Mark Flowerchild #MMT #RealProgressives@MarkFabian21

A UBI is a Neoliberal idea that would allow employers to continue wage suppression while offering a few $s to keep the oppressed consuming. Without a price anchor, the “U” in UBI leaves that guaranteed stipend open to rentier class predation. https://realprogressives.org/2019-09-17-neoliberalism-at-work-through-the-universal-basic-income/

Aipamena

HUDI@humandataincome

ots. 29

“we’ll have to have some sort of Universal Basic Income (UBI)” Elon Musk But who is going to pay?

We believe our data! HUDI = Human Data Income We are building a Universal Basic Income based on our data.

Our data is our asset, the new oil, but we have no transparency nor profit from it.

Help us build the Human Data Income: we made great progress, but it’s just the beginning!

Bideoa: https://x.com/i/status/1763211408165015925

oooooo

Irtenbidea: A job guarantee, lan berme bat:

Warren Mosler eta Job Guarantee (Lan bermea)

oooooo

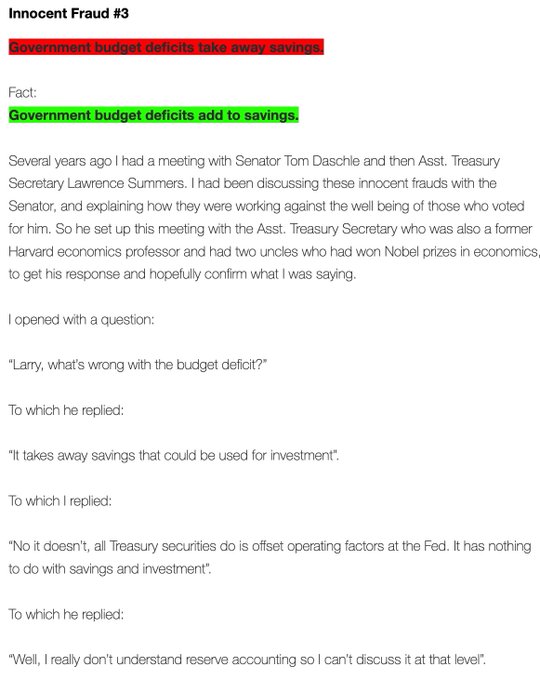

Just to be perfectly clear, finding government officials who do understand the monetary system/monetary operations is a lot harder than finding those who don’t. From

@wbmosler‘s book. https://moslereconomics.com/mandatory-readings/innocent-frauds/

oooooo

From our conversation with @wbmosler a few weeks back. We dug into the details of modern monetary theory and the biggest

misconceptions about economics. Here Mosler lays out how no one seems to have an accurate model of where money comes from:

Bideoa: https://x.com/i/status/1802118378296922123

oooooo

The 8th Deadly Innocent Fraud

The 8th Deadly Innocent Fraud of Economic Policy

(https://understandingmmt.org/general/the-8th-deadly-innocent-fraud-of-economic-policy/)

By Warren Mosler | May 31, 2024

Myth:

- Raising interest rates works to slow the economy, increase unemployment, and bring down inflation.

- Reducing interest rates works to support the economy, reduce unemployment, and increase inflation.

Fact:

The Fed has it backwards.

Rate increases cause government deficit spending to increase and support the economy, reduce unemployment, and support inflation.

And cutting rates reduces government deficit spending which reduces economic growth, employment, and inflation.

When the Fed announces a rate increase, the only thing that changes for the government is that the Fed increases the interest it pays out to the economy (on reserves and on reverse repurchase accounts). The Treasury pays out more interest to the economy on new securities that it issues, called Treasury bills, notes, and bonds.

Furthermore, as the rate increases are not done in conjunction with offsetting tax increases, the increase in government interest expense is all new deficit spending that’s added to the US government’s budget. In short, Fed rate hikes continuously flood the economy with new money.

Federal Government expenses on interest payments rapidly increasing.

Federal Government expenses on interest payments rapidly increasing.

When the Fed last raised rates, Federal Debt was only in the 30% range.

When the Fed last raised rates, Federal Debt was only in the 30% range.

With the current government debt (held by the public) over 96% of GDP, compared to about ⅓ what it was the last time the Fed raised interest rates, the Fed’s rate increases, and consequent increased interest expense, has nearly three times the impact it did during prior periods of Fed rate increases.

