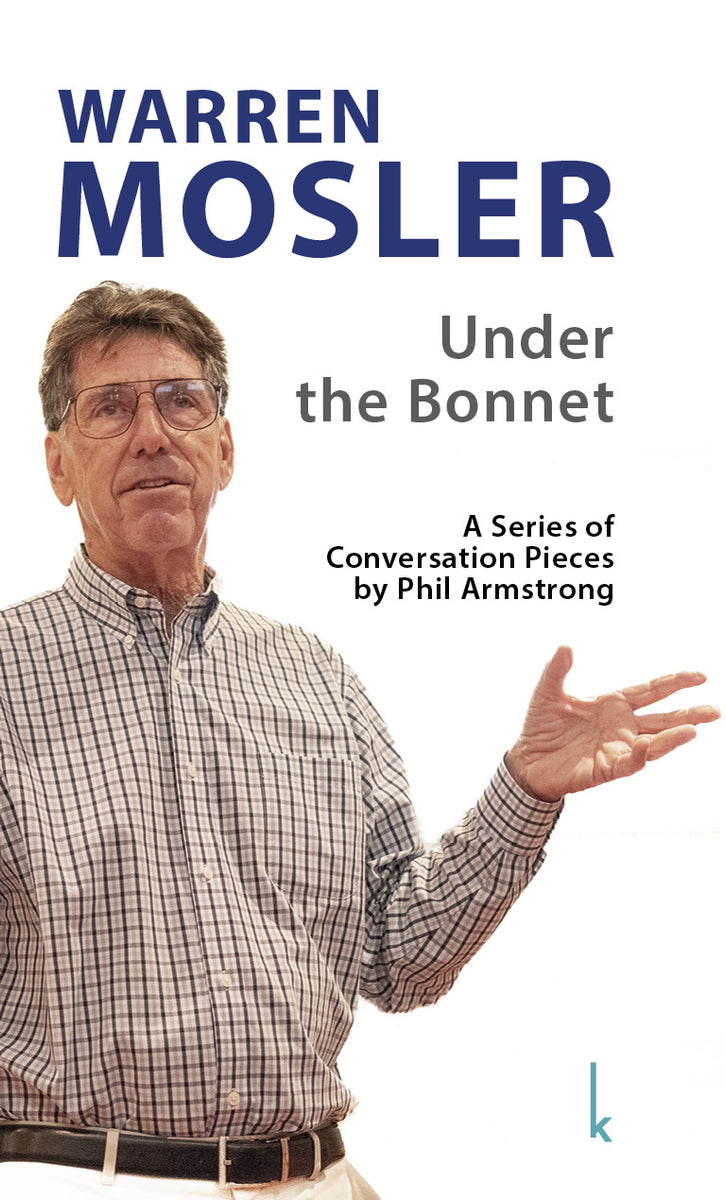

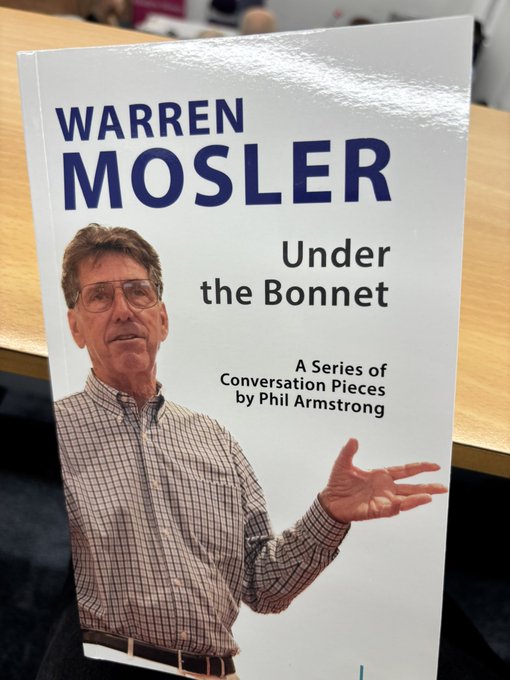

Kapotaren azpian. Under the bonnet

“Under he Bonnet” with Warren Mosler

ooooooo

Gower Initiative for Modern Money Studies@GowerInitiative

“Under the Bonnet” with Warren Mosler

Join GIMMS for this one-off event to celebrate the publication of Warren Mosler’s biography. Saturday, August 30 · 1

