The Modern Monetary Theory Perspective on the external economy

(https://billmitchell.org/blog/wp-content/uploads/2024/07/Trade_William_Mitchell_June_3_2022.pdf)

William Mitchell

June 2022

1. Introduction

There are three types of constraints that impact on decision making in an economic setting: (a)

financial; (b) real resource; and (c) political. These constraints can work independently or

together to alter the feasible decision-making environment. The problem is that many

economists conflate these constraints and produce erroneous analyses as a result. This is

particularly the case when it comes to analysing the capacities and opportunities of currency-

issuing governments and contextualising this analysis within an open economy setting with

trade and capital flows. Modern Monetary Theory (MMT) provides a clear framework for

distinguishing between these types of constraints because it accurately constructs the way

governments spend and successfully disentangles these constraints in an analytical way in an

open economy setting.

In this paper, we consider the way in which MMT constructs the external sector. We argue, in

part, that criticisms mounted against this view reflect the fact that much of the mainstream

macroeconomics and open economy analysis is predicated on understandings that were

relevant during the fixed exchange rate era. In particular, the way fiscal policy constraints are

perceived within the mainstream theory are directly related to the ‘constraints’ faced by fiscal

authorities during that period who had to ensure they did not compromise the central bank’s

primary responsibility to maintain external currency stability. Once exchange rate flexibility

freed macroeconomic policy (monetary and fiscal) to pursue domestic policy goals, those

‘constraints’ became inapplicable.

However, many economists, still consider currency vulnerability in the face of global financial

trends remains the greatest challenge facing any government, which embarks on an

expansionary policy program. The fear of currency collapse is shared by mainstream and many

heterodox economists, which in the view of this author has hampered the progress of non-

mainstream macroeconomic analysis. While the mainstream economists propose a raft of

fictions about both the domestic and external economies to mount their case against MMT,

many heterodox economists focus on what they consider to be a balance-of-payments-

constraint on fiscal policy. We analyse the ‘balance-of-payments-constrained-growth’ (BPCG)

theory and conclude that, if there is a binding constraint, it comes from politics rather than

finance or the real economy.

2. A real resource starting point

On August 15, 1971, US President Nixon suspended convertibility of the US dollar, which

effectively ended the fixed exchange rates system (Bretton Woods), which had organised

international currencies since 1946. After a futile attempt to salvage the broken system

(Smithsonian Agreement), the Jamaica Accords in 1976 formally ended the arrangement and

the era of fiat monetary systems began.

Under Bretton Woods, central banks had to manage the supply of their currencies to ensure the

agreed parities were maintained. An excess supply of a currency in foreign exchange markets

required the responsible central bank to purchase that currency using their foreign currency

reserves and/or to increase domestic interest rates to attract foreign investment to redress the

downward pressure.

But the money supply contraction and higher interest rates pushed unemployment up and if

expansionary fiscal policy was used too aggressively to reduce unemployment – putting

currency back in the system – it would compromise the central bank’s efforts to maintain

currency stability. Consequently, without an increase in gold reserves, increased government

expenditure (injecting currency) had to be matched (‘financed’) by taxation and if they wanted

to spend more than their tax revenue, they had to issue debt (draining currency).

The collapse of Bretton Woods dramatically altered the opportunities available to currency-

issuing governments. First, under a fiat monetary system, ‘state money’ no longer had any

intrinsic value. For an otherwise ‘worthless’ currency to be acceptable in exchange some

motivation was required. That motivation emerged because the sovereign government required

its use to relinquish private tax obligations.

Second, as the central bank no longer had to defend the floating currency, it followed that there

was no financial constraint on government spending. Currency-issuing governments can buy

any goods and services that are available for sale in its currency including all idle labour. The

only meaningful constraint is the ‘inflationary ceiling’ that is reached when all productive

resources are full employed. This is a dramatic change. Accordingly, we traverse from thinking

about financial constraints on government spending and all the negative narratives about the

need to ‘fund’ spending, to a focus on real resource constraints defined in terms of available

productive resources and available final goods and services.

Third, logically, the government no longer needs to issue debt and debt issuance serves other

purposes which evade public scrutiny (Mitchell et al., 2019).

Thus, it was a major shift in the organisation of the external economy, which spawned the

evolution of the modern fiat monetary systems and provided the point of departure for MMT.

Accordingly, MMT economists shift the focus from financial aggregates (such as deficit-to-

GDP ratios) to the functional outcomes that are desired from public spending given the

available real resources. In that regard,

The shift in focus carries over to the way that the external economy is introduced into the

macroeconomic framework (Mitchell et al., 2019; Mitchell, 2023). The interaction between

nations is driven, in part, by a desire to expand their respective consumption possibilities.

Nations produce to consume. From a material or real resource perspective, a particular nation

benefits from receiving goods and services rather than sending them elsewhere.

Exporting goods and services incurs an opportunity cost in the form of real resources that could

be used locally being made available to other nations (as raw materials or final products).

Imports occur when other nations transfer their real resources to the importing nation, depriving

their own citizens of their use. MMT thus starts with the observation that exports represent a

cost and imports a benefit. In this vein, trade deficits allow a nation to enjoy a higher material

living standard. Trade surpluses are achieved by depriving local citizens of a higher material

standard of living – in the sense that they are being underpaid, under consuming, and/or

working too hard.

Nations thus incur the export ‘cost’ to generate benefits that are otherwise unattainable, given

their domestic resource base, to enhance the material prosperity of the nation. MMT considers

the export cost to be an investment in generating an increased capacity to import to expand

consumption possibilities. A trade deficit is a sign that the real terms of trade are working in

favour of the deficit nation.

The focus on real resources also has significant implications for how we conceive of fiscal

space. The purpose of fiscal policy is not to achieve some financial target, but rather to achieve

functional outcomes, such as full employment. Accordingly, MMT considers the desired fiscal

position would be whatever is required, given the spending, and saving decisions of the non-

government sector, to maintain full capacity output.

