Ikus From the River to the Sea: Ibaitik Itsasora (87) eta MTM (Oinarri historikoak eta logikoak)

Bertan ikus MTM (Oinarri historikoak eta logikoak)

******

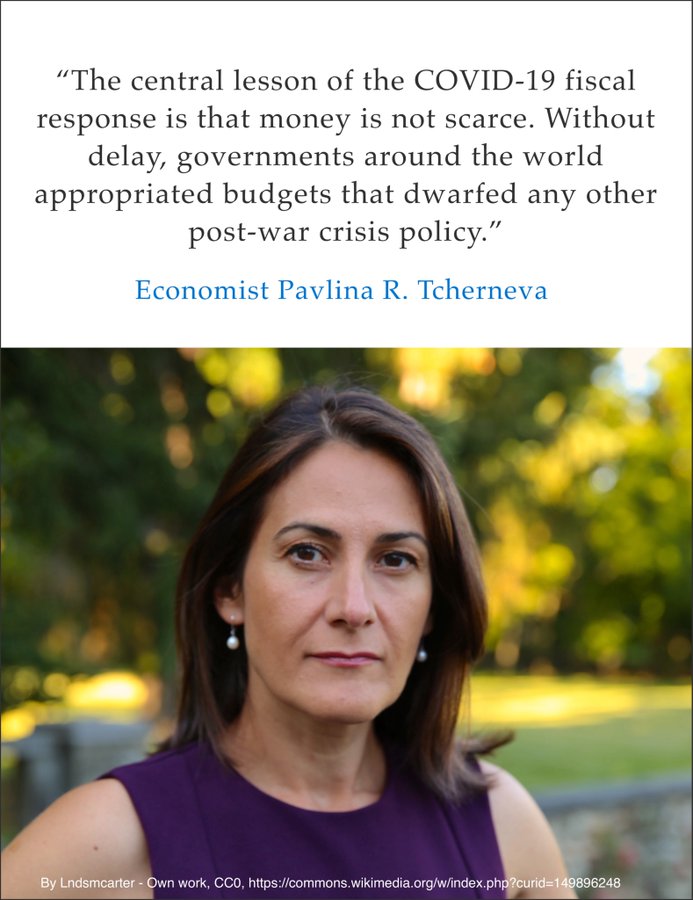

A valuable lesson from economist Pavlina R. Tcherneva.