– 4pm Doors at 12:45pm University of Westminster

ooo

Under the Bonnet with Warren Mosler

Agenda

13:00 – 16:00

“Under the Bonnet” with Warren Mosler

13:00 – 13:10

Welcome with Prue from the Gower Initiative for Modern Money Studies

13:10 – 13:30

Introduction with Phil Armstrong

13:30 – 14:00

Thinking like an MMTer with Neil Wilson

14:00 – 14:30

Coffee Break

14:30 – 15:15

MMT Past and Future with Warren Mosler

15:15 – 15:50

Questions

15:50 – 16:00

Closing remarks and thanks with Prue

GIMMS is delighted to present this one-off event to celebrate the publication of Phil Armstrong‘s biography of Warren Mosler. Warren, whose groundbreaking work challenges the global economic orthodoxy that has influenced government policy for decades, will be joining us to talk about the book, his work and his life.

oooooo

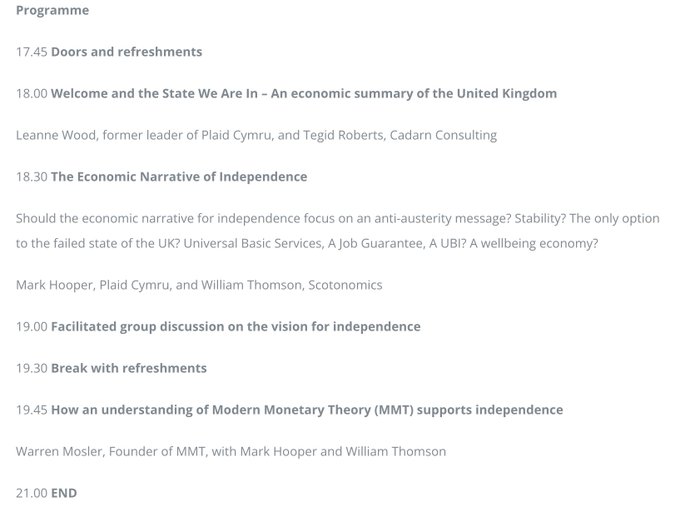

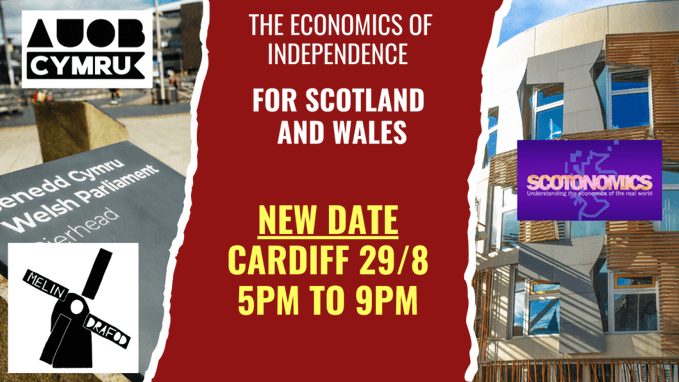

Independentziaren Ekonomia

The Economics of Independence – Cardiff, 29th August. BOOK NOW. Includes an introduction to #MMT with Warren Mosler.

ooo

Understanding the importance of issuing your own currency in an independent Scotland and Wales

(https://scotonomics.org/event/the-economics-of-independence-for-wales/)

In this unique short series of events (Glasgow, 11th July, and Cardiff, 18th July), Scotonomics, AUOB Cymru, and Melin Drafod have come together to put on a fantastic event focusing on the importance of our independent nations issuing their own currency on the day of independence.

