(i) Sarrera

(https://twitter.com/DerekHenry1970/status/1029499429823373312)

Could Turkey Default? The Maths Say No

Alan Longbon is a MMT’r.

Could Turkey Default? The Maths Say No

(https://seekingalpha.com/article/4199031-turkey-default-maths-say)

2018 abu. 14

(ii) Alan Longbon

(https://seekingalpha.com/author/alan-longbon/articles#regular_articles)

Hello,

I have an MBA and over 25 years of experience in real estate development, stocks, bonds, finance and forex markets.

My investment approach is very simple. I find countries with the highest and strongest macro-fiscal flows and low levels of private debt and invest in them using country ETFs and contract for difference (CFDs)

I use functional finance and sectoral flow analysis of the national accounts of the nations I invest in. This is after the work of Professors Wynne Godley, Micheal Hudson, Steve Keen, and William Mitchell. Roger Malcolm Mitchell, Warren Mosler, Robert P Balan, and many others.

One can analyze a country in seconds with four numbers as a % of GDP and these are G P X C where

[G] Federal spending.

[P] Non-Federal Spending.

[X] Net Exports

[C] Credit

One can then derive a set of accounting identities that are correct by definition.

GDP = G + P + X

Aggregate Demand = G + P + X + C or GDP + Credit.

GDP = GDI

G and X are regularly reported in official national account statistics and one can work out P as follows:

P = G + X

Asset prices rise best where the macro-fiscal flows are strongest and where the private sector balance is highest.

The 20-year land/credit cycle identified by Fred Harrison and Phillip Anderson is also a key investment framework that I take into account.

Could Turkey Default? The Maths Say No

Prime Minister Erdogan makes a valid point with his criticism of the central bank driving inflation.

Turkey has a negative private sector balance, and the national government needs to spend more to stave off a recession.

Only private credit creation is driving aggregate demand at present and filling the spending gap.

Turkey has been in the news lately with the newly re-elected Prime Minister Erdogan quite rightly suggesting the central bank and its rate rises are fueling inflation and currency devaluation.

The purpose of this article is to look at the macro sectoral flows and assess whether Turkey is a good place for investment and to debunk the popular press view that Turkey is going to default on its debts and collapse.

Prime Minister Erdogan has made a connection between central bank rate policy and inflation.

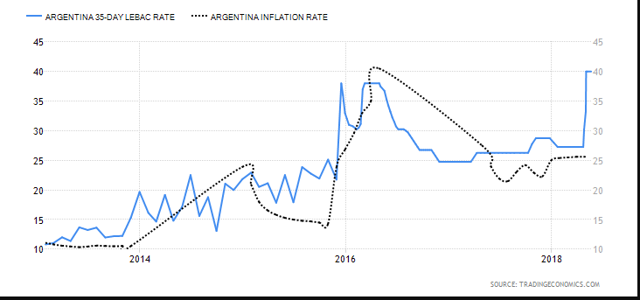

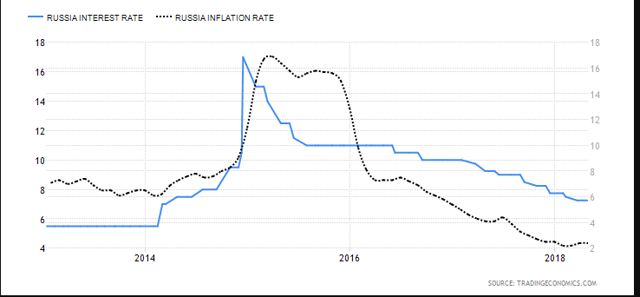

It is the Prime Minister’s contention that the high central bank rates are the cause of the inflation. His view is correct, though not mainstream, and there is plenty of evidence to support his view. President Putin of Russia is on record with a similar view, and it is possible that the two exchanged notes at a recent meeting because President Erdogan’s comments began shortly after the Turkey-Russia summit.

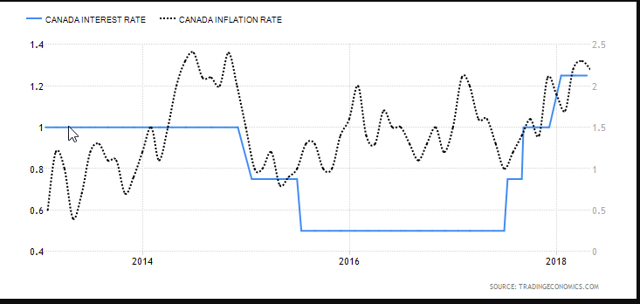

We have seen globally that as soon as a central bank lowers or lifts rates, inflation moves in the same direction. This makes logical sense, as a rise in borrowing costs increases the price of products and services that have a finance or credit component in their cost structure.