Fiscal space is thus a real, not a financial concept. Fiscal space is exhausted when there are no

idle resources available for sale. The question then arises as to whether the external economy

impacts on the fiscal space. More specifically is there a balance-of-payments constraint on

government net spending? We will consider that question in Sections 4 and 5.

3. Understanding the financial transactions and trade

The basic macroeconomic rule is that spending equals income equals output, which drives

employment. The starting point in macroeconomics, then, is to consider the determinants of

the expenditure sources. Later, the analysis is complicated to include a focus on the supply-

side, which leads to the distinction between quantity-adjustment and price-adjustment and

introduces the possibility that spending becomes constrained by productive capacity (Okun,

1981).

International trade is a significant determinant of national income movements in most nations,

given that total expenditure in any period is the sum of domestic demand (household

consumption, business investment and government spending) and net exports. Net exports is

the difference between an injection (exports) and a leakage (imports) from the income-

expenditure stream. Expenditure on imported goods and services means that some of the

national income produced in a period does not return to local firms, which reduces output and

income, other things equal. Exports are generated by external factors and boost local

production and income and can help offset the imports leakage.

Import spending rises with national income and is also influenced by exchange rate movements

and relative inflation rates between nations Exports are similarly influenced by the real

exchange rate as well as economic conditions in the foreign country. So as a nation’s economic

growth increases, it will import more goods and services. As world growth increases, exports

from a nation will typically rise (Robinson, 1947, Part III; Mitchell et al., 2019).

While the impact of trade on the national accounts is broadly uncontroversial, there are many

misconceptions surrounding the financial aspects of the transactions between a nation and the

rest of the world that are recorded in the Balance of Payments. These misconceptions often

motivate erroneous claims about the solvency of national governments, which, in turn, restricts

responsible policy choices from being taken. MMT provides a clear framework for

understanding the implications of these transactions

A trade deficit means that foreigners have given up more real resources (inputs, final goods)

than they have received in return. Why would they do that? The answer is that a trade deficit

allows foreigners to accumulate financial assets in the currencies of deficit nations. If the

foreigners change their desires to hold financial or other assets denominated in the currency of

the deficit nation, then the trade flows will change as the deficit nation’s real terms of trade

worsen because it becomes harder to get the foreign exchange necessary to maintain the same

level of imports.

It is possible that foreigners will have no desire to accumulate financial assets in a particular

foreign currency, which means that nation would have to run trade balances. It is also possible

that the preference for foreign currency financial assets could change quickly, which could be

highly disruptive for the deficit nation. In general, however, these adjustments are not sudden.

We can also extend the MMT insight, that net financial assets can only be created and destroyed

in the non-government sector through transactions with the government (central bank and/or

treasury), to an analysis of trade.

Consider the following story:

§ I wish to buy a Japanese manufactured car, where the manufacturer measures profit and

loss in yen.

§ The manufacturer maintains a dealer network in, say, Australia and invoices dealers in yen.

§ The car dealership accepts the yen-liability but sells the car in Australian dollars ($A).

§ When I pay the dealer, my bank reduces my deposit balance by the price of the car and the

balance at dealer’s bank is increased by the same amount.

§ The Australian central bank records a decrease in reserves for my bank and a corresponding

increase in reserves for the car dealer’s bank as part of the clearing process, which just

means that the ownership of these $A transfers to the dealer. No new net financial assets

are created.

§ Alternatively, if I take out a loan to buy the car, then my bank’s balance sheet now records

the loan as an asset and creates a deposit (the loan) on the liability side. When I hand over

the cheque to the car dealer (drawing on the loan), the dealer now has a new asset (bank

deposit) via the fact that loans create deposits within the system. Again, no new net

financial assets are created.

At this stage, the export surplus (1 car) manifests as an accumulation of $A assets in the form

of a bank deposit (or equivalent). What happens next depends on the aspirations of the

manufacturer. There are several options:

1. Require the invoice to the dealer to be paid in yen.

2. Leave the sales revenue in $A accounts at Australian banks.

3. Purchase $A-denominated assets (financial or otherwise).

A currency mismatch would arise if the car dealer decides to pay the invoice from the

manufacturer in yen. Accordingly, after deducting profits, the car dealer will then negotiate an

$A for yen sale in the foreign exchange market (probably via their bank). That sale can only

proceed if a current yen holder desires to hold $A. Once the contract exchange takes place, the

car dealer transfers the yen purchased from the counterparty to the Japanese bank of the car

manufacturer (ignoring almost certain hedging arrangements).

The resulting financial effects are: (a) The $A balances in the Australian financial sector remain

the same, only the ownership of the balances changes; (b) The yen balances in the Japanese

financial sector remain the same but ownership has transferred from the Foreign Exchange

dealer to the car dealer and finally to the car manufacturer. If the manufacturer decided to

accept payment of the invoice in $A (then the foreign exchange market transaction would be

unnecessary) and the transaction would just mean that the Japanese car company would have

a new $A financial asset (bank deposit). In summary, the net export surplus does not increase

the yen or $A balances – only the ownership of these currency holdings changes.

What would happen if the Japanese car firm accepted payment in $A assets and bought

Australian Government debt with the $A-denominated bank deposits? In this case, the

Japanese car company would instruct its agent to put in an order for the bonds and the firm

would instruct its Australian bank to transfer the $A bank deposit to the favour of the bond

seller (which might be the central bank). The Japanese car maker’s lawyers or representative,

in turn, would receive the bond certificate and the Australian government’s foreign debt rises

by that amount. In this case, the Australian Government promises, on maturity of the bond, to

credit the bank account of the ultimate holder of the bond with the face value of the bond plus

interest and debit some account at the central bank (or whatever specific accounting structure

is involved with bond sales and purchases).

In other words, this transaction merely amounts to substituting a non-interest bearing reserve

balance for an interest-bearing Government bond. That transaction can never present any

problems of solvency for a sovereign government despite many commentators (and

economists) arguing that without the foreign funding, the government would have no financial

viability. The corollary to this narrative is that the foreigners could suddenly change their

preferences and the government would become insolvent.