@tobararbulu # mmt@tobararbulu

Sabrina on MMT https://youtu.be/1LESNdZnn7s?si=DoXYIyGo1CBS8m-_

youtube.com

ooo

0:00

is sabrina for mmt for you and me mmt is

0:05

modern monetary theory and it teaches us

0:07

that the economy is bad because the

0:09

federal budget deficit is too small yes

0:12

i know everyone thinks the deficit is

0:15

too large everyone that’s all you ever

0:17

hear so why is that can they all be so

0:21

completely wrong well the good news is

0:24

to understand mmt you only need to

0:26

understand two things if there isn’t an

0:29

inflation problem there isn’t a deficit

0:32

problem that’s all just focus on those

0:35

two things no inflation problem means no

0:38

deficit problem ever hold those two

0:41

thoughts no inflation problem means no

0:44

deficit problem so give me just two more

0:46

minutes to explain thanks every

0:49

economist who’s paid to be right yes

0:52

that’s every economist who’s paid to be

0:54

right they all agree that the tax hikes

0:57

and spending cuts congress keeps making

0:59

the economy worse just like we’ve seen

1:02

happen everywhere in the world that does

1:04

this everywhere so why would everyone in

1:07

congress want to do that and all those

1:10

same thousands of economists will tell

1:12

you that making the deficit larger makes

1:15

the economy better more jobs and higher

1:18

paychecks so let me repeat those two

1:20

things as well making the defic deficit

1:23

smaller is bad for the economy and

1:26

making the deficit larger is good for

1:28

the economy and everyone in government

1:31

knows this so why are they trying to

1:33

make the deficit smaller when we need it

1:35

to be larger well they know we can’t run

1:38

out of money like greece because the us

1:40

prints its own dollars and they know

1:43

interest rates can’t skyrocket like

1:45

greece because whoever prints the money

1:47

sets the interest rates too that’s the

1:50

federal reserve and if we want low rates

1:53

that’s what we get the market has no say

1:55

and never will even when we got

1:58

downgraded and the deficit went up rates

2:00

stayed low right where the fed set them

2:04

so back to those two things to remember

2:06

if there’s no inflation problem there’s

2:09

no deficit problem in fact the only

2:12

thing bad that can happen from

2:13

overspending is that prices can go up

2:16

that’s called inflation and yes too much

2:19

spending that buys everything in sight

2:21

until there is nothing left for sale

2:23

will drive up prices so back to those

2:26

two things if there is no inflation

2:28

problem there can’t be a deficit problem

2:31

because inflation is the only possible

2:33

problem that deficits can cause if you

2:36

can’t show me an inflation problem there

2:38

is no deficit problem you did remember

2:41

those two things right so there is there

2:44

a long-term inflation problem that would

2:46

tell us we have a deficit problem the

2:49

answer is no the fed’s long-term

2:51

inflation forecast is only 2% and all

2:55

those highly paid private forecasters

2:57

have low inflation forecasts too but all

3:00

our politicians are telling us there is

3:02

a long-term deficit problem with no

3:05

inflation problem that is just not true

3:08

and they want me to believe there’s a

3:10

deficit problem no way do i look that

3:13

stupid the burden of proof is on them to

3:16

show me the inflation problem i remember

3:20

those two things if they want me to

3:22

believe there is a deficit problem hike

3:24

my taxes and put millions out of work

3:27

they need to prove to me there is an

3:29

inflation problem and until they can do

3:32

that i want my payroll tax holiday back

3:35

and all those jobs back so remember

3:37

those two things no inflation problem

3:40

means no deficit problem and that’s what

3:43

mmt for you and me is all about

oooooo

Endogenous Money | Randall Wray Explains Warren Mosler’s Unique Insight https://youtu.be/LUBquM3LB3Q?si=PZ88_hcpyiYNN1Ow

oooooo

Good to see this happening!

Aipamena

MMT Podcast (Christian Reilly)@MMTpodcast

eka. 6

@MMTpodcast erabiltzaileari erantzuten

MORE LIVE EVENTS!

THE ANTI-AUSTERITY CONFERENCE 12-13 September 2025, Bristol

Confirmed speakers: @ZackPolanski @StephanieKelton @markjhooper @StevenHailAus @randeepramesh @Williamgallus @PhilArmstrong58 @PatriciaNPino @sheridanvk

https://modernmoneylab.org.uk/events/bristol-conference-2025/

oooooo

erabiltzaileari erantzuten

I’ve mentioned it in some interviews. Also, working with Phil Armstrong on my biography including interviews with people from my past brought a few things to the surface I’d forgotten about.

