31:30

the Yuan accounted for 48.4% of all crossborder transactions while the dollar share dropped to

31:38

46.7% from 48.6% the month before by May 2024 the

31:44

yuan’s share had climbed to an impressive 53% while the US dollar share

31:49

fell to 43% the Euro accounted for 2% and the Hong Kong dollar for 1% these figures

31:57

cover both current account and capital account transactions highlighting the comprehensive nature of the Wan’s

32:02

adoption the use of the Yan has also grown significantly in China’s own foreign trade in the first quarter of

32:10

2024 28% of China’s Goods trade was conducted in Yuan this internal shift is

32:16

crucial as it demonstrates China’s commitment to using its own currency for international transactions setting an

32:23

example for other nations to follow the global acceptance of the Yuan is expanding rapidly several developing

32:30

economies including Brazil Argentina Iraq and Pakistan have announced their

32:35

willingness to accept uan payments in trade with China there are also media

32:41

reports suggesting that Saudi Arabia is considering using Yuan for oil trade with China a move that could potentially

32:48

reshape the global oil Market the yuan’s rise is not limited to trade

32:53

transactions it’s also making significant inroads in financial markets

32:58

as of the end of May 2024 foreign investors held 4.2 trillion uon in

33:04

Mainland Chinese debt Securities a 32% increase from the previous year the

33:09

issuance of Yuan denominated bonds by Foreign entities in mainland China known as Panda bonds has also increased

33:16

substantially since last year the appeal of panda bonds lies partly in their relative affordability with China’s

33:22

nominal interest rates significantly lower than those in the US between January and May 2024 Panda bonds worth

33:29

81 billion wian were issued in the inbank market bringing the total stock of panda bonds to around 240 billion

33:37

yuan up from 195 billion yuan at the end of 2023 the rise of the Yuan as an

33:43

international currency is not without challenges the US dollar still holds a dominant position in many aspects of

33:50

global finance and the transition away from it will likely be gradual however the recent developments signal a clear

33:57

shift in the Global Financial order with potentially far-reaching consequences for international trade investment and

34:04

geopolitics as the Yuan continues to gain traction questions arise about the future role of the US dollar in the

34:11

global economy how will this shift affect us economic power and influence on the world stage will other countries

34:18

follow suit and reduce their Reliance on the dollar these are critical questions that policy makers economists and

34:25

Business Leaders will need to Grapple with in the coming years the implications of this shift extend beyond

34:31

economics as countries increasingly use the uan for trade and investment China’s

34:37

political influence May grow correspondingly this could lead to a realignment of global power dynamics

34:44

with China playing an increasingly Central role in shaping International economic policies and norms for

34:51

developing countries the rise of the uon offers both opportunities and challenges

34:58

on one hand it provides an alternative to Dollar dominance potentially reducing vulnerability to us sanctions and

35:04

economic pressure on the other hand it may lead to increased dependence on China raising questions about economic

35:11

sovereignty and geopolitical Alignment the financial industry will need to adapt to this changing landscape Banks

35:17

investment firms and multinational corporations will need to develop expertise in un denominated transactions

35:24

and Investments this could lead to new Financial products services and career opportunities centered around the

35:30

Chinese currency as we witness this historic shift in the Global Financial system it’s clear that the world is

35:37

entering a new era of economic multipolarity the rise of the Yuan

35:42

challenges long held assumptions about the structure of international finance and trade it opens up new possibilities

35:50

for economic cooperation and development particularly among emerging economies

35:55

however this transition is likely to be complex and potentially turbulent as the Yuan gains ground we may see increased

36:02

competition and tension between China and the US in the financial sphere this could lead to new forms of economic

36:09

diplomacy as countries balance their relationships with these two economic Giants in conclusion the recent news of

36:15

Yuan payments surpassing the US dollar by 2.5% marks a significant milestone in

36:21

the ongoing transformation of the Global Financial system it underscores China’s growing economic clout and signals a