Let’s clear that misconception up using Chinese trade surpluses against the US as an example

and drawing on the understanding we have achieved to date. China automatically accumulates

US-dollar denominated claims because of these surpluses. They are the ‘reward’ for running

the real terms of trade in favour of the US. These claims are initially held within the US banking

system and can manifest as US-dollar deposits or interest-bearing bonds. The difference is

immaterial to how the US government spends.

Of course, the US car worker in Detroit who endures unemployment because of the cheaper

imports coming from China, is unlikely to consider the superior real terms of trade the US

enjoys an advantage. But the US, overall, benefits from China’s willingness to deprive its

citizens of the use of its own real resources so that it can net ship its ‘labour’ and other real

resources embodied in the exports to other nations.

What would happen if the Chinese holders of US government debt decided to liquidate their

holdings of US government debt that have been accumulated using the $US-denominated trade

surpluses? This could be done slowly or quickly. A rapid liquidation (conversion into Chinese

currency) would devastate the Chinese wealth stored in those $US assets because the $US

would depreciate significantly. Such a liquidation would have no bearing on the US

government’s capacity to buy goods and services for sale in US dollars but would seriously

undermine the international competitiveness of China.

4. The external sector and sustainable policy space

The late Canadian economist Harry Johnson (1969: 18) noted that:

The adoption of flexible exchange rates would have the great advantage of freeing

governments to use their instruments of domestic policy for the pursuit of domestic

objectives, while at the same time removing the pressures to intervene in international

trade and payments for balance-of-payments reasons.

A flexible exchange rate regime maximises the policy space for government to pursue domestic

objectives. Once a nation adopts a currency peg of any description (fixed exchange rate,

dollarisation, currency board, etc) it loses its full currency sovereignty and compromises

domestic policy aspirations.

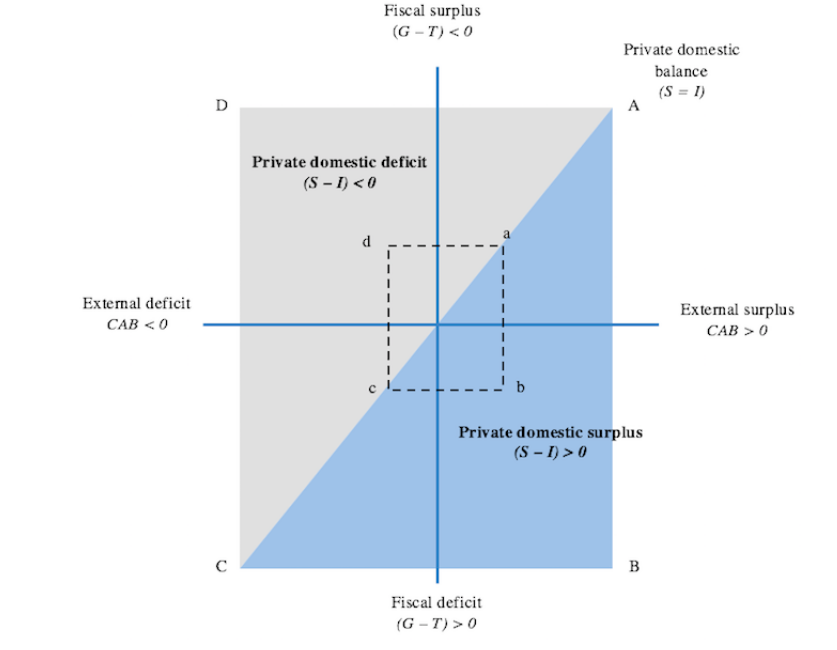

In this section, we develop a concept of sustainable policy space. The well-known sectoral

balances framework, which is derived from the national accounting framework can be depicted

graphically (see Mitchell et al., 2019).

The sectoral balances accounting statement is written:

(1) (S – I) = (G – T) + CAB

where S is household saving, I is private capital formation, G is government spending, T is

taxation revenue and CAB is the Current Account balance (which is the sum of exports (X)

minus imports (M) plus net external income flows (FNI)).

Equation (1) is interpreted as meaning that government sector deficits (G – T > 0) and current

account surpluses (CAB > 0) generate national income and net financial assets for the private

domestic sector, which must then be saving overall (S > I). Saving overall is different to the

residual flow of saving that is left after household consumption decisions are executed.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce

national income and undermine the capacity of the private domestic sector to add financial

assets.

Figure 1 Sustainable policy space

Source: Mitchell et al. (2019).

Source: Mitchell et al. (2019).

In Figure 1, all points above zero on the vertical axis represent a government fiscal surplus and

all points on the vertical axis below the origin denote government fiscal deficits. Similarly, all

points to the right of the origin on the horizontal axis denote external surpluses and all points

to the left of the origin on the horizontal axis represent external deficits. These balances are

usually expressed as shares of GDP. Clearly, the origin of both axes denotes a position where

all balances are equal to zero.

We also know that when the private domestic balance is zero (S = I), then the government fiscal

deficit (surplus) will equal the external deficit (surplus). Thus, the diagonal 45-degree line (AC)

shows all combinations of government fiscal balances and external balances where the private

domestic balance is zero.

At points a and c, there is a private domestic balance. Point b corresponds to a fiscal deficit and

an external surplus. Thus, the private sector must be engaging in positive net saving. Then

between points b and a, and b and c, net saving by the private sector is falling until private

domestic balance is achieved at points a and c, respectively.

Similarly, at d, the private domestic sector is net spending. Between points d and c and d and

a, net spending by the private sector declines until private domestic balance is achieved at

points a and c respectively.

We can generalise this knowledge and conclude that all points above the 45-degree line on

each side of the vertical axis correspond to private domestic sector deficits and all points below

the 45-degree line on each side of the vertical axis correspond to private domestic sector

surpluses.

Several observations are then possible. First, for a sovereign, currency-issuing government, all

combinations of the sectoral balances represented by the points in the four quadrants are

permissible. With private sector spending and saving decisions combining with the flows of

income arising from trade with the external sector driving national income, the government

sector can allow its balance to adjust to whatever magnitude is required to maintain full

employment and price stability.