oooooo

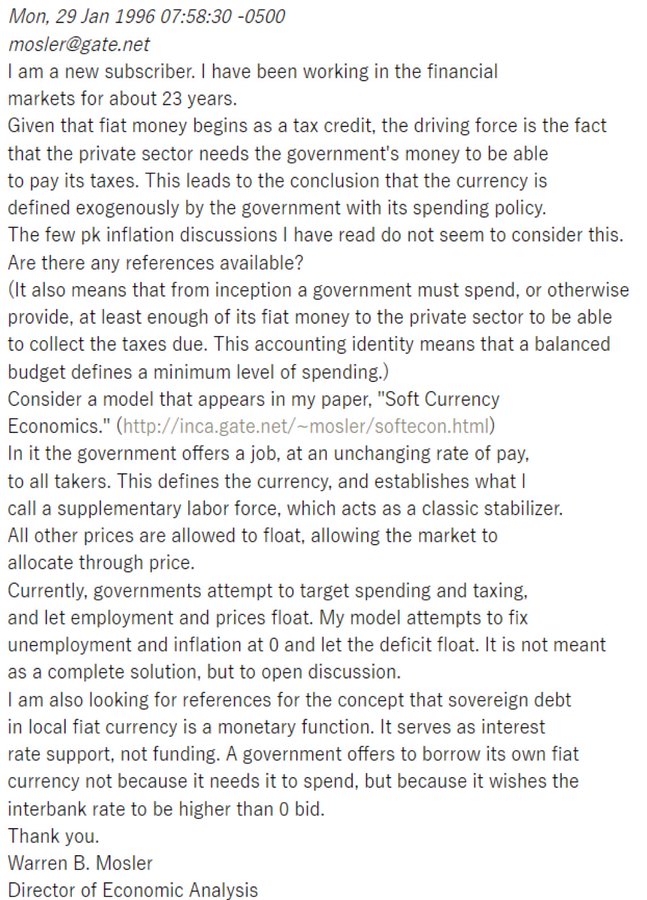

@wbmosler’s original 1996 post to an internet Post Keynesian discussion group.

What’s been popularized as MMT is all there: http://ameblo.jp/sorata31/

oooooo

ooo

Taxes DON’T fund government spending!

(https://www.youtube.com/watch?v=VnBTyF4W3sg)

End the deficit myth, neoliberalism, and austerity! The deficit myth is made up so that the establishment, plutocrats, and the 1% can hoard all the wealth and resources, instead of giving some up to US THE PEOPLE.

We must educate ourselves and others so that we can stay strong in the face of establishment neoliberal garbage.

We must educate ourselves and others so that we can stay strong in the face of establishment neoliberal garbage.

“How I came to Learn MMT” https://www.realprogressivesusa.com/n…

What is Modern Monetary Theory?

Modern Monetary Theory is the correct understanding of Macroeconomics.

It proves the following:

-

Taxes don’t fund government spending and

-

Deficit spending is good most of the time.

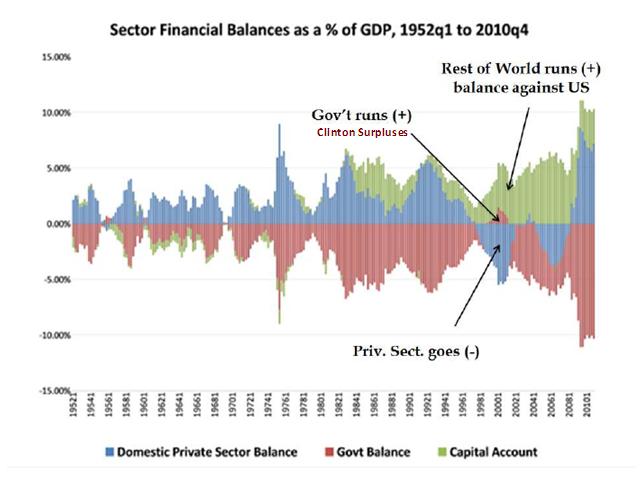

Simple Economics Facts: Government deficit = Private sector surplus Government debt = private sector savings The constraint on government spending is the availability of real assets/resources in an economy, not the federal budget!

Transkripzioa:

0:00

is that tax money that the Fed is

0:02

spending it’s not tax money we simply

0:04

use the computer to mark up the size of

0:07

the account

oooooo

ΛЦƧƬΣЯIƬY IƧ MЦЯDΣЯ@sdgrumbine

Stephanie Kelton@StephanieKelton

oooooo

MMT to Washington: There Is No Long-term Deficit Problem!

(https://www.huffpost.com/entry/mmt-to-washington-there_b_2822714)

What do the president, the party leaders, all members of Congress, all the headline economists (both hawks and doves), the entire Federal Open Market Committee, and just about everyone else apart from Modern Monetary Theory (MMT) proponents agree on?