In the economy, if not for the government, for every dollar borrowed there is a dollar saved. So, apart from what the government pays, raising interest rates only transfers income from borrowers who pay more interest to savers who earn more interest. That simple transfer would only slow the economy if the borrowers cut back on their spending more than savers increased their spending. And while this may be the case, studies show it’s a relatively small factor, dwarfed by the enormous amount of new interest expense the government has to pay because of the Fed’s interest rate increases.

And there’s more- interest payments only go to people who already have money, and in proportion to how much they already have. So, when the Fed decides to raise rates to fight inflation, what it’s actually doing is causing the government to pay out $ trillions of interest income only to people who already have money and in proportion to how much they already have. I call it ‘basic income for people who already have money.’ What could be more obscenely regressive??? And the Fed decides to do this on its own!

Somehow, the Fed, Congress, and pretty much the entire global financial community believe that increasing the government’s deficit spending by throwing $ trillions of interest payments to people who already have money is supposed to fight inflation by causing unemployment to go up and the economy to slow down. That’s why they’ve all been forecasting recession ever since the Fed started the rate increases.

Meanwhile, the US economy has been booming, with unemployment near 50-year lows ever since the rate hikes. The economy is defying fear-mongering and rapidly growing. The inflation indicators, after spiking higher due to COVID disruptions and a spike in oil prices when the war in Ukraine started, came down some but then leveled off well above pre-COVID levels, all because of the higher interest rates that the Fed still thinks just need a little more time to create a slowdown and bring down those inflation indicators:

Recent inflation rates peaking and then showing a significant decline.

Recent inflation rates peaking and then showing a significant decline.

The problem is the Fed now responds to high inflation indicators and low unemployment with rate hikes, which only makes inflation indicators go higher and unemployment go lower. And when they see that they hike again, and this crazy spiral continues with no end in sight if they don’t see the error of their ways and reverse course. Or, if we get lucky, and there’s some other deflationary shock, like a collapse in oil prices, that causes them to cut rates to stimulate the economy, which doesn’t work either!

So, what’s the answer? The Fed should cut its policy rate back to 0%, ultimately cutting government interest expense to people who already have money by over $1 trillion per year and taking the pressure off the inflation indicators so they can settle back to where they were before the COVID crisis.

Here’s the paper I first wrote on this some 25 years ago:

The Natural Rate of Interest is Zero – PDF

The Fed also doesn’t understand that the inflation rate tends to gravitate to the interest rate set by the Fed. It’s too complex for this post, but can be found in my latest paper:

A Framework for the Analysis of the Price Level and Inflation – Google Docs

oooooo

Episode 2 of Modern Money Authority with

and

is premiering today at 3pm ET. Today’s episode is about inflation & deficits, and Warren uses a car metaphor (go figure) when discussing economic responsibility.

Modern Money Authority – Episode 2: Asleep at the Wheel

Bideoa: https://www.youtube.com/watch?v=eSVsCYtDZwM

Warren Mosler and Joe Firestone discuss why inflation can still be relatively low despite high deficits, and Warren uses a car metaphor for illustrating how blame SHOULD be placed when major events negatively effect our economy.

Warren Mosler and Joe Firestone have teamed up to cover economics through the lens of Modern Monetary Theory (MMT), with a focus on accuracy and ease of understanding. Each episode will cover a new topic and will be accompanied by visual aids and references to help viewers follow along.

Understanding MMT is a nonprofit organization founded in 2023 to promote awareness and understanding of Modern Monetary Theory (MMT). Our team of experienced writers and educators creates accessible, engaging content that demystifies MMT principles for a broad audience. Through our website, blog, and social media, we strive to empower individuals and policymakers with the knowledge to make informed economic decisions. Understanding MMT is committed to accuracy, objectivity, and relevance in our educational materials, contributing to the public discourse on economic policy and theory. Visit our website to learn more and join our mission to build a more informed populace.

Transkripzioa:

0:04

[Music]