36:28

potential shift away from the dollar Centric model that has dominated international finance for decades as we

36:35

move forward it will be crucial to monitor how this trend develops and what implications it holds for the global

36:41

economy will the uvon continue to gain ground or will the dollar reassert its dominance how will other major

36:47

currencies like the Euro and Yen fare in this changing landscape these are questions that will shape the future of

36:53

global finance and international relations in the years to come Russia and China are in discussions about a $13

37:00

billion oil and gas pipeline project Mongolia initially proposed as a Transit

37:05

country for the pipeline May no longer be needed instead there’s growing speculation that the route could shift

37:12

to pass through Kazakhstan this potential change has raised eyebrows and left people wondering why is China

37:18

hesitant about the Mongolian route what is the current status of the project and how could this new route enhance Russian

37:25

exports the invasion of Ukraine has had severe consequences for Russia’s gas

37:30

exports to Europe since the conflict began these exports have plummeted

37:36

resulting in an annual loss of approximately $150 billion for Russia

37:42

this enormous Financial blow has forced Russia to look Eastward for new buyers with China being the primary target

37:49

however Russia faces significant challenges in this pivot towards Asia one of the main obstacles is Russia’s

37:55

lack of liquefied natural gas LNG infrastructure LNG facilities allow

38:01

natural gas to be cooled and compressed into a liquid form which can then be transported by ships to markets around

38:07

the world without adequate LNG infrastructure Russia’s ability to export gas to distant markets is

38:14

severely limited in a bid to address this issue and secure new export routes

38:19

Russian President Vladimir Putin recently visited China to discuss the power of Siberia 2 project despite

38:26

Russia’s eagerness to see the deal China has shown a surprising lack of enthusiasm this tepid response from

38:32

China has raised questions about the Project’s viability and the future of Russia China energy

38:38

cooperation yeah I’m I’m happy to start so you know there is a lot of enthusiasm

38:43

I think right now in Russia and in Mongolia for routing the power of

38:49

Siberia to pipeline through Mongolia um I think that right now that there’s not

38:55

an equal amount of enthusiasm in China One you know they don’t need this gas

39:00

right away uh and two I think there are concerns about routing this pipeline

39:06

through a third country that isn’t supplying natural gas to China um you

39:13

know obviously you know the more countries you route a pipeline through the more chances there are for things to

39:18

um you know disrupt the flow of gas you know intentional or accidental so I’ll

39:24

leave it at that okay anybody else uh want to pop in on that one to understand

39:30

the context of this new pipeline proposal we need to examine China’s current natural gas demand and sources

39:37

in 2022 natural gas accounted for 9% of China’s total energy

39:43

consumption this might not seem like a large percentage but given the size of China’s economy it represents a

39:49

significant amount of gas moreover China has set an ambitious Target to increase

39:55

this share to 15% by 20 30 as part of its efforts to reduce carbon emissions

40:00

and improve air quality thank you um happy to address all of those topics um so I’ll start

40:08

with the role of natural gas in China’s Energy Mix uh last year natural gas

40:14

counted for almost 9% of China’s total

40:20

energy consumption and that compares to 24% for the world as a whole uh China

40:27

would like to increase the role of natural gas in its energy consumption mix uh both to reduce air pollution and

40:36

to combat climate change uh the government has a target of increasing

40:41

the share of natural gas to 15% of the energy mix by

40:47

2030 China’s growing appetite for natural gas necessitates increased Imports currently China sources its

40:54

natural gas through a combination of pipeline Imports and LNG shipments the country has existing pipeline

41:01

connections with several neighboring countries including Turkmenistan Russia and Myanmar additionally China receives

41:08

LNG from various Global suppliers allowing it to diversify its sources of natural gas uh the main play in Central

41:17

Asia in gas is turkistan and turkistan pumping gas to China um Erica already

41:24

mentioned the fourth P pipeline pipeline d uh to increase uh the supply of gas to