For example, when a trade deficit coincides with overall private domestic sector saving, the

drain on aggregate demand requires the government to run a deficit of sufficient size to ensure

that total spending is sufficient to absorb the real productive capacity available in the economy.

Alternatively, if there is a trade surplus, which adds to total demand and the private domestic

sector is in deficit, then the government has to ensure it ran a surplus of sufficient size to ensure

that the economy does not overheat and exhaust its productive capacity. The strong economy

would be associated with robust tax revenue growth, which would help the government achieve

its surplus. Discretionary adjustments in spending and taxation rates might also be required.

Second, while these combinations are permissible, the private domestic sector cannot easily

sustain deficits permanently because they manifest in an increasing stock of debt. There is a

difference, however, between private domestic deficits driven by consumption expenditure and

those driven by capital expenditure. In the latter case, a capital importing nation, for example,

may well record private domestic and external trade deficits as firms invest in productive

capital, which delivers a profitable rate of return, that, in turn, allows the increasing

indebtedness to be serviced. In that case, the private domestic sector may be able to sustain

deficits while economic growth is uninterrupted.

The process of private debt accumulation is limited because at some point the susceptibility of

the private balance sheet to cyclical movements (for example, rising unemployment, falling

sales) increases and the risk of default rises. The only unambiguously sustainable position is

for the private domestic sector to be in surplus. An economy can absorb deviations from that

position but only for short periods. Thus, it is only the area ABC that can be considered the

sustainable policy space available to governments that issue their own currency.

Third, any imposition of fiscal rules (for example, the 3 per cent threshold in the EMU Stability

and Growth Pact), will shrink the sustainable fiscal space significantly. An unconstrained

government can always utilise the available space to ensure aggregate demand is sufficient to

maintain full employment and price stability. While the external surplus nations have more

policy flexibility when operating under a fiscal rule than external deficit nations, the fact

remains that the allowable fiscal deficits may be insufficient to maintain the aggregate demand

necessary to sustain full employment.

The policy inflexibility facing nations which run external deficits and simultaneously must

operate under fiscal rules becomes even more restrictive. When such an economy experiences

a negative economic shock significant enough to drive the private domestic sector to reduce its

spending and target a sectoral surplus, the extent to which the fiscal deficit can be used to

absorb the loss of overall aggregate demand is very limited. It is highly likely that such an

economy will experience enduring recessions because of the artificial fiscal rules (restrictions)

that are placed on its government.

However, the contention that policies that situate the economy in the area ABC are sustainable

is contested by those who assert that nations must ultimately sustain growth rates consistent

with trade balance. This view is broadly referred to as ‘balance-of-payments-growth-

constraint’ (BPGC) theory, which we turn to now.

5. The Balance-of-Payments Constraint debate

Critics essentially assert that MMT is flawed because it doesn’t recognise the fiscal limits

imposed by the need to maintain a stable trade balance. Much of this argument is based on

fixed exchange rate logic, despite being applied to nations adopting flexible exchange rates. A

hangover from the fixed exchange rate period is the view that trade deficits are unsustainable.

Belkar et al. (2007: 1) state:

Perhaps the key concern is that countries in this situation could be on a path to

insolvency, building up excessive net foreign debt, raising the prospects of default

and/or a sharp reversal in capital flows, which might force an abrupt and costly

adjustment … Also, large deficits and rising indebtedness could leave countries more

vulnerable to adverse external shocks (including a change in sentiment of foreign

creditors).

Clearly under fixed exchange rates, persistent current account deficits are problematic and

compromise the ability of nations to pursue domestic policy targets. During the Bretton Woods

period, nations endured recurring ‘stop-go’ growth cycles, where fiscal authorities would be

forced to tighten fiscal policy and create unemployment to support their central bank’s efforts

to stabilise the currency in the face of external deficits. Then, to address falling political

popularity, they would stimulate the economy, which would increase import expenditure and

precipitate a new round of currency pressures (Hood and Himaz, 2017).

Some economists point to the UK experience in the 1992 as evidence of the damage that

speculative capital can wreak on a nation through the external sector, and, as a result, most

economists urge governments to reduce their current account deficits and target surpluses.

Unfortunately, these critiques fail to trace the source of the 1992-93 currency crisis, which

demonstrated that fixing exchange rates between economies that are disparate in structure and

performance will always fail with mobile capital (see Mitchell, 2015, for a detailed analysis).

The problem is that, even though most of the world has moved to flexible exchange rates, Black

Wednesday, and similar crises under fixed exchange rates, have become the model for those

who predict that the amorphous financial speculators will destroy a currency if governments

run fiscal deficits and/or current account deficits. Even heterodox economists (Post

Keynesians, Marxists) mount fears of insolvency and currency instability arising from external

deficits (see for example, McCombie and Roberts, 2002; Epstein, 2020).

While mainstream economics is predicated on a confusion between financial and real resource

constraints, Post Keynesians and Marxists often conflate political constraints with financial

constraints, especially when considering the balance of payments. They use the BPCG

framework to claim that attempts by the government to stimulate growth will fail if they result

in current account deficits. In terms of Figure 1, they argue the sustainable area is much smaller

than we demonstrated in Section 4. We argue here that the balance-of-payments-constraint can

only be understood in political terms and says nothing about financial and/or real resource

constraints. In that regard, the BPCG approach does not provide a basis for discrediting MMT.

The BPCG approach grew out of the work of Hicks (1950), Kaldor (1957, 1970, 1971, 1978,

1989) and Thirlwall (1979). While mainstream growth theory posits that the constraints on

progress are to be found on the supply-side (technology, population, etc) with the demand-side

(expenditure) always adjusting to ensure there is no idle capacity along the growth path, Post

Keynesian approaches, following Marx, Kalecki and Keynes seek to shift the focus to the

demand-side constraints. However, the BPCG approach places a particular meaning on the

demand-side constraints. It is not domestic demand failures that ultimately matter but export

demand. Mitchell (2023) considers this literature in some detail.