Programme

17.00 (Optional pre-event workshop) – Principles of Modern Monetary Theory

Warren Mosler, “Father” of MMT interviewed by William Thomson

17.45 Doors and refreshments

18.00 Welcome and the State We Are In – An economic summary of the United Kingdom

Leanne Wood, former leader of Plaid Cymru, and Tegid Roberts, Cadarn Consulting

18.30 The Economic Narrative of Independence

Should the narrative for economic independence focus on an anti-austerity message? Stability? The only option to the failed state of the UK? Universal Basic Services, A Job Guarantee or a UBI? A wellbeing economy?

Mark Hooper, Plaid Cymru and William Thomson, Scotonomics

19.00 Facilitated group discussion on the vision for independence

19.30 Break with refreshments

19.45 Monetary Sovereignty

Dr Thibault Laurentjoye, Author, “Currency Options For An Independent Wales” and commissioned by Scottish Currency Group, “Options available for Scotland’s currency post-independence.” Interviewed by Leanne Wood.

20.15 How an understanding of Modern Monetary Theory (MMT) supports independence

Mark Hooper, Warren Mosler and William Thomson.

21.15 END

oooooo

When you don’t understand how the monetary system works you end up trapped in where the money goes analysis. The money goes nowhere. Private sector balances are debited, they have less financial assets. Period.

The @nytimes explaining how the process does not work.

ooo

In https://modernmoneybasics.com/

Taxes remove from the economy currency that was previously spent.

Governments spend by crediting bank accounts, creating currency in the process.

Governments tax by debiting bank accounts. Taxes remove or delete some of the currency they previously created. So taxes cannot “give” the government “money” to spend; rather government spending actually gives us its currency so we can later pay our taxes. We have it backward!

oooooo

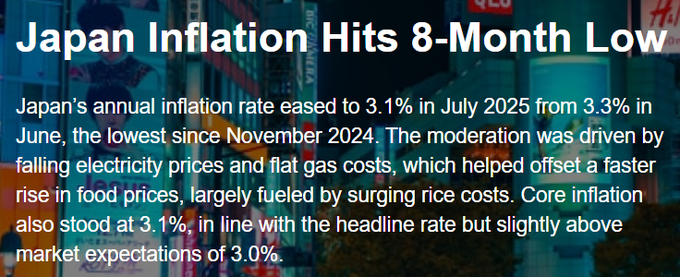

Near 0 rate policy throughout, and debt/gdp off the charts:

erabiltzaileari erantzuten

1993:

Warren Mosler: Kapotaren azpian

(Warren Mosler: Under the Bonnet: Tax liabilities)

Warren Mosler: Under the Bonnet

(https://www.google.es/books/edition/Warren_Mosler/DgN2EQAAQBAJ?hl=eu&gbpv=1&dq=inauthor:%22Phil+Armstrong%22&printsec=frontcover)

Warren Mosler: Under the Bonnet

By Phil Armstrong

… tax payment , the government is not only the price – setter for the policy rate but also for the price level as well … liabilities was the sole cause of unemployment , by design , with the further purpose of facilitating …

ooo

… tax liabilities, not the extensive range of other factors pointed to by economists, that are the cause of unemployment. Unemployment in the economy is evidence that the state’s spending is insufficient to allow the non-government sector …

ooo

… tax liability , a requirement which creates sellers of real goods and services looking for that currency in exchange . This gives value to the state’s currency ; it can then spend its otherwise worthless currency to buy what its tax …

ooo

… taxation, by design, is the cause of unemployment – defined as people seeking work paid in that currency – presumably for the further purpose of the US Government hiring those that its tax liabilities caused to become unemployed. The …

ooo

… tax liabilities shifting people from one function to another , shifting income from one group to another , fiscal … taxation it is just a question of starting from a command economy . That command economy needs to adjust …

ooo

… tax liabilities in the currency it issues”. And that was my second paper. When I returned to Gettysburg college, I combined the two research papers: the theoretical review and the math model, into my college honors thesis. My …

ooo

… tax liabilities have caused to become unemployed. That is, it’s a case of a monopolist – the government – restricting supply, which in this case refers to net government spending. Current policy is to utilize unemployment as a counter …

oooooo

It’s not too late to book a place at our event in London this Saturday, @wbmosler will be answering your MMT questions and giving us his insights on the global economy.