41:32

China I think last year about 35% of natural gas Imports were pipeline gas so

41:38

Russia Central Asia Myanmar um other 65% are

41:43

LNG um and if you look at you know China’s gas suppliers as a whole I think

41:49

77% of China’s natural gas Imports last year came from um just six countries but they nicely sort of illustrate this

41:55

diversity of suppliers and rout so we have you know Australia and turkistan and Russia and the United States um and

42:04

Malaysia and cutter um and you know earlier this year there were reports of

42:09

Chinese companies Chinese National oil companies negotiating with cutter

42:15

forecasts of China’s gas demand through 2030 and 2040 show a potential Supply

42:20

gap which Russia hopes to fill with the power of Siberia 2 pipeline however the

42:26

situation is Complicated by China’s existing import commitments and the uncertain trajectory of its future

42:32

demand these factors make it challenging to predict exactly how much additional gas China will need and when let’s take

42:39

a closer look at China’s current gas pipeline infrastructure the country has three major pipelines from Turkmenistan

42:46

known as a b and c these pipelines were constructed between 2008 and 2014 at a

42:53

combined cost of approximately $14 billion together they currently Supply 55

42:59

billion cubic meters of gas annually to China there are plans to increase this capacity to 85 BCM in the next 3 years

43:08

reflecting China’s growing demand for natural gas the power of Siberia one

43:14

pipeline connecting Russia to China became operational in 2019 this massive

43:20

infrastructure project spans 3,000 kilm and cost an estimated $55 billion to

43:26

construct in 2023 it delivered 22 BCM of natural gas to China the pipeline’s

43:33

capacity is expected to increase gradually with projections to reach a maximum capacity of 38 BCM by

43:39

2027 China also receives gas from Myanmar through a pipeline constructed in

43:45

2013 this pipeline was designed to deliver 12 BCM of gas per year however

43:51

it currently operates at only onethird of its capacity due to various operational issues Des desite these

43:57

challenges the pipeline remains an important part of China’s gas import infrastructure the proposed power of

44:04

Siberia 2 pipeline would take a different route from its predecessor while power of Siberia 1 travels through

44:11

Eastern Siberia and enters China in its Northeastern region power of Siberia 2

44:16

would pass through Mongolia to reach China this route presents both

44:21

opportunities and challenges the estimated cost of the power of Siberia 2 project is $13.6

44:30

billion this is a significant investment especially considering the current geopolitical tensions and economic

44:37

uncertainties the high cost raises questions about funding and economic viability particularly given China’s

44:44

apparent hesitation the pipeline’s proposed route through Mongolia introduces additional political risks

44:51

agreements must be reached not only between Russia and China but also with Mongolia for Transit rights

44:57

this adds complexity to the negotiations and potential vulnerabilities to the gas supply chain any future political

45:04

tensions between these countries could potentially disrupt gas flows however recent discussions about this project

45:11

have hit some unexpected complications China it turns out isn’t too keen on the pipeline passing through

45:17

Mongolia instead they’re pushing for a route through Kazakhstan there are several reasons for this potential

45:24

change firstly China has expressed concerns about mongolia’s growing alliance with the United States Mongolia

45:31

has been strengthening its ties with the US in recent years signing a strategic partnership in 2019 and participating in

45:39

joint military exercises this closer relationship between Mongolia and the US has raised

45:45

eyebrows in Beijing as China is wary of increased American influence in the region Kazakhstan on the other hand

45:52

presents several advantages as a Transit country it already has experienced with oil and gas pipelines including those

45:59

connecting to China the Kazakhstan China oil pipeline operational since 2006 and

46:05

the central Asia China gas pipeline which passes through Kazakhstan demonstrate the country’s existing

46:11

energy infrastructure links with China moreover kazakhstan’s political landscape may be seen as more stable and

46:19

predictable from China’s perspective while Kazakhstan has its own challenges it has maintained relatively

46:25

balanced relations with both Russia and China potentially making it a less risky Transit option the Kazakhstan route