Kaldor (1957: 593) argued that ‘the general level of output at any one time is limited by

available resources, and not by effective demand’ and thus characterised the shortage of labour

as the binding constraint. Clearly, at full capacity no further real output will be forthcoming

which is a central MMT proposition. However, in his later work, Kaldor (1970, 1978)

abandoned that view, and, instead, claimed that it was export demand that limited a nation’s

growth potential. He assumed that export revenue was the only source of expenditure injection,

which, in turn, induced increases in domestic expenditure. Accordingly, after an export boost,

domestic expenditure would rise on the income stimulus and once the new leakages equalled

the initial external exogenous boost, the growth constraint would reassert itself because the

nation would run out of reserves to purchase its imports. In other words, growth was only

possible through the accumulation of foreign exchange reserves via export demand.

Kaldor (1970: 146) summarised his long-run relationship between aggregate output and export

spending using the Harrodian foreign trade multiplier, which he reinterpreted as the growth

constraint:

- 𝑌 = 1/m 𝑋

where Y is aggregate output, X is total exogenous exports, and m is the marginal propensity to

import.

Thus, in the absence of any other exogenous spending sources, output growth will ultimately

be limited to the rate that is consistent with a trade balance. Importantly, there must also be

some adjustment process that ensures that balance, which in Kaldor’s approach is exclusively

determined by induced income changes rather than price changes.

From an MMT perspective, Kaldor’s treatment of government spending, which we typically

consider to have an autonomous or discretionary component, is problematic. Kaldor (1970)

assumed that government spending was financially constrained by endogenous changes in tax

revenue and always adjusts to those changes, thus denying the ability of government to run

persistent deficits or surpluses. Kaldor (1971: 7) also claimed that using fiscal policy to

increase ‘production and employment through a stimulus to domestic demand would …

increase imports relative to exports; this would have brought a downward pressure on sterling’.

It is surprising that heterodox economists ever accepted this neoclassical argument against

discretionary fiscal interventions.

Another interesting deviation by Kaldor from previous Keynesian growth theory was his

rejection of Harrod’s investment duality (Harrod, 1939), where capital formation: (a) added to

immediate aggregate spending; and (b) augmented future capacity, which then required growth

in future spending to absorb that productive potential and avoid recession. Kaldor considered

it was exports that were dual in nature because they not only added to total spending but also

created extra space (through foreign exchange earnings) for import spending to increase.

This duality is at the basis of the BPCG theory, formalised by Thirlwall (1979), which asserts

that the long-run growth process is constrained by a nation’s exports, assuming the real

exchange rate is constant and that balance of trade is zero (see also McCombie and Thirlwall,

1994).

Thirlwall (1979: 429) was investigating ‘why growth rates differ between countries’ and

criticised the neoclassical approach for ignored the fact that ‘it is demand that ‘drives’ the

economic system to which supply, within limits, adapts’ (p.429). This, in turn, focused his

attention on the ‘constraints on demand’ (p.429).

For Thirlwall (1979: 430):

The importance of a healthy balance of payments for growth can be stated quite

succinctly. If a country gets into balance of payments difficulties as it expands demand,

before the short term capacity growth rate is reached, then demand must be curtailed;

supply is never fully utilised; investment is discouraged; technological progress is

slowed down; and a country’s goods compared to foreign goods become less desirable

so worsening the balance of payments still further, and so on. A vicious circle is started.

By contrast, if a country is able to expand demand up to the level of existing productive

capacity, without balance of payments difficulties arising, the pressure of demand upon

capacity may well raise the capacity growth rate.

Note his reference to the ‘balance of payments’ is somewhat of a misnomer because he is really

talking about the trade balance.

Following Kaldor, Thirlwall starts with a strict condition on the growth rates of exports and

imports

- 𝑃dt Xt = Pft 𝑀t 𝐸t

where X is the volume of exports, Pd is the home currency price of exports, M is the volume of

imports, Pf is the foreign currency price of imports, E is the nominal exchange rate, and t is

time.

In growth terms, balance of payments equilibrium requires that growth in export revenue

continuously equals the growth in import expenditure

(4) 𝑝dt + 𝑥t = 𝑝ft +𝑚t + 𝑒t

where the lower-case letters depict growth rates.

Thirlwall adopted the standard assumptions about the determinants of exports and imports and

assumed that the ‘Marshall-Lerner condition is just satisfied or … relative prices measured in

a common currency do not change over the long run’ (Thirlwall, 1979; 434).

Then, imposing a balance of payments equilibrium condition (which is really a trade

equilibrium), we get

(5) 𝑦Bt = 1/π xt

where yBt is the balance of payments equilibrium growth rate and π is the income elasticity of

demand for imports and is assumed to be greater than 0.

Thirlwall (1979: 437) used this simple expression to assert that if a nation wishes ‘to grow

faster they must first raise the balance of payments constraint on demand’ and that must come

from increasing exports and/or reducing the income elasticity of imports.

What mechanisms did Thirlwall envisage that makes (5) binding on growth? McCombie (2011)

says that:

The rationale behind the law is that no country can grow faster than its balance-of-

payments equilibrium rate for very long, as its level of overseas debt to GDP ratio will

grow to levels that will precipitate a collapse in international confidence, the

downgrading of its international credit rating, and a sovereign debt and currency crisis.

Setterfield (2011: 397) expresses this in a different way:

a fundamental premise of BPCG theory in its original form is that we must observe

trade balance, either: a) because countries are unable to run chronic trade deficits (than

cannot attract permanent net inflows of financial capital from abroad); or b) because

countries are unwilling to run chronic trade deficits (they do not wish to attract

permanent net inflows of financial capital from abroad, because of the resulting

accumulation of foreign indebtedness and consequent debt servicing commitments)

(emphasis in original)

In one conception, it is the alleged power of global financial markets that impose the constraint,

and, in the other, it is the choice of governments, presumably based on a fear of the former.

