EFTA-ranzko bideaz…

(https://twitter.com/malcolm_reavell/status/1228937119126691840)

Malcolm Reavell@malcolm_reavell

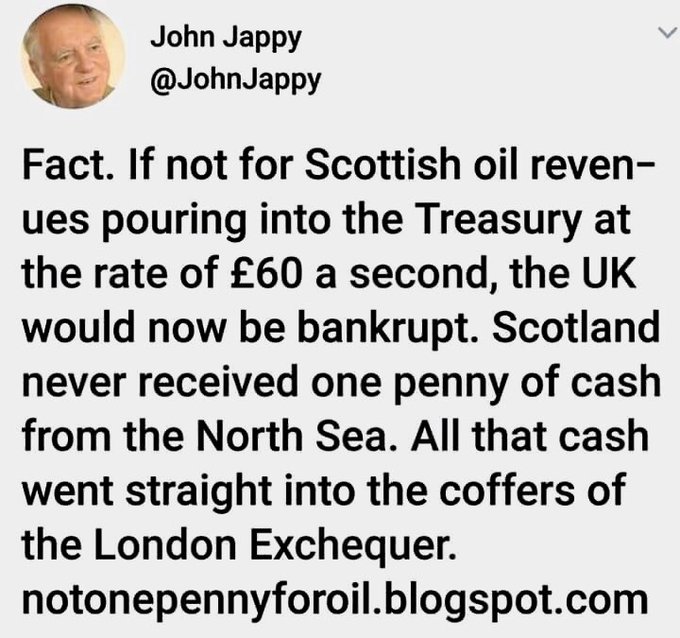

Sorry, @JohnJappy, but not a fact. Regardless of Westminster hiding the truth about the oil revenues, the UK is not a Nando’s and does not need to be run “at a profit”. The UK issues its own currency. 1/18

2020 ots. 16

Malcolm Reavell@malcolm_reavell

Such a monetary sovereign country (USA, Japan, Australia, Canada, Iceland, Norway, etc, but NOT €zone countries!) can never run out of money, can never be forced to default on it’s sovereign debt, and can never go bust. Ever. Such countries are not like a business. 2/18

Malcolm Reavell@malcolm_reavell

The “household” analogy for such a country is false. They do not need an income to fund government spending. The government actually creates the money and spends it into existence by act of Parliament. It passes an act or bill, approves a budget, and the currency is created. 3/18

Malcolm Reavell@malcolm_reavell

Someone types the amount into a computer at the Bank of England, debits the government account, and credits the payee’s bank. Tax is used to remove currency from circulation and regulate the economy in several ways, but it is not needed to fund public spending. 4/18

Malcolm Reavell@malcolm_reavell

In fact if you think about the nature of the state’s money, it becomes clear that the “tax and spend” model is backwards. Spending must come first. 5/18

Malcolm Reavell@malcolm_reavell

The reverse is true – government cannot impose taxes unless it has first spent into existence the currency that the private sector need to use to pay those taxes. “Taxpayers’ money” is a lie. It is impossible for taxes to fund spending. 6/18

Malcolm Reavell@malcolm_reavell

Taking that logic to the next stage, when you think about it, such a system of state issued currency means that the government cannot actually “save” money. As the sole issuer of the currency, all money it spends into existence creates a deficit on its account.7/18

Malcolm Reavell@malcolm_reavell

Taxes returned to government reduce that deficit, but as long as the private sector are in surplus the government will always be in deficit. This is normal. So what’s all this about then? Oil is a commodity exported and sold in dollars. 8/18

Malcolm Reavell@malcolm_reavell

It does not create money, only government can do that. Oil exports can add the a balance of trade surplus, but this just increases UK holding of US$. 9/18

Malcolm Reavell@malcolm_reavell

It does not increase the amount of £, it does not make everyone in the UK richer, and it does not provide an income for the UK government to spend in the UK. Only government can do that by its power of currency creation. 10/18

Malcolm Reavell@malcolm_reavell

A foreign currency surplus is useful to allow the UK to engage in foreign trade – it can be used to buy imports, but any more than that is a vanity project. It only means something if you don’t understand how currency and a country’s economy really work. Norway? 11/18

Malcolm Reavell@malcolm_reavell

The sovereign wealth fund? Very nice, but unnecessary beyond a certain point. It’s nice to have a small wealth fund to pay for imports, but there are several issues with what Norway has done. Its wealth fund is held in many foreign currencies. 12/18

Malcolm Reavell@malcolm_reavell

Can a Norway spend that currency in Norway? No, it has to be exchanged for NOK. Is all that currency “real” wealth? No, it is financial wealth. It is just numbers on a spreadsheet. It represents purchasing power only as long as it can be used to buy real goods and services. 13/18

Malcolm Reavell@malcolm_reavell

Are there enough real goods and services in Norway and the rest of the world? Probably, but if this wealth fund is to be spent on Norwegians in Norway it will need to be exchanged for NOK which the Norwegian government will have to create. 14/18

Malcolm Reavell@malcolm_reavell

Since the Norwegian government can create all the NOK it wants by government decree, it has no need of foreign currency. So the UK does not need oil revenue to fund its domestic spending. 15/18

Malcolm Reavell@malcolm_reavell

As a final note, this whole monetary system of fiat currency (money created by government decree) means that austerity is a totally unnecessary political choice. 16/18

Malcolm Reavell@malcolm_reavell

There is no need for the UK government to cut spending as it did in order to “save money” because a fiat currency issuer cannot ever save that which it issues. Trying to run a surplus for the sake of the household budget analogy is a very damaging policy. 17/18

Malcolm Reavell@malcolm_reavell

It kills people when the spending cuts that are chosen affect people at the lowest ends of the economy. Buying into that myth allows it to persist. Once the truth about money and currency is widely understood it makes political decisions much clearer. 18/18

joseba says:

Europako Merkataritza Libreko Erkidegoa, EFTA ingelesez

https://eu.wikipedia.org/wiki/Europako_Merkataritza_Libreko_Erkidegoa

joseba says:

@tobararbulu # mmt@tobararbulu

Toc d’atenció del govern espanyol a Costa per la seva visita a Islàndia via @elnacionalcat

https://twitter.com/tobararbulu/status/1231685168655749121

joseba says:

Norway – Is It The Perfect Economy?

https://www.youtube.com/watch?time_continue=11&v=hKGwGAHznFQ&feature=emb_logo