0:15

okay good morning Joe good morning

0:18

Warren how are you good thanks good

0:21

thanks so I guess today we’re gonna talk

0:23

about one of our pet peeves yes we will

0:27

yeah so why don’t you go ahead and start

0:29

y okay I got a question for you which is

0:32

something that I hear from people all

0:34

the time is Hey Joe

0:38

deficits really large it’s just huge how

0:43

can we run deficits that are so huge and

0:47

not have a runaway inflation I mean yeah

0:50

we got a little bit of inflation but

0:53

it’s not much okay it’s real surprising

0:56

that we don’t have

0:57

more so what do you think that is war

1:01

okay well the good news is that this all

1:04

falls under under consumption Theory

1:07

which was first written down over 400

1:10

years ago so it’s nothing

1:14

new and uh it it’s just something you

1:17

never hear about or read about or

1:19

anything so uh and I I get that all the

1:21

time too you know and so uh it’s even

1:24

like a heading in one of my soft

1:27

currency economics from

1:28

1993 so the story goes like this and

1:32

this is the part that you have to

1:34

understand to be able to figure out the

1:36

rest of it and that is if there’s any

1:39

money being spent somebody’s spending it

1:42

and somebody else is getting it so if

1:44

somebody’s selling something getting

1:46

paid for that that’s somebody’s expense

1:49

and it’s his income and that that money

1:52

would go around and round and you know

1:54

without government in theory and it

1:56

wouldn’t be itself a problem so if you

1:59

look at GDP last year which was I’ll

2:01

just say 28 trillion or something that

2:05

means $28 trillion was spent by somebody

2:09

buying things they just add up

2:10

everything that was bought and it means

2:12

somebody got $28 trillion of income on

2:15

the other side now if that was happening

2:18

and that was just the private sector

2:19

that’s fine if the government stepped in

2:22

into that flea market let’s call it a

2:24

big flea market the economy is like a

2:26

big flea market where people are

2:27

spending 28 trillion and people are

2:29

selling 28 trillion the ones who sell it

2:32

get 28 trillion and that’s the same

2:34

money that gets spent just going round

2:36

and round now the government steps in

2:38

and wants to spend another five trillion

2:41

that would just blow prices through the

2:42

roof just like you were talking about

2:44

okay but it doesn’t happen and it’s for

2:47

one simple reason and that is yes 28

2:50

trillion is spent and somebody receives

2:52

28 trillion but the re people receiving

2:55

that money don’t want to spend it all

2:57

maybe they only want to spend 23

2:59

trillion they want to put the rest in

3:00

the bank in their IRAs in their kios

3:03

leave it in their pockets you know it

3:05

gets lost in the wash you know and uh

3:08

their parents take it home for souvenir

3:10

who knows what happens to it but they

3:11

decide that they only want to spend 23

3:14

trillion now there’s a shortage let me

3:16

give you the extreme example let’s say

3:19

nobody wanted to spend anything in this

3:21

economy all people just wanted their

3:23

income they wanted to save the whole

3:25

thing and not spend Penny what happens

3:28

to the economy well it all goes to zero

3:31

because if nobody’s spending nothing’s

3:33

getting sold if nothing’s getting sold

3:35

nobody’s getting paid and nobody’s got a

3:37

job anymore and we’re all in this

3:40

Oblivion and that’s called the Paradox

3:42

of thrift and what that says is that if

3:45

everybody decided to save all their

3:46

money there wouldn’t be any savings it’