If increasing interest rates were to strengthen a currency, then the Argentine peso would be the strongest currency in the world. But it is not.

The Canadian inflation rate was bumping along the bottom until they raised rates.

The US inflation rate was bumping along the bottom until rates were raised.

Russian inflation is moving with central bank rate movements.

What I am asserting is that the Fed and the mainstream have it backwards with regard to how interest rates interact with the economy. They have it backwards with regard to both the current health of the economy and inflation, and, therefore, their discussion of appropriate monetary policy is entirely confused and inapplicable. – Source: Warren Mosler1

Turning to Turkey’s lira, we have seen that higher rates have not led to a stronger currency, as the chart below shows.

The stock market is no worse than it was in January 2017 as the chart below shows, and has followed the trajectory of most emerging market countries over the same period.

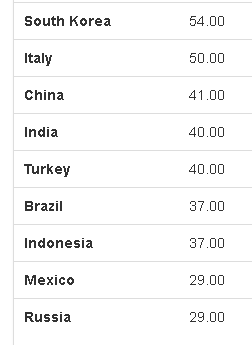

Not all currencies are made the same. Corruption and business confidence play a big part in its value. Turkey has a corruption index rating of 40, which puts it in the same league as the countries shown in the table below. The higher the number the better.

(Source: Trading Economics dot com)

Not surprisingly the yield on the Turkish ten-year bond has moved up with the central bank rate.

This has an influence on GDP as measured in USD in the chart below:

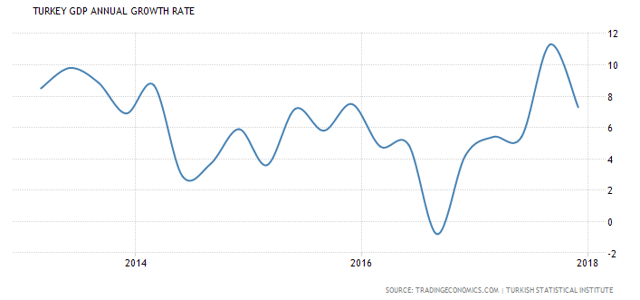

Thanks to a volatile lira, Turkey’s GDP, expressed in USD, appears to be falling. However, in reality GDP has been growing strongly, as the above chart shows.

Turkey will be assessed using a balance of sectoral flows model after the work of British economist Professor Wynne Godley.

In 1970, Professor Wynne Godley moved to Cambridge where, with Francis Cripps, he founded the Cambridge Economic Policy Group (CEPG). In early 1974, Godley first apprehended the strategic importance of the accounting identity – which says that measured at current prices, the government’s budget balance, less the current account balance, is by definition equal to the private sector balance.

GDP = Federal Spending + Non-federal Spending + Net Exports

As a percentage of GDP, all three sectors sum to zero.

GDP = GDI

These are accounting identities and correct by definition.

By definition, the stronger the private sector balance is, the stronger the private domestic economy and investment markets within it.

The following formula can express a nation’s balance of accounts:

Private Sector [P] = Government Sector [G] + External Sector [X]

The community, business, and the stock market are located in P. For P to expand, it needs the balance of inputs from G and X to be positive. A negative balance causes P to contract.

When one adds all three sectors together, it equals the GDP for that year. One sector’s loss is the other’s gain, and if they all go down, so does GDP.

When one does a sectoral analysis, one finds the following…

Sectoral Balance Analysis

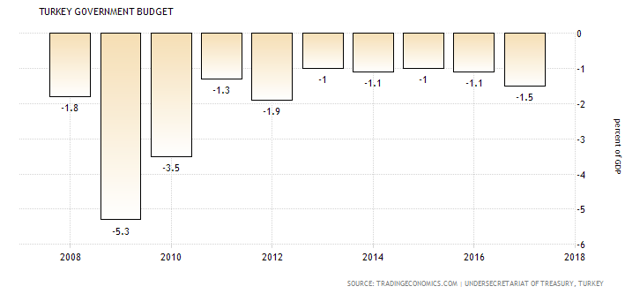

The charts below show the key information required to calculate the sectoral balances:

One can calculate the private sector balance by adding the current account balance and the government budget and expressing it as a percentage of GDP. As an accounting identity, this must sum to zero overall as a percentage of GDP.