Looking forward to seeing you there!

Aipamena

Gower Initiative for Modern Money Studies@GowerInitiative

uzt. 28

“Under the Bonnet” with Warren Mosler Join GIMMS for this one-off event to celebrate the publication of Warren Mosler’s biography. Satur

oooooo

Russian translation of my 7DIF book:

http://moslereconomics-kg5winhhtut.stackpathdns.com/wp-content/uploads/2020/07/7DIF-Russian.pdf

oooooo

India can get to full employment/prosperity without the US:

ooo

Should the US be worried? India’s Modi set for rare China trip after Trump’s tariff sting

(https://edition.cnn.com/2025/08/26/india/india-china-relations-sco-summit-intl-hnk)

Analysis by

Updated Aug 27, 2025

Chinese President Xi Jinping and Indian Prime Minister Narendra Modi at the BRICS Summit in Fujian, China on September 4, 2017.

Kenzaburo Fukuhara/AFP/Getty Images

A relationship frozen after a deadly clash high in the Himalayas five years ago appears to be thawing under the heat of US President Donald Trump’s economic pressure.

For the first time since 2018, Indian Prime Minister Narendra Modi will travel to China this week to attend a summit hosted by Chinese leader Xi Jinping, a visit that comes after Trump imposed punishing 50% tariffs on imports from India.

In a moment of geopolitical whiplash, the two leaders – whose soldiers fought a brutal hand-to-hand combat with fists, rocks and clubs at their disputed border in 2020 – could now shake hands, prioritizing economic stability over entrenched rivalry.

Alongside Modi, world leaders from Russia, Pakistan, Iran and Central Asia will join Xi this weekend for what Beijing has said will be the largest summit yet of the Shanghai Cooperation Organization (SCO), a Moscow and Beijing-founded regional security club aimed at reshaping the global balance of power.

India’s presence at the event is the most telling example yet of the warming ties between the two Asian powers – a budding realignment that threatens to undo years-long US efforts to cultivate New Delhi as a counterweight against a rising and increasingly assertive China.

While a thaw in India and China’s fractious relationship was already underway, analysts say Trump’s “America First” policies are making the two leaders, who have built their political brands on a strong foundation of nationalism, explore a partnership of necessity.

Trump’s imposition of tariffs over India’s purchases of Russian oil have been especially hard to swallow for Modi, who enjoyed a budding bromance with Trump during the US president’s first term.

The threat of the levies “infused a certain amount of urgency” in New Delhi’s pivot toward stabilizing its relationship with Beijing, said Manoj Kewalramani, who heads Indo-Pacific studies at the Takshashila Institution research center in the Indian city of Bengaluru. However he said it wasn’t the “primary driver” for a reset, with both India and China looking to stabilize their relationship for their own national interests.

Successive White House administrations have worked to boost strategic ties with India through technology transfers and joint military drills, working with the world’s largest democracy to counter an increasingly assertive China in the Indo-Pacific region.

Losing India would be “the worst outcome” for the US, analysts have said.

US President Donald Trump and Indian Prime Minister Narendra Modi shake hands at the White House in Washington, D.C., on February 13, 2025.

Kevin Lamarque/Reuters

Following a meeting between Chinese Foreign Minister Wang Yi and Prime Minister Modi in New Delhi last week, both sides recognized the recent improvements in their strained relationship.

“India-China relations have made steady progress guided by respect for each other’s interests and sensitivities,” the Indian leader said. “Stable, predictable, constructive ties between India and China will contribute significantly to regional as well as global peace and prosperity.”

The view from Beijing, according to Yun Sun, director of the China Program at the Stimson Center think tank in Washington, is that “this detente was definitely started by Trump.”