Fixed income fund manager specializing in monetary policy; Founder, MMT

Mar 11, 2013,

Question: What do the president, the party leaders, all members of Congress, all the headline economists (both hawks and doves), the entire Federal Open Market Committee, and just about everyone else apart from Modern Monetary Theory (MMT) proponents agree on?

Answer: They all agree the U.S. has a long-term deficit problem. Therefore they all agreed to let the FICA tax holiday expire at the end of last year without any discussion, just as they let the sequester go into effect March 1 with no serious discussion.

Together these fiscal adjustments reduce the U.S. economy’s income and savings by about $5 billion per week, reducing sales, output, and employment accordingly from where it would have been otherwise, which also increases the risk of aborting a fledgling private sector credit expansion, which would further hurt the economy.

And what have they gained by the pain inflicted by this proactive deficit reduction policy? Absolutely nothing of value. The ‘national debt’ is nothing more than a bunch of dollars balances in savings accounts’ at the Federal Reserve Bank better known as ‘Treasury securities.’ These ‘securities accounts,’ as insiders call them, along with checking accounts at the same Federal Bank (called ‘reserve accounts’) and the actual cash in circulation constitute the total net dollar savings of the global economy, to the very penny. When the U.S. government spends more than it taxes, those extra dollars it spent first go into our checking accounts, and then some gets exchanged for actual cash as needed, and some goes into those savings accounts at the Fed called Treasury securities.

So how is ‘all that debt’ paid off? When Treasury securities are due, the Fed simply shifts the dollars from those savings accounts at the Fed to checking accounts at the Fed. That’s all! And this is done for tens of billions every month. The debt is paid off by a simple debit and credit on the Fed’s books. There are no grandchildren or taxpayers in sight — they would only be getting in the way. There is no such thing as leaving our debt to our grandchildren!

What if no one buys ‘the debt’? In other words, what if no one wants to shift their dollars from checking accounts to savings accounts at the Fed? Who cares! The dollars can just sit in the checking accounts (and earn a little less interest).

What about interest rates? The Fed meets and votes on the interest rates it wants the government to pay on those extra dollars it created and put into checking and savings accounts by deficit spending. ‘Market forces’ don’t grab Chairman Bernanke’s arm and raise it to vote for higher rates. The level of rates paid by our government is entirely a political decision. The Fed has the tools to set both short- and long-term rates at any level it votes to implement.

Think of it this way. Congress has appointed the Fed as scorekeeper for the dollar. And just like any other scorekeeper it neither has nor doesn’t have any dollars. It just has a ‘scorecard’ — a giant spreadsheet — with all of our bank accounts tied to it. It spends by changing numbers in our bank’s accounts to higher numbers, and it taxes by changing numbers in our bank’s accounts to lower numbers. Notice that the federal government therefore doesn’t actually ‘get’ anything when it taxes or ‘use up’ anything when it spends.

Think of federal spending as printing dollars, and taxing as ‘unprinting’ dollars, which means there is no such thing as the federal government running out of dollars. And it means we can’t ‘become Greece’ the way a U.S. state, corporation, or individual that doesn’t spend by ‘printing’ can ‘become Greece’ and go broke. So if the U.S. can’t run out of dollars, it is not leaving debt to the grandchildren, and it can never become Greece.

So you may ask, “Why not just go and spend like crazy and not tax at all?” In other words, what is the actual risk of too much deficit spending? How do we know if we have a long-term deficit problem or not?

Inflation! ‘Overspending’ would mean ‘using up’ all available resources in a fully employed economy and then trying to deficit spend even more than that. In that case all you do is drive up prices.

The good news is the world is chock full of credible, professional inflation forecasters who are paid to be right (not the fear mongering sensationalists shamelessly making wild, unsupported claims with no need to be right) and do a pretty good job of getting it right. And what were they saying about inflation before deficit reduction? The Fed had a 2 percent long-term inflation forecast and most all the others were pretty close to that. And the longer term U.S. Treasury inflation indexed securities also were presuming very low rates of inflation.