Importantly, the first premise is only relevant to a fixed-exchange rate regime, while the second

premise is best understood as a political constraint.

Johnson (1969: 19), long ago, countered the argument that flexible exchange rates would be ‘unstable … jumping about from day to day’:

… in response to such changes in demand and supply — including changes induced by

changes in governmental policies — and normally will move only slowly and fairly

predictably. Abnormally rapid and erratic movements will occur only in response to

sharp and unexpected changes in circumstances; and such changes in a fixed exchange

rate system would produce equally or more uncertainty- creating policy changes in the

form of devaluation, deflation, or the imposition of new controls on trade and payments

While the fixed exchange rate system was ultimately derailed by speculative capital flows,

which threatened exhaustion of the foreign exchange and gold reserves of nations recording

trade deficits, no such constraints impact on nations running flexible exchange rates.

Further, the long-run constraint is not binding if the capital account offsets the current account

deficit. The introduction of financial flows on the capital account negates the Thirlwall

assumption that exports are required to pay for imported goods and services. In other words, a

nation could record permanent trade deficits, without degrading its currency.

Belkar et al. (2007: 4), representing the ‘modern’ central banking perspective under flexible

exchange rates, argue that:

The current account balance need not … be seen by itself as a reliable indicator of

vulnerabilities … The fact that Australia has managed to sustain investors’ confidence

is evident in the maintenance of the current account deficit at an average of around 41⁄2

per cent of GDP over two decades combined with a real exchange rate showing no

discernible trend over the same period.

So, in the case of financial flows, the maximum BPCG output level would be below the

possible output level. The question then is at what point do the net financial inflows stop. Some

writers have suggested that “that the propensity of … [net financial inflows] … to boost growth

must be regarded as a strictly short-run result … [and] … cannot represent the long-run

equilibrium growth rate” (Setterfield, 2011:408). However, that conclusion remains purely an

assertion. Why has Australia, for example, been able to run persistently large current account

deficits for extended periods of time without any observed collapse in the currency or any debt

crisis?

Belkar et al. (2007: 28) note that a nation can have ‘a number of institutional features that help

to lessen its vulnerability of external shocks’. They itemise these features: ‘Stable government,

credible and sustainable monetary and fiscal policies, a sound financial system based on

efficient regulation and supervision, effective legal and accounting frameworks, and

transparent and open markets for factors of production and outputs’ (p. 29). These features

allow a nation ‘to be resilient in the face of large nominal exchange rate fluctuations’ and

provide an attractive basis for attracting a stable volume of capital inflows.

Palumbo (2009: 363) also notes that later in his career, Kaldor (1989) effectively abandoned

his earlier position ‘as he applies the model to the analysis of actual processes of growth in real

economies’. Post Keynesians who consider the BPCG concept to be an eternal verity and a

major flaw in MMT appear to have lost sight of Kaldor’s shift.

Another curious aspect of the popularity of Thirlwall’s law is the adherence to a long-run

equilibrium separate from the short-run. Neoclassical theory has always considered such a

distinction to be significant and the temporal separation into short-run periods and some

distinct long-run period has been used to attack policy-activism by government. However,

Kalecki, among others clearly rejected this temporal dichotomy. King (2002: 54) in

summarising Kalecki’s approach, wrote that one characteristic was:

There is no such thing as the long run, defined independently of the set of short periods

which constitute it. The notion that neoclassical equilibrium analysis applies in such a

long run is profoundly mistaken.

6.Additional considerations with respect to the BPCG theory

6.1, Flexible exchange rates and inflation

BPCG theory leads to conclusion that if the markets ‘sell-off’ a currency, the increase in import

prices and resulting inflation will negate any real income gains that might be made through

domestic expansionary policy. Clearly, exchange rate movements influence real value of the

nominal incomes produced. Non-tradable goods and services will be much less influenced by

exchange rate movements than direct imports. In many cases, these goods and services will

have negligible exposure to exchange rate movements. The provision of many services, for

example, will have little variability to exchange rate fluctuations.

The extent to which movements in domestic prices are influenced by shifts in import prices

arising from exchange rate movements depends on the degree of ‘pass through’ and the

importance of imported goods and services to the overall basket that determines the workers’

material living standards.

The estimates of ‘exchange rate pass through’ (ERPT) are highly variable and depend on many

factors including the extent of the exchange rate shift, how much spare capacity there is in the

economy, the adjustment costs incurred to adjust prices, the degree of import competition, etc.

(see for example, Taylor, 2000).

The sensitivity of domestic inflation to changes in import prices is also important. ERPT might

be high and rapid but this sensitivity might be low and drawn out, making the overall impact

inconsequential. There is also the question of time lags and the sum of the two impacts can

take years to manifest.

While it is difficult to statistically disentangle these separate effects, Bailliu et al. (2010: 1)

conclude that ‘a substantial literature has shown that the correlation between changes in

consumer prices and changes in the nominal exchange rate has been quite low and declining

over the past two decades for a broad group of countries’ (see also Parker, 2014; Forbes, 2015).

Forbes (2015) concluded that:

First, contrary to common belief, exchange rate movements don’t seem to consistently

have larger effects on prices in sectors with a higher share of imported content. Second,

exchange rates don’t seem to consistently have larger effects on prices in the most

tradable and internationally-competitive sectors. Third, the effects of exchange rates on

inflation – and even just on import prices – do not seem to be consistent across time.

Most of what I learned in grad school on this topic no longer seems to apply.

6.2 Living beyond the nation’s means

Proponents of the BPCG theory construct trade deficits as signalling a nation ‘living beyond

its means’. The excess of investment over saving can only be countered with the net

accumulation of foreign claims on the nation. The proponents of this view then claim that the

nation’s potential growth path is lowered because local profit retention and hence local

investment is reduced.

There are several issues. From a consumption perspective, it is undeniable that for an economy,

imports represent a real benefit while exports are a real cost. Thus, net imports means that a

nation gets to enjoy a higher material living standard by consuming more goods and services

than it produces for foreign consumption. Recognising this, does not mean we should disregard

a current account deficit.