46:33

would also be shorter than the Mongolia route potentially reducing construction costs and transit times this could make

46:40

the project more economically viable an important consideration given the estimated 13 to 15 billion price tag

46:49

Chris weer CEO of Eurasia based strategic consultancy macro advisory

46:54

said using the khaak route where the cost of repair and upgrade will be considerably less than power of Siberia

47:00

2 is a much more attractive option and one which appears to be acceptable to Beijing he further added they share a

47:08

long Common border and the old Soviet infrastructure is repairable to allow more gas via Kazakhstan selling at a

47:16

price lower than it gets from Europe and turkey is an acceptable cost to expand volumes and

47:22

infrastructure while natural gas remains a key part of China’s energy strategy

47:27

the country is also exploring Alternatives China has shown significant interest in hydrogen as a future energy

47:34

source particularly green hydrogen produced using renewable electricity hydrogen production methods

47:40

are categorized as gray blue or green gray hydrogen is produced from fossil

47:46

fuels without capturing the resulting CO2 emissions this is currently the most

47:51

common and cheapest method of hydrogen production but it’s also the most environmentally damaging blue hydrogen

47:58

uses fossil fuels but captures and stores the CO2 making it more environmentally friendly than gray

48:03

hydrogen but still not entirely clean green hydrogen produced using renewable

48:09

electricity to split water molecules is the most environmentally friendly option but currently the most expensive to

48:15

produce China recently announced a massive $45 billion investment in green

48:21

hydrogen development signaling its strong commitment to this technology this move could potentially impact

48:28

future natural gas demand as hydrogen could replace natural gas in some applications particularly in industrial

48:35

processes and transportation Russia’s desperate need for new gas export routes contrasts

48:41

sharply with China’s lack of urgency this imbalance in negotiating positions could significantly impact the

48:48

final terms of any deal Russia currently holds about 24% of the world’s proven

48:53

natural gas reserves making it the country with the largest gas reserves globally however these vast reserves are

49:00

of little value if Russia cannot get the gas to Market it’s worth noting that the power of Siberia 2 project is not just

49:07

about natural gas recent statements from Russian officials suggest that the

49:12

pipeline could also be used to transport oil Russian President Vladimir Putin

49:18

stated moreover it’s possible to lay both a gas pipeline and an oil pipeline

49:24

in the same Corridor this dual use potential could make the project more attractive

49:30

economically the geopolitical implications of the power of Siberia 2 project extend beyond just Russia and

49:37

China the United States which has been promoting its own LNG exports to Asia is

49:43

likely watching these developments closely increased energy ties between

49:48

Russia and China could potentially challenge US influence in the region despite all the challenges Russia

49:55

remains optimistic about the project Alexander Novak Russia’s Deputy Prime

50:00

Minister has stated that they expect to sign a contract for power of cyberia 2 soon the negotiations surrounding the

50:08

power of Siberia 2 project are intricate with pricing being a key point of

50:13

discussion despite these complexities Putin remains confident in the Project’s

50:19

potential he emphasized that China’s expanding economy has a growing need for energy resources and he positioned

50:26

Russia as the most Dependable supplier to meet this demand Putin also highlighted the

50:33

Project’s resilience against potential Western interference he asserted that the deal would be structured in a way

50:39

that makes it impervious to sanctions whether they target shipping fleets or financial

50:45

institutions Putin stated nobody can get in the way of this neither sanctions on

50:50

tanker fleets or even sanctions on financial institutions we will buy and sell everything in our National

50:57

currencies so the interest from both sides is confirmed by conducting transactions in

51:03

their National currencies Russia and China aim to circumvent potential Financial restrictions this approach

51:09

according to Putin underscores the mutual interest and commitment of both Nations to the project

oooooo

MMT: Modern Monetary Theory

Understanding how money works so that we can address climate change easily and prosperously plus address AI’s impact on humanity.

Members: https://x.com/i/communities/1672597800385921024/members

(…)

oooooo