Recent, current and projected annual sector balances are shown in the table below:

|

Private Sector [P] |

External Sector [X] |

Government Sector [G] |

|

|

2016 |

-2.7% |

-3.8 % |

1.1% |

|

2017 |

-4% |

-5.5% |

1.5% |

|

2018 # |

-3.5% |

-5.5% |

2% |

(Source: Trading Economics, FRED and author calculations based on the same)

# Forecast based on existing flow rates and plans.

The private sector balance is negative due to the drain from the current account and the meager input from the government sector. To fund what is in effect a private sector deficit, the private sector must be going into debt or running down its stock of existing wealth.

The private sector balance is also reinforced by private credit creation from private banks. One can say that aggregate demand in any period is GDP + Credit. The chart below shows the private credit trend:

Private credit creation added 3.6% of GDP in 2017 to the economy and money supply. This makes up the “gap” between the current account and government spending and enables the private sector to keep on spending. 2018 is already at 3.45% of GDP or $US29B. Credit is used in place of income to maintain purchasing power.

Borrowing in inflationary times is a good idea as the principal is inflated away much to the chagrin of the lender.

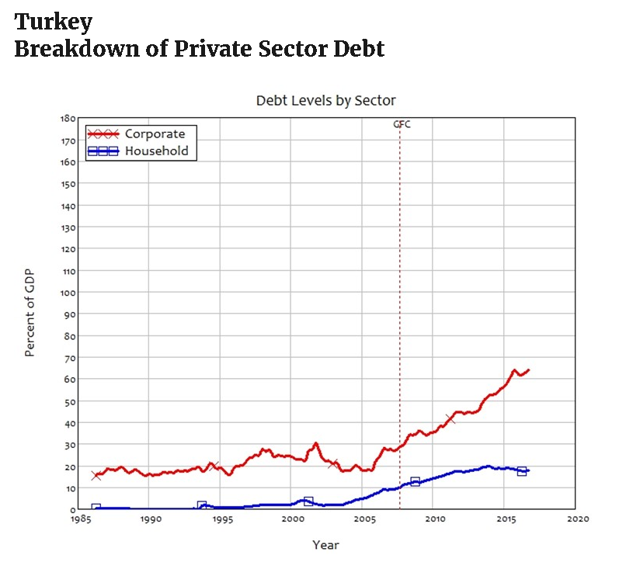

The flow of credit adds to the stock of private debt shown in the chart below:

(Source: Professor Steve Keen)

Private debt is about 80% of GDP, which is low by developed world standards. Most of this debt is held by the corporate sector and the household sector has hardly any debt at all.

Professor Steve Keen, an expert on private debt, says that 150% of private debt-to-GDP is the point at which most economies tend not to take on any more debt. It is a natural barrier.

Turkey could add a further 70% of GDP to its private debt before meeting this natural barrier.

The recent inflationary phase impact can be seen in the debt in that household debt is falling as it is inflated away in real terms. Corporate debt has kept growing because a lot of it is foreign debt denominated in USDs and Euros which keep pace with the exchange rate and rise when domestic inflation is high to keep pace with the principal and interest payments in real terms.

This is where the popular press believe that Turkey will default on its foreign debts and collapse.

Turkey is a currency sovereign which means that it has its sovereign currency that it is legally entitled to create to pay its bills and circulate in its nation-state. Turkey is sovereign in the Lira and can never become intentionally insolvent in the Lira anymore than a referee at a football game can run out of points to award in a game.

(Ikasiko ote dute inoiz Euskal Herriko ekonomialariek, politikariek, kazetariek eta progreek? Dudatan nago!)

The chart below shows Turkey stock of foreign exchange currency reserves.

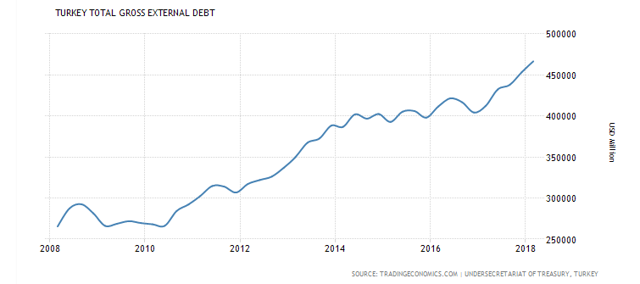

The chart below shows Turkey stock of external debt not denominated in Lira and therefore at risk of default should Turkey not be able to obtain the currency for which the debt is denominated.