First, it is true that foreigners (surplus nations) build up financial claims in the currency of the

deficit nation. If the government allowed, they might liquidate these claims purchasing real

estate (for example, Russian and Chinese property acquisitions in London), which might

undermine the prosperity of the local residents (for example, through housing affordability

issues). But the nation state can legislate whatever restrictions they like in this regard and

prevent foreigners purchasing strategic assets.

Second, the foreigners might liquidate their local currency holdings in forex markets. The

reason that nations can run external deficits is because foreigners are willing to exchange their

exports for financial claims in the local currency. That preference could change at any time.

Clearly, the deficit nation gains the terms of trade benefit while the preference holds. But if the

preference changed suddenly, then the deficit nation may be exposed to rather harsh adjustment

costs. That possibility should always be recognised. But major sell-offs of currency holders

would also expose the selling parties to exchange losses if a significant exchange rate

depreciation resulted.

Third, if the local currency holdings end up in the hands of speculators, which implies the

motivation is different from a trading entity, the nation state can always impose capital controls

to protect its currency (see Section 6.4)

Fourth, more problematic is that foreign interests may seek to use their financial clout to

manipulate the political system and the public through media domination. However, strict

campaign funding and media ownership rules can militate against these negative consequences.

6.3 Trade deficits and deindustrialisation

Some argue that persistent external deficits accelerate the process of deindustrialisation (loss

of manufacturing capacity), which reduces opportunities for high-skilled, well-paid

employment, damages productivity growth and innovation, and leaves the nation reliant on

imported goods and services. There are often arguments made that a nation needs to protect

local manufacturing to ensure self-reliance in the event of war. Which means that a government

can always adopt a forward-thinking industry policy to expand domestic industry, spawn

innovating research and development, upskill the workforce, build export capacity, etc, as long

it has available real resources or can acquire them from abroad. An MMT understanding allows

us to appreciate that there would be no financial impediment for a government building national

industries, funding research and development, providing first-class universities and

apprenticeship training and the rest. If a nation with its own currency slides into oblivion by

closing its manufacturing sector, cutting career public sector jobs and relying on low-paid and

precarious service sector jobs for employment creation, then that has little to do with running

external deficits, and everything to do with political choices.

Further, there are other reasons for maintaining a manufacturing sector, which include

maintaining infrastructure as part of a defence strategy and building self-sufficiency in essential

goods and services (such as health care products).

6.4 The role of capital controls

The BPCG literature suggests that governments must prioritise the appeasement of

international investors over domestic policy goals such as full employment. Clearly under

Bretton Woods, damaging speculative attacks on national currencies was a factor because the

speculators knew that in the short-run, the central bank would try to stabilise the currency at

the agreed parity and as a result, the short-sellers could reap havoc. As a result, governments

imposed recessed conditions on their populace from time to time to head-off speculative

attacks.

The MMT position is that ultimately speculative financial flows not directly relating to

reducing exchange rate risk in real productive activities should be outlawed. But in lieu of that

being achieved through global cooperation, other means must be found by governments to

defend their currencies in the event of a speculative attack.

Capital controls have proven to be an effective strategy to restrict the free movement of capital

across borders in either direction. Mitchell (2023) discusses the types and uses of capital

controls in detail.

(Ikus Capital controls – William Mitchell – Modern Monetary Theory)

While there are various forms of controls that can be imposed, the important point is that they

free the central bank from directing monetary policy towards defending the nation’s currency

parity and allow the fiscal authorities to pursue demand management policies, which prioritise

domestic targets, such as full employment.

While mainstream economists claim that the financial markets will always subvert capital

controls, Rodrik (2010) notes that:

Even if true, evading the controls requires incurring additional costs to move funds in

and out of a country – which is precisely what the controls aim to achieve. Otherwise,

why would investors and speculators cry bloody murder whenever capital controls are

mentioned as a possibility? If they really couldn’t care less, then they shouldn’t care at

all.

The balance of payments should not be an issue of concern for governments when designing

policies to advance the well-being of their citizens. All open economies experience fluctuations

in their external balances. While these fluctuations were problematic under fixed exchange

rates, the exchange rate does the adjustment under a flexible system. There is no balance of

payments constraint facing a nation in this regard.

6.5 The plight of poor nations and industry policy

Noting that a currency-issuing government is not constrained in its capacity to generate full

employment through appropriate fiscal policy settings is not the same thing as saying that

achieving this desirable goal can rescue nation from poverty. The fact that such a government

can spend its own currency to bring idle resources back into productive use does not mean that

it can avoid the external factors that can constrain material prosperity. A currency-issuing

government in a poorer nation, particularly one that is dependent on imported food and energy,

faces additional constraints that cannot be easily solved with increased fiscal deficits.

But this insight just reinforces the initial observation that the ultimate constraint on material

prosperity is the real resources a nation can command (people, productive capital, and natural

resources). The reality is that if a nation that is dependent on imported food and/or energy,

cannot find sufficient demand for its exports, then the capacity of the currency-issuing

government to alleviate poverty is limited. While this might appear to be a ‘balance of

payments constraint’, it is better conceived as a real resource constraint arising from spatial

inequalities in the unequal distribution of resources.

MMT considers the only effective way to resolve real resource constraints that operate through

the balance of payments is for all nations to share responsibilities mediated through a new

multilateral institution that would replace the failed World Bank and IMF. Such an organisation

would be required to ensure that disadvantaged nations would have access to essential real

resources at fair terms (see Mitchell and Fazi, 2017).

Further policy initiatives would be required including: (a) outlawing speculation in financial

markets on food and other essential commodities; (b) multilateral agreements to end financial

market speculation that has no necessary relationship with improving the operation of the real

economy; (c) use of import controls on luxury items that only the rich enjoy would provide

more external space to import essentials; rewarding nations that restrict their own capacity to

export commodities that are injurious to global well-being (such as coal).