“India is no longer able to pretend that it still has strong support from (Washington),” Sun said. Therefore, Beijing’s view is that because the US has “dialed back” India has to “recalibrate its foreign policy and improve its relationship with China.”

But analysts say the summit is unlikely to usher in a fundamental realignment.

“To me, it’s not a reset in the sense that India is saying ‘we are done with America.’ That’s not going to happen,” said Kewalramani.

“The United States remains (India’s) most important partner in the world, but China is our largest neighbor,” Kewalramani said. “We have to live with it.”

The trajectory of India-China relations has evolved from one of post-colonial brotherhood to modern-day strategic rivalry.

India was one of the first countries to establish diplomatic relations with the People’s Republic of China in 1950, with that decade characterized by a shared vision of Asian solidarity. That nascent friendship was, however, shattered by the 1962 Sino-Indian War, a brief but brutal conflict that established a legacy of deep mistrust and an unresolved border dispute that remains the relationship’s festering wound.

In the decades that followed, the countries’ leaders took steps to build economic ties that saw bilateral trade grow, despite ongoing tensions at their shared border. But the deadly 2020 Galwan Valley clashes – which left at least 20 Indian and four Chinese soldiers dead – violently upended this balance.

Indian officers occupying a fort on the Ladakh border during the war between India and China in 1962.

Hulton Deutsch/Corbis Historical/Getty Images

“The 2020 clashes are not simply something India can put behind it,” said Farwa Aamer, director of South Asia Initiatives at the Asia Society Policy Institute. “Instead, the aim here is to ensure no such episodes repeat, and that is where rebuilding the relationship rests on reaching a joint understanding on border stability.”

There has been a gradual normalization of ties between India and China after Modi and Xi met on the sidelines of the BRICS summit in Russia last October. The two sides agreed to restart direct flights cancelled since the Covid-19 pandemic, Beijing recently agreed to reopen two pilgrimage sites in western Tibet to Indians for the first time in five years, and both started re-issuing tourist visas for each other’s citizens.

India’s recalibration of ties with China is a textbook application of its policy of strategic autonomy, which prioritizes national interests over rigid bloc allegiance.

At the SCO summit, as well as China’s Xi, Modi will be in the presence of the prime minister of traditional adversary Pakistan, with whom India recently engaged in a deadly conflict, as well as traditional partner Russia, whose continued oil sales to India since its invasion of Ukraine have irked the US and pushed Trump to slap 25% tariffs on Indian goods as punishment.

This engagement with a China-dominated bloc stands in stark contrast to India’s deepening ties with the Quad – a security grouping with the US, Japan, and Australia – that is widely seen as a democratic counterweight to China’s growing influence in the Indian Ocean.

Indian Prime Minister Narendra Modi meets with visiting Chinese Foreign Minister Wang Yi in New Delhi, India on August 19, 2025.

Javed Dar/Xinhua/Sipa

With their border dispute locked in a stalemate, India is choosing to insulate its diplomatic and economic imperatives from the security conflict with China, according to Kewalramani from the Takshashila Institution.

“While both sides know there are structural challenges and this relationship will remain difficult, both sides realize that a deterioration to the extent that it happened is in neither’s interest,” he said.

India’s strategic recalibration toward China is rooted less in a softening security posture and more in economic necessity.

Last year, China was India’s second-largest trading partner after the US, with bilateral trade reaching $118 billion, according to data from India’s department of commerce. India depends on China not just for finished goods like electronics, but for the essential intermediate products and raw materials that fuel its own industries.

Yet, this economic entanglement exists under the shadow of a tense military reality.

Any talks between Modi and Xi would be complicated by the tens of thousands of troops still deployed at their disputed Himalayan border and this unresolved conflict remains the primary barrier to rebuilding confidence. Last week, the two sides agreed to 10 points of consensus on their border issue, including maintaining “peace and tranquility,” according to a statement from China’s Ministry of Foreign Affairs.

Armoured vehicles of the Indian army at a military camp in Eastern Ladakh, on May 19, 2024.