Comparing the two charts ones sees that there is $130B of Forex reserves and about $466B of external debt. If the debt were called in like a home loan, Turkey would have to find $336B in short order to meet the creditors. The interest on the $466B of debt would be in the order of $10B per year at five percent interest. At the current rate of twenty percent interest, it would be around $43B per annual. How much it is can only be speculated upon however it is more likely to be lower rather than higher.

One has seen with the Greek experience that terms are always renegotiated and extended to keep the debt alive. Debt “haircuts” are also possible.

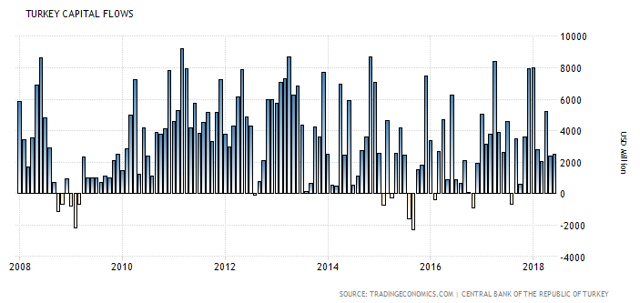

When one looks at serviceability regarding foreign income with which to meet principal and interest payments on external debt one sees a healthy and positive income flow in the capital account shown in the chart below.

Turkey recorded a capital and financial account surplus of 2518 USD Million in June of 2018. Capital Flows in Turkey averaged 1736.75 USD Million from 1992 until 2018. That makes an average of some $24B capitaI flows per annum with which to meet an interest bill that lies somewhere in the same vicinity.

The big fear in the popular press is that Turkey will have a foreign currency shortfall. Turkey would then sell Lira on the foreign exchange market for dollars and euros and thus be at the mercy of short sellers who would devalue the currency and make it ever harder for Turkey to get its needed foreign exchange reserves.

It first has to sell Lira to get dollars, and the speculators and short sellers know this and bet against the Lira. This is what happened in Zimbabwe years ago.

This is not a likely scenario given the stock of foreign exchange reserves and also the steady foreign exchange income. Short sellers beware of a burn.

Another source of foreign debt settlement income is gold.

Turkey’s gold reserves have taken a hit this year. However, there are still upward of 200 tons worth about $7.6B.

Conclusion, Summary and Recommendation

One can see then that the private sector has a negative sectoral balance of over -3.5% of GDP. This is one of the weakest in the world, and but for credit creation fuelling aggregate demand, Turkey would be in recession now. This is not a good background for financial assets in the private sector such and stocks, bonds, and real estate.

More importantly, there is little risk of foreign currency default in Turkey given its stock of foreign exchange reserves and its steady inward capital inflows.

The Presidents understands that the central bank is in large part fuelling both the inflation and currency devaluation in his country with its excessive interest rate levels. The central bank is the monopoly supplier of the Lira and can set the price where it wants with its rate-setting policy and bond buying powers.

No doubt Turkey will soon be offered an emergency credit line from the World Bank or International Monetary Fund, similar to Argentina, on the usual neoliberal conditions:

1. Cut government spending on health care, education, and infrastructure.

2. Smash unions and deregulate the job market.

3. Privatize as much of public infrastructure as possible.

4. Open all its markets to foreign companies.

5. Buy Western made military items.

In essence become a low-cost export production platform for Western business interests. Turkey’s own central bank is preparing the grounds for this scenario at the moment and it will be interesting to see how it turns out. Will President Erdogan prevail over the central banks and Western business imperialism? He is certainly aware of what is going on.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

1 Ikus There is no right time for the Fed to raise rates!: http://moslereconomics.com/2014/10/13/there-is-no-right-time-for-the-fed-to-raise-rates.

joseba says:

In http://neweconomicperspectives.org/2018/08/alexandria-on-the-daily-show-the-moral-economy-and-modern-money.html#more-11321

Ray Kumar | August 17, 2018 at 11:52 pm |

Turkey’s Erdogan seems to subscribe to MMT as per his pronouncement on inflation and interest rates.

If he doesn’t capitulate to conventional economic dogma and manages a recovery for Turkey, this might serve as a test case of a sovereign currency issuing nation demonstrating its power to mobilize the productive capacity of the economy and serve as an economic and political epiphany of the modern contemporary monetary system aka MMT.