3:48

just be a total collapse that’s why it’s

3:50

a paradox can’t be done right so what

3:53

happens in our economy is that the

3:56

government gives people powerful

3:57

incentives to not spend their money for

4:00

example if you put your money in your

4:02

Pension funds you make your pension fund

4:04

contribution you don’t pay income taxes

4:06

on that until way down the road so it’s

4:09

compelling do you want to pay 30% now on

4:12

a dollar that you make you know keep 70

4:14

cents or do you want that whole dollar

4:15

to be invested in compound over time of

4:17

course people are going to go for that

4:19

and so we have a huge percentage of

4:22

spending every year going into Pension

4:23

funds they give insurance companies

4:26

incentives to put money in reserve funds

4:28

and there’s IRA and there’s K and

4:30

there’s all kinds of reasons to not

4:32

spend your money okay well if all that

4:35

money is getting not spent we’d have an

4:37

absolute collapse if somebody out there

4:40

wasn’t spending more than their income

4:42

to make up for it so who in the economy

4:44

spends more than their income well if

4:46

you buy a house and get a mortgage you

4:48

just spend $500,000 which could be five

4:50

times your income right or if you buy a

4:52

car on car payments you could be

4:54

spending more than your income so all

4:56

the people who are borrowing to spend

4:58

are spending more than their income but

5:01

even that’s not enough all the savings

5:03

all the money not spent is even more

5:05

than that and so who’s the biggest

5:07

entity that spends more than their

5:08

income the government the government is

5:10

spending almost $2 trillion dollars more

5:13

than their tax revenues okay that’s

5:15

called the budget deficit and we know

5:18

that that two trillion is pretty much

5:21

just making up for two trillion that

5:23

people you know want to save two

5:25

trillion of people’s unspent income that

5:27

they don’t want to spend they’d rather

5:28

put it in their pension fund or somebody

5:30

else how do we know that because

5:32

inflation’s not that high okay so the

5:34

simple the simple answer is that the

5:37

reason the government can spend that

5:40

much with more than its income that much

5:42

deficit spending without causing

5:43

inflation is because we all want to

5:46

spend that much less than our income and

5:48

they’re just making up for our shortfall

5:50

bill Mitchell calls that the spending

5:52

Gap right and when you take a look at it

5:55

that way it just boggles the mind how

5:58

large this spending Gap is how much of

6:00

our income we really don’t spend and

6:02

don’t want to spend and that leaves it

6:05

up the government to spend it for us and

6:07

that’s the uh long answer to your short

6:10

question I don’t know can you think you

6:12

can follow up with that when people ask

6:14

you again or is it uh too much uh yeah I

6:17

think I can follow up with it I I can

6:20

also point out that okay when the

6:23

government okay or other entities spent

6:27

in the economy there are leakages of

6:29

spending now you were talking about the

6:32

leakage to savings and of course uh lots

6:36

of people want to save and there other

6:37

savings incentives and so that’s

6:40

withdrawing money out of the active

6:44

economy the

6:45

circulation spending but that’s not the

6:48

only source of leakage there’s also

6:51

foreign trade right now if you look

6:53

closely at foreign trade those are

6:56

people who don’t live here who want to

6:57

sell things to us earn the income and

7:01

then they don’t spend it so you’re

7:03

exactly right but if you look at it

7:05

closely it’s kind of the same thing it’s

7:07

just somebody who doesn’t live here not

7:09

spending their income and instead

7:11

letting it pile up in their central bank

7:14

right right right but yeah you’re

7:15

correct that’s a big Source that’s a big

7:18

Source you know but if you look at the

7:20

empirical data there are certain years

7:23

where the public has a greater desire to

7:26

save okay than in other years for

7:30

um after the crash of 2008 Yes but you

7:33

know during 200920 you know

7:37

2011 yes the savings rates were like 6%

7:41

of GDP yeah or so okay or more even yes

7:46

okay and we also found that in certain

7:48

other years you know that the current

7:51

account deficits were also as high as

7:54

six or s% now they’re not up to six or

7:56

s% now I think the current account

7:59

deficit is running something like you

8:01

know maybe 3% for that kind of leakage

8:04

and I think savings are probably also

8:07

running at maybe 3% of GDP or 4 per okay

8:10

of GDP that’s right that’s right you

8:13

know so we’re looking okay at leakages

8:15

that that total maybe 7% okay of GDP

8:19

yeah and when you look at the deficit

8:22

the government it’s running it maybe

8:24

5.6% K of GDP and so the deficit of

8:28

government is still not making up for

8:30

the demand leakages it’s still too low

8:33

it’s not making up for those but and

8:35

you’re you’re absolutely right that they

8:37

vary overtime so after recession that’s

8:41

why we run a much higher deficit without

8:43

inflation and during expansion the

8:45

government runs a much lower deficit

8:47

without inflation and the reason that

8:50

varies let’s call it the

8:52

non-inflationary deficit if there is

8:54

such a thing there is quite such a thing

8:56

is exactly for the reason you said

8:58

because these savings desires whether

9:00

it’s just residents or non-residents

9:02

foreigners put together corporations and

9:06

U what also varies is the degree that

9:08

people want to spend more than their

9:09

income home buying car buying all this

9:13

Consumer Credit domestic credit it’s all

9:16

move a moving Target all the time and

9:19

and so that puts the government in the

9:21