This means, even before any deficit reduction measures were taken, there was no long-term deficit problem!

And there still is no long-term deficit problem!

And wouldn’t you think that at a minimum, before cutting the military, Social Security, and Medicare, the burden of proof would be on those claiming a long-term deficit problem?

But no, even without a long-term inflation problem, paradoxically, the burden of proof is on those claiming there is no long-term deficit problem, as we continue to destroy our economy and our civilization.

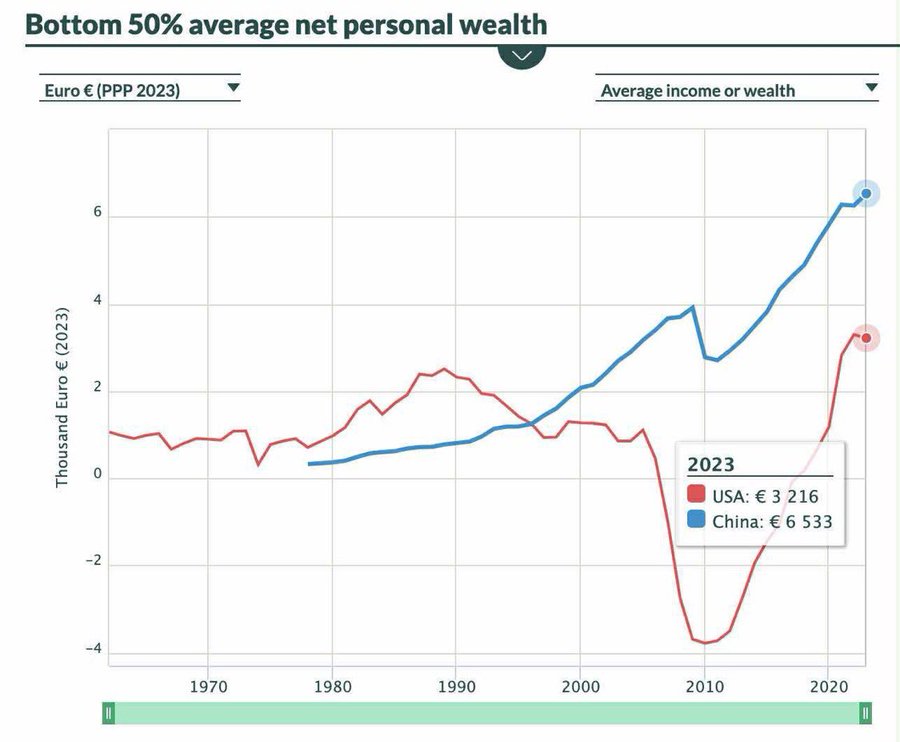

The graph below by Professor Stephanie Kelton sums it up. It shows that for the U.S. domestic private sector to carry a positive balance, the government must in effect carry a negative balance. A balanced budget, such as achieved by President Clinton, simply does not work. With Congress taking this budget cutting, balanced budget path, the one with one eye in the land of the blind becomes king.

Fig. 1 Government deficits add exactly that many $ to global $ net savings

oooooo

Mark Flowerchild #MMT #RealProgressives@MarkFabian21

“Military in the streets” are not funded with tax $s! Like all federal spending, it is funded by US Congressional appropriations. Who receives federal funding is a political choice.

I want my tax dollars going towards healthcare, not military in the streets.

oooooo

“All over Africa, you will find a mine owned by foreigners, Europeans, Americans, Canadians, Chinese & Australians. They mine our resources in the morning and give us loans in the night. It’s like someone steals your cow, slaughters it and donates its intestines to you. And then you welcome them as donors and investors for giving you intestines from your own cow”

~ Ibrahim Traore

oooooo

Enjoy.

oooooo

Hampton Institute@HamptonThink

US capitalists (via control of US govnt) pulled off the biggest heist in history, robbing US workers of countless trillions over decades. But workers have been duped into believing immigrants, “globalists,” and even “socialism” are responsible.

oooooo