Tauseef Mustafa/AFP/Getty Images

As Tanvi Madan, a senior fellow in the Center for Asia Policy Studies in the Foreign Policy program at the Brookings Institution, notes, it’s “not clear that either side will really trust each other.”

The major test, she said, is whether the rhetoric from the two leaders translates to de-escalation on the ground, something that has failed before.

The future of the India-China relationship will be defined by their ability to manage this delicate dance.

The future, said Asia Society’s Aamer, will bring “perhaps a more stable relationship, where competition isn’t necessarily over, but conflict is at bay.”

oooooo

If you design a circuit, there are things like AND gates and OR gates… shift registers, etc. When you think of banks and the federal government, the federal government creates money that doesn’t HAVE to be paid back, and banks create loans. Both are “money,” but only one can be net saved by an individual. Loans must be paid back and with interest.

Government spent dollars are different in the way the circuit is designed.

They hang out in the economy. A federal deficit is a public surplus. If you think about this, a bank types numbers into your bank account when you take out a loan and it pulls payments with interest to pay it back. The dollars lent as loans have absolutely NOTHING to do with lending bank deposits or banking reserves. They literally create dollar denominated loans and look and behave like government spent/created dollars, except the loans must be paid back. When a tax is levied and paid, government dollars return to sender and are destroyed. When the government spends money, a reserve is created in the banking system at the Fed. That reserve is used to facilitate transactions between banks.

Once it returns home in the form of a tax paid, that reserve is destroyed.

On the other hand, when a loan payment is completed, the bank that keystrokes your loan money purges reserves, and the bank keeps the interest you paid on the loan.

So, federal spending is different than bank lending. The terms of the “money” are different. The life cycle of a bank loan and government spent dollar is different. The intent is different. If you cut government spending, you push folks into private borrowing scenarios. It’s not hard to get, but you have to care enough to learn the difference for it to stick.

oooooo

Pavlina R Tcherneva@ptcherneva

As we approach our 40th anniversary, this is one of the best opportunities to learn about the Levy Institute’s unique approach, programs and contributions to economics.

Join us!

Aipamena

Levy Institute@LevyEcon

abu. 25

This Friday: Sr. Scholar James Galbraith opens the Levy Fall Seminar Series with a virtual lecture on why mainstream economics has reached an impasse—and how Levy advances critical alternatives from Minsky and Godley to MMT. Register to attend virtually

https://connect.bard.edu/register/galbraith-why-levy-matters

Thatcher was wrong. There is only public money and no such thing as taxpayer money.

Aipamena

Jamie Jenkins@statsjamie

abu. 27

| Margaret Thatcher – ‘The state has no source of money other than the money that people earn themselves. There is no such thing as public money there is only taxpayers money’

Bideoa: https://x.com/i/status/1960811684534345893

oooooo

Celebrating the life and work of “One of the greatest thinkers of our time” Phil and Carlos welcome us to an afternoon of macroeconomics and engineering boats and cars!

erabiltzaileari erantzuten

“MMT ideas are beginning to trickle down from the top after decades of being pushed to the surface, thanks a to armies of activists around the world”

Yes. But I like think of it the other way ’round. Unemployment etc. is the evidence gov spending is insufficient to cover the need to pay taxes and desires to save. It’s about satisfying that core savings need agents prioritize/borrowing reduce

oooooo

Aipamena

Pavlina R Tcherneva@ptcherneva

abu. 28

Happy 62nd Bday to the March on Washington for Jobs and Freedom! The most pro worker policy is also the best alternative to the NAIRU. The Job Guarantee ends precarious work and unemployment, improves state budgets, controls demand driven inflation, &more

Spanish Translation

French Translation

German Translation

Korean Translation

Polish Translation

Italian Translation

Ukrainian Translation

Chinese Translation

oooooo

Gehigarria:

oooooo

Gehigarri berezia:

Warren Mosler: Zerga-betebeharrak (Tax Liabilities)

oooooo