This discussion also feeds into the need for industry policy, given the problem facing less

developed nations is the lack of a stable industrial base. Nations that trade in industrial goods

enjoy more stable prices in international markets than primary commodity exporters, who

endure large swings in their terms of trade, which make it difficult build viable manufacturing

sectors (Corden and Neary, 1982). Mitchell (2023) argues that nations that chose a state-driven

import-substitution approach to industrialisation grew strongly without an export-bias. Further,

the reason that growth was not sustained in the 1970s is because the IMF and World Bank

forced nations into abandoning import-substitution strategies in return for currency support,

not that such strategies failed. Import-substitution strategies increase self-reliance and allow a

nation to better avoid the damage from fluctuations driven by currency speculation (see also,

Rowthorn, 1981; Chang, 2007; and Cherif and Hasanov, 2019).

References

Bailliu, J., Dong, W. and Murray, J. (2010) ‘Has Exchange Rate Pass-Through Really

Declined? Some Recent Insights from the Literature’, Bank of Canada Review, Autumn 2010,

1-8.

Belkar, R., Cockerell, L., and Kent, C. (2007) ‘Current Account Deficits: The Australian

Debate’, Reserve Bank of Australia Research Discussion Paper 2007-02, March.

Chang, Ha-Joon (2007) Bad Samaritans: The Myth of Free Trade and the Secret History of

Capitalism, London, Bloomsbury Press.

Cherif, R. and Hasanov, F. (2019) ‘The Return of the Policy That Shall Not Be Named:

Principles of Industrial Policy’, IMF Working Paper 19/74, International Monetary Fund,

Washington.

Corden, W.M. and Neary, J.P. (1982) ‘Booming Sector and De-industrialisation in a Small

Open Economy’, The Economic Journal, 92, 825–48.

Epstein, G. (2020) ‘The Empirical and Institutional Limits of Modern Monetary Theory’,

Review of Radical Political Economics, 52(4), 772-780.

Forbes, K. (2015) ‘Much ado about something important: How do exchange rate movements

affect inflation?’, Speech at 47th Money, Macro and Finance Research Group Conference,

Cardiff.

Hicks, J.R. (1950) A Contribution to the Theory of the Trade Cycle, Oxford, Clarendon Press.

Hood, C. and Himaz, R. (2017) A Century of Fiscal Squeeze Politics: 100 Years of Austerity,

Politics, and Bureaucracy in Britain, Oxford, Oxford University Press.

Johnson, H.G. (1969) ‘The Case For Flexible Exchange Rates’, The Federal Reserve Bank of

St. Louis Review, June, 12-24.

Kaldor, N. (1957) ‘A Model of Economic Growth’, The Economic Journal, 67(268),

December, 591-624.

Kaldor, N. (1970) ‘The case for regional policies’, Scottish Journal of Political Economy,

17(3), November, 337-48.

Kaldor, N. (1971) ‘Conflicts in national economic objectives’, The Economic Journal, 81(321),

March, 1–16.

Kaldor, N. (1978) Further Essays on Economic Theory, London, Duckworth.

Kaldor, N. (1989) ‘The role of effective demand in the short and long–run growth’, in A.

Barrére (org.), The Foundations of Keynesian Analysis, London, Macmillan Press, 1988.

King, J.E. (2002) A history of Post Keynesian economics since 1936, Cheltenham, Edward

Elgar.

McCombie, J.S.L. (2011) ‘Criticisms and defences of the balance-of-payments constrained

growth model: some old, some new’, PSL Quarterly Review, 64(259), 353-392.

McCombie, J.S.L. and Roberts, M. (2002) ‘The Role of the Balance of Payments in Economic

Growth’, in Setterfield, M. (ed.) The Economics of Demand-Led Growth: Challenging the

Supply-Side Vision of the Long Run, Cheltenham, Edward Elgar, 87-114.

McCombie, J.S.L. and Thirwall, A.P. (1994) Economic Growth and the Balance-of-Payments

Constraint, London, Macmillan.

Mitchell, W.F. (2015) Eurozone Dystopia: Groupthink and Denial on a Grand Scale,

Cheltenham, Edward Elgar.

Mitchell, W.F. (2023) ‘The Balance of Payments and Modern Monetary Theory’, in Wray,

L.R., Armstrong, P., Holland, S., Jackson-Prior, C., Plumridge, P. and Wilson, N. (eds.)

Modern Monetary Theory: Key Insights, Leading Thinkers, Cheltenham, Edward Elgar,

forthcoming.

Mitchell, W.F. and Fazi, T. (2017) Reclaiming the State: A Progressive Vision of Sovereignty

for a Post-Neoliberal World, London, Pluto Books.

Mitchell, W.F., Wray, L.R. and Watts, M.J. (2019) Macroeconomics, London, Red Globe

Press.

Okun, A.M. (1981) Prices and Quantities: A Macroeconomic Analysis, Washington, D.C., The

Brookings Institute.

Palumbo, A. (2009) ‘Adjusting Theory to Reality: The Role of Aggregate Demand in Kaldor’s

Late Contributions on Economic Growth’, Review of Political Economy, 21(3), 341-368.

Parker, M. (2014) ‘Exchange rate movements and consumer prices: some perspectives’,

Reserve Bank of New Zealand Bulletin, 77(1), 31-41.

Robinson, J. (1947) Essays in the Theory of Employment, Oxford, Basil Blackwell.

Rodrik, D. (2010) ‘The End of an Era in Finance’, Project Syndicate, March 11, 2010.

Rowthorn, R. (1981) ‘The Politics of the Alternative Economic Strategy’, Marxism Today,

January, 4-10.

Setterfield, M. (2011) ‘The remarkable durability of Thirlwall’s Law’, PSL Quarterly Review,

64(259), 393-427.

Taylor, J. (2000) ‘Low Inflation, Pass-Through, and Pricing Power of Firms’, European

Economic Review, 44(7), 1389–408.

Thirlwall, A.P. (1979) ‘The Balance of Payments Constraint as an Explanation of International

Growth Rate Differences’, Banca Nazionale del Lavoro Quarterly Review, March, 32, 45-53.