role of you know offsetting all of this

9:24

being the entity that has to look at all

9:27

this count the bodies and the employment

9:29

line which is the only total evidence

9:31

they have the macro evidence and then

9:34

make its policy accordingly you know

9:36

look at the inflation rate with the

9:37

unemployment rate and then decide what

9:40

the deficit needs to be you know to meet

9:42

their policy goals but um again circling

9:45

back to what we first talked about I

9:47

think this you know gives people the

9:50

understanding of why the deficit needs

9:53

to be can be so high and so variable

9:57

without causing inflation without

9:58

necessarily causing inflation uh yes I

10:01

agree with that I think we can say

10:03

though even more about it we can add

10:06

that um we’re talking about inflation

10:09

that comes from excess demand okay and

10:12

not inflation that comes from other

10:14

sources now if you go back to this

10:16

particular bot of inflation we’ve had

10:18

the Federal Reserve uh only um traced

10:21

about 0.5% about half a percent

10:24

inflation to excess demand the rest was

10:27

all traced to the types of things you’re

10:29

talking about but again we’re coming

10:31

back to the questions that people are

10:33

asking about how can government spend

10:35

all this money without blowing the roof

10:37

off inflation now uh the other thing is

10:40

if we get in situation where deficit

10:43

spending is not high enough to fill the

10:46

spending Gap where people’s savings

10:48

desires for whatever reason are so much

10:50

that the government’s deficit isn’t

10:52

enough how do we know that okay and the

10:55

evidence at the macro level is always

10:57

unemployment yes okay say the

10:59

unemployment whatever it is is the

11:02

evidence that the government has not

11:03

spend enough to fill the need to pay

11:05

taxes and desires to net safe so we can

11:08

use that as our indication there can’t

11:10

be any other reason for unemployment the

11:14

currency Monopoly the monopolis is price

11:16

Setter it’s not a market situation there

11:19

can be shocks that cause unemployment

11:22

but the proper response to those shocks

11:24

which happen all the time would be a

11:25

fiscal adjustment I like to give the

11:27

example of the RVE driving down the road

11:30

some reason I come back to cars a

11:32

lot and uh this is particular let’s go

11:37

back to

11:38

2008 where people would blame the banks

11:41

blame The Regulators blame Leman and be

11:44

Sterns and subprime mortgages and bad

11:47

lending standards and whatnot but

11:49

Underneath It All I I and I don’t like

11:52

those things are all true but I don’t

11:54

like using that as the cause of the

11:57

unemployment the cause of the col CSE

11:59

and again it’s like the car going down

12:01

the road and the driver is asleep at the

12:04

wheel okay and the road is smooth but

12:07

there’s some undulations in the road and

12:09

he’s going down the okay for a while but

12:11

sooner or later there’s some undulation

12:13

or some bump and the car veers off and

12:15

crashes and we come back and we say look

12:18

the problem is the road if we’d only

12:20

Built the road straight enough and

12:22

smooth enough you know just right then

12:25

this car won’t crash and I’ll go yes but

12:27

there’s a driver in a steering wheel you

12:29

know and and the cars are you know

12:32

that’s that’s a nice in theory but in

12:34

practice we’re never going to build a

12:35

road like that we’re never going to

12:36

build a car that’s perfect enough you

12:38

know this was before automatic you knowu

12:41

driving but what we need to do is have

12:43

the driver stay awake and hold his hands

12:44

on the wheel when it’s car starts to go

12:46

to one side just move the wheel so he

12:49

stays on the road and not crash into the

12:50

side in other words we have to blame the

12:52

driver for this crash and not the not

12:55

the road or we’re never going to solve

12:57

the problem okay now in the United

12:58

States

12:59

the driver is Congress they have the

13:02

fiscal policy at their control in

13:04

2008 they could have had the full

13:06

payroll tax holiday like I had been

13:08

pushing middle of8 or any other fiscal

13:11

adjustment okay and the the economy

13:13

would not have crashed there still would

13:15

have been Financial losses debits and

13:17

credits but we wouldn’t have had eight

13:18

million people lose their job all at

13:20

once who suddenly couldn’t make their

13:22

mortgage payments and if people are

13:24

making their payments instead of not

13:25

making their payments we don’t have any

13:27

banks to bail out if people can make

13:29

make their car payments because they’re

13:30

still working and not defaul in their

13:32

car payments because 8 million people

13:34

got laid off all at once then we don’t

13:36

have to bail out automobile companies

13:39

okay simple fiscal adjustment which is

13:41

just debits and credits would have kept

13:42

this car on the road and avoided having

13:45

a financial crisis spill over into the

13:47

real economy in 2008 but instead the

13:51

lessons from 2008 were that we if we can

13:55

fix the financial structure the

13:57

financial economy then we can prevent

13:59

these Financial accidents in the future

14:01

we can prevent undulations and bumps in

14:03

the roads so that Congress can keep

14:05

sleeping at the wheel and we’ll never

14:06

have a problem in can okay and that’s

14:09

exactly what’s happening so I I you know

14:12

I consider that a major teaching moment

14:15

lost well I’m Warren Mosler and great to

14:17

be here with Joe Firestone and uh

14:20

looking forward to our next interview

14:21

and I’m looking forward to our next

14:23

conversation also thanks I hope it’ll be

14:25

as much fun as this conversation was

14:27

good

14:30

[Music]

oooooo